How to obtain a business tax receipt

- Register your business You need a business before you can ask the local government to let you start operating. Follow our guide to business registration.

- Apply for the business tax receipt Once you have a business, complete an application for the business tax receipt in your city, county, or both. ...

- Pay the business tax

Full Answer

How to organize receipts for a small business?

Ways to organize business receipt:

- Go paperless. Paper recording will require large spaces and it will be costly for any business regardless of its size.

- Invest in supplies. The various supplies help the ineffective organization of receipts. ...

- Digital storage and use of software. The software applications are very useful in digital storage and automation of regular works. ...

- Categorize. ...

How to make an offer to purchase a business?

Making an offer. After you've conducted due diligence and valued the business, it's time to begin negotiations—usually with professional support and business advice. Negotiating the purchase of a business involves making an offer, which is usually followed by the seller's counter offer and bargaining to reach an agreement.

How to create a custom receipt?

Top 10 Free Online Receipt Generator & Invoice Maker to Create Custom Receipts

- Custom Receipt Maker. One of the most simple but useful online tools to create custom receipts online is – Custom Receipts Maker.

- Online Receipt Maker. Next to come to this list is – Online Receipt Maker. ...

- FakeReceipt.us – Free Online Receipt Maker. ...

- Fake ATM Receipt Generator. ...

- Free Invoice Generator. ...

- Redo Receipt. ...

- Lost Hotel Receipt. ...

- Make Receipts. ...

How do I make money from receipts?

- Create an account – Use your email address to create an account on Receipt Hog. You will also need to share your home address with the app. ...

- Take photos of your receipts – You can immediately start uploading photos of your receipts to the app. ...

- Extra rewards – You can earn some extra coins on Receipt Hog by completing some simple activities. ...

How do I get a receipt for a small business?

No matter how you're making your receipt, every receipt you issue should include:The number, date, and time of the purchase.Invoice number or receipt number.The number of items purchased and price totals.The name and location of the business the items have been bought from.Any tax charged.The method of payment.More items...•

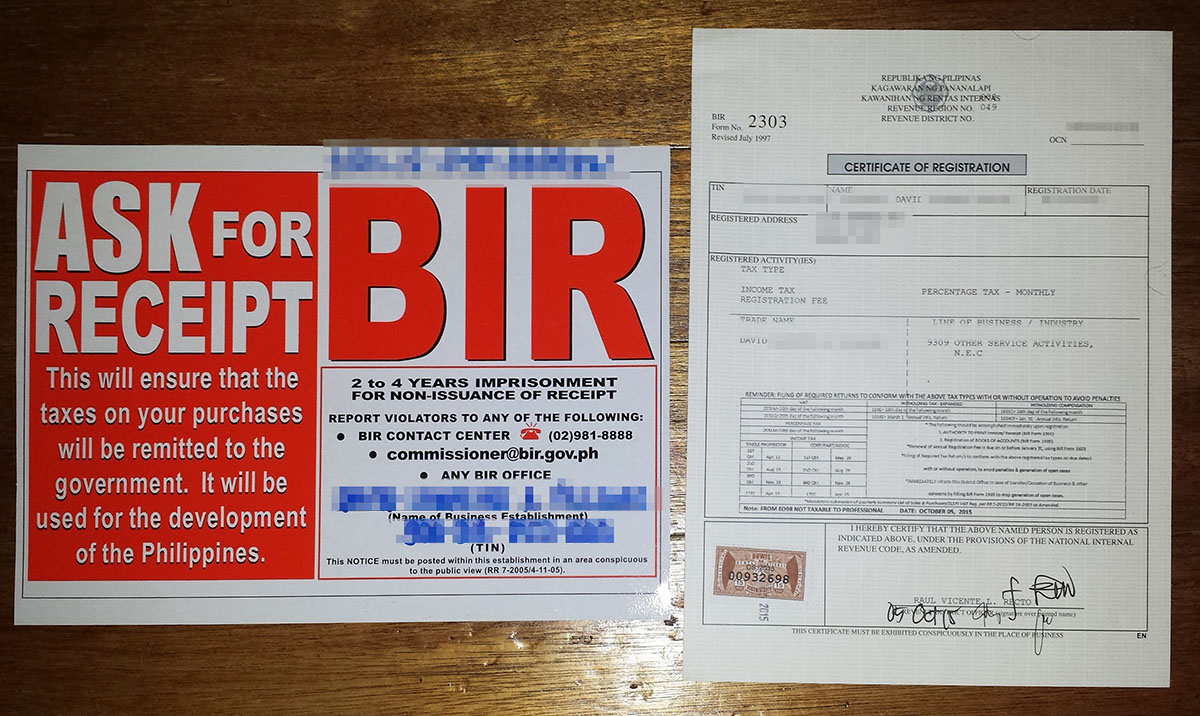

How do I get an official receipt for my business?

Head to your BIR branch, which is officially called a Revenue District Office (RDO). You are actually assigned an RDO — it is where you got your Tax Identification Number (TIN), or where you're registered from your last employer.

How do I get a receipt for self employed?

How to Make an InvoiceDownload a free invoice template.Include your business name and contact information.Add business media or logo.Include client's name, business and contact details.Input unique invoice number on template, plus invoice date and due date.List services or products with descriptions and costs for each.More items...

Can you write your own receipts?

A receipt can be issued on paper or electronically. It can be handwritten or typed.

How do I issue a receipt?

How to write a receiptYour business name, logo, and contact information;The date of sale;An itemized list of sold products and services;The price of each sold product and service;Any discounts or coupons;The total amount paid, including any sales tax or fees.

How do you get a receipt?

You can usually obtain a copies of receipts by contacting the store where you made your purchase or by using a computer scanner to make a copy yourself. It is relatively easy to make a copy of the original receipt by using a copy machine.

What receipts should a small business keep?

What receipts to keep for taxesReceipts.Cash register tapes.Deposit information (cash and credit sales)Invoices.Canceled checks or other proof of payment/electronic funds transferred.Credit card receipts.Bank statements.Petty cash slips for small cash payments.More items...•

Can I claim expenses without a receipt?

The Cohan rule allows taxpayers to deduct business-related expenses even if the receipts have been lost or misplaced—so long as they are “reasonable and credible.” This ruling means that the IRS must allow business owners to deduct some business expenses, even if they don't have receipts for all of them.

What receipts should I keep for self-employed?

Keep proof Types of proof include: all receipts for goods and stock. bank statements, chequebook stubs. sales invoices, till rolls and bank slips.

How do I make a simple receipt?

The basic components of a receipt include:The name and address of the business or individual receiving the payment.The name and address of the person making the payment.The date the payment was made.A receipt number.The amount paid.The reason for the payment.How the payment was made (credit card, cash, etc)More items...

Are bank statements as good as receipts?

Can I use a bank or credit card statement instead of a receipt on my taxes? No. A bank statement doesn't show all the itemized details that the IRS requires. The IRS accepts receipts, canceled checks, and copies of bills to verify expenses.

How do I make a cash receipt?

How to Write a Cash Payment Receipt1 – The Cash Payment Receipt Can Be Downloaded From This Site. ... 2 – Introduce The Payment Recipient As The Issuer Of This Receipt. ... 3 – Produce The Documentation For This Cash Payment. ... 4 – Payment Information Must Be Included To Define The Cash Received.

Are handwritten receipts legal?

The short answer is yes. Handwritten contracts are slightly impractical when you could just type them up, but they are completely legal if written properly. In fact, they're even preferable to verbal contracts in many ways.

Can I use my bank statements as receipts for taxes?

Can I use a bank or credit card statement instead of a receipt on my taxes? No. A bank statement doesn't show all the itemized details that the IRS requires. The IRS accepts receipts, canceled checks, and copies of bills to verify expenses.

How do I write a receipt for a business expense?

A proper receipt that counts as documentary evidence of a business expense in the eyes of the IRS must include: 1) the transaction amount; 2) the name of the vendor or place where the transaction took place; 3) the date the transaction took place, and; 4) the nature of the expense.

Do I need a new business tax receipt if my business moves?

Your local government website can answer this for your specific business.

Do business tax receipts expire?

Most business tax receipts last just one year and require annual renewal. Check your town and county tax collector websites to see the terms of you...

I have multiple businesses in the same city. Do I need multiple business tax receipts?

Usually, you need a business tax receipt for every business you operate. For example, if you have three businesses operating in Orlando, Fla., you...

Do all cities and counties require business tax receipts?

Not all cities and counties require business tax receipts. However, it's likely your city or county will make you pay for a business license before...

Are some business types exempt from business tax receipts?

Your jurisdiction might exempt certain types of businesses from obtaining business tax receipts. For example, Deltona, Fla., does not require busin...

How long do you need to keep receipts?

Most receipts are printed on thermal paper, which degrades over time. The IRS recommends that you keep your receipts for 6 years. However, the ink on a thermal paper receipt may have faded to the point that it just looks blank after that long.

What to include in travel expenses?

With travel expenses, note the reason for the travel. You might also include a brochure or other information. For example, if you traveled for a trade convention, you might attach a brochure for the convention to the receipts connected to that convention.

What is receipt in accounting?

A receipt is a written record of a transaction between two (2) or more parties. A standard receipt will include the following transaction details: Date; Amount received ($); Payment type; Description of the service or goods; and. Who accepted payment.

What is receipt in cash register?

A receipt is made after a transaction has occurred that details the price of the goods or services along with any taxes, discounts, shipping fees, or other line items. A receipt from a traditional cash register is made from thermal paper with heat being applied as the “ink”.

How long do you keep receipts?

How Long to Keep a Receipt. According to the IRS, a business should keep their receipts for three (3) years. If a business claimed a loss for any tax year, then the receipts for that year must be kept for seven (7) years. Source: IRS – How long should I keep records?

What are some good tools to keep receipts?

Take a look at tools like Cam Scanner, NeatReceipts, Receiptmate, and Shoeboxed to see if they might be helpful for your recordkeeping.

How far back can you go to get an IRS audit?

Most audits can only go back three years (from the date you file your tax return), but in some dire cases where fraud or severe tax underpayment is suspected, the IRS can audit you back to six years (again, from the date you file your tax return).

Do you have to keep receipts for 6 years?

Six years worth of business receipts is a lot of paper. But fortunately, nothing says you have to keep the receipt in it’s original paper form. You can file them away or digitize them. It’s up to you.

What is a spiral bound receipt book?

These 3-to-a-page Spiral Bound Receipt Books are the clear receipt choice for your business. Spiral-bound makes it easy and secure to keep accurate records of your receipts. With a blue colored design printed on ...

Can a carbonless book be used as a receipt book?

These versatile Carbonless Sales Books can be used as a receipt book or an invoice book. They are practical enough to be taken everywhere! The bottom copy of the receipt stays bound so that you are sure to stay ...

What is receipt in accounting?

Receipts serve as a document for customer payments and as a record of sale. If you want to provide a customer with a receipt, you can handwrite one on a piece of paper or create one digitally using a template or software system.

What should be included on a donation receipt?

Community Answer. A donation receipt would include the same things you'd include on the receipt for a sale. List what the donation is on the left side of the receipt and the estimated value of the goods on the right side of the receipt. You should also include your nonprofit ID number for tax purposes.

How to write down payment method?

The payment method could be cash, check, or credit card. On the last line of the receipt write the customer’s full name. If they paid by credit card, have them sign the bottom of the receipt.

Can you reset receipt numbers every day?

004. You can reset the receipt numbers every day as long as you also write the date on every receipt.

Can you handwrite receipts on paper?

Make sure to get booklets with 2 part forms so that you get a copy that you can keep for your records. If you don’t have a booklet on hand, you can simply handwrite receipts on a piece of paper and photocopy them.