- Select + New.

- Select Invoice.

- Select the Customer name from the dropdown list.

- In the Product/Service column, select the Retainer or Deposit item you set up.

- Enter the amount received for the retainer or deposit in the Rate or Amount column.

- Select Save and close.

See more

How do I categorize customer deposits in QuickBooks online?

Classifying deposits in QB OnlineHighlight the Accounting tab.Select Chart of Accounts.Click New.Set the Account Type to Other Current Liabilities, then the Detail Type to Client Trust Accounts - Liabilities.Enter a name for the account.More items...•

How do you record a customer deposit?

Accounting for a Customer Deposit The company receiving a customer deposit initially records the deposit as a liability. Once the company performs under its contract with the customer, it debits the liability account to eliminate the liability, and credits a revenue account to record the sale.

How do I enter a customer deposit in QuickBooks?

Applying a customer deposit to an invoice or sales orderClick the Banking menu, then select Make Deposits.Check the amount from the sales receipt.Set the Deposit To to your bank account.Add any other information such as memo or transaction details.Click Save & Close.

How do I record a deposit that is not an income in QuickBooks?

Here's how:Go to the Create icon and select Bank Deposit.Choose the deposit to account from the drop-down.In the Add funds to this deposit section, fill in the Received From, Description, Payment Method and Amount.Select a non-income account from the Account column. ... Hit Save and close.

Are customer deposits considered income?

Explanation. For a company -- whether it be a bank or a non-financial business -- customer deposits are not income items and, therefore, do not go into taxable income calculation.

What kind of account is customer deposit?

liability accountA liability account on the books of a company receiving cash in advance of delivering goods or services to the customer. The entry on the books of the company at the time the money is received in advance is a debit to Cash and a credit to Customer Deposits.

How do I record a deposit in Quickbooks online without an invoice?

If you don't want to use an invoice you can use the sales receipt when your customer pays you on the spot for goods or services. This way, you'll record it once you have exact amount.

Do I need to issue invoice for deposit?

Any time you're requesting money from another business, including a deposit, you should issue an invoice.

How do I record a prepayment in Quickbooks online?

Go to the Expenses tab, then select the OCA account. Enter the amount of the prepayment as a negative value....Enter the bill.Go to the Vendors menu, then select Enter Bills or Receive Items (if you like to record the bill later).Fill in the necessary information.Select Save & Close.

Can you make a deposit in QuickBooks without an invoice?

Follow the steps given below in recording income without an invoice. Open QuickBooks, from Banking option available across the top, click Record Deposits/Make Deposits. In the Make Deposits window that opens up, click on Deposit To drop-down and after that choose the bank account where the payment has to be deposited.

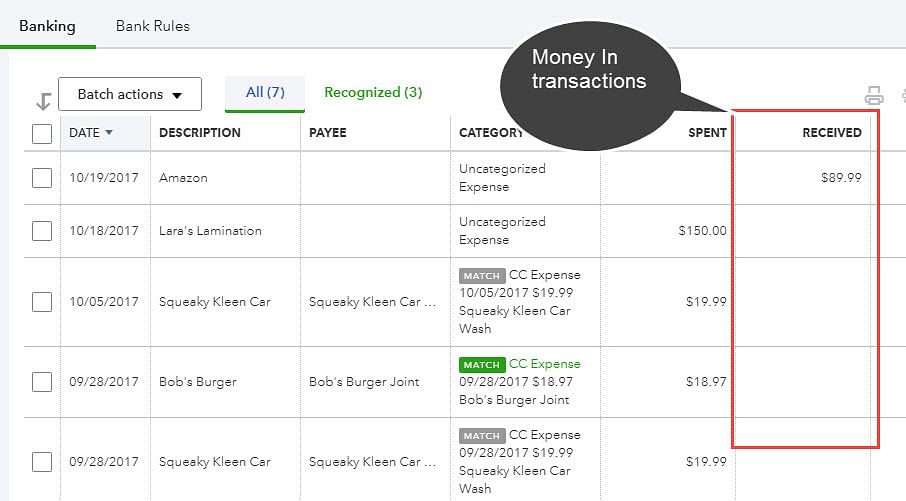

What are 2 scenarios in which you would use a bank deposit transaction in QBO?

The Bank Deposit feature serves two functions: If payments are received into the Undeposited Funds account, you can group payments and deposit them as a single record into an account. The ability to record items that aren't typically captured on invoices or bills, such as assets and loans.

Are customer deposits liabilities?

When a customer makes an advance payment for an order or project, you can record the funds received as a customer deposit. These payments are recorded in your general ledger as a liability until the goods or services are actually delivered and do not affect the customer's accounts receivable balance.

Is a deposit a debit or credit?

The money deposited into your checking account is a debit to you (an increase in an asset), but it is a credit to the bank because it is not their money. It is your money and the bank owes it back to you, so on their books, it is a liability. An increase in a Liability account is a credit.

Are customer deposits considered debt?

Does the company collect deposits for the use of assets (e.g., gas cylinders or beer kegs) to be refunded when the asset is returned? These types of deposits can be considered debt-like items, as the customer either advances payment or “loans” money to guarantee the return of the asset.

Is a deposit an expense?

How Making a Deposit Affects Accounting. You've paid money toward a rug that you do not yet have, so technically, it's not an expense yet. But your cash account has decreased, and this has to be reflected in your records.

What is a bank deposit report?

The report lists all your completed bank deposits. Select individual deposits to get more details.

Where do all transactions in undeposited funds appear?

Important : All transactions in your Undeposited Funds account appear in the bank deposit window. If you don’t see one you need to add, put it in the Undeposited Funds account.

Where does the payment go in Undeposited Funds?

The payment will go back to the Undeposited Funds account. You can add it to another deposit.

Do all deposits go back to the undeposited funds?

All payments on the deposit go back to the Undeposited Funds account. You can start over and create a brand new deposit.

Can you combine bank deposits in QuickBooks?

In these cases, QuickBooks has a special way for you to combine transactions so your records match your real-life bank deposit. Here’s how to record bank deposits in QuickBooks Online.

Do banks add fees to QuickBooks?

Some banks add service charges and processing fees. Don't edit the original transactions in QuickBooks. Instead, add the fee while you're on the bank deposit window:

Can you deposit multiple payments in QuickBooks?

If you enter the same payments as individual records in QuickBooks, they won’t match the way your bank recorded the deposit.

Save Time, Reduce Errors, and Improve Accuracy

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

Turn-On the Deposits Field in the QuickBooks Online Customer Invoices

For quick and small jobs that have little or no risk, you can choose the turn-on or in-built “Deposits” feature. Here is the process mentioned:

Delete a Bank Deposit

If ever you need to retrace your steps and start over, you can delete a bank deposit:

Record Recurring Deposits

If you are in habit of recording the same deposits regularly, you can also make an existing deposit as a recurring transaction:

Accounting Professionals, CPA, Enterprises, Owners

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries.

Technical Details

Bulk import, export, and deletion can be performed with simply one-click. A simplified process ensures that you will be able to focus on the core work.

Frequently Asked Questions

You need to click "Start" to Export data From QuickBooks Desktop using Dancing Numbers, and In the export process, you need to select the type you want to export, like lists, transactions, etc. After that, apply the filters, select the fields, and then do the export.

How to add deposit to QuickBooks Online?

For small jobs with little or no risk you can turn-on the built-in “Deposits” feature in QuickBooks Online by going to “Account and Settings”, “Sales” and “Sales from content”, then turning-on “Deposit”. This will add a “Deposit” field to your Invoice so that you can enter the deposit amount received and reduce the outstanding balance of the invoice. Many professional service providers take small deposits for scheduled services with established delivery dates.

What type of bank account do lawyers use?

Lawyers receive deposits from their clients that go into a trust liability bank account. Landlords receive deposits from tenants that also go into a liability account. General contractors receive retainer deposits and down payments from customers for constructions jobs in progress that go into a liability holding account as well.

Is a deposit on an invoice a product or service line item?

Note that a deposit itself is NOT a product or service line item and should NOT be the only item on a customer invoice.

Is a deposit considered income?

Most companies record deposits as an “ Other Current Liability ”. When you accept money from your customer as a deposit it is not yet considered income, as the money is not yours until you have earned it. If the job is cancelled or not completed for some reason, you will have to give the money back, unless you negotiated a contract for a non-refundable deposit.

Does a deposit on an invoice count as income?

When you add the received deposit to the customer invoice it will immediately count as income for your business. You will select either the bank or undeposited funds if the payment was included with other deposits that were made that day. This process works best when you’re ready to make a customer invoice, and have already received money, the balance less the deposit will remain on the invoice as outstanding until paid.

Why do you need to record advance payments in QuickBooks?

Recording advance payments from customers correctly in QuickBooks is essential for making sure that you’re accurately reporting your taxable income to the IRS. And note one other thing too. If you report cash you receive in the wrong year then get audited, you will get caught. A standard trick up any IRS auditor’s sleeve is ...

What happens if you report cash in the wrong year?

And note one other thing too. If you report cash you receive in the wrong year then get audited, you will get caught. A standard trick up any IRS auditor’s sleeve is the “bank deposit analysis,” where the auditor adds up all your bank deposits, compares it to the revenue you report on your tax return, and then asks you the taxpayer to explain the difference.

Can you use a credit memo to record advance payments?

Don’t use credit memos to record advance payments. Credit memos really only work well for recording refunds to customers and returned items. In our experience, incorrectly used credit memos cause a lot of weird-looking errors on QuickBooks balance sheets. (By the way, if you do want some assistance on how to use a credit memo correctly, Steve’s written a tutorial on how to do so that’s available here .)

Do you report cash payments to the IRS?

Here’s a key piece of information to know. Taxpayers almost always need to report payments from customers as income to the IRS when cash is received, not necessarily when it is earned. This is true even if they’re accrual-basis taxpayers [see Commissioner v. Indianapolis Power & Light Co. (1990)] [1].

Does customer deposit show up on balance sheet in QuickBooks?

Note that customer deposits show up on the balance sheet in QuickBooks this way regardless of whether the balance sheet is accrual or cash basis.

How to deal with customer deposits?

Here is the best way to deal with customer deposits: 1. Create Current Liability Account on your Chart of Accounts called “Customer Deposits Received”. 2. Create an Item on your Item list – the item type “Other Charge” Called “Deposit Received” and map it to the “Customer Deposits Received” Liability Account. 3.

Why is negative deposit important in order processing?

It’s great for order processing because when you create the Sales Order or Estimate with the negative deposit amount, it will be very clear when you invoice the customer in the future that they have made a payment toward these services and the invoice will be created for the correct total.

What is a custom transaction detail?

The Custom Transaction Detail on the Customer Deposits Liability Account will show the history of that account by customer so that you can see what customer’s deposits are still out-standing and those to whom you owe goods or services.

Can a negative customer deposit be post to a bank account?

On the accounting end , because Sales Orders and Estimates are non-posting, you have not at that time actually posted this negative amount to the Customer Deposits Liability account. The Sales Receipt will post the customer’s payment to your bank account as well as post the Liability appropriately to the Customer Deposits Liability Account – as it should be. After all you do owe either goods and services or a refund to this customer. When the invoice is created, the negative Customer Deposit item will post and cancel out the original liability, now that your obligation has been met.