Here’s how to sign up for micropayments pricing: Go to https://micropayments.paypal-labs.com/, Click “Signup” near the top of the page, Select your country or region and click “Login here,” and Enter your PayPal account password and click “Log in.” Please Allow 2 business days for micropayments pricing to take effect.

What is PayPal Micropayments?

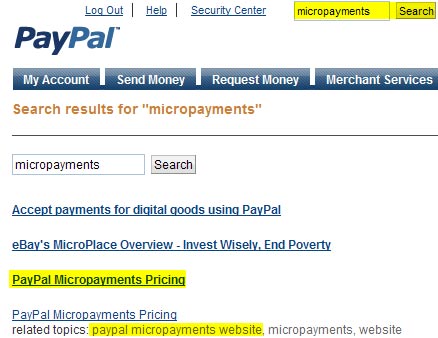

PayPal's micropayments price can be found by clicking Fees at the bottom of any PayPal page. Micropayments designed for merchants who process low-value transactions (typically under $10 in value). The micropayments rate is available to all merchants and in all countries where Business accounts are available.

What is the cost of international micropayments?

International Micropayments Cost of Product Standard Fee Micro Fee €1 €0.67 €0.06 + flat fee based on currency €2 €1.01 €0.12 + flat fee based on currency €3 €1.35 €0.18 + flat fee based on currency €4 €1.69 €0.24 + flat fee based on currency 1 more rows ...

What percentage does PayPal take from your profits?

For example, if you happen to sell products under £5, PayPal will charge up to 45p from your profit. This is because PayPal’s standard transaction fee for domestic transfers within the UK is 2.90% + 30p on every transaction. This percentage is unfair to small businesses.

What is PayPal micropayment account?

How does PayPal micropayments work? This is where micropayments come in. It is PayPal's attempt to reduce these unfair fees on small transactions. By applying PayPal's micropayments option on your website, you'll be paying less fees on small payments, which will save you money.

What is micropayment account?

A user sets up an account with a micropayment processor and pays an average or large sum of money into the account. If the provider is also used by the e-commerce platform where the user makes small purchases, the user's account with the provider is easily debited for the dollar amount of the purchase.

What are the PayPal micropayment fees?

How much are the PayPal micropayment fees? When micropayment fees are enabled, PayPal charges 5% (4.99% in the USA) + a small fixed fee per transaction.

What are digital micropayments?

A micropayment is defined as an eCommerce transaction which involves a small payment in exchange for an online service, a piece of digital content or an application download. To qualify as micropayments, these “a la carte” purchases must fall below a specific amount, generally $1.

What is micropayment or small payment?

A micropayment is an e-commerce transaction involving a very small sum of money in exchange for something made available online, such as an application download, a service or Web-based content. Micropayments are sometimes defined as anything less than 75 cents and can be as low as a fraction of a cent.

How do companies use micropayments?

Businesses like PayPal that use a prepaid micropayment system use a micropayment processor their consumers set up an account with. Each consumer then deposits a sum of money into that account and can then draw from that account to make micropayments on small purchases like digital downloads.

Why is PayPal charging me a fee for friends and family?

When sending money via “friends and family”, if the person sending the money is using a credit or debit card then the payor is charged a 2.9% fee with the option to pass that fee on to the recipient of the money. If the payor is paying from their bank account, they can send money to anyone in the US for no fee.

Is a PayPal merchant account free?

PayPal business account fees vs personal account fees Opening a PayPal business account or personal account is free, unless you choose to upgrade your account. There are no startup costs, termination fees, or monthly maintenance fees for the standard version of these accounts.

Is there a PayPal fee for friends and family?

Friends and Family payments can be made to anyone in the U.S. for free (from your bank account or PayPal). If you are sending money internationally, you may be charged a transaction fee equal to 5% of the send amount (up to $4.99 USD).

What is micropayment in Blockchain?

By definition, micropayments are transactions with a value smaller than a certain threshold. Importantly, below that threshold, the transaction fee incurred becomes a significant portion of the total transaction value and, consequently, not economical.

Which of the following is not a digital wallet?

It is a type of electronic card which is used for transactions made online through a computer or a smartphone. Unlike mobile wallets (PayTM, MobiKwik, mPesa, Airtel Money, etc.) which hold money, the BHIM app is only a mechanism which transfers money between different bank accounts. So BHIM is not a e-wallet.

What is macro payment?

Introduction. Macro-payment systems are used by most E-commerce systems today. These typically use credit card debiting, digital cash or real-time bank transfers, where a customer pays for products or services before or at the time of delivery.

What is PayPal micropayment?

PayPal micropayment is a method introduced by PayPal to eliminate the unequal fees on small transactions. For example, if you happen to sell products under £5, PayPal will charge up to 45p from your profit. This is because PayPal’s standard transaction fee for domestic transfers within the UK is 2.90% + 30p on every transaction.

Why do you need to select your payment platform carefully?

This is why you need to select your payment platform carefully. Another factor that you need to watch out for is the commissions and fees that you’ll pay on every transaction. Many payment platforms charge excessive commissions and fees on every transaction. This is especially true for international payments.