Ways to unfreeze credit

- Experian ®. Online: Experian ® doesn't require you to create an account to lift a credit freeze.

- Equifax ®. From there, you can unfreeze your credit, check on the status of your request, or make a new request to freeze your credit if you need to.

- TransUnion ®. When should you unfreeze your credit? ...

Full Answer

How do I freeze my other credit reports?

Freezes are federally regulated. To freeze your other credit reports, you will need to contact Experian and TransUnion directly. A security freeze must be lifted each time you apply for credit. At Equifax, you can manage your freeze online with your username and password after creating a myEquifax account.

How to unfreeze your credit with Equifax?

Contact info: Experian; Experian Security Freeze, P.O. Box 9554, Allen, TX 75013; 888-397-3742. How to unfreeze credit with Equifax You can unfreeze your Equifax credit report online by creating a "myEquifax" account. A PIN is no longer needed for online freezing or lifting an Equifax credit freeze.

How do I unfreeze my Experian credit card?

Phone: 800-685-1111 (New York residents, 800-349-9960). Whether online or by phone, Experian requires a PIN to unfreeze your credit. You can request that a freeze be lifted for a specific time but unlike Equifax there is no maximum date range with Experian.

How long does it take to unfreeze your credit?

To unfreeze your credit, you’ll need to use the secure PIN that you received when you originally requested a freeze. In most cases, if you make the request by phone or online, the credit bureaus can lift a freeze in as little as 15 minutes, although the Federal Trade Commission gives them up to three business days.

How can I quickly unfreeze my credit?

The quickest and easiest way to unfreeze your credit report is to contact the credit bureau (or bureaus) you used to freeze your credit either online or by phone. But you also have the option to contact them by mail.

Do you have to unfreeze all three credit bureaus?

You have to unfreeze your credit with each credit bureau individually, unless you know which credit bureau a creditor is using and choose to lift your credit freeze at just that one. You will need your personal identification number to unfreeze your Experian credit report.

How do I unfreeze my Experian report?

To unfreeze your Experian credit report, log in to your Experian account or create one for free. After you log in, you can navigate to the Help Center, where you can find quick actions to manage your freeze and toggle your freeze status to "Unfrozen."

How long does it take to unfreeze credit?

In most cases, if you request to remove the freeze (also known as "thawing" your credit report) online or by telephone, your Experian credit file can be unfrozen within a matter of minutes—although you should allow up to an hour.

Is there a fee to unfreeze your credit?

Secures your credit report to help prevent identity theft and fraud. There's no longer a fee required to freeze or unfreeze your credit.

Do I need to unfreeze my credit to open a bank account?

Opening a bank account. When you apply for a checking or savings account, the bank or credit union may use your credit report to verify your identity. Depending on the institution, you don't necessarily have to remove your freeze. With PNC, for example, a freeze may only prevent you from opening an account online.

How do I unfreeze my Experian account without PIN?

We have implemented a newly enhanced authentication protocol for security freezes so that you no longer need a PIN to freeze or unfreeze your Experian credit file. You can log in to your Experian account to manage your security freeze online and ensure the security of your credit file.

How do I unfreeze my Equifax without a PIN?

By phone: Call us at (888) 298-0045. You'll have the option to verify your identity by providing certain personal information, and receiving a one-time PIN by text message (data charges may apply) or answering questions based on information in your Equifax credit report.

How long does it take to unfreeze credit TransUnion?

Unfreezing your TransUnion credit report is fast and easy. You can do it online or by phone and expect the freeze to be lifted within an hour. If you submit your request via mail, TransUnion will unfreeze your credit record within 3 days after receiving your letter.

How do you unfreeze TransUnion and Equifax?

This includes TransUnion, Equifax and Experian....To unfreeze your credit, simply do the following:Log in to your account online.Once logged in, you will be presented with a status screen that says “Frozen”To unfreeze, click the button that says “Remove Freeze” on the screen.

How do you tell if your credit is frozen?

If you view your credit report through AnnualCreditReport.com, you'll see a statement on the report indicating the freeze. You could also call Experian to check on your credit report's status and add or remove a freeze. You can contact Experian support at 888-EXPERIAN (888-397-3742).

Does a credit freeze affect your credit score?

A credit freeze means potential creditors will be unable to access your credit report, making it more difficult for an identity thief to open new lines of credit in your name. A credit freeze does not affect your credit score, and it's free.

How do I speak to a live person at Experian?

The number (888) 397-3742-6 (1-888-EXPERIAN) will also work....How to Talk to a Real Person at Experian.How to Speak With a Real Person at ExperianReason for CallingPhone NumberQuestion about a recent credit reportCall the number on your document from ExperianQuestion about Experian membership account(866) 617-18941 more row•Feb 24, 2022

How do I know if my Experian account is frozen?

If you view your credit report through AnnualCreditReport.com, you'll see a statement on the report indicating the freeze. You could also call Experian to check on your credit report's status and add or remove a freeze. You can contact Experian support at 888-EXPERIAN (888-397-3742).

How do I contact a live person at Experian?

Call Experian's National Consumer Assistance Center at 888-EXPERIAN (888-397-3742).

How do I unfreeze my Equifax account?

At Equifax, you can use your myEquifax account to lift a security freeze for a date range you specify. You can also lift a security freeze by phone by calling our automated line at (800) 349-9960 or calling Customer Care at (888) 298-0045.

How to unfreeze credit report?

Unfreezing your credit reports is fairly simple. To do this, you will have to contact each credit bureau online or by phone to properly lift your credit freeze. Remember, placing and lifting freezes costs no money. This is a service the credit bureaus provide to help you manage your credit and your finances effectively.

What to do if you have a credit freeze?

If you have initiated a credit freeze, you might now want to undo it and reopen your credit scores. You may be looking to apply for a new car loan or credit card and now need a potential credit issuer to review your scores and history.

How long can you unfreeze your TransUnion account?

However, once you sign up for that account you will not need a PIN. You then can lift the freeze for a range of up to 30 days, beginning on a start date you choose.

How long can you unfreeze your credit?

Equifax allows you to do this for a time period ranging from 1 to 365 days. You can also choose to permanently unfreeze credit. To lift or reinstate a credit freeze with Equifax by either phone or mail, you will need a PIN.

Which credit bureaus unfreeze credit?

Each of the Major Credit Bureaus is Slightly Different. Here’s a guide to unfreeze your credit with Equifax, Experian and TransUnion . The three major credit bureaus are all different. So, you have to unfreeze your credit with each bureau individually.

Why is my credit card frozen?

There are many reasons to have placed a freeze on your accounts. This article strives to help you make confident and positive financial decisions. So whether bad credit, ID theft or data breaches or just difficult decisions led to you freezing your credit, it’s now time to thaw.

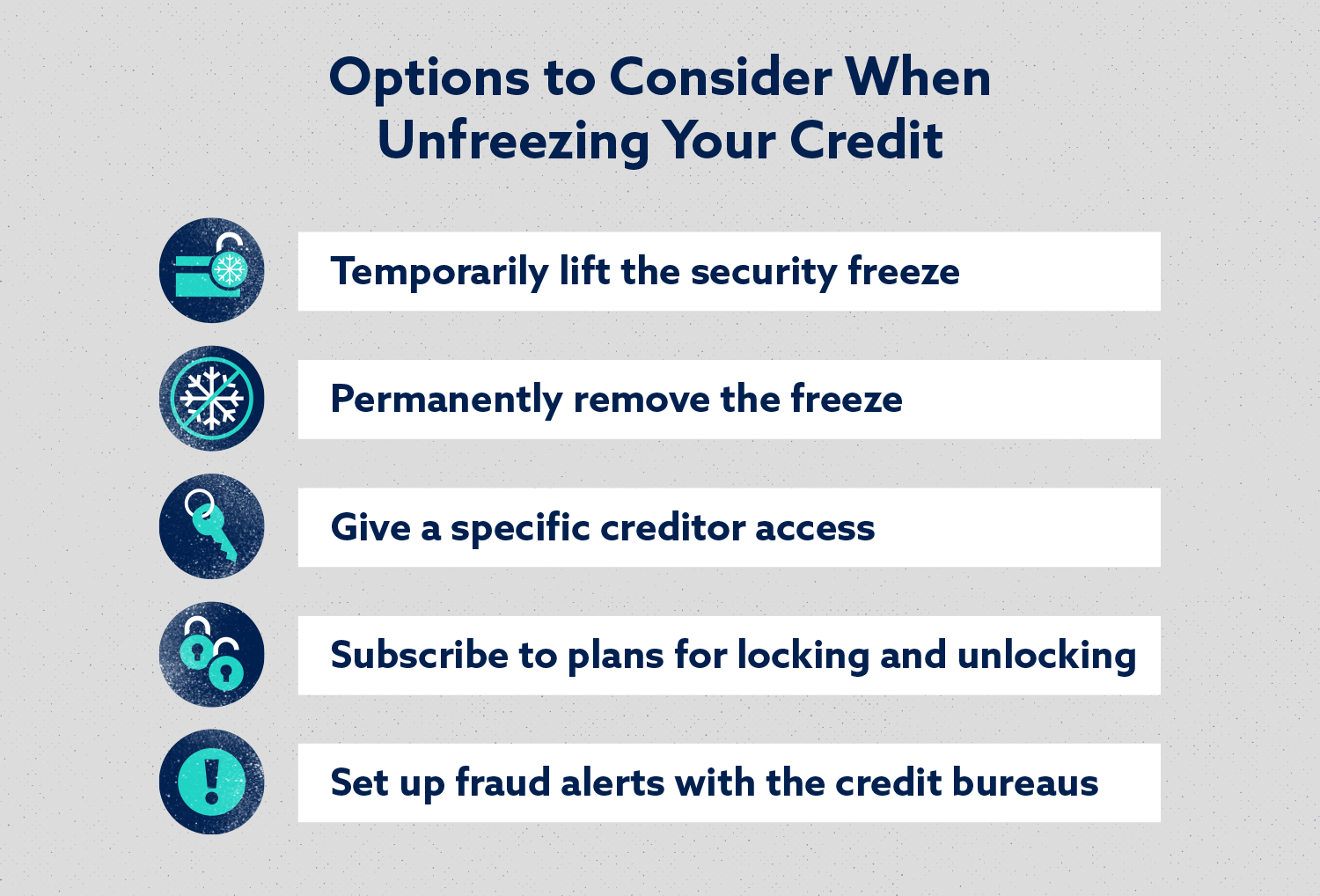

Can you lift a credit freeze permanently?

Permanently lifting a credit freeze is also an option. But when you opt for permanent removal you give up some important protections that frozen credit provides. Temporarily lifting a freeze, for example, can be less hassle than repairing the impact of identity theft.

How to unfreeze Equifax credit report?

You can unfreeze your Equifax credit report online by creating a "myEquifax" account. A PIN is no longer needed for online freezing or lifting an Equifax credit freeze. Equifax allows you to unfreeze your credit temporarily for a specific creditor or for a specified period, from one day to one year.

How long can you unfreeze TransUnion credit?

You no longer need a PIN. You can lift a TransUnion credit freeze for one to 30 days, beginning on a start date you pick.

Which credit bureaus require you to freeze your credit?

The other two bureaus, TransUnion and Equifax, now require that you set up accounts to freeze or unfreeze online. (If your account was already frozen and you were issued a PIN, you'll be directed to establish a password-protected account with the credit bureau to manage your freeze.) See your free credit report.

What to do when you're shopping for a mortgage?

You might do this if you're shopping for a mortgage or car loan or applying for a credit card. Allow access to a specific creditor. If you are applying for a loan, you may be able to ask the lender which credit bureau will be used and unfreeze only that one.

Do you have to unfreeze your credit?

You have to unfreeze your credit with each credit bureau individually, unless you know which credit bureau a creditor is using and choose to lift your credit freeze at just that one.

Do you have to unfreeze your credit with each credit bureau?

You have to unfreeze your credit with each credit bureau individually. Experian requires a PIN to lift a credit freeze, while TransUnion and Equifax require that you set up online accounts.

How long does it take to lift a credit freeze?

If you make the request online or by phone, the three major credit bureaus are required to lift the freeze within an hour (Opens Overlay) . The request can be done by mail, but note that this is a longer process. The credit bureaus, however, are required to remove the freeze within three business days of receiving notice.

Ways to unfreeze credit

To unfreeze your credit, you have to put in a request with each major credit bureau.

When should you unfreeze your credit?

You should unfreeze your credit before you apply for a new line of credit. Some examples include when you're house hunting, opening a store credit card or are looking to get a car loan. In order to qualify, the lender will need to pull your credit report to see if you qualify.

Does it cost anything to remove a credit freeze?

Both freezing your credit and lifting a credit freeze are free, as per the Fair Credit Reporting Act (Opens Overlay) .

How to remove a credit freeze?

In order to place or remove a credit freeze on your credit reports, you must contact each of the three major credit bureaus (Equifax, Experian and TransUnion) individually. It might be worth asking your potential creditor or employer which bureau it uses for credit checks. That way you’ll only have to lift the freeze with a single bureau instead of all three.

How to contact experian for a credit freeze?

That way, the company can check your credit without your having to ask for a credit freeze lift. Here’s how to contact Experian. Phone: 1-888-397-3742.

How long does it take for a credit freeze to be lifted?

In terms of timing, a credit freeze must be removed no later than one hour after a credit bureau receives your request by phone or online. If you mail in a request to have a freeze lifted, credit bureaus have three business days after receiving it to lift the credit freeze.

How far in advance can you freeze your credit report?

TransUnion allows you to schedule a credit freeze lift up to 15 days in advance. This scheduled lift differs from Experian’s single-use PIN in that it allows any creditor access to the credit report over the period of time that you choose.

What is a temporary lift on credit?

A temporary lift allows creditors or companies access to your credit reports within a specific date range, determined by you. This option is likely the smarter choice because you can set it and forget it.

What is a credit freeze?

In a Nutshell. A credit freeze is a free tool that can help reduce your risk of identity theft by restricting access to your credit file. A credit freeze can be lifted — either temporarily or permanently — to allow creditors access to your credit reports.

Why do you have to freeze your credit?

Placing a credit freeze on your credit reports can help reduce your risk of identity theft, but sometimes you’ll need to lift the freeze for credit or job applications. If your identity is stolen, an immediate action plan is essential to try to make yourself — not to mention your finances — whole again.

How to manage a freeze on Equifax?

At Equifax, you can manage your freeze online with your username and password after creating a myEquifax account. You can also manage your freeze by phone: call us at (888) 298-0045. You'll be required to give certain information to verify your identity. You'll also have the option to receive a one-time PIN by text message or answer questions based ...

What does a security freeze on Equifax do?

Your security freeze restricts access to your Equifax credit report for the purposes of extending credit in your name.

How to freeze an incapacitated adult on Equifax?

To place a security freeze on the Equifax credit report of an incapacitated adult, you will need to submit proof of their identity, along with yours, and proof that you are their authorized representative . Download and follow the instructions on the Incapacitated Adult Freeze Request form.

Can a power of attorney freeze credit report?

Parents, legal guardians, or others with Power of Attorney can place a security freeze on the Equifax credit reports of minors under the age of 16.

Is a security freeze free?

Placing, temporarily lifting, or removing a security freeze is free.

Can you freeze your Equifax credit report?

Placing a security freeze on your Equifax credit report will prevent access to it by certain third parties. Freezing your Equifax credit report will not prevent access to your credit report at any other credit reporting agency.

What is a credit freeze?

A credit freeze prevents lenders from checking your credit in order to open a new account. Think of it as having a padlock on your credit report. Remember, if you have a freeze you must remove it to apply for credit. We make it easy for you though, so don’t worry.

How to remove a freeze on Transunion?

To remove your freeze, log in to your account online and select “Remove Freeze.”. When you are ready, you can come back and freeze again. *By removing your Transunion credit freeze, your credit report will be accessible to lenders.

When should I use Freeze?

If you want a free option to make sure no one can access your credit report.

What is identity theft? And, how can I protect myself from identity theft?

Identity theft is a serious crime where your personal information—anything from your name, your driver’s license, or Social Security Number—has been hijacked by an imposter in order to commit fraud in your name. You’re the first line of defense when it comes to protecting your identity. Check your credit reports and financial accounts regularly for any suspicious activity. You can get your credit report here for free, once a year, from all three bureaus. Set up transaction alerts if your bank offers them to notify you of all account activity. Finally, consider adding some extra armor like a fraud alert or credit freeze. For more information, check out our Identity Theft web page.

Why would I need a credit freeze or fraud alert?

These powerful tools can help you steer clear of identity theft or prevent history from repeating itself if you’ve already fallen victim. They offer added protection, making it more difficult for anyone, including fraudsters, to apply for credit using your info.

What is the difference between a fraud alert and credit freeze?

A fraud alert notifies lenders to call you to verify your identity before extending new credit, but it does not block access to your credit report. A credit freeze blocks access to your credit report if anyone tries to open a new account.

How long does it take my freeze/freeze removal to go into effect when I place it online or by phone?

For the most part, freezes or freeze removals occur in real time. To be on the safe side, allow up to one hour, especially if you will be shopping for credit.