- Once you have opened the QuickBooks Online on your system, open the Sales tab from the left menu.

- Now click open the invoices tab and select the invoice you would want to void in QuickBooks Online.

- In this step, click Void from the Action drop-down menu. ...

How to open invoices in QuickBooks?

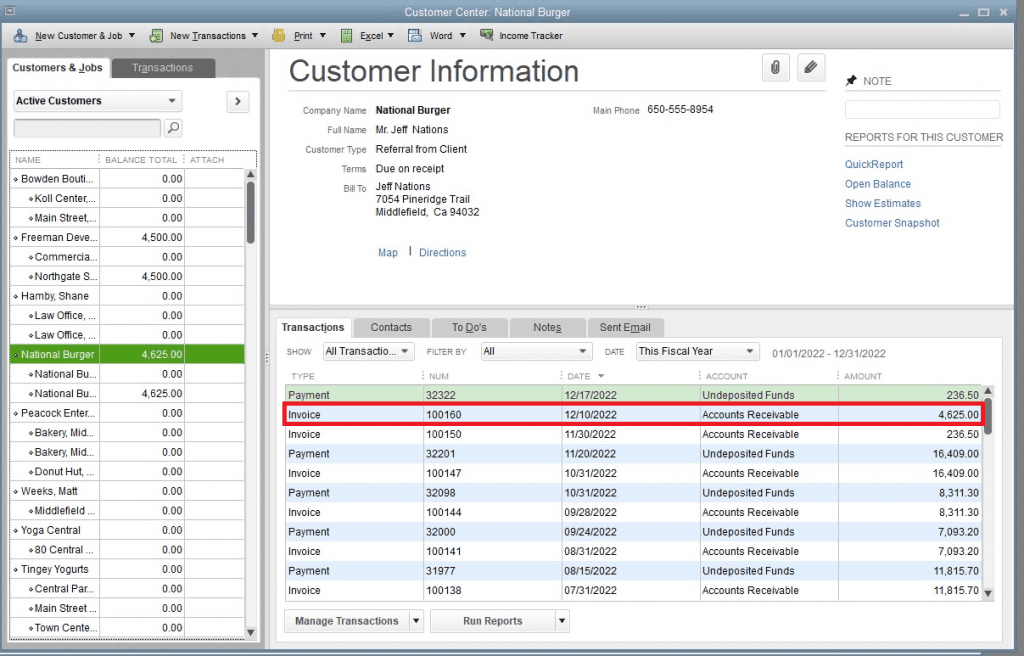

Enter our QuickBooks and go to the "customers" menu and click on the customer center. Choose the customer from the customers and job list and click on show. Once you clicked on show in the transaction menu, a drop-down list containing invoice will appear. Double click on the invoice to open it.

How do I record overdue invoices in QuickBooks Online?

Since there are no deposits, we'll have to record the invoice payments in QuickBooks Online. I'll show you how. Go to the Sales menu and then select All Sales. Click the Filter button. On the Type field, select Invoices. You can select Open or Overdue on the Status field.

How to delete duplicate invoices in QuickBooks?

1 Open your QuickBooks and click on your company profile. 2 Click open to open it and select banking menu. 3 From the drop-down list, select Make deposits. 4 Then choose the line with the duplicate invoice you wish to delete. 5 Click on the edit menu and select delete line. 6 Select save to save all changes made.

How to void an invoice in QuickBooks?

How to Void an Invoice 1 Opening the invoice, and then click on the edit menu. 2 Once there, you select delete invoice and click on Ok. 3 That’s it.

How do I close out open invoices in QuickBooks?

How do i clear old invoices that show open from previous yearsGo to the Sales menu and then select All Sales.Click the Filter button.On the Type field, select Invoices.You can select Open or Overdue on the Status field.Enter the date.You can also filter the specific customers.More items...•

How do I close an invoice in QuickBooks Online?

Go to Get paid & pay and select Invoices (Take me there). Find and select the invoice you wish to delete. On the Invoice page, select More at the bottom then Delete. Select Yes to confirm.

What is an open invoice in QuickBooks?

The Open Invoice report in QuickBooks gives you a comprehensive view of all of your current invoices grouped by the customer and the job, so you can quickly see the name of the individual or business you've invoiced and the amount they need to pay.

Is it better to delete or void an invoice in QuickBooks?

For good bookkeeping, it's better to void a transaction, when you can, rather than delete it so you keep a record of the transaction. You can delete all transaction types in QuickBooks, but you can only void certain transaction types.

How do you close an invoice?

Generally speaking, invoice should never be deleted. If an occurrence arises that requires the invoice to be cancelled or amended, issuing a credit note is usually enough. A credit note allows you to cancel an invoice officially, and legally.

Can I just delete an invoice in QuickBooks?

0:271:51How to Delete an Invoice in QuickBooks - YouTubeYouTubeStart of suggested clipEnd of suggested clipThere is no way to recover or restore deleted invoices the only record of the changes in the auditMoreThere is no way to recover or restore deleted invoices the only record of the changes in the audit log section in this video you will learn how to delete an invoice in QuickBooks. Let's get started

What is an open invoice?

Open invoices, also known as outstanding invoices, are invoices that have been sent to the client but have yet to be paid. Why are they important? Keeping track of open invoices helps you monitor your business's cash flow, as well as show you which clients still owe you payment.

What is a closed invoice?

When the status of the invoice is Paid, this means that the customer paid the partial amount and there's still an open balance left. On the other hand, when it's Closed, it means that the invoice is paid in full.

What are unprocessed invoices?

Unprocessed invoices are invoices that contain deviations in quantity or price in comparison to the delivery or the order, beyond the tolerance values specified in the basic contract.

Why would you void an invoice in QuickBooks?

Voiding an invoice will keep the invoice number and list it in reports but changes the amounts to zero. Hence, if you want to stop a particular payment from being realized by QuickBooks, select void.

When should you void an invoice?

Void - If there was an error in a customer invoice and if you do not want to delete it, you can simply void it. Voided invoice will not be removed from the organization, hence it will not affect the invoice numbering sequence. Also, the customer cannot make payment for a voided invoice.

How do I void an invoice in QuickBooks without affecting prior periods?

In order to void invoices from the prior closed period, you may want to create customer 'credit memo' and then apply credit memo against the outstanding invoice.

How do I delete a paid invoice in QuickBooks online?

Select Menu ☰. Then select Sales. Select the dropdown arrow ▼ from the filter options, then choose Invoice Payments....Delete an invoice payment on an AndroidSelect Menu ☰. ... Select Invoice Payments.Select the payment you want to delete.Select the Ellipses ⋮Select Delete.More items...•

What does it mean to void an invoice in QuickBooks?

Voiding an invoice will keep the invoice number and list it in reports but changes the amounts to zero. Hence, if you want to stop a particular payment from being realized by QuickBooks, select void.

Can you edit a deposit on an invoice?

After updating the entry, apply it as a credit to the invoice. For detailed instructions, go to the Apply the deposit entry as an invoice payment section in this guide: How to link a deposit to an invoice.

Can you link accounts receivable to invoices?

We’ll have to review your deposits and make sure Accounts Receivable is the posting account. Then, link them to the invoices to show that they’re already paid.

Can you mark an invoice as paid?

There should be a reason why some of your old invoices are still open. Yes, you can mark them as paid, but the payments will also affect your books, so I recommend checking why those transactions haven’t been paid yet. If you can no longer collect payments, you can record them as bad debt. Check out this article for your reference: Write off bad debt in QuickBooks Online.

Do you have to record invoices in QuickBooks Online?

Since there are no deposits, we'll have to record the invoice payments in QuickBooks Online. I'll show you how.

What is an open invoice?

Finally, Open invoices are invoices that haven’t been paid and are not Overdue.

Do you have to keep track of invoices on Amazon?

If you’re an Amazon seller, keeping track of whether or not your invoices have been paid is critical not only to maintaining accurate books, but to ensure that you’ve been paid for items you’ve sold. You can view a quick summary of Open, Overdue, and Paid Invoices on the Sales Transactions page.

Is invoice 2587 closed?

Invoice 2587 on 9/17/2019 is marked as Paid. Its associated Payment in full is on 9/18/2019, and that payment is marked as Closed. Once you receive payments, they’re generally marked as Closed.

Is invoice 2590 overdue?

For our purposes, Invoice 2590 is Overdue, but it also has a partial payment of 58.75 applied to it on 9/23/2019. If you take a look at the Balance for Invoice 2590, you’ll see that there’s 50.00 remaining. Until that 50.00 balance is paid, this invoice will remain Overdue . You can click on the invoice to open it and view all associated payments ...

How to open invoice in QuickBooks Online?

In QuickBooks Desktop: Navigate to the Customer Center , enter the customer’s name and click on the invo ice from the list to open the in voice. b. In QuickBooks Online: Click on Sales and then Customers, then enter the customer’s name and click on the invoice from the list to open the invoice. 2.

What happens if you delete an invoice in QuickBooks?

You could overpay your sales tax obligations. If you simply delete an invoice in QuickBooks, you run the risk of skewing your sales tax payable liability account. This could result in you remitting sales taxes you never actually collected. Items on the deleted invoice will be marked unbilled.

What happens if you write off an invoice?

The problem of overstated income. When you write off an invoice in the manner outlined above, the invoice will show as “paid” after the credit memo is applied to it. This means your income will increase by the amount of the invoice on your cash basis profit and loss statement.

How to add bad debt expense in QuickBooks?

In QuickBooks Desktop: Click into the Item field and then click Add New. Select Other Charge as the type from the drop-down box, and then enter Bad Debt in the Item Name/Number field. For Account, you’ll want to select your bad debt expense account (if you don’t have one, you can create it on the fly, too.)

Where is the credit memo in QuickBooks?

You can find the credit memo feature under the Customers tab in QuickBooks Desktop. In QuickBooks Online, you’ll want to first duplicate the browser tab by right-clicking on it. Then click on the “+” sign in the new tab to create a new transaction and select Credit Memo from the menu that appears.

Why do you write off invoices in QuickBooks?

Reasons to write off an invoice. There are a couple of reasons why you might want to write off an invoice in QuickBooks: Bad debt. Sometimes, a customer is unable to pay an invoice due to financial circumstances beyond their control. Less frequently, a customer chooses not to pay for other reasons.

Why is there a balance due on my invoice?

Maybe your customer has made a payment on your invoice, but there is still a balance due on it. This is usually due to a clerical error on the customer’s end. In cases of underpayment, the amount is often too small — sometimes only pennies — to warrant reaching out to the customer for the remainder of the payment.

What to do if invoice was mistakenly generated?

If the invoice that was mistakenly generated has not been saved, all you need to do is delete it. You do this by

How to get to QuickBooks customer center?

Enter our QuickBooks and go to the "customers" menu and click on the customer center.

How to enter chart accounts in QuickBooks?

Enter your QuickBooks and select the list menu and choose chart accounts from the drop-down.

What is the best alternative to QuickBooks?

Best Alternatives to QuickBooks: FreshBooks. FreshBooks is an awarding winning accounting software developed with excellent cloud accounting app. Suitable for small business and freelancer and a great customer support system to make your integration smooth and easy.

Can you delete an invoice in QuickBooks?

How to Delete an Invoice. You should only delete an invoice if you have not saved, printed or even distributed it ; this is because QuickBooks will delete that particular invoice permanently from the system. So, that means you can never retrieve such record again.

How to open invoices in QuickBooks?

Launch your QuickBooks and go to the report menu. Click on customers and receivables from the drop-down lists and select "the open invoices" report.

What is the best alternative to QuickBooks?

Best Alternatives to QuickBooks: FreshBooks. FreshBooks is one of the best alternatives to the QuickBooks available for small businesses and freelancers. It is straightforward to use, affordable and offers top-notch services without much stress.