How do I read a HUD 1 settlement statement?

- File No./Escrow No. Think of the escrow number like your bank account number—it's a series of digits specific to a single transaction between a buyer and seller.

- Date & Time:

- Officer/Escrow Officer:

- Settlement Location:

- Property Address:

- Buyer:

- Seller:

- Lender:

Full Answer

How to properly record a HUD settlement?

- Understanding the HUD-1 settlement sheet

- Setting up your rental property in QuickBooks

- Making the journal entry in QuickBooks

What is a final HUD statement?

- Look at the first page of the HUD statement.

- Move on to the next page, which gives a detailed listing of each charge included in the summary on page one.

- Compare the actual costs with the good-faith estimates found on page three.

- Review the loan-terms section at the bottom of page three.

What does a settlement statement look like?

“I, too, was called ‘n—-r,’ Vanessa,’” Paige recalled Cheetham-Richard telling her, “but I don’t wear being a woman of color on my sleeve like you do ... an “internal investigation.” In a statement to Billy Penn, Cheetham, the ...

How to read a settlement statement?

How to read the top of the settlement statement At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

How do you read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

How do you read a closing settlement statement?

0:217:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

How do you read a settlement sheet?

How to read the top of the settlement statementFile No./Escrow No. Think of the escrow number like a bank account number — it's a series of digits specific to a single transaction between a buyer and seller.Date & Time: ... Officer/Escrow Officer: ... Settlement Location: ... Property Address: ... Buyer: ... Seller: ... Lender:More items...•

How do you read a settlement statement when buying a house?

4:3813:06How To Read A Closing Statement - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyerMoreSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyer and seller. And then all of the numbers are added and subtracted at the very bottom.

Is a HUD-1 the same as a closing statement?

The HUD-1 form, often also referred to as a “Settlement Statement”, a “Closing Statement”, “Settlement Sheet”, combination of the terms or even just “HUD” is a document used when a borrower is lent funds to purchase real estate.

Is a settlement statement the same thing as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What does POC on a settlement statement mean?

Amounts paid to and by the settlement agent are shown. Items marked “(p.o.c.)” were paid outside the closing; they are shown here for informational purposes and are not included in the totals.

What is a final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

Where do you find points on a closing statement?

Your lender will send you a Form 1098. Look in Box 2 to find the points paid for your loan. If you don't get a Form 1098, look on the settlement disclosure you received at closing. The points will show up on that form in the sections detailing your costs or the sellers' costs, depending on who paid the points.

Are HUD-1 settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Which two items will appear on a closing disclosure?

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

Where do I find sales expenses on settlement statement?

Sales expenses are listed in the sellers column of your settlement statement and include: commissions. appraisal fees. broker's fees.

What is a HUD settlement statement?

The Department of Housing and Urban Development (HUD) requires that all banks provide a HUD-1 settlement statement (also called a settlement statement) to people taking out HELOCs, reverse mortgages or mortgages for manufactured homes that aren’t attached to real estate.

When was the HUD-1 settlement statement published?

Understanding the HUD-1 Settlement Statement. Written by Denny Ceizyk. Published on: August 8th, 2019. Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

The Good Faith Estimate Is Not Reliable

Your Good Faith Estimate is just an estimate. The law requires that your get this document after submitting your application; however, it does not require that it accurately reflect the fees associated with any mortgage offer.

Mortgage Garbage Fees

Garbage fees come mostly from your mortgage company or broker. If you find anything on your Good Faith Estimate that resembles an application fee, processing fee, broker courier fee, rate lock fee, or broker rebate you’re looking at thousands of dollars in unnecessary junk fees. Here’s a rundown of these mortgage junk fees:

So What is Yield Spread Premium?

Yield Spread Premium or YSP for short is the “rebate” your mortgage broker receives from the wholesale lender for charging you an above market mortgage rate. This markup of the wholesale mortgage rate that your lender approved you is what makes mortgage interest rates retail by nature.

How Can You Tell If Your Mortgage Has YSP?

Finding Yield Spread Premium in your loan documents can be difficult. The first opportunity you’ll have during the mortgage process to spot the infamous broker rebate is on your wholesale lender’s rate lock confirmation.

Click for Instant Online Access

Check out my free Underground Mortgage Refinancing Videos and you’ll discover how easy it is to save thousands of dollars getting the best refinance rates without paying unnecessary markup or lender junk fees.

What is a HUD-1?

The HUD-1 is the financial picture of the real estate closing. It shows all of the money transfers between the buyer and seller, as well as the closing costs, including the escrow and title fees and the costs of the buyer’s loan, if applicable. The HUD-1 is a standardized form that the title company prepares for the closing, as required for all closings involving a federally insured lender under the Real Estate Settlement Procedures Act (“RESPA”). It is important to save your HUD-1 for your tax preparer. You will need it in the year of the purchase, as well as the year the property is sold. The HUD-1 form itself was created by the U.S. Department of Housing and Urban Development (“HUD”) and is updated periodically.

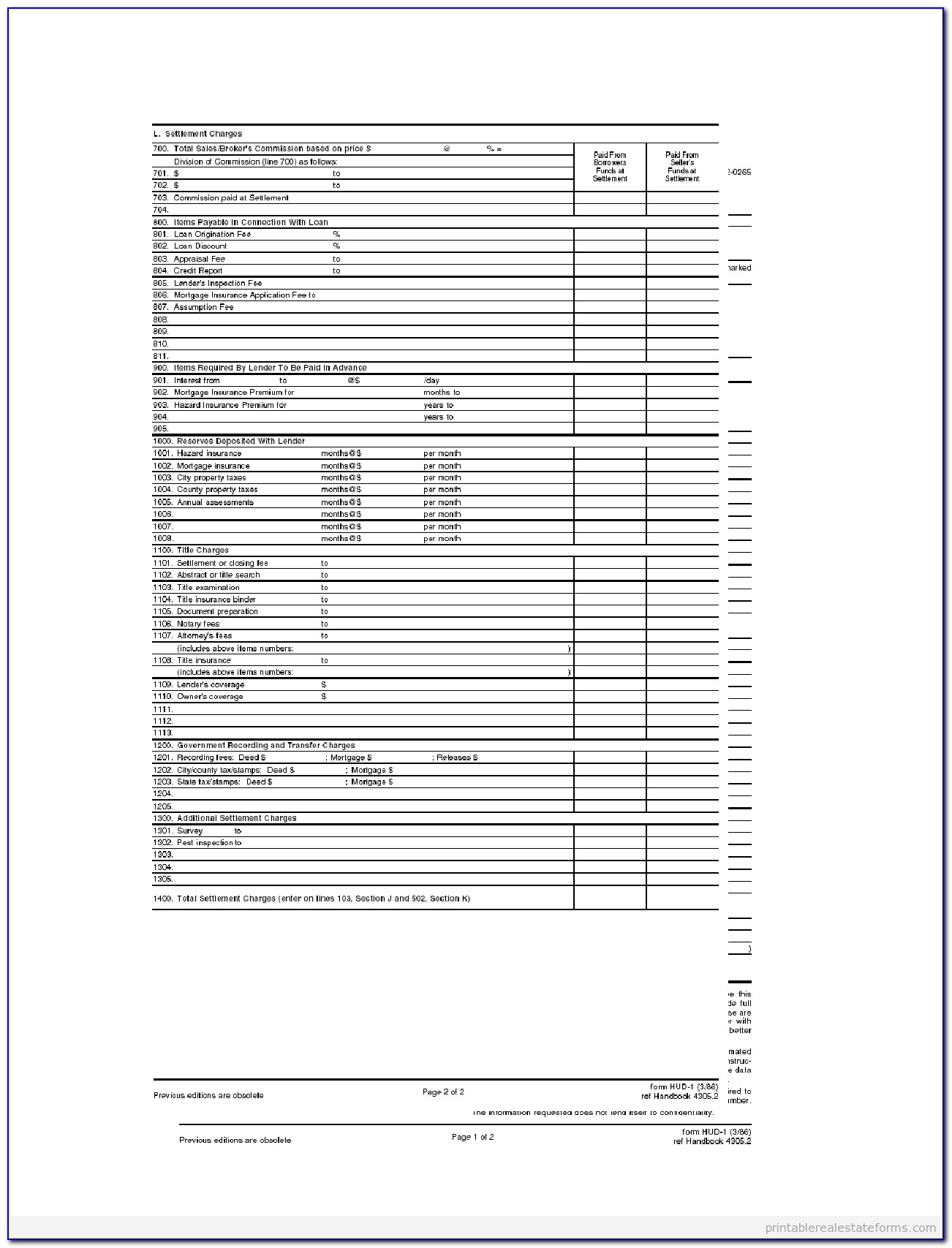

What is section L in a settlement?

Section L contains a long list of settlement charges. Charges shown in the left column are to be paid by the buyer, and charges shown in the right column must be paid by the seller. The settlement charges are grouped into the following line series:

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

What form do you use for a refinance loan?

In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form.