To take the Series 7 exam, you must be sponsored by a FINRA member firm or a self-regulatory organization (SRO). Firms apply for candidates to take the exam by filing a Uniform Application for Security Industry Registration or Transfer (Form U4). There is also an exam fee that is commonly covered by the sponsoring firm.

Is it hard to pass the series 7 exam?

Like most professional exams, the Series 7 has a pass/fail outcome. Given that it’s almost a four-hour exam, aim to pass the first time around. That will help put an end to working all day, and studying all night…It’s even worse than it sounds! So How Hard is the Series 7 Exam?

How much time needed to study series 7?

Most financial institutions will provide new hires with Series 7 study materials and will encourage them to allocate about 1 week of dedicated study time. In reality, test takers should spend close to 100 hours, of which at least 20-30 hours should be dedicated to practice exams and questions. All the test prep providers below provide these).

How much does it cost to take the series 7?

The registration for the Series 7 exam costs $245.00. How do I get my Series 7? If you want to get your Series 7 license, you will be required to first be sponsored by a FINRA member firm or a SRO (self-regulatory organization). How many questions are on the Series 7 exam? The Series 7 exam consists of 135 questions over 3 hours and 45 minutes.

How hard is the series 7?

Series 7 exams are very difficult because the success ratio is just 65%, but your success rate could increase if you get better prepared. The best way to prepare for the series 7 exams is to enroll with a registered institute to prepare for series 7 courses. You can easily pass the series 7 exam by preparing under the supervision of experts.

Can I take the Series 7 exam online?

FINRA offers online delivery of select qualification exams. Available exams include the Securities Industry Essentials (SIE), Series 6 and Series 7; and the National Futures Association (NFA) Series 3, Series 30, Series 31, Series 32 and Series 34.

How much does a Series 7 cost to take?

FINRA Representative-level ExamsDurationCostSeries 6 – Investment Company and Variable Contracts Products Representative Exam1 hour and 30 minutes$75Series 7 – General Securities Representative Exam3 hours and 45 minutes$300Series 22 – Direct Participation Programs Limited Representative Exam1 hour and 30 minutes$605 more rows

How can I take the Series 7 exam without sponsorship?

Do I need a sponsor? To take the Series 7 exam, you need a FINRA-member firm or SRO to sponsor you. After you've worked for them for four months or more, they can file a Form U4 (Uniform Application for Securities Industry Registration), which registers you for the exam.

How long does it take to get Series 7?

You need to spend 80-100 hours studying for the FINRA Series 7 exam if you have a finance background and about 150 if you don't. The first thing you should do is lay out a study plan that ensures you put those hours in. Give yourself enough time to take breaks from study to let concepts percolate.

Can I take Series 7 on my own?

To take the Series 7 exam, you must be sponsored by a FINRA member firm or a self-regulatory organization (SRO). Firms apply for candidates to take the exam by filing a Uniform Application for Security Industry Registration or Transfer (Form U4).

Is the Series 7 harder than the bar exam?

Clocking in at 125 questions to be answered in three hours and 45 minutes, the Series 7 exam is considered the most difficult of all the securities licensing exams.

How many times can you fail the Series 7?

A candidate can take the Series 7 exam as many times as they like; however, for the first three times, the candidate has to wait 30 days before trying again; after the first three attempts, the candidate has to wait six months.

Is a Series 7 license worth it?

In a Nutshell Typically, the Series 7 is the better choice if you're interested in selling individual securities either now or in the future. Plus, once the Series 7 is completed, no additional exam is required.

What does a Series 7 allow you to do?

A candidate who passes the Series 7 exam is qualified for the solicitation, purchase and/or sale of all securities products, including corporate securities, municipal fund securities, options, direct participation programs, investment company products and variable contracts.

Can you study for the Series 7 in a week?

Studying for the Series 7 Most financial institutions will provide new hires with Series 7 study materials and will encourage them to allocate about 1 week of dedicated study time. In reality, test takers should spend close to 100 hours, of which at least 20-30 hours should be dedicated to practice exams and questions.

What happens if you fail the Series 7?

What happens if I fail the Series 7? After the first or second time a candidate fails the Series 7, there is a mandatory 30-day waiting period before they can take the exam again. After the third (and subsequent) fails, the waiting period increases to 6 months. The $245 exam fee applies each time they take the exam.

How do you pass the Series 7 exam first time?

While everyone learns in a different way, there are certain steps you must take to pass the Series 7 exam. First, read the Series 7 textbook book completely and fully. Take notes and highlight the key points. Once you have completed the textbook, take as many Series 7 practice questions as you can.

How many times can I take the Series 7?

A candidate can take the Series 7 exam as many times as they like; however, for the first three times, the candidate has to wait 30 days before trying again; after the first three attempts, the candidate has to wait six months.

How do you get a Series 7 sponsorship?

To be eligible to take the series 7 exam, you need a sponsorship from a Financial Industry Regulatory Authority (FINRA) member organization or a self-regulatory organization (SRO). To earn this sponsorship, find a job or internship at a financial institution, such as a brokerage firm or bank.

How much does it cost to take the SIE exam?

$80This is the same for the SIE and all other representative-level exams. 8. What is the cost of the SIE exam? The cost of the SIE exam is $80.

How much does the Series 63 exam cost?

What do the exams cost? The exam fees are: $147 for the Series 63; $187 for the Series 65; and $177 for the Series 66.

How long does it take to pass the Series 7 exam?

The exam consists of 125 multiple-choice questions, and you have 3 hours and 45 minutes to complete it.

What is a Series 7 license?

What is a Series 7 license? Known as the General Securities Registered Representative license, this license allows you to sell a broad range of securities. A holder is allowed to sell corporate stocks and bonds, municipal bonds, mutual funds, variable annuities, options, direct participation program (DPP) partnerships, and packaged securities (i.e., collateralized mortgage obligations).

What is the SIE exam?

The SIE exam tests common topics such as fundamentals, regulatory agencies and their functions, product knowledge, and acceptable and unacceptable practices. You can take the SIE exam before being sponsored by a firm and even while you are still in school. You have a four-year window in which to take and pass any of the representative level ...

What is a Series 7 broker?

The Series 7 is generally preferred by banks and broker dealers for new recruits coming directly into the financial services industry. Those who get this license are officially listed as registered representatives by FINRA, but are more commonly referred to as stockbrokers. Here are the steps to follow to earn your license.

Do you have to take the SIE and Series 7 exam at the same time?

Note that FINRA says that the SIE and Series 7 exams are "corequisites," which does not mean you have to take them at the same time. What FINRA means is that you have to pass both to get your license, but you can take them in any order.

What is the Series 7 exam?

The Series 7 exam is an exam and license that gives successful candidates the authority to sell all types of securities such as stocks and bonds, except commodities and futures .

How long does it take to pass the Series 7 exam?

Series 7 Exam Structure. The Series 7 exam comprises 125 multiple-choice questions that candidates are required to complete within 3 hours and 45 minutes. It means that the candidate is allowed one minute and 48 seconds per question. The passing score for the exam is 72%, which candidates must achieve to obtain a practicing license.

What is a banking and securities committee?

Banking and Securities Industry Committee (BASIC) Banking and Securities Industry Committee (BASIC) The Banking and Securities Industry Committee (BASIC) was established in 1970 with the goal of standardizing, automating, and streamlining the processing. CFI’s Test Center.

What is the SEC?

Securities and Exchange Commission (SEC) The US Securities and Exchange Commission, or SEC, is an independent agency of the US federal government that is responsible for implementing federal securities laws and proposing securities rules. It is also in charge of maintaining ...

What is the broker exam?

The exam tests a candidate’s knowledge of the functions of a broker, such as the sale of corporate securities, investment company products, government securities, options, variable annuities, packaged securities, direct participation programs, and municipal securities. Professionals who pass the exam become officially registered representatives ...

What is a series 7 contract?

Understanding the Series 7 Exams. Futures Contract A futures contract is an agreement to buy or sell an underlying asset at a later date for a predetermined price. It’s also known as a derivative because future contracts derive their value from an underlying asset.

Does the SIE exam require a FINRA sponsor?

and how they function, acceptable and unacceptable industry practices, product knowledge, and fundamentals of securities trading. The SIE exam does not require potential candidates to be sponsored by a FINRA member firm.

What is the series 7 exam?

Ben Affleck wants to know if anyone here has passed the Series 7 exam? The Series 7 exam, also called the General Securities Representative Exam, is a regulatory licensing exam administered by FINRA to assess the competency of entry-level finance professionals involved in the selling, trading or dealing of securities.

How long is the Series 7 exam?

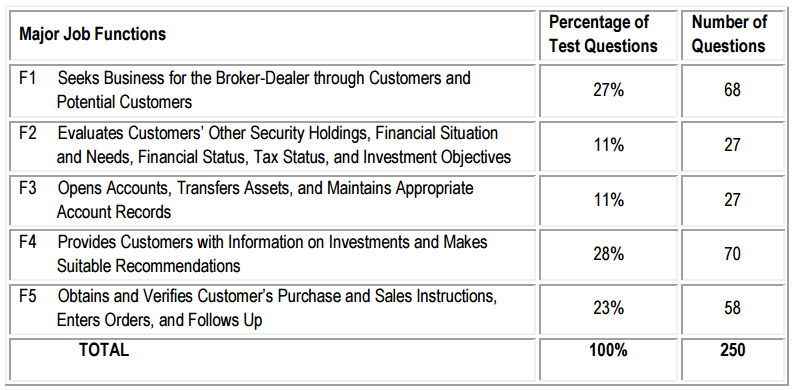

Registration before October 1, 2018, the Series 7 was a beast of an exam: 6 hours long, with 250 multiple choice questions, covering general financial knowledge as well as product-specific knowledge. Registering on or after October 1, 2018, the exam will be significantly shorter: 3 hours and 45 minutes with 125 multiple choice questions.

How Useful is the Series 7?

As I’ve alluded to, you should know that the Series 7 is widely perceived by employers as irrelevant for the actual day-to-day work of their finance professionals. Ben Affleck captured this sentiment in a his famous and totally NSFW speech to his fresh crop of finance bros in the movie “Boiler Room”:

What is the series 7 content outline?

The Series 7 content outline goes into more detail on each topic and compares the old Series 7 with the new Series 7. (We find the layout of FINRA’s content outline somewhat non-accessible, but study materials from Series 7 exam prep providers (which we list below) reorganize the topic outlines in a far more straightforward and digestible way.)

Why do financial institutions require Series 7?

That’s because many financial institutions have a better-safe-than-sorry policy around regulatory exams. FINRA member firms (i.e. investment banks and other financial institutions) want to be in good standing with FINRA. As a result, they mandate the Series 7 even to professionals not directly involved in the selling or trading of securities. This means that finance professionals involved in sales and trading and equity research, asset management, investment banking advisory services and even operations are often required to take the Series 7.

What is the minimum pass rate for series 7?

The minimum passing score is 72% , and the pass rate is around 65%. Do yourself a favor: Pass the Series 7 on the first try. If you fail, your employer and colleagues will know you couldn’t hack it and while your fellow new hires begin their jobs in earnest, you’ll have to retake the exam alone. But hey, no pressure.

Is the series 7 exam shorter?

Going forward (after October 1, 2018), the Series 7 will be shorter, but will need to be taken along with the SIE ( unless you take the SIE on your own before you’re hired). We expect that the combined study time required to pass both exams will be comparable to the current study regimen.

Who must take the Series 7 exam?

You must be affiliated with a FINRA-member company, firm, or organization to take the Series 7 exam. FINRA members include financial services companies and firms, as well as self-regulatory organizations. You should be employed by your sponsor, but do not necessarily need to be working in a securities-related role.

What happens if you don't take the Series 7 exam?

If you are not able to take the exam within your 120 day window, you can apply for an extension. You should plan to prepare for and take your Series 7 test as scheduled to continue working toward a full license to market and sell securities.

What is a SIE exam?

The SIE Exam is a prerequisite exam that covers the basics of the securities industry. These include topics such as knowledge of the market, securities products, activities you will be expected to perform, and regulations that you will need to follow. Your passing score is valid for four years. Before you can register for ...

How much is the FINRA registration fee?

The $245 registration fee is also paid online.

What is a Series 7 license?

The Series 7 license allows you to market and sell securities and is a highly sought-after credential for financial advisors, insurance agents, and other positions in the securities industry. The Series 7 license is regulated by the Financial Industry Regulatory Authority, FINRA, and all licensees must register with FINRA before taking ...

How long does it take to get a Series 7 license?

Once you submit the Form-U4, you’ll need to take the Series 7 test within 120 days. FINRA recommends scheduling your exam as soon as possible to make sure your desired testing date is available. Registration is completed by following instructions provided by FINRA after you submit your Form-U4.

How long is a series 7 pass?

Your passing score is valid for four years. Before you can register for the Series 7, you must pass the SIE Exam. While not required to apply for a job in the financial services industry, it will certainly set you apart from other applicants.

How long is the Series 7 exam?

The Series 7 exam consists of 125 multiple-choice questions and takes 225 minutes. It focuses on the nature of various securities and financial instruments such as equities, bonds, options, and municipal securities. Almost 75% percent of the questions relate to providing customers with investment information, making suitable recommendations, transferring assets, and maintaining appropriate records. If you’re tempted to focus only on memorizing formulas related to these topics, don’t. Instead, be sure to learn the concepts; they are more important than formulas. A number of the questions will test how you incorporate all your knowledge to make suitable recommendations for a hypothetical client.

Why do you need to practice for the Series 7 exam?

Because there are different types of questions on the exam, practice questions are your secret weapon for Series 7 exam success. Plan to invest a significant amount of time answering questions to get a better understanding of where your strong and weak points are, and where you need to focus more attention. If your exam prep provider provides ...

Why are practice exams different from real exams?

Practice exams are different from practice questions because they closely replicate the real exam in terms of degree of difficulty, weighting, and format. Most are updated to address the latest regulations, and you receive a score with diagnostic feedback. The better you perform on these exams, the greater your likelihood ...

How long does it take to study for FINRA?

You need to spend 80-100 hours studying for the FINRA Series 7 exam if you have a finance background and about 150 if you don’t. The first thing you should do is lay out a study plan that ensures you put those hours in. Give yourself enough time to take breaks from study to let concepts percolate. We strongly recommend including a Series 7 preparation package as part of your plan. Most web sources say the Series 7 pass rate is 65% (FINRA doesn’t release the pass rates), but in a recent Kaplan survey of Kaplan Series 7 students, 85% reported passing the Series 7 qualification exam.

What is the pass rate for series 7?

Most web sources say the Series 7 pass rate is 65% (FINRA doesn’t release the pass rates), but in a recent Kaplan survey of Kaplan Series 7 students, 85% reported passing the Series 7 qualification exam.

Is the Series 7 exam hard?

The Series 7 exam can be tough, but if you follow these strategies, study wisely, and invest in exam prep, you have a great chance of passing.

What do you need to take the Series 7 exam?

To be qualified to take the Series 7 exam, you must be employed by a firm that’s a member of FINRA and also pass the Securities Industry Essentials (SEI) exam. According to FINRA, this prerequisite “assesses a candidate’s knowledge of basic securities industry information including concepts fundamental to working in the industry, such as types of products and their risks; the structure of the securities industry markets, regulatory agencies and their functions; and prohibited practices.”

What to expect on the series 7 test?

What to Expect on Test Day. When at the testing lab to take the Series 7 exam, you won’t be allowed access to any type of reference material. Test administrators will provide you with a four-function calculator, two dry-erase boards and a dry erase pen.

What is a series 7 license?

The Series 7 exam is a test that brokers and other financial professionals must pass in order to be licensed to sell, trade and recommend most types of securities including stocks, bonds and mutual funds. However, the Series 7 license doesn’t allow you to sell or deal with real estate investments, life insurance products, commodities or futures.

How long do you have to wait to take the FINRA exam?

You should use this to develop a more effective studying strategy before retaking the exam. Typically, you can do so after 30 days. After the third try, you’ll have to wait 180 calendar days.

Can you sell real estate with a Series 7 license?

However, the Series 7 license doesn’t allow you to sell or deal with real estate investments, life insurance products, commodities or futures. Officially, the Series 7 assessment is known as the General Securities Representative Exam.

Do all financial advisors have to be brokers?

Brokers sell securities and other financial products – and some sell advice. But not all financial advisors are brokers. Those who are both follow different standards, depending on the role. To minimize the confusion, ask prospective advisors if they always follow the fiduciarystandard of working in their clients’ best interests. (Brokers only have to provide suitable recommendations.)

How hard is the Series 7 exam?

The Series 7 top-off exam expects candidates to be able to apply their knowledge of securities concepts to specific scenarios. The questions are detailed and related to the day-to-day activities, responsibilities, and job functions of representatives. Therefore, candidates should expect it to be challenging.

What is the Series 7 top-off exam? Why should I take it?

As part of this restructuring, FINRA has created a tailored top-off examination for earning the Series 7 license.

What is the Series 7 License?

Also known as the General Securities Registered Representative license, the Series 7 license is administered by FINRA . FINRA is the governing body that ensures that anyone who sells securities products is qualified and tested. If you hold this license, you can sell corporate stocks and bonds, municipal bonds, mutual funds, variable annuities, options, direct participation program partnerships, collateralized mortgage obligations, and more. The benefit of the Series 7 license is that it permits you to sell several types of securities products, except commodities and futures.

What is the difference between the Series 6 and Series 7 license?

You’re a lot more restricted to what you can sell with a Series 6 license as opposed to a Series 7 license, which permits you to sell many more types of securities. Both serve specific needs and are appropriate for financial professionals who want to offer certain capabilities to their clients.

What are the requirements to sit for the Series 7 exam? Do I need a sponsor?

To take the Series 7 exam, you need a FINRA-member firm or SRO to sponsor you. After you’ve worked for them for four months or more, they can file a Form U4 (Uniform Application for Securities Industry Registration), which registers you for the exam. Fortunately, most firms that hire or train you will have a mandatory Series 7 licensing program included in their training package.

Is the Series 7 exam paper or computer-based?

Like all other securities qualification exams, the Series 7 exam is administered by computer at a Prometric testing center.

How many questions are on the exam?

The exam consists of 125 multiple-choice questions, and each question has four answer choices. There are also ten additional unidentified and unscored pretest questions that do not contribute to your score that are randomly distributed throughout the exam.