How to Create a Loan Amortization Schedule in Excel

- We use the

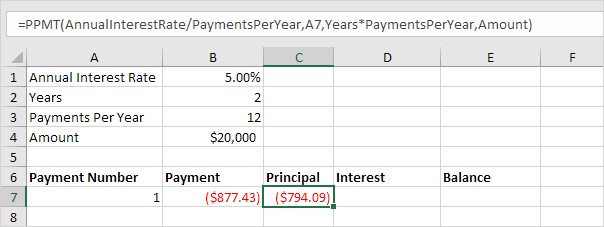

- Use the PPMT function to calculate the principal part of the payment ...

- Use the IPMT function to calculate the interest part of the payment ...

- Update the balance.

- Select the range A7:E7 (first payment) and drag it down one row ...

- Select the range A8:E8 (second payment) and drag it down to row 30.

Full Answer

How to build a simple amortization schedule in Excel?

Schedule of Loan Amortization in Excel (Step by Step)

- Put the inputs in this standard format given below. ...

- Find the Monthly Payment or the EMI (Equal Monthly installments) We use the PMT function given in Excel to easily calculate the monthly installments here. ...

- Prepare the Loan Amortization Schedule table as given below. ...

- Calculate the Interest on the Beginning Balance.

How to make an amortization table in Excel?

The Best Guide to Make An Amortization Table In Excel

- Setting up the Amortization Table. ...

- Calculate Total Payment Amount (PMT Formula) Let’s begin by defining the input cells where you will enter the known components for the loan. ...

- Calculate Interest (IPMT Formula) In Excel, the PMT (rate, nper, pv, [fv], [type]) function is used to calculate the payment amount. ...

How to create a bond amortization table in Excel?

Method 1 Method 1 of 2: Creating an Amortization Schedule Manually

- Open a new spreadsheet in Microsoft Excel.

- Create labels in column A. Create labels for your data in the first column to keep things organized.

- Enter the information pertaining to your loan in column B. ...

- Calculate your payment in cell B4. ...

- Create column headers in row 7. ...

- Populate the Period column. ...

- Fill out the other entries in cells B8 through H8. ...

How do I calculate the loan amortization schedule?

- The principal is the current loan amount. For example, say you are paying off a 30-year mortgage. ...

- Your interest rate (6%) is the annual rate on the loan. To calculate amortization, you will convert the annual interest rate into a monthly rate.

- The term of the loan is 360 months (30 years). ...

- Your monthly payment is $599.55. ...

How do I create an amortization schedule in Excel?

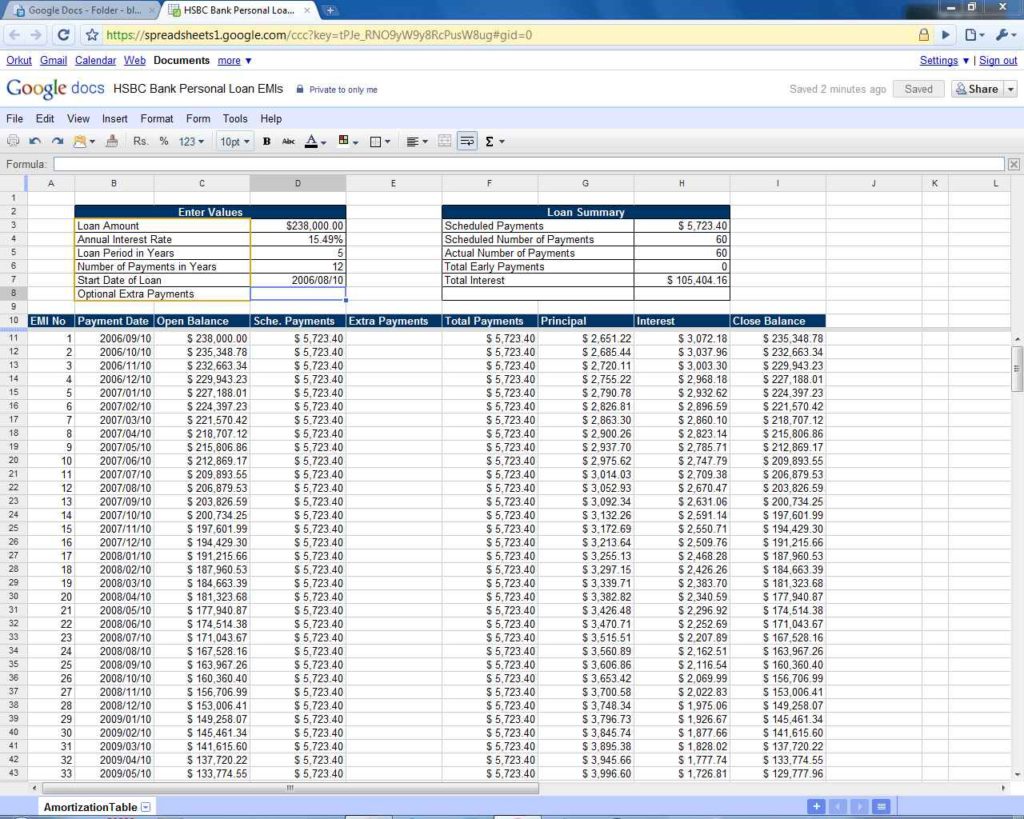

How to make a loan amortization schedule with extra payments in ExcelDefine input cells. As usual, begin with setting up the input cells. ... Calculate a scheduled payment. ... Set up the amortization table. ... Build formulas for amortization schedule with extra payments. ... Hide extra periods. ... Make a loan summary.

Does Excel have a loan amortization schedule?

Stay on top of a mortgage, home improvement, student, or other loans with this Excel amortization schedule. Use it to create an amortization schedule that calculates total interest and total payments and includes the option to add extra payments.

How do I create an amortization schedule?

It's relatively easy to produce a loan amortization schedule if you know what the monthly payment on the loan is. Starting in month one, take the total amount of the loan and multiply it by the interest rate on the loan. Then for a loan with monthly repayments, divide the result by 12 to get your monthly interest.

Does Excel have an amortization function?

EMI (equated monthly installment) is the monthly amount paid by the loaned (principal+ interest) and is calculated using the PMT () function.

What is the Excel formula for amortization?

In cell B4, enter the formula "=-PMT(B2/1200,B3*12,B1)" to have Excel automatically calculate the monthly payment. For example, if you had a $25,000 loan at 6.5 percent annual interest for 10 years, the monthly payment would be $283.87.

What is the formula for calculating amortization?

Now, we have to calculate the EMI amount and interest component paid to the bank. Amortization is Calculated Using Below formula: ƥ = rP / n * [1-(1+r/n)-nt]

How do you calculate an amortization schedule manually?

How to Calculate Amortization of Loans. You'll need to divide your annual interest rate by 12. For example, if your annual interest rate is 3%, then your monthly interest rate will be 0.25% (0.03 annual interest rate ÷ 12 months). You'll also multiply the number of years in your loan term by 12.

How do you set up an amortization schedule by hand?

0:268:59Constructing an Amortization Schedule 141-37 - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe first thing is we're going to use the present value formula and we'll figure out what theMoreThe first thing is we're going to use the present value formula and we'll figure out what the monthly payment amount should be.

What is the best amortization calculator?

Best Online Amortization CalculatorsThese calculators will get the job done right. Canva.com.Amortization schedule calculator. Amortization schedule calculator.Free mortgage amortization calculator. Mortgage Amortization.Simple Mortgage Calculator. Simple Mortgage Calculator.

How do I create a payment schedule in Excel?

0:073:56Setting Up a Payment Schedule in MS Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipNumber then total payment followed by the interest. For payment the principal per payment. And thenMoreNumber then total payment followed by the interest. For payment the principal per payment. And then the balance after the payment has been made. We're going to put the original loan amount balance.

How do I calculate a loan payment in Excel?

Excel PMT FunctionSummary. ... Get the periodic payment for a loan.loan payment as a number.=PMT (rate, nper, pv, [fv], [type])rate - The interest rate for the loan. ... The PMT function can be used to figure out the future payments for a loan, assuming constant payments and a constant interest rate.

How do I calculate principal and interest payment in Excel?

Excel PPMT FunctionSummary. ... Get principal payment in given period.The principal payment.=PPMT (rate, per, nper, pv, [fv], [type])rate - The interest rate per period. ... The Excel PPMT function is used to calculate the principal portion of a given loan payment.

How do I create a payment schedule in Excel?

0:073:56Setting Up a Payment Schedule in MS Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipNumber then total payment followed by the interest. For payment the principal per payment. And thenMoreNumber then total payment followed by the interest. For payment the principal per payment. And then the balance after the payment has been made. We're going to put the original loan amount balance.

How do I calculate loan payments in Excel?

3:3733:14Building a Loan Calculator With Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipSeven thousand and two hundred and for any interest rate I'm going to use 4.25 and for the loanMoreSeven thousand and two hundred and for any interest rate I'm going to use 4.25 and for the loan amount I'm going to use six. So let's do six years.

How do I calculate loan repayments in Excel?

=PMT(17%/12,2*12,5400) The rate argument is the interest rate per period for the loan. For example, in this formula the 17% annual interest rate is divided by 12, the number of months in a year. The NPER argument of 2*12 is the total number of payment periods for the loan.

How do I make a balloon payment amortization schedule in Excel?

Step-By-Step Procedures to Make an Amortization Schedule with Balloon Payment in ExcelStep 1: Establish Input Fields.Step 2: Make a Schedule for the Amortization.Step 3: Make a Summary of the Balloon Payment/Loan.Final Template.Step 1: Specified Input Fields.Step 2: Construct an Amortization Schedule.More items...•

What is an amortization schedule?

An amortization schedule is a list that displays all mortgage or loan payments and describes the payment cost for the principal amount and interest. The principal amount represents the sum of money put into a loan or investment purchase. Interest is a monetary charge for being able to borrow money.

What are the benefits of using an amortization schedule in Excel?

There are several benefits to using an amortization schedule within the Excel software application, such as:

Who can use an amortization schedule?

While amortization's primary function is for showing long-term loans, you can also use it for other types of debt payments. There's a wide variety of entities that can use amortization schedules, including the following:

How to create an amortization schedule in Excel

Here are eight steps to help you create an amortization schedule within the Excel software application: