To becoming a CFP ® professional, you must:

- Complete a CFP Board-registered education program . You can choose from several options for your education. ...

- Sit for the CFP® exam. ...

- Hold or earn a bachelor’s degree from an accredited university or college within five years of passing the CFP® exam. ...

- Demonstrate financial planning experience. ...

- Pass CFP Board’s Candidate Fitness Standards. ...

What are the requirements to become a CFP?

- Family Status (traditional family, single parent, same-sex couples, blended families, widowhood)

- Net Worth (ultra-high-net-worth, high-net-worth, mass affluent, emerging affluent, mass market)

- Income Level (high, medium, low)

- Life or Professional Stage (student, starting a career, career transition, pre-retirement)

How much does it cost to become a CFP?

Your final application requires a $100 fee for the background check plus a $360 biennial certification fee, which you’ll continue paying as long as you’re an active CFP ®. Total cost to become a CFP ®? Anywhere from $2,260 up to $20,000+ depending on what route you take.

Is it worth it to become a CFP?

You don't need a cfp to help people with their investments and retirement planning. If you want to make a living out of it, the cfp will help your credibility and you can essentially tell clients you're held to a fiduciary standard as a cfp. Might help you get a job too.

How long does it take to become a CFP?

You'll need to sign the Ethics Declaration, and CFP Board will conduct a background check. Here are some of the most common paths to CFP® certification. Typically, it takes 18-24 months to become a CFP® professional, but the certification process offers flexibility so you can make it work for you.

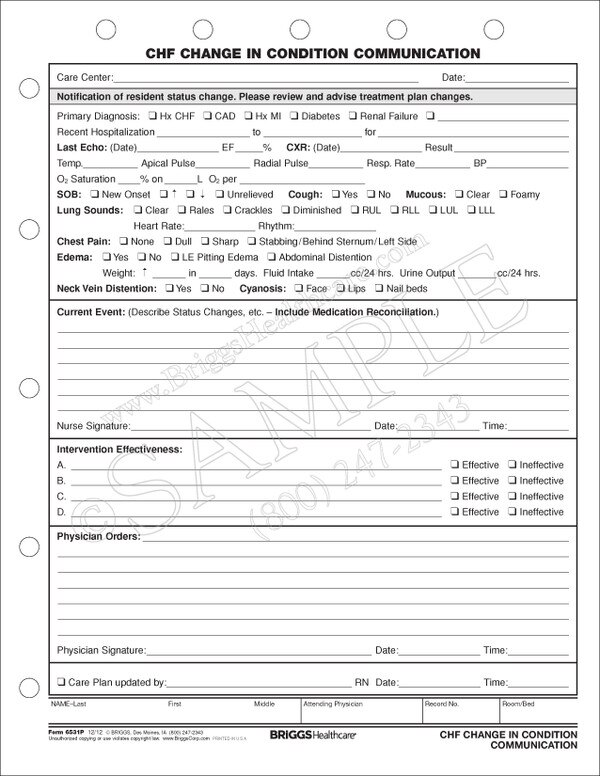

Is the CHFP certification worth it?

64% said earning their Certified Healthcare Financial Professional (CHFP) helped them make more money. 36% said earning their Certified Healthcare Financial Professional (CHFP) helped them get a job. 100% said they would recommend a family member or friend earn their Certified Healthcare Financial Professional (CHFP)

What is CHFP degree?

Certified Healthcare Financial Professional (CHFP) Dive into the new financial realities of health care and come up with a better business skill set, new ideas on financial strategy, and insights into future trends.

How do you become a Fhfma?

Requirements for FHFMA® certification include:Hold the Certified Healthcare Financial Professional (CHFP) designation.Minimum five (5) years professional membership in HFMA (student membership does not count toward this total)Evidence of bachelor's or master's degree.More items...

What is a HFMA certification?

The HFMA Business of Health Care® online program offers participants an overview of healthcare finance, risk mitigation, evolving payment models, healthcare accounting and cost analysis, strategic finance, and managing financial resources.

What are the best certifications to have in healthcare?

Best Healthcare Administration Certifications (2022)Healthcare Administration Certifications in Compliance & Risk Management.Healthcare Administration Certifications in Finance.Healthcare Administration Certifications in IT & Informatics.Healthcare Administration Certifications in Management.More items...

How do I get a CRCR certificate?

Prerequisite: One or more years of experience in revenue cycle activities. Assessment Information: This online program includes a key concepts guide, course modules and a certification assessment. The assessment has 75 multiple-choice questions, and you have 90 minutes to complete it in one sitting.

What is the best revenue cycle certification?

Certified Revenue Cycle Executive (CREC) It is not always clear what is meant by Certified Revenue Cycle Executive, but it is the highest level of revenue cycle management certification. It offers three different credential levels: basic, advanced, and master.

Does CHFP expire?

HFMA members who have earned either the Certified Healthcare Financial Professional (CHFP) or Fellow of HFMA (FHFMA) designation must maintain their certification every three years by meeting two basic requirements: Remain an active HFMA member in good standing.

How much is CRCR certification?

Designed for members of revenue cycle teams with one or more years of experience, the CRCR certification is an accredited program offering up to 14 CPE Credits. Study materials and examination are $400 per individual candidate while discounts are offered to organizations having more than 10 CRCR candidates.

What is a CHFP?

Certified Healthcare Financial Professional (CHFP) Certified Healthcare Financial Professionals are healthcare leaders and professionals who have demonstrated a deep understanding of knowledge in healthcare financial management, new financial realities within healthcare.

What is CHFP in healthcare?

The CHFP is geared toward financial professionals, clinical, nonclinical and health plan leaders - all those whose jobs require a deep understanding of the financial realities of health care.

Certified Healthcare Financial Professional (CHFP)

Dive into the new financial realities of health care and come up with a better business skill set, new ideas on financial strategy, and insights into future trends.

Certified Revenue Cycle Representative (CRCR)

Updated July 2021– new design with improved functionality and enhanced user experience!

Certified Specialist Accounting & Finance (CSAF)

Strengthen your skills and mastery of financial reports and statements, risk-sharing arrangements, managed care contracts, and profitability ratios.

Certified Specialist Business Intelligence (CSBI)

Learn methods for looking at data and using tools to ensure the right information is illuminated and used to enable powerful actions and decisions.

Certified Specialist Payment & Reimbursement (CSPR)

Demonstrate specialist-level knowledge in federal, state and managed care reimbursement workflows, rate structures, benefit coordination, value-based reimbursement, legislative updates and more.

Certified Specialist Physician Practice Management (CSPPM)

Demonstrate your physician practice finance, cost accounting, revenue cycle, coding, reimbursement, and payer contracting acumen.

Fellow of HFMA (FHFMA)

Extend your expertise and leadership by sharing your personal financial knowledge and skills in voluntary professional development activities and services in the healthcare finance industry.

How to become a CFP?

To becoming a CFP ® professional, you must: Complete a CFP Board-registered education program . You can choose from several options for your education. CFP Board must be notified when you’ve completed it. Many of the coursework providers can do that for you. Sit for the CFP® exam.

How long does it take to get a CFP?

Hold or earn a bachelor’s degree from an accredited university or college within five years of passing the CFP® exam. You can sit for the exam beforehand, but you need to make sure you complete your degree in that 5-year window. Demonstrate financial planning experience. This can be professional experience (6,000 hours) in relevant personal ...

How much does it cost to take the CFP exam?

The standard registration fee for the CFP® exam is $825, but there’s an early bird rate of $725, which is available until six weeks before the registration deadline. There’s a late registration fee of $925 for the two weeks before the registration deadline.

When will CFP certification be available in 2021?

April 1, 2021. With financial advising projected to be one of the top 10 fastest growing occupations, getting your CFP ® mark can help set you apart in the industry. Let’s take a look what a CFP ® professional is and what it takes to earn financial planning certification.

How many questions are asked in the Financial Planning exam?

The exam is given in a computer-based format and consists of 170 multiple-choice questions that test your financial planning knowledge in client situations. You are given the exam in two 3-hour sessions with a 40-minute scheduled break between the two sessions.

1. Education

The educational component includes completing a CFP Board-Registered Education Program and then 30 hours of continuing education in each reporting period. These ongoing requirements give the CERTIFIED FINANCIAL PLANNER™ professional the extra knowledge to enhance their reputation in the field.

3. Personal Characteristics and Interests

There are also certain personal characteristics and traits that a successful CFP® professional should possess that can predict your level of enjoyment in the industry.

4. Experience

Experience in the field is required to attain the certification. According to the CFP Board’s experience requirement, you must achieve 6,000 hours of professional experience related to the financial planning process or 4,000 hours of apprenticeship.

5. Ethics

Ethics is one of the most important characteristics and requirements of the CFP® professional. When you seek to attain this credential, you are vowing to adhere to high ethical and professional standards laid out by the CFP Board.

How is it Different From a Financial Advisor?

Your financial status will always be a part of planning your future. Many of us need help with this and can find it from a CERTIFIED FINANCIAL PLANNER™, or CFP® professional.

How to get CFP certification?

Start your journey to CFP® Certification 1 Track your progress with the CFP ® Certification Tracker 2 Post your resume at the Career Center 3 Connect with a mentor who can guide you 4 Register and prepare for the exam 5 Find career and financial support 6 Connect with other candidates at our online forum

What education do I need to take the CFP exam?

The two-part education requirement includes both (1) completing coursework on financial planning through a CFP Board Registered Program, and (2) holding a bachelor's degree or higher (in any discipline) from an accredited college or university. You must complete the coursework before you can take the CFP® exam.

What is the pass rate for CFP?

In 2019, the pass rate for first-time exam takers was approximately 67%.

What is the pass rate for the Financial Planning exam?

In 2019, the pass rate for first-time exam takers was approximately 67%. Experience. The Experience Requirement. The experience requirement prepares you to provide personal financial planning to the public without supervision. You can fulfill the experience requirement either before or after you take the exam.

What is the ethics requirement for CFP?

The ethics requirement is the final step on your path to CFP® certification. It indicates you've agreed to adhere to high ethical and professional standards for the practice of financial planning, and to act as a fiduciary when providing financial advice to your client, always putting their best interests first.

How many hours is the CFP exam?

The CFP® exam is a 170-question, multiple-choice test that consists of two 3-hour sessions over one day.

How many hours of experience do I need to become a financial planner?

You can fulfill the experience requirement either before or after you take the exam. You need to complete either 6,000 hours of professional experience related to the financial planning process, or 4,000 hours of apprenticeship experience that meets additional requirements. Experience must be completed within 10 years before ...

Becoming A Financial Planner

With the great demand for certified financial planners in the market and the impressive salaries that they earn, this is a field that you would want to be in for a long while.

Step 2: Get The Required Certification In Financial Planning

There is no better way of advancing your career as a financial planner than obtaining the necessary additional credential and getting certified a a CFP.

Step 3: Take The CFP Certification Examination

Acing the CFP exam by obtaining the mark will no doubt be a career-defining moment for you.

Step 4: Get Licensed

As a certified financial planner, you cannot operate without obtaining state licenses or registering with the SEC (Securities and Exchange Commission).

How to Become a CFP – Conclusion

It is clear that to become a certified financial planner, you must obtain certified financial planner certification, meet all the certified financial planner requirements and meet all the CFP education requirements.

FAQs

Yes, becoming a CFP is worth it because you can earn an average income of around $80000 annually if you have been at it for 5 years. If you become a CFP for more than 2 decades, you could earn an average income of around $140,000.

How to become a CFP?

It’s not easy to become a CFP, and for good reason. Helping people navigate their finances is an important job. On average, it takes between 18 and 24 months to become a CFP, and can cost a minimum of $4,000 (if you already have an undergraduate degree). Here’s what else it takes: 1 Complete the education requirement. The CFP Board requires completion of specific coursework on financial planning and a bachelor’s degree or higher. Applicants have up to five years from the date they pass the exam to receive their bachelor’s degree. 2 Pass the exam. The exam consists of 170 multiple-choice questions to be completed in a total of six hours. According to the CFP Board, about 67% of first-time exam-takers passed in 2019. 3 Gain professional experience. To meet the experience requirement, prospective CFPs need to complete either 6,000 hours of professional experience related to financial planning or 4,000 hours of apprenticeship that meets additional requirements. These hours can be completed either within 10 years before taking the exam or within five years after passing it. 4 Adhere to the ethical standard. The last steps of becoming a CFP are to sign the Ethics Declaration, in which you commit to acting as a fiduciary for your clients, and pass a background check conducted by the CFP Board.

How long does it take to become a CFP?

On average, it takes between 18 and 24 months to become a CFP, and can cost a minimum of $4,000 (if you already have an undergraduate degree). Here’s what else it takes: Complete the education requirement. The CFP Board requires completion of specific coursework on financial planning and a bachelor’s degree or higher.

What is the CFP exam?

CFPs must have several years of experience related to financial planning, pass the CFP exam and adhere to a strict ethical standard as set by the Certified Financial Planner Board of Standards. CFPs, unlike some other types of financial advisors, are held to a fiduciary standard, meaning they are obligated to act in their client's best interest.

How much does a CFP cost?

The 2018 Kitces Research survey on financial planning found that CFPs charge, on average, $1,871 for a comprehensive financial plan, $235 for hourly services and $5,528 for annual retainer services.

How long does it take to pass the CFP exam?

Applicants have up to five years from the date they pass the exam to receive their bachelor’s degree. Pass the exam. The exam consists of 170 multiple-choice questions to be completed in a total of six hours. According to the CFP Board, about 67% of first-time exam-takers passed in 2019.

What is a CFP?

A CFP might start by determining your financial goals and discussing your current financial situation and appetite for risk. A CFP can also advise you on everything from choosing specific investments, saving for a down payment on a home and planning for retirement.

Can a CFP be a financial advisor?

More often than not, a financial advisor who is a CFP will be able to help you with your financial planning needs, but other advisors may be able to better assist you in certain areas, such as tax advising. Some advisors even have multiple designations, making them more competitive within their field.