How do I invest in retirement Dave Ramsey?

- Pay Off Debt First.

- Don't Be Too Greedy.

- There Is No Substitute for Saving.

- Invest in Products You Understand.

- Make Investment Decisions Yourself.

- Know Your Comfort Level for Risk.

- Take Advantage of Tax-Advantaged Investments.

...

Here's how you get started with your retirement savings:

- Get the 401(k) match. ...

- Open up a Roth IRA. ...

- Go back to your 401(k).

What percentage of income should go to retirement Dave Ramsey?

This is your retirement we're talking about, so it pays to get a little more specific by doing your homework up front. What percentage of income should go to savings Dave Ramsey? Giving — Ramsey recommends giving 10% of your monthly income to worthy causes. Saving — Saving 10% of your income for retirement, which ideally is within a 401(k) or IRA.

How to budget your money like Dave Ramsey?

Types of Budgeting Methods

- The Cash Envelope System. The cash envelope system was made popular by Dave Ramsey, where this type of budgeting involves spending money while using cash only.

- Line Item Budgeting. This is the traditional way of doing your budgeting, where you will categorize all your spending in a spreadsheet.

- The 50/30/20 Method for Budgeting. ...

- Zero-Based Budget. ...

What is Dave Ramsey investing strategy?

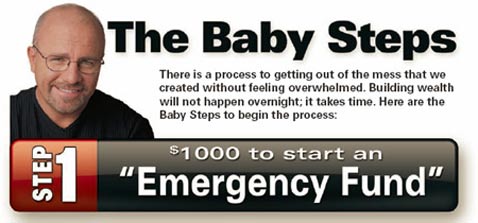

They are:

- Save a $1,000 starter emergency fund.

- Pay off all debt using the debt snowball.

- Save 3-6 months of expenses for a fully funded emergency fund.

What mutual funds does Dave Ramsey invest in?

Plain and simple, here’s Dave’s investing philosophy: Get out of debt and save up a fully funded emergency fund. Invest 15% of your income in tax-favored retirement accounts. Invest in good growth stock mutual funds. Keep a long-term perspective. Know your fees. Work with a financial advisor.

What kind of retirement does Dave Ramsey recommend?

At Ramsey, we love Roth IRAs and Roth 401(k)s because the money you invest in them grows tax-free and you won't be taxed when you take out money in retirement.

What is the best way to invest retirement money?

The 9 best retirement plans:Defined contribution plans.IRA plans.Solo 401(k) plan.Traditional pensions.Guaranteed income annuities (GIAs)The Federal Thrift Savings Plan.Cash-balance plans.Cash-value life insurance plan.More items...•

How should I invest my retirement portfolio?

The key is staying invested--and that means having at least part of your portfolio allocated to stocks, but in the right balance with other investments.Set aside one year of cash.Create a short-term reserve.Invest the rest of your portfolio.Adapt your strategy over time.

How much does a $50000 annuity pay per month?

approximately $219 each monthA $50,000 annuity would pay you approximately $219 each month for the rest of your life if you purchased the annuity at age 60 and began taking payments immediately.

Can I retire at 60 with 500k?

The short answer is yes—$500,000 is sufficient for some retirees. The question is how that will work out. With an income source like Social Security, relatively low spending, and a bit of good luck, this is feasible.

What should a 55 year old invest in?

The point is that you should remain diversified in both stocks and bonds, but in an age-appropriate manner. A conservative portfolio, for example, might consist of 70% to 75% bonds, 15% to 20% stocks, and 5% to 15% in cash or cash equivalents, such as a money-market fund.

How much should I have saved for retirement by age 60?

A general rule for retirement savings by age 60 is to aim to have about seven to eight times your current salary saved up. This means someone earning $75,000 a year would ideally have between $525,000 to $600,000 in retirement savings at that age. If you aren't there yet, you're not alone.

What should my portfolio look like at age 62?

According to this principle, individuals should hold a percentage of stocks equal to 100 minus their age. So, for a typical 60-year-old, 40% of the portfolio should be equities. The rest would comprise high-grade bonds, government debt, and other relatively safe assets.

How much of your income should you invest in retirement?

Here are some options for when you’re ready to invest beyond 15% of your income toward retirement: Max out your 401 (k) and tax-favored investment options. When you have extra money to invest, the first step is to max out your 401 (k) and/or Roth IRA.

How to make passive income from a rental?

Invest in real estate. Buying a rental property can be a great way to earn passive income, but there are some very important guidelines we want you to follow—like staying local and having an emergency fund set aside just for your rentals. But the most important one is this: we want you to pay cash for your real estate investments— no exceptions. Don’t put yourself at financial risk by financing a rental property. It’s a bad idea.

What to do if you maxed out your Roth IRA?

Go back to your 401 (k). If you maxed out your contributions to your Roth IRA for the year and still haven’t hit 15%, then bump up your 401 (k) contributions until you do.

Why do millionaires keep putting debt on their money?

Why? Because millionaires know that debt will hold you back and prevent you from reaching your financial goals. Stay away!

How to cut your budget?

Are you already thinking about some things in your budget you might be able to slash? Here are a couple of my suggestions: 1 Check your insurance policies. When was the last time you reviewed your insurance policies? If it’s been a while, reach out to an independent insurance agent and see if they can find you a better deal on car insurance or homeowner’s insurance. You might be leaving hundreds of dollars in savings on the table! 2 Cut down on the kids’ extracurricular activities. From guitar lessons to sports equipment, almost 40% of parents spend more than $1,000 each year on their kids’ extracurricular activities. 9 That adds up fast! Limiting kids to one extracurricular per season or trading travel teams for rec leagues won’t only help with your budget, it also might increase your family time.

How to take control of your money?

Stick to a monthly budget. If you haven’t been budgeting, now’s the time to start! A budget helps you take control of your money and make a plan for every dollar. Tell your money where to go instead of wondering where it all went.

How many Americans are not saving for retirement?

Ramsey Solutions conducted a study on the state of retirement in the U.S. and it found that nearly half of Americans aren’t saving for retirement. 1 And even those who do save for retirement aren’t saving enough.

Why does Dave recommend mutual funds?

Okay, so why is this the only investment option Dave recommends? Well, Dave likes mutual funds because spreading your investment across many companies helps you avoid the risks that come with investing in single stocks —like Dogecoin. Since mutual funds are actively managed by pros trying to pick stocks that will outperform the stock market, they’re a great option for long-term investing.

Why is Dave not recommending single stocks?

Dave doesn’t recommend single stocks because investing in a single company is like putting all your eggs in one basket—a big risk to take with money you’re counting on for your future.

How to invest 15% of your income?

Invest 15% of your income in tax-favored retirement accounts. Invest in good growth stock mutual funds. Keep a long-term perspective. Know your fees. Work with a financial advisor. If you haven’t paid off all your debt or saved up three to six months of expenses, stop investing—for now.

What happens if you invest before you have an emergency fund?

And if you start investing before you’ve built up your emergency fund, you could end up tapping into your retirement investments when an emergency does come along, totally ruining your financial future in the process.

What to do if you haven't reached your 15% goal?

If you still haven’t reached your 15% goal with the first two steps and have good mutual fund options available, keep bumping up your contribution to your 401 (k), 403 (b) or TSP until you hit that 15%.

How much of your income should be invested in tax favored retirement accounts?

Invest 15% of your income in tax-favored retirement accounts.

Why is Dave not recommending CDs?

Like money market accounts and savings accounts, CDs have low interest rates that don’t keep up with inflation, which is why Dave doesn’t recommend them. While CDs can be useful for setting aside money for a short-term goal, they aren’t good for long-term money goals that take more than five years to reach.

What to do with 15% of your retirement?

Once you’ve put that 15% in retirement every month, you need to think about two other goals: saving for your kids’ education and paying off your mortgage early. The College Fund. You and your spouse (if you’re married) need to decide how much money you want to put away in your child’s college fund.

How long has Ramsey Solutions been around?

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

What to do if you don't have cash to invest in real estate?

If you really want to invest in real estate but don’t have the cash on hand, save it up until you do. Debt is bad, even if it generates income! If you decide on real estate, here are some essentials: A separate checking account. It’s easier to do the accounting work and keep track of tax-related transactions.

What do millionaires invest in?

Plenty of millionaires keep their investing very simple—a balance of mutual funds and debt-free real estate. No need to get complicated.

How much of your income should you invest in?

Investing beyond 15% of your income doesn’t have to be complicated. In fact, plenty of millionaires keep their investing very simple—a balance of mutual funds and debt-free real estate. No need to get complicated.

Do millionaires invest beyond 15%?

Investing beyond 15% of your income doesn’t have to be complicated. In fact, plenty of millionaires keep their investing very simple—a balance of mutual funds and debt-free real estate. No need to get complicated. Plenty of millionaires keep their investing very simple—a balance of mutual funds and debt-free real estate.

Is a taxable account good?

A taxable account is a good solution to that problem. The principle of good investing is the same: spread your investments across four categories of funds : growth, growth and income, aggressive growth, and international. Keep a balance across those and you’ll have a buffer against the ups and downs of the market.

How to make the most of your retirement?

Here are three ways to make the most of your retirement savings. 1. Before you retire, pay off all debt including your mortgage.

Why is it important to ease into retirement?

Easing into retirement is a great way to generate income and bridge potential savings shortfalls. Here are a few tips on how to ease into retirement:

How to retire debt free?

First, consider working a few more years so you can retire debt-free. That can be a tough call if retirement is just around the corner, but retiring without the financial and mental burden of debt will be well worth the effort. Another option to consider: Downsize your home.

How much is the gap between Social Security and pre retirement?

Ideally, that gap would be covered by your retirement savings. A simple calculation shows that $36,500 multiplied by 20 years of retirement comes to $730,000—the amount you’ll need in savings to bridge the gap between Social Security benefits and your pre-retirement income.

What to do if you have saved money for years?

If you’ve saved your money for years in preparation for retirement and are unsure about how or when to start using your investments, a professional can guide you through the process. The right advisor will empower you to make the best decisions for your future and keep you in the driver’s seat.

What are the factors that affect retirement savings?

Keep in mind, there are many complex financial variables like market volatility, inflation and cost-of-living adjustments that will impact your overall personal retirement savings equation. That’s why it’s important to talk with your financial professional.

How to get rid of debt before retiring?

First, consider working a few more years so you can retire debt-free.

How did Dave Ramsey help people?

Dave Ramsey has helped millions of people take control of their money, especially through his “Baby Step” debt control program .

Should I retire early?

Retire as early as possible and don't worry so much about having a ton of money." Very probably the main reason we see so many of our elderly working into their '70's and '80's. Retiring sooner sounded like a GREAT idea. Who would have guessed they'd live this long? We will ALL pass, many to soon.....many MUCH later! " It's really not hard to live within your means." I 100% agree with you on this point. Enjoy your retirement! You've EARNED it! But don't assume everyone shares Chris circumstances.

Can you run out of money as a fed?

Running out of money as a fed is easy. Get MS, ALS, have a stroke, or get run over by a truck and end up needing long term nursing care. You will blow through your savings at an alarming rate.

Is it safe to buy 100% stocks?

I think being 100% stocks is fine for people who have the right risk tolerance and where it is part of their financial strategy. Sadly, many folks are unprepared for market crashes, which do occur with some regularity, and crash out of the market, hair afire, at the worst possible moment.

Do financial goals include getting rich?

Our financial goals do not include getting rich. That's already happened, and I am a big fan of the old adage "You only need to get rich once." So instead, capital preservation and ensuring we have enough for nursing care, if we need it, are among our current goals. (We have a few others, but these are the ones relevant to TSP.)

Can an investment advisor run projections based on your monthly contributions and expected retirement age?

An investment advisor can run projections based on your monthly contributions and expected retirement age, making sure to account for inflation and any taxes or fees that may apply down the road.". https://www.ramseysolutions... If you notice he does not list a "Rule of thumb" regarding withdrawal.

Is Dave Ramsey conservative?

Recently I came across Dave Ramsey’s advice on this topic and honestly, I was really surprised. Normally Dave Ramsey is really conservative in his recommendations but he certainly wasn’t this time around.