How do I withdraw from my Wells Fargo 401k?

- Roll your retirement savings into an IRA.

- Move the assets directly into your new employer's retirement plan.

- Take a lump-sum distribution (taxes and penalties may apply)

- Next steps.

Full Answer

What are the penalties for withdrawing from a 401k?

Goldco – Our Top Pick

- A+ rating with BBB (Better Business Bureau)

- 10+ years experience

- Top-notch customer service CONS

- Annual fee of $175 for any account worth below $100,000

- Don’t offer custodian services

How long will it take if I cash out my 401k?

It typically takes around one to two weeks to get cash from your 401(k), though it can take considerably longer. The countdown starts when you request your payout and ends when you actually receive the cash, either as a check or a bank deposit.

When to withdraw from your 401k?

One of those instances involves anyone who delayed their 2021 withdrawal until this ... costs How rising inflation may affect your 2021 tax bill Retirees need to keep this much cash, advisors say RMDs apply to 401(k) plans — both traditional and the ...

How can I withdrawal money from my 401k?

- You can take out a loan from your 401 (k) to buy a home or help pay for college, but you must pay it back.

- You may take a hardship withdrawal from your 401 (k) if the plan is held by your employer.

- When you are age 55 through 59 1/2, you can begin to withdraw from your 401 (k) without penalty.

- You can't take loans out from old 401 (K) accounts.

How do I withdraw money from my Wells Fargo 401k?

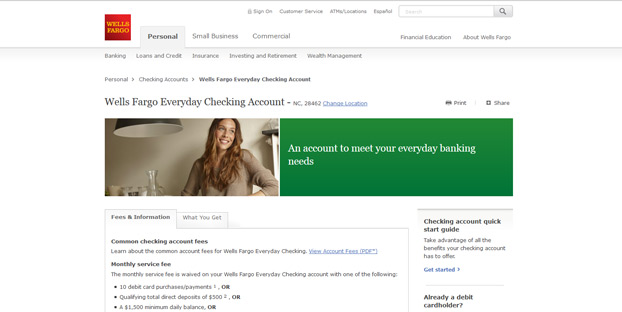

You generally have four options:Roll over your assets into an Individual Retirement Account (IRA)Leave your assets in your former employer's QRP, if the plan allows.Move your assets directly to your current or new employer's QRP, if the plan allows.Take your money out and pay the associated taxes.

How do I access my Wells Fargo 401k?

Access your plan online at any time by signing on at My Retirement Plan. (Note: If you create a plan using the public version of My Retirement Plan, you cannot save or access your plan online.) Visit My Retirement Plan Tips to learn how to make the most of your selected retirement savings plan.

How long withdraw from Wells Fargo 401k?

The distribution may be subject to federal, state, and local taxes unless rolled over to an IRA or another employer plan within 60 days. Funds lose tax-advantaged growth potential. Retirement may be delayed, or the amount you'll have to live on later may be reduced.

How do you withdraw your 401k money?

Wait to Withdraw Until You're at Least 59.5 Years Old By age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401(k) without having to pay a penalty tax. You'll simply need to contact your plan administrator or log into your account online and request a withdrawal.

How long does it take for a 401k withdrawal to be direct deposited?

The 401(k) loan process can anywhere from a day if you do it online to a few weeks if done manually. Once completed, it may take two or three days for a direct deposit to reach your account.

How long does it take to get your 401k check after you quit?

When you leave a job, you can decide to cash out your 401(k) money. Generally, when you request a payout, it can take a few days to two weeks to get your funds from your 401(k) plan. However, depending on the employer and the amount of funds in your account, the waiting period can be longer than two weeks.

How do I transfer money from my 401k to my checking account?

To transfer money from a 401(k) to a bank account, you should send a withdrawal request to the 401(k) plan administrator. It can take up to seven business days for the withdrawal to be processed, and you can expect to receive your funds shortly thereafter.

Can I cancel my 401k and cash out?

Technically, yes: After you've left your employer, you can ask your plan administrator for a cash withdrawal from your old 401(k). They'll close your account and mail you a check. But you should rarely—if ever—do this until you're at least 59 ½ years old!

How do I access my 401k account?

You can find your 401(k) balance by logging into your 401(k) plans online portal and check how your 401(k) is performing. If you don't have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Can I cash out my 401k while still employed?

The first thing to know about cashing out a 401k account while still employed is that you can't do it, not if you are still employed at the company that sponsors the 401k. You can take out a loan against it, but you can't simply withdraw the money.

When can I access my 401k?

age 59½The age 59½ distribution rule says any 401k participant may begin to withdraw money from his or her plan after reaching the age of 59½ without having to pay a 10 percent early withdrawal penalty.

What age can you withdraw from a 401(k)?

In general, when you make a withdrawal from your 401K before you reach age 59 ½ , the Internal Revenue Service may charge you a 10% early withdrawal penalty. You'll also pay taxes on any amounts you cash out because these funds come directly from your pre-tax income. How do you pull money out of your 401k?

How much is the penalty for pulling money out of a 401(k)?

How do you pull money out of your 401k? As of 2019, if you are under the age of 59½, a withdrawal from a 401 (k) is subject to a 10% early withdrawal penalty . You will also be required to pay normal income taxes on the withdrawn funds.

How much is the penalty for 401(k) loan?

Many 401 (k) loans charge one to two points above the prime interest rate. how much will I get if I cash out my 401k? If you withdraw money from your 401 (k) account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax, on the distribution.

Is Wells Fargo insurance insured by the FDIC?

Investment and Insurance Products are: Not Insured by the FDIC or Any Federal Government Agency.

Does Wells Fargo provide tax advice?

Wells Fargo Advisors and Wells Fargo & Company do not provide legal, accounting, or tax advice. Please consult your tax or legal advisors before taking any action that may have tax or legal consequences.

How to access Wells Fargo retirement account?

In addition to visiting an account representative at your local Wells Fargo branch, you can access your Wells Fargo retirement account by reaching a Wells Fargo representative over the phone , creating an online account or using Wells Fargo’s mobile app for your smartphone.

How to contact Wells Fargo about retirement?

To request a consultation or to find out more information about retirement planning, contact a Wells Fargo retirement representative at 1-877-493-4727.

What time does Wells Fargo open an IRA?

Access your existing Wells Fargo IRA by calling a representative at 1-800-237-8472 between 8:00 a.m. and 10:00 p.m. Eastern Time (Monday through Friday) or between 8:00 a.m. and 5:00 p.m. Eastern Time on Saturday.

Does Wells Fargo offer retirement?

Among the products that Wells Fargo offers its customers, retirement accounts provide a savings vehicle outside other types of savings accounts and workplace retirement plans . Customers can remotely access their Wells Fargo retirement account without making a bank visit. Advertisement.

Is Wells Fargo Mobile app compatible with iPhone?

The Wells Fargo Mobile® app is compatible with iPhones®, iPads®, Android™ phones and Android™ tablets. Visit the Wells Fargo app webpage and follow the directions for downloading to your specific device.

Can you rollover a 401(k) into a Roth IRA?

You may gain tax benefits by converting funds from employer-sponsored retirement plans such as a 401 (k) into a Roth IRA. Please verify with your plan administrator that your distribution is eligible for a rollover/conversion.

Does Wells Fargo roll over assets to an IRA?

Wells Fargo offers a number of ways you can work with us. Select your account. Please keep in mind that rolling over assets to an IRA is just one option for your qualified employer sponsored retirement plan (QRP). Each of the following options is different and has advantages and disadvantages and the one that is best depends on your individual ...