Here's how:

- Go to Reports on the top menu.

- Choose Vendors and Payables.

- Select A/P Aging Detail.

- Tick the Customize Report tab.

- In the Dates field choose Custom .

- Enter the date for April in the From and To field.

- Tap OK.

How to generate trial balance report in QuickBooks?

- In your QuickBooks Online Account go to the Hamburger icon and select Reports.

- Enter " Trial Balance" on the search box. Here's how it looks like.

- If you want to have little modifications, you can click on the Customize button.

- Click Run Report .

Does QuickBooks have a work in progress report?

The procedure described here for handling work in progress (WIP) or construction in progress (CIP) in QuickBooks assumes that all revenue and costs will be tracked as assets (for costs) and liabilities (for revenues) until the end of the job, when they'll be transferred to income and expense accounts.

How to create opening balance in QuickBooks?

There are various steps involved to make the opening balance in QuickBooks:

- Open the account you would like to enter a gap balance for. ...

- Double-check your balance before entering it. ...

- Enter the beginning of your calendar or financial year . ...

- Leave the “ Number ” and “ Payee ” fields blank and scroll right down to the sector for “ Opening Account Balance. ...

- Enter the opening account balance. ...

How to create payroll report in QuickBooks?

QuickBooks Payroll Report: QuickBooks Online Payroll

- Firstly, navigate to the Reports Menu, then search the Payroll Section, and after that Payroll Summary.

- In the next step, set a date range from the drop-down.

- Choose one employee or user can also choose a group of employees.

- In the end, choose Run Report to run the QuickBooks Online Payroll Report.

Does QuickBooks have an inventory aging report?

Generating an Inventory Aging Report Starting with the QuickBooks Enterprise Platinum Edition 2021, you can now access two inventory reports that show the value of inventory items in stock, categorized based on their aging since purchase or acquisition.

How do I start an aging report?

To get started, follow these steps:Step 1: Review open invoices.Step 2: Categorize open invoices according to the aging schedule.Step 3: List the names of customers whose accounts are past due.Step 4: Organize customers based on the number of days outstanding and the total amount due.

How do I set up aging in QuickBooks?

Step 1: Click on Reports from the main QuickBooks menu to access the Reports drop down list. Step 2: Select Customers & Receivables from the list. Step 3: Select A/R Aging Detail from the list of report options. This report will show you all outstanding invoices and sort them by due date.

How do I get AP aging report in QuickBooks?

Step 1: Locate Accounts Payable Aging Summary. Click Reports from the left menu bar and scroll down to the What you owe section. ... Step 2: Set Up a Basic A/P Aging Report. ... Step 3: Customize Your A/P Aging Report. ... Step 4: Print, Email, or Export Your A/P Report (If Necessary)

How do I print an AR aging report in QuickBooks?

Step 1: Navigate to Accounts Receivable Aging Report. Select Reports in the left menu bar and scroll down to the Who owes you section. ... Step 2: Create a Basic A/R Aging Report. ... Step 3: Apply Custom Settings to Your Report. ... Step 4: Print, Email, or Export your Report.

What are the two types of Ageing report?

Main Categories of an Aging Report 61- 90 days: Invoices that are 61 to 90 days past their due date. Greater than 90 days: Invoices that are more than 90 days past their due date.

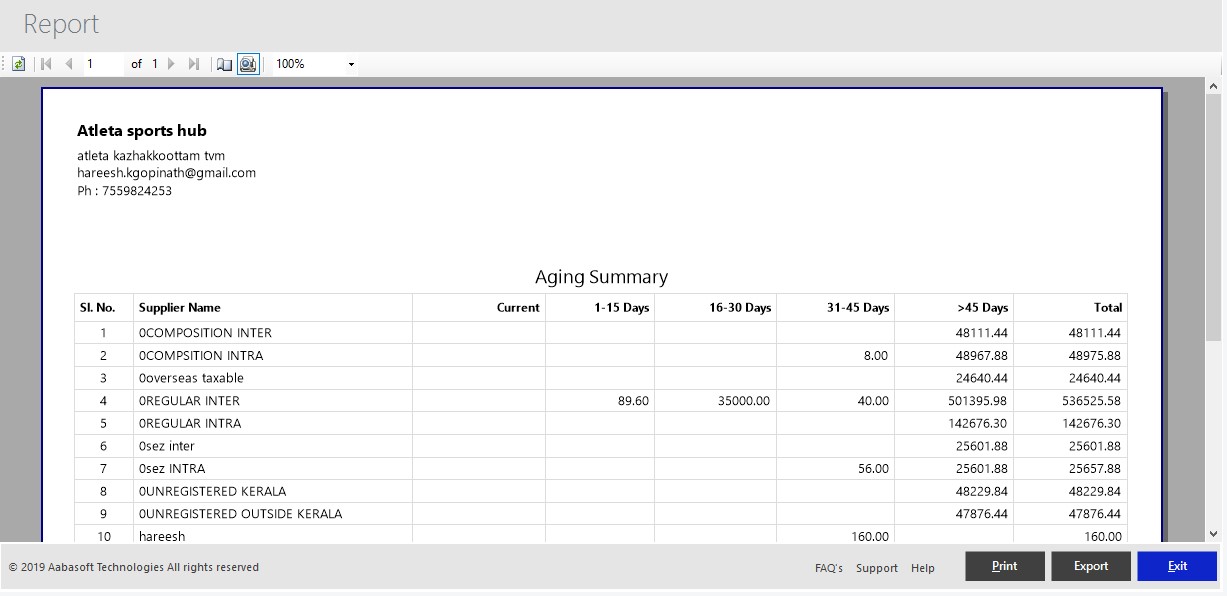

How do you prepare accounts payable aging report?

The process of how to prepare an accounts payable aging report includes: categorizing and summarizing totals for unpaid supplier invoices by each vendor name and invoice (in the detail), with columns for Current amounts (not past due), at least 30-day increments of the number of days the payables invoices are past due, ...

How do I clean up AR aging in QuickBooks?

How do I clear out the negative amount on the A/R Aging report?Click the Reports menu located at the top.Select Customers & Receivables, and then select A/R Aging Detail.Double-click the negative amount.Select the duplicate transactions.Click the Delete button.Select OK in the Delete Transaction window.

What is an accounts payable aging report?

Accounts payable (AP) aging reports are an overview of how much money your business owes to creditors. AP aging reports help you prioritize which payments should be made first and can be especially helpful when cash flow is tight.

How do aging reports work?

An AR aging report contains a list of your customers' unpaid invoices since the time the sales invoice was issued along with their duration. In other words, the accounts receivable report lists the amount due from your customers.

Why does my AR aging not match balance sheet QuickBooks?

If your Balance Sheet, Trial Balance, and Accounts Receivable Aging Reports don't match up, it's usually because the Aging Report defaults to Current.

How do you calculate aging accounts receivable?

The aging accounts receivables are calculated by multiplying average accounts receivables by 360 days. Instead of multiplying it by 365 days, which are the number of days in a year, is done to avoid fractions in the calculations of aging accounts receivables. Then this is divided by the credit sales.

How do you create an Ageing report in Excel?

How to Create an Aging Report & Formulas in ExcelLabel the following cells: A1: Customer. B1: Order # C1: Date. D1: Amount Due. ... Add additional headers for each column as: E1: Days Outstanding. F1: Not Due. G1: 0-30 Days. H1: 31-60 days.

How do aging reports work?

An AR aging report contains a list of your customers' unpaid invoices since the time the sales invoice was issued along with their duration. In other words, the accounts receivable report lists the amount due from your customers.

How do I make an aging schedule?

To prepare accounts receivable aging report, sort the unpaid invoices of a business with the number of days outstanding. This report displays the amount of money owed to you by your customers for good and services purchased.

What is an aging analysis?

Aging is a method used by accountants and investors to evaluate and identify any irregularities within a company's accounts receivables (ARs). Outstanding customer invoices and credit memos are categorized by date ranges, typically of 30 days, to determine how long a bill has gone unpaid.

What is an aging report?

Aging reports give you an overview of your customers’ outstanding balances— who are falling behind their payments, how much are still due, and how long they’re past due.

Can you run an A/R Aging summary report?

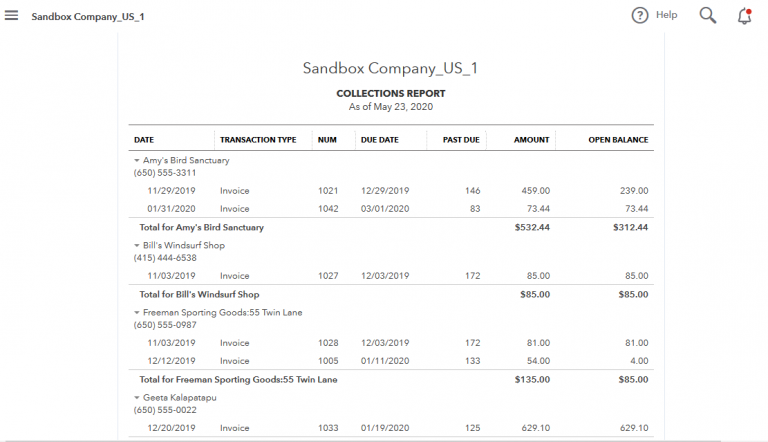

You can run an A/R Aging summary report to see the total outstanding balances and how long they’re past due.

How to Use an Accounts Receivable Aging Report?from corporatefinanceinstitute.com

One must start by looking at the largest balances and understand if the amounts are within the specified credit period or if they have been outstanding for a longer time. The user can also consider using the Pareto Principle, or the 80/20 Principle, which states that about 80% of the effects come from 20% of the causes, i.e., 80% of the amounts overdue may be attributed to 20% of the customers.

Why is the aging report important?from investopedia.com

Therefore, the aging report is helpful in laying out credit and selling practices.

Why is it called the aging schedule?from freshbooks.com

It’s called aging schedule because the accounts receivables are broken down into age categories. It indicates the total accounts receivable balance that have been outstanding for specified periods of time. The aging schedule lists accounts receivable that are less than 30 days old, less than 45 days old or more/less than 90 days old.

What is an aged receivable?from investopedia.com

The aged receivables report, or table, depicting accounts receivable aging provides details of specific receivables based on age. The specific receivables are aggregated at the bottom of the table to display the total receivables of a company, based on the number of days the invoice is past due. The typical column headers include 30-day windows of time, and the rows represent the receivables of each customer. Here's an example of an accounts receivable aging report.

How old is an account receivable?from freshbooks.com

The aging schedule lists accounts receivable that are less than 30 days old, less than 45 days old or more/less than 90 days old. This is used for determining which of its clients are paying on time and may also be utilized for cash flow estimation.

What is the document that a factoring company will require?from freshbooks.com

If you decide to factor your outstanding invoices as a financing tool, one of the documents your factoring company will require is an accounts receivable aging report. It is used to help determine the factoring rate.

How to get a collection report in QuickBooks Online?

1. Select Reports menu in the left pane in QuickBooks Online. 2. Under the standard tab go down to the section “Who owes you ”. 3. Click on “Collections Report”. To find out how you can automate your payments collections process check here.

How to find out who owes you in QuickBooks?

1. Select Reports menu in the left pane in QuickBooks Online. 2.Under the standard tab go down to the section “Who owes you ”. 3.Click on “Accounts Receivable Aging Summary”.

Appointment Scheduling

Then create headings for supplier, total amount owed, current amount due, one to 30 days past due amount, days past due amount, and more than 60 days past due amount. The amounts under the current and past days due columns should equal the figure under the total amount owed column.

What Is An Accounts Receivable Aging Report?

When using an accounts payable aging report, keep a couple of other things in mind to ensure your report is accurate and helpful. When you purchase goods or services on assets = liabilities + equity credit, you may wind up owing a vendor for several transactions.

Why Are Accounts Receivable Aging Reports Important?

It is used as a gauge to determine the financial health of a company’s customers. Since these tasks are vital to a company’s success, the time spent running and reviewing accounts payable aging reports is generally time well spent. In most cases, the accounts payable aging report should be run and reviewed on a monthly basis.

Business Courses

First, accounts receivable are derivations of the extension of credit. If a company experiences difficulty collecting accounts, as evidenced by the accounts receivable aging report, specific customers may be extended business on a cash-only basis. Therefore, the aging report is helpful in laying out credit and selling practices.

The Difference Between Official Receipts & Cash Invoice

Suppliers are the companies that provide goods and services to your business. An aged accounts payable report lists the names of the suppliers you owe a balance to in the first column. The A/P aging report is a critical tool to help business owners manage the payables process.

The Difference Between Accrued Expenses And Accounts Payable

The “Total Balance” column of an accounts payable report lists the entire balance you owe each individual supplier. With QuickBooks accounting software, you’ll be able to generate accounts receivable aging reports. Our software is extremely flexible, allowing you to customize customer settings to send invoices and reminders.

Customer and sales reports

The report is a list of all customers that have a taxable sales tax code.

Item reports

Item and item description are readily available in Open Purchase Orders Detail report available in QuickBooks Premier 2013/QuickBooks Enterprise 13 or later. If you use QuickBooks Pro or QuickBooks for Mac, you can run a Transaction Detail report.

Company and financial reports

Follow the steps below to create a Profit & Loss report that displays yearly data separated by column for easy comparison.

Payroll and employee reports

Follow the steps below to create a detailed custom report that lists each individual payroll item, the rate for each payroll item, and the total amount that has been paid to that payroll item.

Where is the reporting option in QuickBooks?

All QuickBooks reports offer the following reporting options, which can be found at the top of the report screen.

How to schedule reports in QuickBooks Desktop?

To get started creating a schedule for your reports, access the Report Schedule Setup option found under the Reports option on the drop-down menu.

How to combine reports in QuickBooks?

To combine these reports, select the Combine Reports from Multiple Companies option on the Reports menu in QuickBooks Enterprise. For QuickBooks Desktop Pro and Premier users, the only option to create reports across multiple companies is to export data to Excel, where you can manually create a multi-company report.

What is reconciliation report?

The reconciliation report is the final step in the bank reconciliation process and can be printed in either a summary or detail version.

What is transaction detail by account?

The transaction Detail by Account report displays all account activity for a defined period.

How to review your account balance?

One of the best ways to review your account balances is to run a transaction report by account. This report is particularly helpful if you spot any ending balances that seem to be too high or too low.

Where is the journal entry option in QuickBooks?

The Make General Journal Entries option is available under the Company option located at the top of the screen.