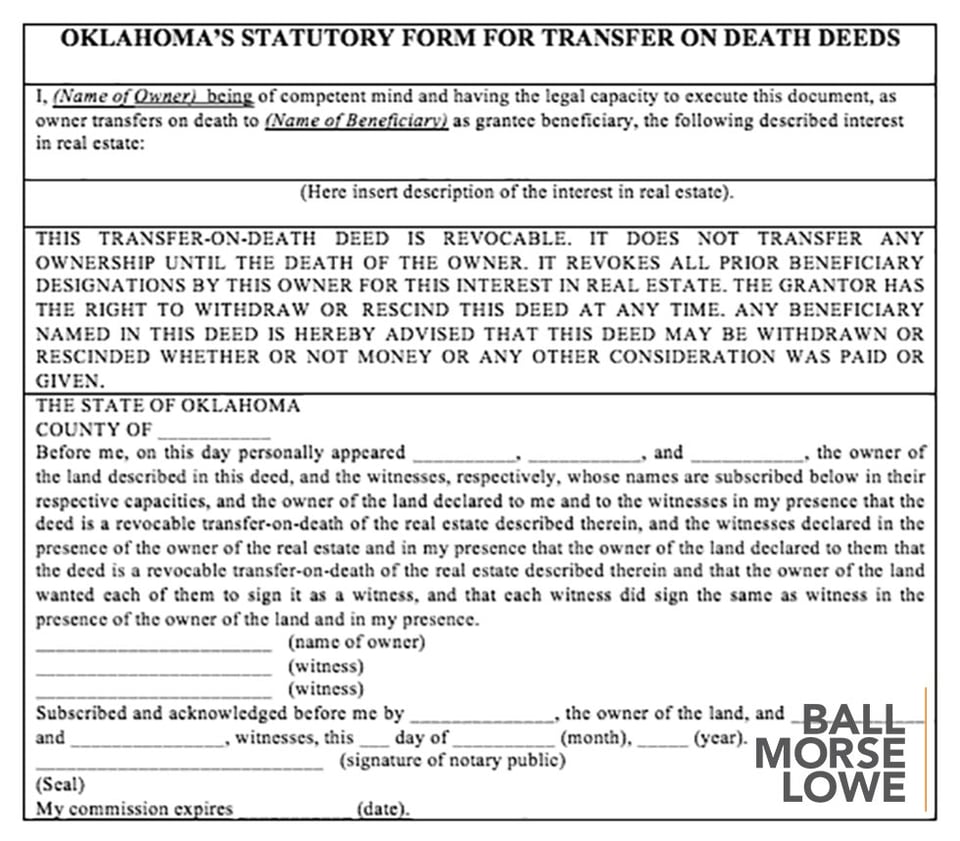

How to get a transfer on death deed Complete the deed Sign the deed Find a notary if notarization is required by your state File it with county recorder’s office

- Get Your State-Specific Deed Form. Look up the requirements for the state the property is in. ...

- Decide on Your Beneficiary. ...

- Include a Description of the Property. ...

- Sign the New Deed. ...

- Record the Deed.

How do I get a deed changed over after death?

What Are the Steps to Transfer a Deed Yourself?

- Retrieve your original deed. If you’ve misplaced your original deed, get a certified copy from the recorder of deeds in the county where the property is located.

- Get the appropriate deed form. Be sure to select the form that applies to the county and state where the property is located. ...

- Draft the deed. ...

- Sign the deed before a notary. ...

How do you transfer real property at death?

Probate will be necessary to transfer the real estate to the new owner or owners unless:

- the deceased person used a living trust (as opposed to a will) to leave the real estate to someone

- the deceased person completed and filed a transfer-on-death deed, allowed in more than half of states, to designate someone to receive the property after death, or

- the deceased person co-owned the real estate in one of a few ways.

Can You rescind a transfer on Death Deed?

There are three primary ways to revoke a recorded transfer on death instrument: Execute and record a new transfer on death instrument, explicitly revoking any previously recorded transfers on death related to the same property Convey all interest in the property to someone who is uninvolved with the original transfer.

What do I need to know about a transfer on Death (Tod) deed?

- Transfer on death deeds are allowed in more than half of the states.

- A TOD deed shouldn't take the place of writing a will and it cannot be altered by one.

- TODs let the property avoid probate but it may not provide additional protections.

- You can create a transfer on death deed for free to create and you can revoke it at any time.

Does Alabama have transfer on death deed?

The only problem is Alabama does not have a TODD statute, so any such deed would have no validity. As of January 14, 2022, twenty-nine states, along with the District of Columbia and the U.S. Virgin Islands, have some form of TODD. Alabama is not one of them, and neither is Georgia or Florida.

What are the disadvantages of a TOD deed?

Disadvantages of a Transfer on Death Deed For example, your property will be subject to probate court if your beneficiary predeceases you and you lack an alternate estate plan. Another disadvantage is if you co-own property under a joint tenancy.

Does Tennessee have transfer on death deeds?

Tennessee law does not recognize transfer-on-death (TOD) deeds. In states that authorize them, TOD deeds allow real estate to automatically transfer to a named beneficiary upon the current owner's death. The advantage of TOD deeds is that they do not limit the owner's property rights during life.

Does North Carolina have a transfer on death deed?

Transfer-on-Death Deeds for Real Estate North Carolina does not allow real estate to be transferred with transfer-on-death deeds.

Is TOD a good idea?

The most important benefit of a TOD account is simplicity. Estate planning can help minimize the legal mess left after you die. Without it, the probate system can take over the distribution of your assets. It can also name an executor of your estate and pay off your remaining debts with your assets.

What is the advantage of transfer on death?

The primary advantage of a transfer on death deed is to avoid the probate process. If a property owner has executed a transfer on death deed, then as soon as the property owner dies, that property passes to the person named. The beneficiary does not have to go to court.

Who inherits when there is no will in TN?

If you die intestate and you do not have either a spouse or descendants, the State of Tennessee dictates that the subsequent relative to inherit your estate is any surviving parents. If your parents survive you, your estate is distributed to them in equal parts.

What happens to bank account when someone dies without a will in Tennessee?

If you die without a will in Tennessee, your assets will go to your closest relatives under state "intestate succession" laws.

How do I transfer property after death of a parent in Tennessee?

An affidavit of heirship is the simplest way of transferring real property after a person has passed away. When a person dies in Tennessee without a will, real estate immediately vests in the heirs of the decedent.

What is the difference between beneficiary and transfer on death?

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

What states allow transfer on death accounts?

As of September 2019, the District of Columbia and the following states allow some form of TOD deed: Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia, ...

Who can prepare a deed in NC?

Preparing the Deed If your county government does not provide a deed, you may purchase one from a local stationery store or download one from the Internet. You could even prepare your own, although you'll need to make sure the language is correct. You can also pay an attorney to prepare one for you.

What is the difference between beneficiary and TOD?

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

What is the difference between TOD and POD?

There are various components to titling; one is using a transfer on death (TOD), generally used for investment accounts, or payable on death (POD) designation, used for bank accounts, which acts as a beneficiary designation to whom the account assets are to pass when the owner dies.

What are the disadvantages of a beneficiary deed?

Cons To Using Beneficiary DeedEstate taxes. Property transferred may be taxed.No asset protection. The beneficiary receives the property without protection from creditors, divorces, and lawsuits.Medicaid eligibility. ... No automatic transfer. ... Incapacity not addressed. ... Problems with beneficiaries.

Does Mississippi have a transfer on death deed?

The Mississippi Real Property Transfer-On-Death Act began allowing property owners to use Mississippi transfer-on-death deeds in 2020. The act applies to TOD deeds signed after July 1, 2020, by a Mississippi property owner who dies after that date.

Why is a TOD deed invalid?

Otherwise, the transfer could be invalidated because the property is automatically distributed to the remaining co-owners. Survivorship tenants wishing to execute TOD deeds should review state laws concerning joint tenancy, or seek legal advice.

What is a ladybird deed?

This reservation of powers enables land owners to retain full title rights, preserving their homestead status (if claimed) as well as any deductions, protections, and tax exemptions associated with the real estate during their lifetimes. The remainder, if any, goes to the named grantees/beneficiaries after the owner's death, thereby avoiding the probate process. Ladybird deeds are most common in Michigan, Florida, California, and Rhode Island. Even though they have been used and accepted for years, enhanced life estate deeds are not generally statutory (Rhode Island is one exception. See R.I.G.L. 34-4-2.1).

What is the power to revoke a death instrument?

Because of this feature, there is no obligation for the owner to provide notice to or collect consideration from the beneficiary (consideration implies a transfer of ownership that is not present here).

What is a survivorship tenancy?

Survivorship tenancy is a form of shared ownership that identifies the joint owner's right to the whole title upon the death of the other joint owner.

How to fill out a deed form?

All deed forms offered here: 1 Are available for immediate download 2 Are fill in the blank on your computer 3 Include step by step guide explaining every blank on the form 4 Include completed example of forms for reference 5 Meet state statutory requirements for content 6 Are formatted to meet county requirements for recording 7 Can be saved to your computer and re-used 8 Include supplemental forms that may be required by state or county 9 Save time and money. Get your real estate document done right the first time.

Why is it possible to collect property transferred at death?

This option is possible because the owner retains full ownership of the property, and also because there is no consideration associated with TOD instruments. The procedure to collect the property transferred at death often differs from state to state.

What happens if a deed is not in accordance with both the local and state standards?

If a deed form is not in accordance with both the local and state standards, there may be additional fees charged for recording or the form may be rejected altogether. The right form matters. With transfer on death deeds, the little things can make a big difference.

What is a TOD deed in Nevada?

In Illinois, a TOD deed is called a transfer-on-death instrument. In Nevada, a TOD deed is called a deed upon death. These names all refer to the same type of deed.

How to avoid probate of real estate?

As discussed in How to Avoid Probate of Real Estate, a transfer-on-death deed is a new and popular tool to avoid probate. If you own property in a state that recognizes TOD deeds, a TOD deed is often the best choice to avoid probate. Unlike life estate deeds and right of survivorship deeds, a TOD deed form avoids probate without sacrificing control. A property owner that creates a TOD deed retains the right to change or revoke the deed during life without the consent of the beneficiaries.

What is a transfer on death deed?

A transfer-on-death deed serves the same purposes as a lady bird deed (also known as a ladybird deed or enhanced life estate deed ). Both provide continued control during life and pass the property at death. Lady bird deeds are only recognized in five states: Florida, Texas, Michigan, Vermont, and West Virginia.

What is a TOD deed?

A TOD deed allows the property owner to keep control of their property. If the owner wants to change or revoke the deed before death, he or she may do so. The TOD beneficiary named in the deed has no interest in the property and no say in the matter.

What states have lady bird deeds?

Lady bird deeds are only recognized in five states: Florida, Texas, Michigan, Vermont, and West Virginia. Although the two deeds serve the same purposes, they are based on different sources of law and are not identical. If a state only offers TOD deeds, then a TOD deed is often the best choice for avoiding probate.

What happens to a property owner when he dies?

The property owner may cancel the designation, sell the property, or name a different beneficiary or group of beneficiaries.

Is a lady bird deed better than a TOD deed?

In those states, it can be a close call between a lady bird deed and a TOD deed. In Texas, for example, lady bird deeds are often a better choice than a TOD deed for the reasons listed in our discussion of Texas TOD deeds vs. lady bird deeds.

What happens to a married couple's deed when one spouse dies?

If one spouse dies, the surviving spouse automatically becomes sole owner. A married couple may also create a TOD deed.

What happens to a deed when you die?

Upon the death of one owner, title automatically goes to the surviving joint owner or owners. But all joint owners have equal rights in the property. Therefore, selling or mortgaging the property will require the agreement of all joint owners. With a TOD deed, you keep full control of the property.

What is a TOD deed?

In a TOD deed, the current owner designates one or more persons as beneficiary. The beneficiary automatically becomes the owner of the property when the current owner dies. A beneficiary can be an individual or an organization such as a charity. In some states a TOD deed is referred to as a beneficiary deed, TOD instrument or deed upon death.

What information is required on a real estate deed?

All real estate deeds must include certain information, such as the names of the grantor (current owner) and grantee (beneficiary), legal description of the property, signature of the grantor, and legally required witness and notary provisions.

What are the advantages of a TOD deed?

Other advantages of a TOD deed may include: Maintaining homestead advantages . Many states offer asset protection and taxation benefits for a person's principal residence.

What states allow TOD deeds?

As of September 2019, the District of Columbia and the following states allow some form of TOD deed: Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia, Washington, West Virginia, Wisconsin and Wyoming. Ohio has replaced the TOD deed with a TOD affidavit, but the effect is the same. With a trend toward permitting TOD deeds, more states may be added in the future. A few states, such as Michigan, have a similar but technically different document, commonly called a Lady Bird deed.

What happens to the capital gains on a property when the beneficiary dies?

If the beneficiary later sells the property, any capital gain will be based upon the value of the property at the original owner's date of death, not the value when the original owner acquired the property. Maintaining Medicaid eligibility.

How does a transfer on death deed work?

A transfer on death deed is a document that transfers your ownership in a piece of real estate to someone else after you die. The person transferring property is called the transferor or grantor, and the person named to receive the property is the beneficiary, grantee, or grantee beneficiary.

What are the disadvantages of a transfer on death deed?

For one, it does not offer a title warranty. That means there is no guarantee that the transferor actually owns the property and has the right to give it to you. If there are ownership issues, like someone else has a claim to the property, the beneficiary may not be able to receive it. Additionally, a transfer on death deed does not protect against estate creditors — the property can be sold to satisfy estate debt once the grantor dies. (For credit protection, you may want an irrevocable trust .)

What is a TOD deed?

A TOD deed simplifies the transfer of property after your death and is fairly easy to create. Even if you have other assets that will need to go through probate, using the deed for your house can help ease the probate process for your beneficiaries and loved ones. A TOD deed is especially useful if you have property in other states ...

Why do you need a transfer on death deed?

Using a transfer on death deed avoids the probate process, so your chosen beneficiary can ultimately receive the house or property much faster than with a will. (You still need a will to pass on other assets and belongings.) A transfer on death deed can be a useful addition to your estate plan, but it may not address other concerns, ...

What is joint tenancy?

Joint tenancy supersedes the terms of a transfer on death deed . For example, let’s say you and your spouse own a house as joint tenants and you execute a transfer on death deed by yourself and name your daughter as beneficiary. When you die, your daughter won’t get the house — your spouse does.

How to get a transfer deed after death?

In order for the transfer on death deed to become valid, you must file it and record it with the proper local authority, like the county clerk or recorder’s office. Your state may use other names for this department, like county office of land records and you may have to pay a small filing fee. The deed is only valid if you record it. If someone finds an unrecorded transfer on death deed with your belongings after you’ve died, it will not be valid.

Can you revoke a deed in the same manner as you created it?

You must revoke the deed in the same manner that you created it (we’ll discuss how to do both later). Writing a will does won’t change the transfer on death deed . If you create a deed and then state different instructions in your will, the TOD deed will take precedence.

Is an attorney required to create a transfer on death deed?

No, you do not need an attorney to create a transfer on death deed. While some states provide basic forms that can be used to create a transfer on death deed, these forms are not always up to date and are often too rigid to meet everyone’s unique needs. A better option is to use online software to create a custom transfer on death deed, tailored to your specific needs and the laws of your state. The best online estate planning software will allow you to create your transfer on death deed in a matter of minutes and have it fully customized to your wishes.

What is a deed in a trust?

A trust is usually created with a legal document called a “declaration of trust”. In addition to the declaration of trust document, which creates the trust, property must be transferred into the trust. In the case of real estate, the transfer is done by a deed. So when using a trust to avoid probate, an individual also needs to ensure that they create a transfer deed to place the home in the trust.

How to create a revocation form?

To create a revocation document, you can go to the county recording office where the document was recorded and request a revocation form. This revocation form should be filled out, signed, and recorded just as the deed was.

Why do we use transfer on death deeds?

Transfer on death deeds are mainly used in estate planning to keep real estate out of the probate process. Probate is a long, expensive legal process through which the property of a deceased person is managed and distributed, under court supervision. With proper estate planning, probate can and should be avoided altogether.

What happens to a beneficiary when the owner dies?

Once the owner dies, the beneficiaries simply need to record the owner’s death certificate with the county where the property is located, and they become the new owners. Note that the transfer of the property to the new owners includes any associated mortgages, liens, etc. So your beneficiary will inherit financial obligations that come with the home, such as an outstanding mortgage.

How to keep property out of probate?

To keep property out of probate, it must be turned into a “non-probate property”. Real estate can start out as non-probate property depending on how the title is held (that, is the way the deed is written). Real estate can also be turned into non probate property by using a transfer on death deed or a trust.

What is considered probate property?

Real estate that is not owned or held in any kind of special way is considered “probate property” and will have to pass through the probate process. For example, a house in the sole name of the owner, with no special form of ownership — no special arrangement.

What happens to a TOD deed when someone passes away?

Joint ownership takes precedence. If the property is jointly owned with someone else, that ownership supersedes a TOD deed. The property will instead transfer to the other owner if you pass away. Once they also pass away, the TOD deed will go into effect (if still valid).

What is a TOD deed?

If you have real estate property, and want it to transfer to loved ones without passing through probate, a transfer on death (TOD) deed may be the answer. Because a TOD deed, also known as a beneficiary deed, bypasses probate, it can simplify the inheritance process and reduce costs for your loved ones.

What happens if a beneficiary dies first?

If your beneficiary dies first, your property goes to probate anyway. If you pass away along with or after your beneficiary, and don’t have a backup beneficiary named, your property will go through probate with the rest of your estate.

How to transfer a deed to a deceased person?

It’s simple. Establishing a transfer on death deed is easy. It just requires signing the document and filing with your county land records office. You don’t even need to let the beneficiary know you’ve done it.

What is transfer on death deed?

A transfer on death deed is quite simple: you just name the person (or persons) who you want to inherit your property after you pass away. Once this document is signed and filed with your local land records office, it is considered valid until replaced or revoked. In the meantime, nothing else changes: You continue to own your home, make applicable mortgage payments, pay property taxes, make repairs and the like.

What happens to property when you die?

When you die, ownership of the property will pass automatically and immediately to your beneficiary, along with any mortgage balance, liens or judgments on the property. It does not need to pass through probate, and it is not considered a gift (so gift taxes don’t apply).

Where to file a TOD deed?

TOD deeds are legal documents that can be filed in local land records offices , and do not require the notice of the beneficiary, though it’s probably a good idea to give them a heads up. Each state has its own requirements as to what the deed entails. TOD deeds are offered in 27 states (and D.C.).

What is transfer on death deed in Virginia?

These deeds are governed by the Uniform Real Property Transfer on Death Act (URPTODA), which is incorporated into the Virginia statutes at 64.2-621 et seq.#N#A transfer on death deed is an instrument that allows owners of Virginia real estate to convey land to chosen beneficiaries without the need for a will or probate distribution ( 64.2-624). To be valid, the completed and notarized form must, among other things, meet the same standards as a regular inter vivos deed (one that transfers title while the owner is still living); state that the transfer will only occur at the owner/transferor's death; and be recorded <i>while the transferor is alive</i> in the land records at clerk's office of the county where the property is located ( 64.2-628).#N#The deeds are revocable, which means that while alive, the owner retains 100% control over the property, may use or sell it as desired, and may also redirect, modify, or even cancel the future transfer at will. As a result, there is no requirement for notice, delivery, acceptance, or consideration, all necessary for standard deeds ( 64.2-629). This is possible because the named beneficiaries only have a potential future interest in the real estate. The process and requirements for revocation are specified in 64.2-630.#N#During the owner/transferor's life, the recorded transfer on death deed does not change the owner's interest or rights to sell or mortgage the property; grant the beneficiary any interest in the land; change a creditor's interest in the real estate; affect the owner's or beneficiary's eligibility for public assistance; create a legal or equitable interest in favor of the beneficiary; or open the property up to claims from the beneficiary's creditors ( 64.2-631).#N#When the transferor dies, the title to the real property vests in the beneficiary according to the rules stated in 64.2-632. In some cases, however, the beneficiary may not wish to accept the property. If that happens, he/she may "disclaim all or part of the beneficiary's interest as provided by Chapter 26 ( 64.2-2600 et seq.)" ( 64.2-633).#N#Overall, Virginia's transfer on death deed adds an efficient, flexible tool for those considering options for estate planning. As with other important financial decisions, take the time to carefully review the different options. Each case is unique, so when in doubt, contact an attorney or other appropriate professional for advice.

What does "revocable deed" mean?

The deeds are revocable, which means that while alive, the owner retains 100% control over the property, may use or sell it as desired, and may also redirect, modify, or even cancel the future transfer at will.

Is notice required for a deed?

As a result, there is no requirement for notice, delivery, acceptance, or consideration, all necessary for standard deeds ( 64.2-629). This is possible because the named beneficiaries only have a potential future interest in the real estate. The process and requirements for revocation are specified in 64.2-630.

States That Recognize Transfer-On-Death Deeds

Other Names For Transfer-On-Death Deeds

Tod Deeds vs. Lady Bird Deeds

- A transfer-on-death deed serves the same purposes as a lady bird deed (also known as a ladybird deed or enhanced life estate deed). Both provide continued control during life and pass the property at death. Lady bird deeds are only recognized in five states: Florida, Texas, Michigan, Vermont, and West Virginia. Although the two deeds serve the same purposes, they are based o…

Benefits of Transfer-On-Death Deeds

- Transfer-on-death deeds have several advantages that make them popular estate planning tools. The Uniform Law Commission identified three primary benefitsof transfer-on-death deeds. 1. For avoiding probate, a TOD deed is an inexpensive alternative to a living trust. People have long used living truststo avoid probate, but—according to the Uniform Law Commission—the cost of establ…

Requirements For Transfer-On-Death Deeds

- Transfer-on-death deeds are designed by state law to be user-friendly. While the exact requirement for transfer-on-death deeds can vary by state, a few general principles apply. 1. A TOD deed must include the elements of a regular deed. These elements include a valid legal description, page formatting and font size requirements, and state-specific ...