IPMT Function in Excel

- IPMT Function in Excel The IPMT function returns the interest payment for a given time period for a particular investment based on the periodic and the constant payments along with the constant interest rate of that particular investment.

- IPMT Syntax = IPMT (rate, per, nper, pv, [fv], [type])

- The IPMT function and arguments ...

- Example for the IPMT function in Excel ...

Full Answer

What is the actual formula behind PMT function in Excel?

What is the actual formula behind PMT function in Excel? Syntax: PMT(rate, nper, pv, [fv], [type])Example: =PMT(A2/12, A3, A4)Description: PMT, one of the financial functions, calculates the payment for a loan based on constant payments and a constant interest rate. Use the Excel Formula Coach to figure out a monthly loan payment.

What are some examples of the PMT function in Excel?

Example #1. Suppose the loan amount is 25,000, and the interest rate is 10% annual, and the period is 5 years. Here the number of payments will be =5*12=60 payments in total. In this PMT excel, we have considered C4/12 because a 10% rate is annual, and by dividing by 12, we get the monthly rate. Here future value and type are considered zero.

What is the meaning of the formula PMT in Excel?

The PMT function uses the following arguments:

- Rate (required argument) – The interest rate of the loan.

- Nper (required argument) – Total number of payments for the loan taken.

- Pv (required argument) – The present value or total amount that a series of future payments is worth now. ...

- Fv (optional argument) – This is the future value or a cash balance we want to attain after the last payment is made. ...

How to calculate interest only payments in Excel?

Using Excel formulas to figure out payments and savings

- Figure out the monthly payments to pay off a credit card debt. ...

- =PMT (17%/12,2*12,5400) The rate argument is the interest rate per period for the loan. ...

- Figure out monthly mortgage payments. ...

- =PMT (5%/12,30*12,180000) The rate argument is 5% divided by the 12 months in a year. ...

- Find out how to save each month for a dream vacation. ...

How to Use the IPMT Function in Excel?

What is IPMT in Excel?

What is IPMT in finance?

How many parameters are used in IPMT?

How to convert 6% into monthly rate?

See 2 more

About this website

How do I use the IPMT function in Excel?

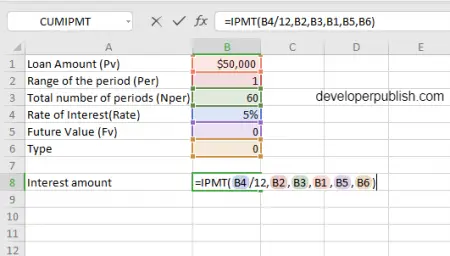

The formula to be used will be =IPMT( 5%/12, 1, 60, 50000). In the example above: As the payments are made monthly, it was necessary to convert the annual interest rate of 5% into a monthly rate (=5%/12), and the number of periods from years to months (=5*12).

How do I use IPMT and PMT in Excel?

The following are the syntax for PMT, PPMT, IPMT formula in Excel.=PMT(rate,nper,pv,[fv],[type])=PPMT(rate,per,nper,pv,[fv],[type])=IPMT(rate,per,nper,pv,[fv],[type])Explanation – The annual interest rate is 0.1 or 10%.More items...•

How do you calculate interest payment on a loan in Excel?

=PMT(17%/12,2*12,5400) The rate argument is the interest rate per period for the loan. For example, in this formula the 17% annual interest rate is divided by 12, the number of months in a year. The NPER argument of 2*12 is the total number of payment periods for the loan.

How do I calculate interest per year in Excel?

If you have an annual interest rate, and a starting balance you can calculate interest with: = balance * rate and the ending balance with: = balance + ( balance * rate ) So, for each period in the example, we use this formula copied down the table...

What is difference between PMT and IPMT in Excel?

Whereas the PMT function tells you how much each payment will be, the PPMT function tells you how much of the principal is being paid in any given pay period. (To find out the inverse of this – how much of the interest is being paid in any given pay period – you can use an IPMT function.)

What is the formula for monthly payments in Excel?

PMT, one of the financial functions, calculates the payment for a loan based on constant payments and a constant interest rate. Use the Excel Formula Coach to figure out a monthly loan payment....Example.DataDescription=PMT(A2/12,A3,A4)Monthly payment for a loan with terms specified as arguments in A2:A4.($1,037.03)11 more rows

What is the formula to calculate interest in Excel?

Calculate compound interestCalculate simple interest. The general formula for simple interest is: interest = principal * rate * term So, using cell references, we have: = C5 * C7 * C6 = 1000 * 10 * 0.05 = 500.Annual compound interest schedule. ... Compare effect of compounding periods.

What is the formula to calculate monthly interest?

What Is the Monthly Compound Interest Formula in Math? The monthly compound interest formula is used to find the compound interest per month. The formula of monthly compound interest is: CI = P(1 + (r/12) )12t - P where, P is the principal amount, r is the interest rate in decimal form, and t is the time.

How do you calculate interest payment?

Divide your interest rate by the number of payments you'll make that year. If you have a 6 percent interest rate and you make monthly payments, you would divide 0.06 by 12 to get 0.005. Multiply that number by your remaining loan balance to find out how much you'll pay in interest that month.

How do I calculate interest in Excel with time?

A more efficient way of calculating compound interest in Excel is applying the general interest formula: FV = PV(1+r)n, where FV is future value, PV is present value, r is the interest rate per period, and n is the number of compounding periods.

How do you calculate interest per year?

To calculate interest rate, start by multiplying your principal, which is the amount of money before interest, by the time period involved (weeks, months, years, etc.). Write that number down, then divide the amount of paid interest from that month or year by that number.

How do I compound interest monthly in Excel?

You can download the free Excel template from here and practice on your own.Calculate Monthly Compound Interest.xlsx.=C5*(1+(C6/12))^(12*C7)-C5.=FV(rate,nper,pmt,[pv],[type])=FV(C6/12,C7*12,0,-C5)-C5.=FVSCHEDULE(principal, schedule)More items...•

What is PMT and IPMT?

The PMT function calculates the payment for a loan that has constant payments and a constant interest rate. = IPMT() The Excel IPMT function calculates the interest payment, during a specific period of a loan or investment that is paid in constant periodic payments, with a constant interest rate. =

How do you calculate PMT manually?

The format of the PMT function is:=PMT(rate,nper,pv) correct for YEARLY payments.=PMT(rate/12,nper*12,pv) correct for MONTHLY payments.Payment = pv* apr/12*(1+apr/12)^(nper*12)/((1+apr/12)^(nper*12)-1)

How do I calculate accrued interest in Excel?

Excel ACCRINT FunctionSummary. The Excel ACCRINT function returns the accrued interest for a security that pays periodic interest.Get accrued interest periodic.Accrued interest.=ACCRINT (id, fd, sd, rate, par, freq, [basis], [calc])id - Issue date of the security. fd - First interest date of security.

What is the formula to calculate monthly interest?

What Is the Monthly Compound Interest Formula in Math? The monthly compound interest formula is used to find the compound interest per month. The formula of monthly compound interest is: CI = P(1 + (r/12) )12t - P where, P is the principal amount, r is the interest rate in decimal form, and t is the time.

The Excel IPMT Function

Note that in this example: The payments are made monthly, so it has been necessary to convert the annual interest rate of 5% into the monthly rate (=5%/12), and the number of periods from years to months (=5*12).

IPMT Function - Interest Portion of a Loan Payment in Excel

What is the IPMT Function? The IPMT Function is categorized under Excel Financial functions.The function calculates the interest portion based on a given loan payment and payment period. We can calculate, using IPMT, the interest amount of a payment for the first period, last period, or any period in between.

How to Use the IPMT Function in Excel?

IPMT function in excel can be used as a worksheet function as well as a VBA Function. Here are some examples of IPMT function to understand the working of IPMT function in Excel.

What is IPMT in Excel?

IPMT Function is used to calculate a specific portion of interest on the basis of loan amount and loan tenure. The syntax of IPMT is quite similar to the syntax of PV Function in Excel which all have seen earlier. To understand better, IPMT helps used to distinguish between different portions or segments of any loan and to what time how much amount is to be paid on the basis of interest applicable, can be calculated.

What is IPMT in finance?

To understand better, IPMT helps used to distinguish between different portions or segments of any loan and to what time how much amount is to be paid on the basis of interest applicable, can be calculated.

How many parameters are used in IPMT?

There are six parameters are used for the IPMT function. In which four parameters are compulsory, and two are optional.

How to convert 6% into monthly rate?

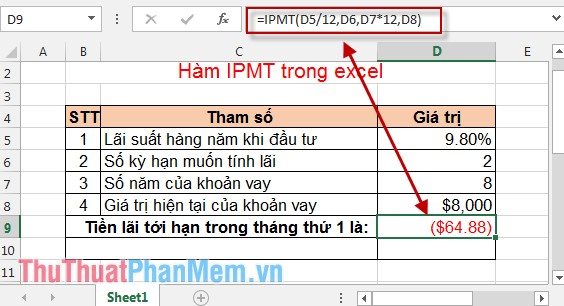

To convert the annual interest rate of 6% into the monthly rate (=6%/12) and the number of periods from years to months (=6*12).

Description

Returns the interest payment for a given period for an investment based on periodic, constant payments and a constant interest rate.

Remarks

Make sure that you are consistent about the units you use for specifying rate and nper. If you make monthly payments on a four-year loan at 12 percent annual interest, use 12%/12 for rate and 4*12 for nper. If you make annual payments on the same loan, use 12% for rate and 4 for nper.

Example

Copy the example data in the following table, and paste it in cell A1 of a new Excel worksheet. For formulas to show results, select them, press F2, and then press Enter. If you need to, you can adjust the column widths to see all the data.

How to use the IPMT Function in Excel?

As a worksheet function, IPMT can be entered as part of a formula in a cell of a worksheet.

What is the formula for IPMT?

The formula to be used will be =IPMT ( 5%/12, 1, 60, 50000).

What is IPMT function?

What is the IPMT Function? The IPMT function is categorized under Excel Financial functions. Functions List of the most important Excel functions for financial analysts. This cheat sheet covers 100s of functions that are critical to know as an Excel analyst. .

How to use the IPMT Function in Excel? (Examples)

This first example returns the interest payment for an $8,000 investment that earns 7.5% annually for 2 years. The interest payment is calculated for the 6 th month and payments that are due at the end of each month.

Things to Remember

Below are the few error details that can come in IPMT function as the wrong argument will be passed in the functions.

Recommended Articles

This has been a guide to IPMT Function in Excel. Here we discuss the how to use IPMT formula (step by step) along with examples and templates. You can learn more about excel from the following articles –

What is IPMT in Excel?

IPMT is Excel's interest payment function . It returns the interest amount of a loan payment in a given period, assuming the interest rate and the total amount of a payment are constant in all periods. To better remember the function's name, notice that "I" stands for "interest" and "PMT" for "payment". The syntax of the IPMT function in Excel is as ...

What is the best formula to use after PMT?

Before we dive in, it should be noted that IPMT formulas are best to be used after the PMT function that calculates the total amount of a periodic payment (interest + principal).

How to calculate interest portion of loan payment?

The interest portion of a loan payment can be calculated manually by multiplying the period's interest rate by the remaining balance. But Microsoft Excel has a special function for this - the IPMT function. In this tutorial, we will go in-depth explaining its syntax and providing real-life formula examples.

How to get the interest portion of a loan payment right?

To get the interest portion of a loan payment right, you should always convert the annual interest rate to the corresponding period's rate and the number of years to the total number of payment periods:

How to calculate monthly interest rate?

If you make weekly, monthly, or quarterly payments, divide the annual rate by the number of payment periods per year, as shown in this example. Say, if you make quarterly payments on a loan with an annual interest rate of 6 percent, use 6%/4 for rate .

What does PMT stand for in a function?

To better remember the function's name, notice that "I" stands for "interest" and "PMT" for "payment".

Can you use IPMT for more than one period?

Note. If you plan to use the IPMT formula for more than one period, please mind the cell references. All the references to the input cells shall be absolute (with the dollar sign) so they are locked to those cells. The per argument must be a relative cell reference (without the dollar sign like A9) because it should change based on the relative position of a row to which the formula is copied.

What is IPMT in Excel?

Microsoft Office Excel provides the IPMT function, which returns the interest portion based on a given loan payment and payment period. Using IPMT, we can calculate the interest amount of payment for the first period, last period, or any period in between. This is a built-in Excel function under the Finance category.

What is IPMT function?

The IPMT function returns the interest payment for a given time period for a particular investment based on the periodic and the constant payments along with the constant interest rate of that particular investment.

How to calculate monthly interest rate?

For the interest rate, we should divide it by 12 to get the monthly interest rate. For the total number of payments, in the given example, it is 60, which is already quoted as monthly, that is 5*12 = 60.

How many months in total is the rate percent?

For the rate argument of the syntax, most of the interest rates are given annually. But since we are calculating for each month, that is 12 months in total, therefore the rate percent should be divided with 12.

When to Use PMT, PPMT, IPMT Function of Excel

The word PMT stands for “payment” for each period. The PMT function of Excel gives the total payment (principal amount + interest money) which we need to pay when taking a loan or we receive on investment.

Must Remember – Excel PMT, PPMT, IPMT Function

The following points must be kept in mind before actually using these functions.

Examples for PMT, PPMT and IPMT Functions of Excel

In this section of the blog, we will discuss some examples to get practical knowledge of these functions.

How to Use the IPMT Function in Excel?

IPMT function in excel can be used as a worksheet function as well as a VBA Function. Here are some examples of IPMT function to understand the working of IPMT function in Excel.

What is IPMT in Excel?

IPMT Function is used to calculate a specific portion of interest on the basis of loan amount and loan tenure. The syntax of IPMT is quite similar to the syntax of PV Function in Excel which all have seen earlier. To understand better, IPMT helps used to distinguish between different portions or segments of any loan and to what time how much amount is to be paid on the basis of interest applicable, can be calculated.

What is IPMT in finance?

To understand better, IPMT helps used to distinguish between different portions or segments of any loan and to what time how much amount is to be paid on the basis of interest applicable, can be calculated.

How many parameters are used in IPMT?

There are six parameters are used for the IPMT function. In which four parameters are compulsory, and two are optional.

How to convert 6% into monthly rate?

To convert the annual interest rate of 6% into the monthly rate (=6%/12) and the number of periods from years to months (=6*12).

Formula

How to Use The IPMT Function in Excel?

- The IPMT function syntax has the following arguments:

Rate Required. The interest rate per period. - Per Required. The period for which you want to find the interest and must be in the range 1 to np…

Nper Required. The total number of payment periods in an annuity.

Things to Remember About The IPMT Function

Additional Resources