How do I enter, deposit and apply a credit??

- Click on the Banking menu.

- Choose Bank Deposits .

- Select the bank account from the Deposit To drop-down.

- In the first column, choose the vendor name. In the From Account column, choose Accounts Payable. Enter the amount.

- Click on Save and Close.

- Click on Vendors menu.

- Choose Enter Bills.

- Choose Credits.

- Enter the vendor name, choose the account/item used on the original Bill.

- Click on Save and Close.

How to set up line of credit in QuickBooks?

Step 1: Set up a liability account for the principle

- Go to Settings ⚙, then select Chart of accounts.

- Select New. ...

- From the Account Type ▼ dropdown menu, select Other Current Liabilities.

- From the Detail Type ▼ dropdown menu, select Line of Credit.

- (Optional) Change the account name.

- Select Save and Close.

How to create credit invoice in QuickBooks?

To create the initial credit invoice, complete the following steps:

- From your QuickBooks home screen, choose Customers from the menu and select Create Credit Memo. ...

- Select the customer you want to apply the credit to by typing in the customer name as it appears on the invoice. ...

- In the item box and quantity box, type in the item the credit applies to and indicate the quantity of items. ...

How do you create credit card account in QuickBooks?

Set up, use, and pay credit card accounts

- Set up credit card accounts. From the Company menu, select Chart of Accounts. ...

- Enter credit card charges. Enter credit card charges to put the amount you owe in the credit card account (Other Current Liability).

- Pay credit card charges. Pay your credit card charges to reduce the amount you owe. ...

- Enter credit card annual and finance charges. ...

How do I enter receipts into QuickBooks?

How do I enter an expense receipt in QuickBooks? Upload receipts from QuickBooks Desktop. Go to the Vendor menu, then select Receipt Management. Choose the Intuit Account you use for the company file. Drag and drop your receipts into QuickBooks or select browse to upload, then select your receipts.

How do I apply a credit to an expense in QuickBooks?

Applying credits to a bill can be done in just a few clicks:Click on Vendors at the top menu bar.Select on Pay Bills.Choose the bill that you wish to be paid.Click the Set Credits button at the bottom to apply credits.Once done, click on Pay Selected Bills.

How do I record a credit in QuickBooks desktop?

Record a Bill Credit for the returned items:Go to the Vendors menu, then select Enter Bills.Select the Credit radio button to account for the return of goods.Enter the Vendor name.Select the Items Tab.Enter the returned items with the same amounts as the refund check.Select Save & Close.

How do I enter a credit from a vendor in QuickBooks Pro?

Apply vendor credits to a bill Select + New. Select Pay bills or Pay bill. Select a bill for your vendor from the list. You'll see the available credit with this vendor in the Credit Applied field.

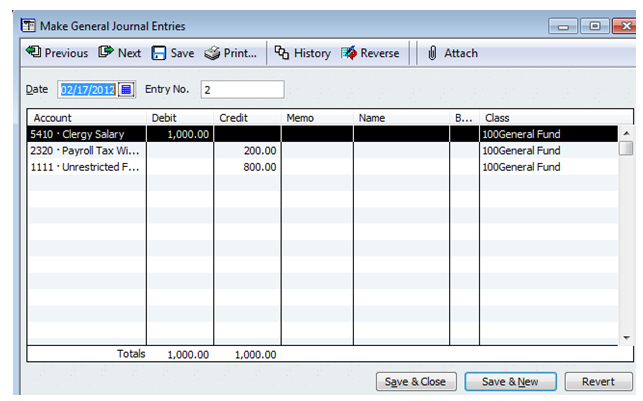

How do you record credit in accounting?

Debits are always entered on the left side of a journal entry. Credits: A credit is an accounting transaction that increases a liability account such as loans payable, or an equity account such as capital. A credit is always entered on the right side of a journal entry.

What is recorded as a credit entry?

A credit entry is used to decrease the value of an asset or increase the value of a liability. In other words, any benefit giving aspect or outgoing aspect has to be credited in books of accounts. The credits are entered in the right side of the ledger accounts.

How do you record credit from a vendor?

How to record a refund from a vendor or apply a credit memo to an invoice that was paid by credit cardOpen the Invoice record.Note all applicable information.Delete the invoice.Re-create the invoice with the correct amount (less the credit)

What is the journal entry for a vendor credit?

In the event of a credit memo, the journal entry you will make is a debit to the supplier's account, which reduces your liability. Then you credit the purchase return account, which decreases the expense.

How do I record a credit note from a supplier in QuickBooks?

Step 1: Enter the supplier creditsSelect + New.Select Supplier Credit.In the Supplier field, select the appropriate supplier name.Enter the Date, Amount, and Account (the account used here is typically the original expense account on the original bill).Select Save and close.

What are the steps in recording credit transactions?

The first step is to determine the transaction and which accounts it will affect. The second step is recording in the particular accounts. Consideration must be taken when numbers are inputted into the debit and credit sections. Then, finally, the transaction is recorded in a document called a journal.

How do you record a credit purchase?

A business records a purchase credit journal entry in its purchases journal at the time it purchases goods on credit from its vendors. When the business makes a purchase on credit, it debits the purchases account in its purchases journal, which will show up on the business's income statement.

How do I manage Credits in Quickbooks?

Go to Settings ⚙ and select Account and Settings. Select Advanced. In the Automation section, select Edit, and select Automatically apply credits....Apply the credit to a new invoiceSelect + New.Select Invoice.Create the invoice.Select + New. ... Select the credit and then Save and new or Save and close.

Learn the differences between credit memos and delayed credits

In QuickBooks, you can give credit using a credit memo or delayed credit. Here are the key differences:

Sign in for the best experience

Ask questions, get answers, and join our large community of QuickBooks users.

Why is it important to match credits to deposits in QuickBooks?

Making sure to match your credits to deposits is important to make sure that your supplier balance is correct. QuickBooks Desktop is a robust program that can help you with managing both your payables and receivables from one software. I can provide some assistance with this.

How to show deposit in Pay Bills?

You must select your Supplier in the Received from section, and Accounts Payable must be selected from within the From account drop-down. Choosing this account means that you're trying to move the money from the supplier balance to deposit it into your bank. Once you've made those selections, the Deposit should show up in your Pay Bills menu to match with your Bill Credit.

Transfer your credit funds into another account

If you want to put your credit funds into another account, you need to make a transfer.

Record interest charges

When you have used your credit, you’ll more than likely have interest charges. When you incur these charges, you will need to record them in your dedicated expense account for paid interest.

Make a payment to your line of credit

When you make a payment, you can track what you pay back to your bank or creditor.

Record paying for expenses with your credit

When you pay for things with your credit, make sure you record the bills and expenses.

Sign in for the best experience

Ask questions, get answers, and join our large community of QuickBooks users.

If you enter bills you plan to pay later

Use these steps if you enter bills to track your expenses. This makes sure the credit hits the expense account you use for this vendor.

If you enter expenses or write checks

To track credits for your vendors, you should consider entering bills in QuickBooks. This way, you can track your account balance and credits using Accounts Payable. Otherwise, you can enter a note to remind yourself about this credit in the future.

Sign in for the best experience

Ask questions, get answers, and join our large community of QuickBooks users.

How to enter credit in QuickBooks Desktop Pro?

To enter vendor credits in QuickBooks Desktop Pro, select “Vendors| Enter Bills” from the Menu Bar. In the “Enter Bills” window, select the option button for “Credit” at the top of the window. Then ensure the word “Credit” appears at the top of the form. Then select the name of the vendor who issued the credit from the “Vendor” drop-down.

Where is the credit button in QuickBooks?

In the “Enter Bills” window, select the option button for “Credit” at the top of the window.