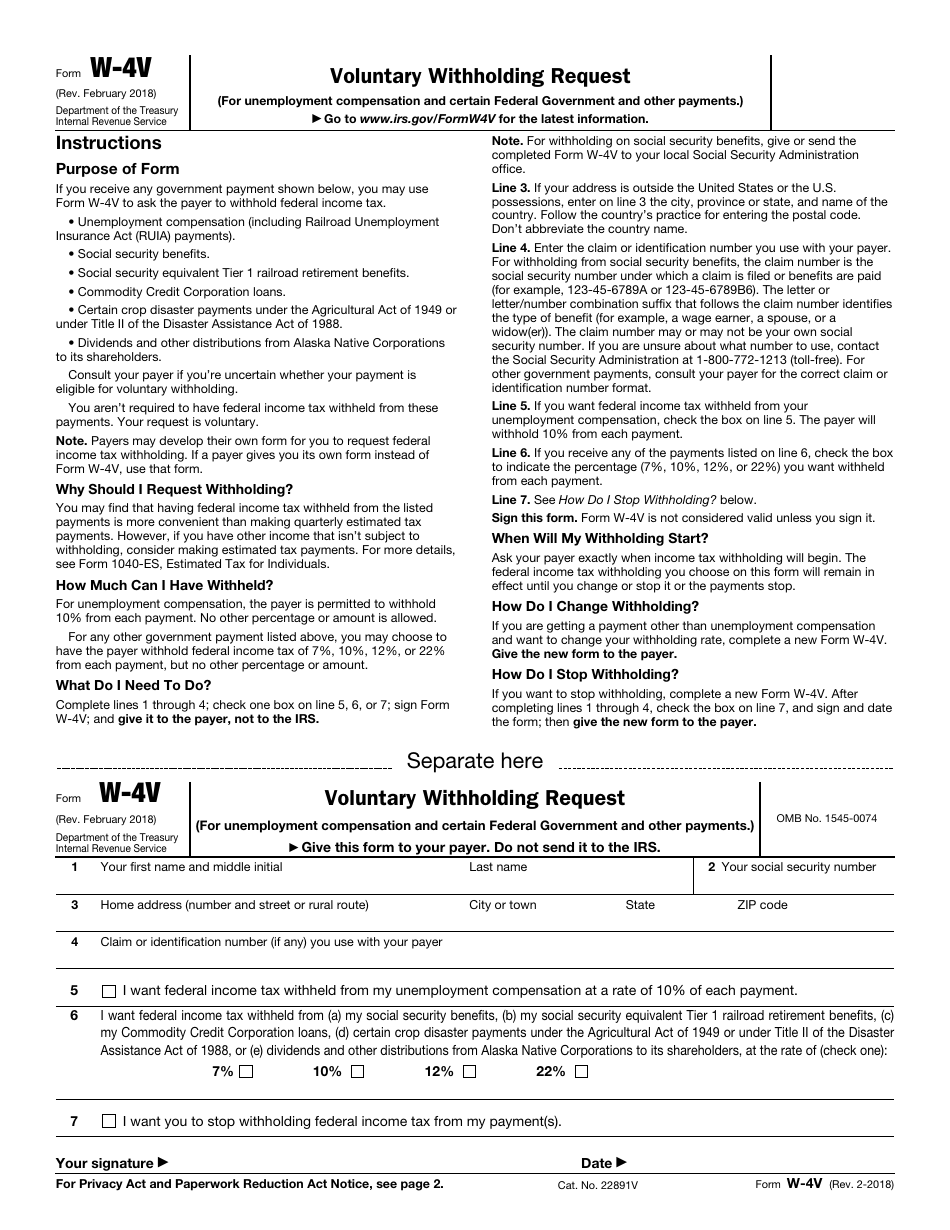

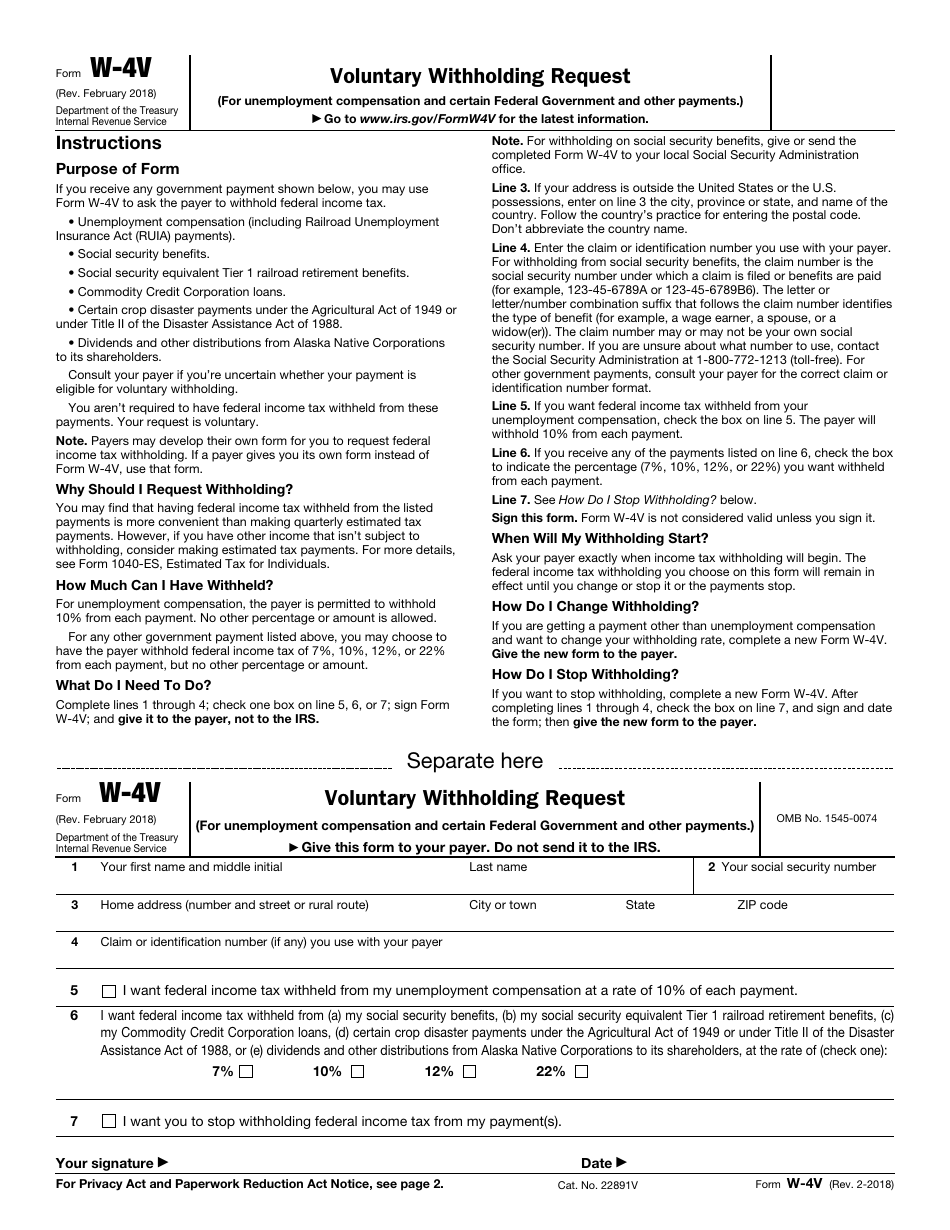

If you are already receiving benefits or if you want to change or stop your withholding, you'll need a Form W-4V from the Internal Revenue Service (IRS). You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request.

Where to send IRS Form W 4V?

send the completed Form W-4V to your local Social Security office. Your signature Form W-4V (Rev. 8-2006) For any other government payment listed above, you may choose to have the payer withhold federal income tax of 7%, 10%, 15%, or 25% from each payment, but no other percentage or amount.

How to fill out a W 4V?

W-4V Form Instructions

- State your full name and social security number;

- Write down your home address;

- Enter your identification or claim number you use with your payer. ...

- Indicate if you want federal income tax withheld from the unemployment compensation, and the payer will withhold 10% of each payment;

How to fill out W-4V form?

How to fill out a Form W-4V on the internet:

- On the website with the blank, press Start Now and pass for the editor.

- Use the clues to fill out the pertinent fields.

- Include your individual data and contact data.

- Make absolutely sure that you choose to enter appropriate data and numbers in suitable fields.

- Carefully examine the written content in the form so as grammar and...

How to fill out a W-4 Form?

How to Complete the New Form W-4

- Provide Your Information. Provide your name, address, filing status, and Social Security number. ...

- Indicate Multiple Jobs or a Working Spouse. Proceed to step 2 if you have more than one job or your filing status is married filing jointly and your ...

- Add Dependents. ...

- Add Other Adjustments. ...

- Sign and Date Form W-4. ...

See more

How do I get my W-4 from 2022?

How to Complete the New Form W-4Step 1: Provide your information. Provide your name, address, filing status, and SSN. ... Step 2: Indicate multiple jobs or a working spouse. ... Step 3: Add dependents. ... Step 4: Add other adjustments. ... Step 5: Sign and date Form W-4.

Can I submit Aw 4V online?

Double check all the fillable fields to ensure total accuracy. Utilize the Sign Tool to add and create your electronic signature to signNow the Can you submit form w 4v online 2018-2019. Press Done after you finish the document. Now it is possible to print, save, or share the form.

What is IRS form W 4V?

Voluntary Withholding Request. (For unemployment compensation and certain Federal Government and other payments.)

What form do I need to have taxes taken out of my Social Security?

About Form W-4V, Voluntary Withholding Request | Internal Revenue Service.

Is there really a $16728 Social Security bonus?

You can receive as much as a $16,728 bonus or more every year. A particular formula will determine the money you'll receive in your retirement process. You must know the hacks for generating higher future payments.

How much taxes should I have withheld from my Social Security check?

There are several ways to pay the taxes throughout the year and avoid an underpayment penalty or a big bill at tax time. You can file Form W-4V with the Social Security Administration requesting to have 7%, 10%, 12% or 22% of your monthly benefit withheld for taxes.

Is Social Security taxed after age 70?

Yes, Social Security is taxed federally after the age of 70. If you get a Social Security check, it will always be part of your taxable income, regardless of your age. There is some variation at the state level, though, so make sure to check the laws for the state where you live.

At what age is Social Security no longer taxable?

However once you are at full retirement age (between 65 and 67 years old, depending on your year of birth) your Social Security payments can no longer be withheld if, when combined with your other forms of income, they exceed the maximum threshold.

Do seniors pay taxes on Social Security income?

Income Taxes And Your Social Security Benefit (En español) between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Do I have to pay taxes on retirement income?

Taxes on Pension Income You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money.

Does Social Security count as income?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is greater than the base amount for your filing status.

How much can a retired person earn without paying taxes in 2022?

In 2022, this limit on your earnings is $51,960. We only count your earnings up to the month before you reach your full retirement age, not your earnings for the entire year.

Where do I send W-4V for Social Security?

For withholding on social security benefits, give or send the completed Form W-4V to your local Social Security Administration office.

How do I stop federal withholding from Social Security?

If you are already receiving benefits or if you want to change or stop your withholding, you'll need a Form W-4V from the Internal Revenue Service (IRS). You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request.

How do I fill out W-4V line 4?

1:523:52How to Fill Out Form W-4V for Unemployment Withholding TaxesYouTubeStart of suggested clipEnd of suggested clipW-4. It's pretty straightforward. You're just completing this voucher down here to name your name.MoreW-4. It's pretty straightforward. You're just completing this voucher down here to name your name. And street address taxpayer id so your social security number or i-10 goes up there.

Are Social Security benefits taxable?

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000.

How to fill out a W-4V?

I will need to write data in 1-4 fields and mark an appropriate box in the last three lines. Then, all you need to do is to put your signature at the end of the document and send it to the payer.

What is a W-4V?

Form W-4V is a document that you can use while obtaining some of the payments from the government if you aim to inform your employer (payer) about your wish to withhold federal income tax. This document is usually used for the following payments:

How to find out my Social Security claim number?

The claim number you may use for this purpose is the social security number under which the benefits are paid, or the claim is completed. If you are not sure that you know what claim number you should use, you can call the designated hotline. Check the telephone number either in the form itself or the official website of the Social Security Administration. By calling them, you can address any troubles you meet with identifying your claim number for withholding. If you are interested in other government forms, then you should contact the payer to find out which number to use when filling out the form.

What is the sixth line of the tax form?

The sixth line includes the percentage identification numbers. You should choose how many withholdings you want and mark an appropriate number from the listed ones.

What do you need to write on a ssn?

Next, you are required to write your SSN (Social Security Number).

Is it necessary to estimate your federal income tax?

However, in some cases, there is the necessity to estimate your tax payment. For instance, it might be relevant for you if there is another income that you receive and that is not subject to withholdings.

Can you ask your employer if you have to withhold federal income tax?

You can ask your employer (payer) whether your payment is acceptable for deliberate withholdings or not. There are no requirements that oblige you to have federal income tax withheld from these payments, by the way, but you have a right to apply if you want.

How many past years versions of W-4V are there?

We have a total of nine past-year versions of Form W-4V in the TaxFormFinder archives, including for the previous tax year. Download past year versions of this tax form as PDFs here:

How much tax is withheld from unemployment?

For unemployment compensation, the payer is permitted to withhold 10% from each payment. No other percentage or amount is allowed. For any other government payment listed above, you may choose to have the payer withhold federal income tax of 7%, 10%, 12%, or 22% from each payment, but no other percentage or amount.

Is TaxFormFinder a government agency?

TaxFormFinder.orgis a free public resource site, and is not affiliated with the United States government or any Government agency

How to fill out a 2019 W4?

Step 1: Congrats on the new job! ... Step 2: Complete lines 1 to 4 of the 2019 W4 Form. ... Step 3: Skip lines 5 and 6 on the 2019 W4 Form and complete line 7. ... Step 4: Fill out the Personal Allowances Worksheet (Page 3)

When is the 1040 due?

Key Point: The due date for your 2018 Form 1040 is April 15, 2019, unless you live in Maine or Massachusetts, in which case your deadline is April 17, 2019. You can automatically extend your return to Oct. 15, 2019 by filing Form 4868 with the IRS on or before the applicable deadline.

Do you get a refund if you claim allowances?

Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund. ... You'll most likely get a refund back at tax time. Claim zero allowances if someone else claims you as a dependent on their tax return.

Is the W-4 updated for 2020?

The Treasury Department and the IRS are working to incorporate changes into the Form W-4, Employee's Withholding Allowance Certificate, for 2020. The current 2019 version of the Form W-4 is similar to last year's 2018 version.