- A small estate affidavit is just a written legal document — you can get a small estate affidavit from the county clerk’s office or have an attorney prepare one

- Administering the estate with an affidavit takes the place of formal probate

- Estates must be valued less than a certain amount to qualify for the use of the small estate affidavit

- Notarizing a small estate affidavit may not be required by your state, but it is still a good idea to do it

Do I need to fill out a small estate affidavit?

The estate must not already be in probate court before you begin your procedure. If it is, the personal representative of the estate must agree in writing to let you file a small estate affidavit. If you and the estate qualify, then you can complete the affidavit.

How to use a small estate affidavit?

- A small estate affidavit is just a written legal document — you can get a small estate affidavit from the county clerk’s office or have an attorney prepare one

- Administering the estate with an affidavit takes the place of formal probate

- Estates must be valued less than a certain amount to qualify for the use of the small estate affidavit

How to file in Small Claims Court in Illinois?

Part 2 Part 2 of 3: Filing Your Claim Download Article

- Get the small claims forms. Illinois has prepared forms available at the clerk's office that you can fill out to start the small claims process.

- Fill out your small claims form. Once you've gathered the information you'll need, you're ready to enter it on your form.

- Decide if you want a jury. ...

- Sign and make copies of your forms. ...

How to file an affidavit of heirship?

- Name and address of the deceased

- date of death

- place of death

- marriages and divorces

- family members listing including the deceased’s parents, brothers and sisters, children and nieces and nephews.

How much does it cost to file a small estate affidavit in Illinois?

between $500.00 to $1,000.00If probate can be avoided with the use of an Illinois Small Estate Affidavit, expect to pay between $500.00 to $1,000.00 in legal fees for advice to the affiant (person signing the affidavit) and assistance executing the affidavit.

How do you handle a small estate in Illinois?

You can request a small estate affidavit from the probate court clerk in the county where the deceased person lived. The affidavit must contain specific information, including the deceased person's name and address, your name, a description of the property and a list of the deceased person's funeral expenses.

How do I file a small estate affidavit in Cook County?

Complete the form and file it with the Cook County Clerk. You can obtain a copy of the affidavit from the Cook county website. State how the assets will be distributed in paragraph 11 of the affidavit. Attach a copy of the death certificate, as required in paragraph three of the affidavit.

How much does an estate have to be worth to go to probate in Illinois?

$100,000Any Illinois estate that exceeds $100,000 in value must go through the probate process unless the property is subject to certain exemptions.

Does a small estate affidavit need to be filed with the court in Illinois?

Does a small estate affidavit need to be filed with the court in Illinois? A small affidavit does not need to be filed with a court. You can find the small estate affidavit form from the Illinois Secretary of State online or in person at your local circuit county clerk's office.

Does an affidavit have to be notarized in Illinois?

We believe that Roth sets forward the state of the law in Illinois as to what is required in an affidavit and that Robidoux presents an exception to this law. Thus, unless otherwise provided for by a specific supreme court rule or statutory authorization, an affidavit must be notarized to be valid.

Who can complete a small estate affidavit in Illinois?

To file the affidavit, you must be either the executor of the decedent's will if there is one, or someone who would inherit through Illinois state intestacy laws if there is no will.

What is the small estate limit in Illinois?

$100,000 or lessTo use a small estate affidavit, all of the following must be true: The total amount of property in the estate is worth $100,000 or less; The person who died did not own any real estate , or they owned real estate that went to someone else when they died.

How do I get a letter of office in Illinois?

Letters of Office cannot be obtained without first opening a probate estate. The Letters of Office document will have a raised seal and will be signed by the Clerk of Court. In Cook County, it will be on yellow colored paper and costs $4 each.

Do I need a lawyer for probate in Illinois?

In Illinois a lawyer is required for probate unless the estate is valued at less than $100,000 and does not have real estate; in that case the Illinois Small Estate Affidavit says the estate does not require a lawyer for probate court. This can reduce the time and cost to distribute the deceased's assets.

Do you pay taxes on inheritance in Illinois?

As of 2021, there is no federal or Illinois tax on inheritances. Some states do impose inheritance taxes, but not Illinois. Illinoisans who inherit money or property, or receive it as a gift, are not taxed.

How do you avoid probate in Illinois?

In Illinois, you can make a living trust to avoid probate for virtually any asset you own—real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

What is the small estate limit in Illinois?

$100,000 or lessTo use a small estate affidavit, all of the following must be true: The total amount of property in the estate is worth $100,000 or less; The person who died did not own any real estate , or they owned real estate that went to someone else when they died.

Do I need probate for a small estate?

Obtaining a Grant of Probate is needed in most cases where the total value of the deceased's estate is deemed small... Going through the process of probate is often required to deal with a person's estate after they've passed away.

Who can complete a small estate affidavit in Illinois?

To file the affidavit, you must be either the executor of the decedent's will if there is one, or someone who would inherit through Illinois state intestacy laws if there is no will.

How do you avoid probate in Illinois?

In Illinois, you can make a living trust to avoid probate for virtually any asset you own—real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

What is a small estate affidavit?

A small estate affidavit is a form that the administrator of a deceased person’s (known as the “decedent”) estate can use to collect the decedent’s assets, pay their debts and distribute the balance of the estate to the decedent’s heirs and beneficiaries. Estate administrators can avoid opening a probate case and instead administer an estate without court oversight by using a Small Estate Affidavit if all of the following are true:

Is there a dispute between heirs and beneficiaries?

There are no disputes between heirs and beneficiaries.

Can an estate administrator avoid probate?

Estate administrators can avoid opening a probate case and instead administer an estate without court oversight by using a Small Estate Affidavit if all of the following are true: The decedent’s assets amount to less than $100,000 and do not include real estate. All of the creditors will be paid.

Does a small estate affidavit need to be filed with the court in Illinois?

A small affidavit does not need to be filed with a court. You can find the small estate affidavit form from the Illinois Secretary of State online or in person at your local circuit county clerk’s office. Once it’s filled out, make at least one extra copy of the affidavit. The form must be notarized, so make sure you don’t sign it until you can do so in the presence of a notary public. You’ll also need to attach a copy of the death certificate and a certified copy of the will, if there is one.

What do you need to fill out a small estate affidavit?

To fill out a small estate affidavit, you will need a list of any unpaid debts owed by the decedent. For example, the decedent might owe money for medical bills and credit card bills. You will also need a list of all the property and assets in the estate.

What is a small estate affidavit?

A small estate affidavit is a way for a person’s property to be transferred when they die without having to go to court. When a person dies, the things they own become part of their estate…. More on Transferring property with a small estate affidavit.

What to do if you have trouble using a small estate affidavit?

Hello. If you are having trouble using the small estate affidavit, you may want to speak to a lawyer at Get Legal Help. Good luck to you.

How many copies of affidavits are needed?

Make at least two copies of the completed affidavit. Attach a copy of the death certificate. Also, attach a certified copy of the will that was filed if there is one.

What to include when you are not an Illinois resident?

If you are not an Illinois resident, you need to provide the information of someone who is. You should include their name, address, and phone number. This person may be contacted if you are gone.

Who can show affidavits?

You can show the affidavit to any person, bank or corporation that has the property of the estate . The bank, person, or corporation must give away the property the way the affidavit says. Once the property is transferred, the person who gave you the property cannot be sued.

Who must turn over the property after a small estate affidavit?

The person or corporation that has the decedent's property must turn over the property after you give them the small estate affidavit. If they don’t, you can file a civil court claim to get the property.

How to show that your small estate affidavit is legal?

You should attach to your affidavit a copy of the Illinois statutes (755 ILCS 5/25-1) that authorize the small estate affidavit method. This law protects banks from liability for good faith distributions.

Who can use a small estate affidavit?

A small estate affidavit can be used whether or not the decedent had a will. But it can’t be used if the estate goes to probate court.

What does it mean to leave a copy of affidavit?

The bank may ask you to leave a copy of your affidavit to check that it meets all legal requirements. If some time passes and the bank still does not honor it, you should ask to speak with someone in the bank’s legal department.

Do banks have to accept affidavits?

Banks and other property holders must accept any properly completed small estate affidavit. Banks must distribute estate property as instructed in the affidavit. If a bank refuses to honor an affidavit, you have several options.

Can you transfer real estate to someone else when you die?

The person who died did not own any real estate, or they owned real estate that went to someone else when they died. Ownership could go to someone else through a Transfer on Death Instrument or if the real estate was owned in a joint tenancy with the right of survivorship; A court has not given out any letters of office.

What Is a Small Estate Affidavit in Illinois?

A small estate affidavit is a form that can be used to administer a decedent’s estate assets without opening a formal probate. An administrator is permitted to use a small estate affidavit to collect a decedent’s assets, pay a decedent’s debts, and distribute the remaining assets to the decedent’s heirs and beneficiaries.

Where to find affidavit of small estate?

The county clerk where the decedent resided will also have the form small estate affidavit in the clerk’s office and usually online as well:

Do you have to file a small estate affidavit?

No. A small estate affidavit does not need to be filed with the court.

What is a small estate affidavit in Illinois?

The Illinois small estate affidavit provides a streamlined way for an heir to gather and distribute the assets of a person who died, provided that the estate does not exceed $100,000. This form allows an heir to collect the personal property of the decedent without going to court. It can only be used for personal property, and cannot be used for real estate.

How to write an affidavit in Illinois?

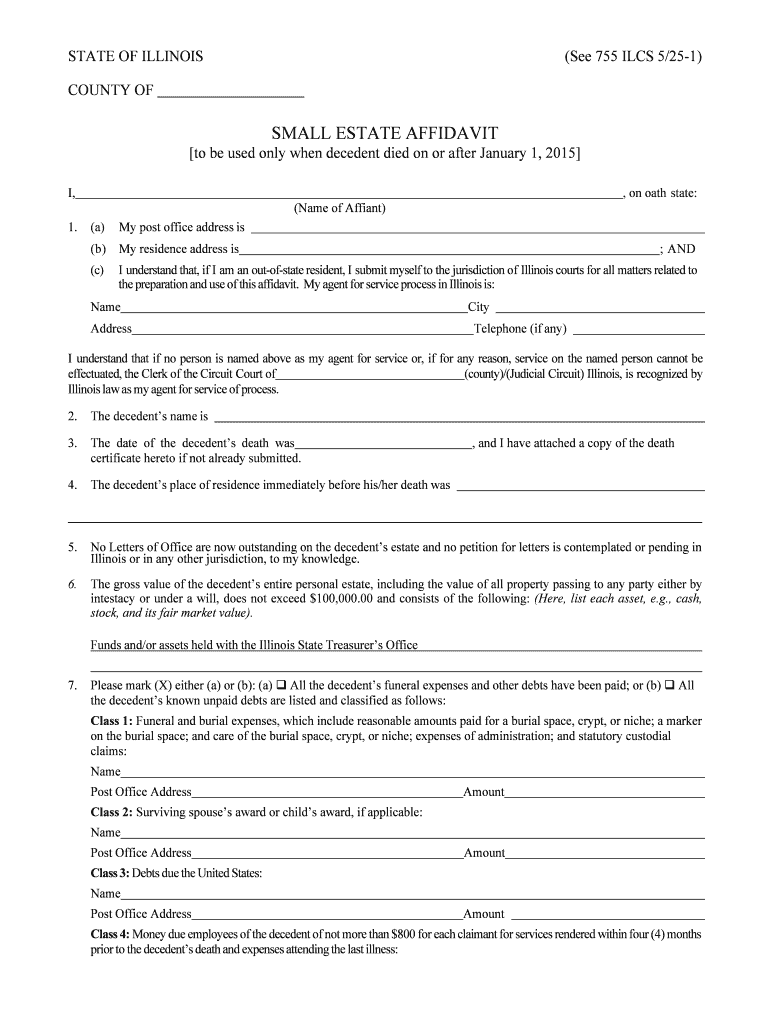

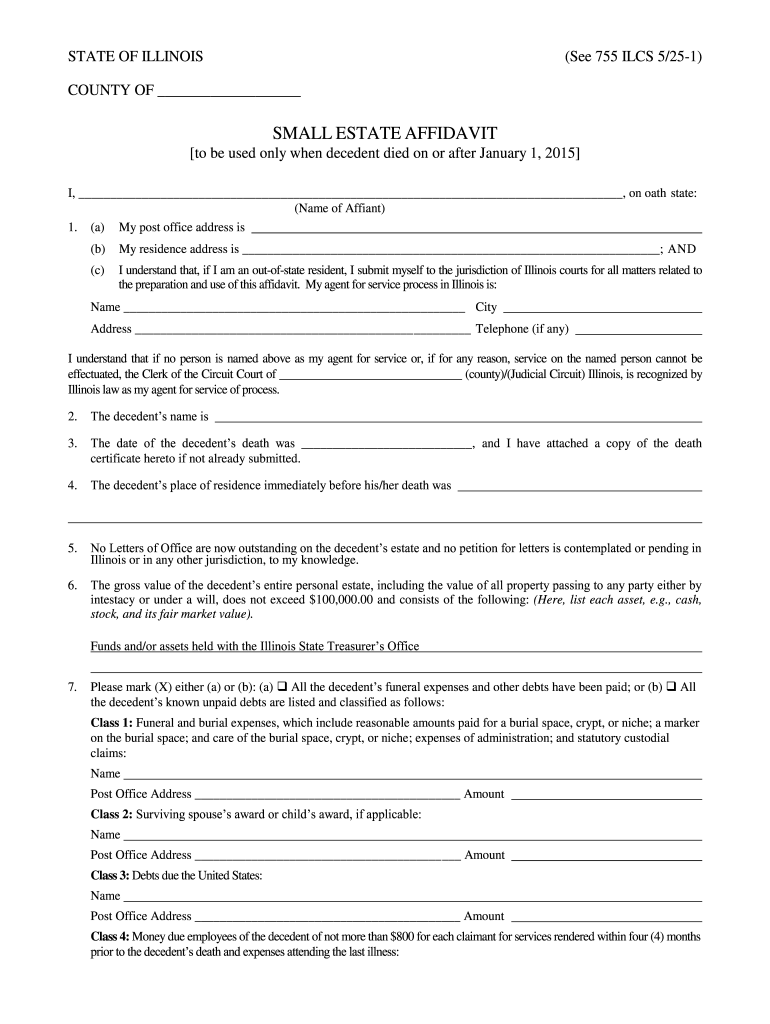

How to Write. Step 1 – At the top of the document, fill in the County in which the decedent lived at the time of death and then enter your name as the person signing the affidavit. Step 2 – In Section 1, enter your mailing and residential addresses, and if you are out of state, you have to list an agent in Illinois who can receive court papers.

Who can show affidavits?

You can show the affidavit to a person, company, or bank that can access the property of the estate. If you encounter any issues, you can file a claim in court.

How long after death can you fill out an affidavit?

Days after Death – As there is no state law requiring a minimum number of days to pass after the death before the affidavit can be used, you can begin filling it out and presenting it anytime.

What information is needed for a small estate affidavit?

The small estate affidavit form requires basic information: names and addresses of the decedent and their descendants, including immediate family and relatives. You will also need to list the assets you wish to claim, along with their value and details, like the bank account number, or motor vehicle number.

Who can use the small estate affidavit?

When the decedent died without a will, the affiant, or person who uses the affidavit, may be limited to the surviving spouse, heirs, or administrator. In some cases a creditor can get a small estate affidavit to recoup unpaid debt.

How to claim a decedent's assets?

To claim the decedent’s assets, a relative or heir can complete a small estate affidavit and present it to whomever holds the asset, like a bank or credit union. Some states require the affidavit to be filed in court first. You can often get a small estate affidavit form from the probate courts and fill it out.

What non-probate assets are not counted?

Other nonprobate assets that you typically don't have to count are those with rights of survivorship or beneficiary designations like a life insurance policy, payable-on-death accounts, and vehicles or real estate with a transfer-on-death deed (not allowed in every state).

What happens to an estate after someone passes away?

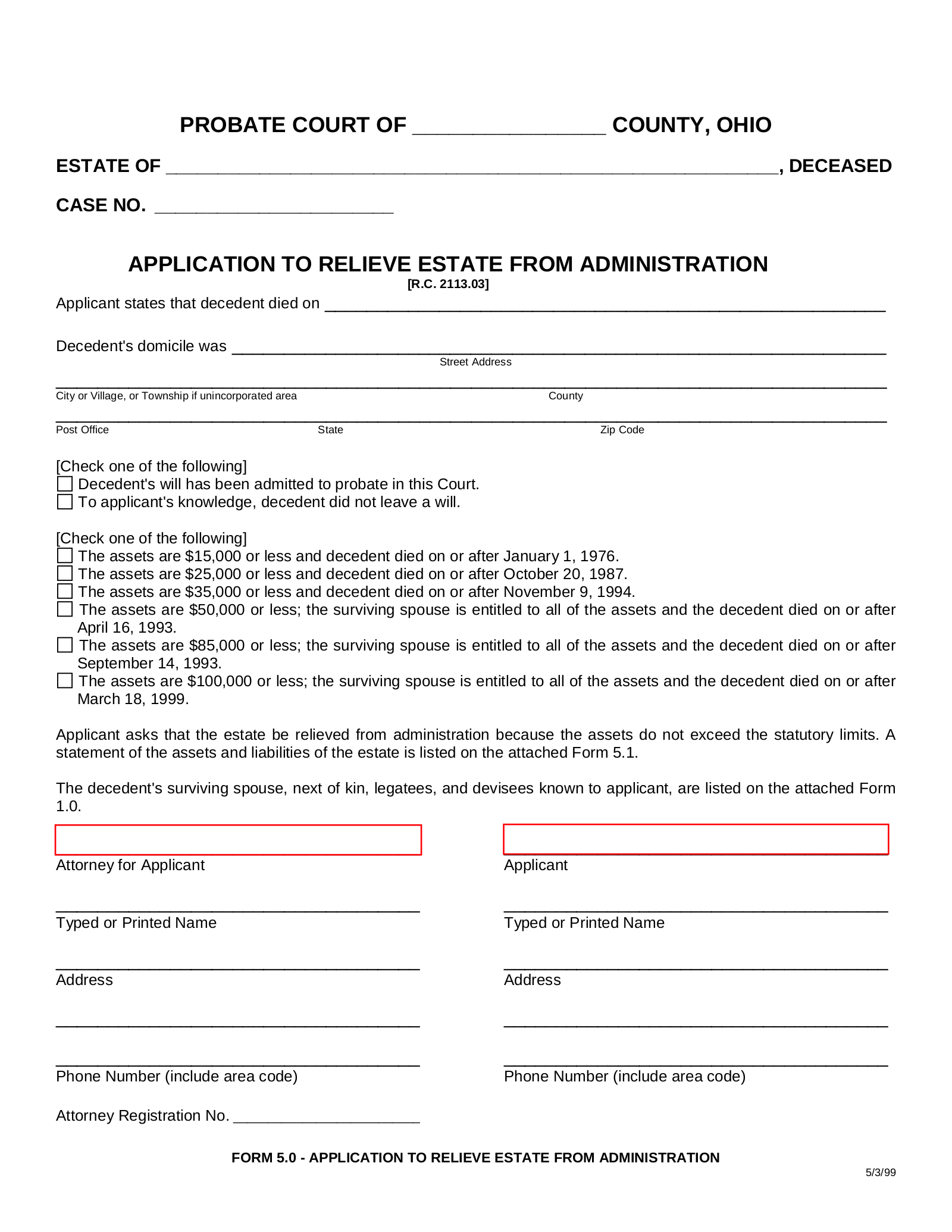

After someone passes away, their assets become part of their estate , and a court process called probate is used to prove the validity of the will or determine heirs if there isn’t a will . For small estates that are valued less than a certain dollar amount, a simplified process can be used to avoid formal probate proceedings, ...

How much is a small estate?

The collection of the decedent’s assets may need to be worth less than $50,000 to be considered small or may be able to be worth as much as $150,000, depending on the state law and what assets are counted. Generally, only probate assets are counted.

What is a copy of a will?

The original will or copy of a will (if it exists) Documentation of the deceased’s assets (proof they owned them, like a stock certificate or bank statement) Your driver’s license or other proof of identity.

What paragraphs do you need to make a small estate affidavit?

Paragraphs seven and eight require the person making the affidavit to identify creditors and make a statement that there are no contested claims. If there are any contested claims, you cannot use the small estate affidavit. Research the records of the Cook county probate court.

Why do you need a small estate affidavit?

If any disputes or claims are expected against the estate, a small estate affidavit cannot be used. A small estate affidavit is used to avoid a probate proceeding and the appointment of an estate representative. A probate proceeding is usually required to settle an estate and distribute the assets of a deceased individual.

What is probate proceeding?

A probate proceeding is usually required to settle an estate and distribute the assets of a deceased individual. Determine the value of the estate and file the original will if there is one. The estate value cannot exceed $100,000. Paragraph six of the affidavit requires a statement of the value of the estate and requires that a list ...

What is the meaning of paragraph 10 section C of a small estate affidavit?

Paragraph 10, section (c) of the affidavit is a representation that there are no such disputes. If there are any such disputes, you cannot use the small estate affidavit.

What is the purpose of paragraph 6 of an affidavit?

Paragraph six of the affidavit requires a statement of the value of the estate and requires that a list of the assets be attached along with the fair market value of each item listed. Paragraph ten of the affidavit requires information as to the status of a will for the deceased. It requires a statement that the will is on file with the court, ...

Does Cook County probate have an executor?

Research the records of the Cook county probate court. Determine that there are no open probate proceedings for the deceased and that the court has not issued letters of office appointing an executor or administrator of the deceased's estate. This is a representation that is made in paragraph five of the affidavit.

What is a small estate affidavit?

A small estate affidavit is used in lieu of probate when the aggregate amount of the deceased person’s assets passing outside of a Trust, beneficiary designation, or joint account, is under $100,000. The person filling out the affidavit is the “affiant” and the affiant affirms that this is true.

What happens if you make false statements on a small estate affidavit?

Needless to say, if you knowingly make false statements on the small estate affidavit you will be committing the crime of perjury.

Is a small estate affidavit a good idea?

A small estate affidavit is fine when the person’s probate assets are under $100,000, and had little to no debt, and ideally the only heir is a spouse or one child. Things get riskier when you start adding more people into the mix.

Can a will leave money to multiple children?

It is a common scenario where a Will leaves money to multiple children. You will have to list them in the small estate affidavit, and the bank will send the money directly to those siblings of yours. So while you signed the affidavit, you only received a portion of the money.

Can you fill out a small estate affidavit on the spot?

Some banks may even hand you a small estate affidavit on the spot. But be careful, filling out a small estate affidavit is dangerous and should only be done with advice from an attorney, such as the probate attorneys at Johnston Tomei Lenczycki and Goldberg LLC.