How do you calculate a loan payment in Excel?

- The outstanding balance due will be entered in cell B1.

- The annual interest rate, divided by the number of accrual periods in a year, will be entered in cell B2. ...

- The number of periods for your loan will be entered in cell B3. ...

How do you calculate total interest in Excel?

You can figure out the total interest paid as follows:

- List your loan data in Excel as below screenshot shown:

- In Cell F3, type in the formula, and drag the formula cell’s AutoFill handle down the range as you need. =IPMT ($C$3/$C$4,E3,$C$4*$C$5, $C$2)

- In the Cell F9, type in the formula =SUM (F3:F8), and press the Enter key.

How do you calculate simple interest on a loan?

Simple Interest Formulas and Calculations:

- Calculate Interest, solve for I I = Prt

- Calculate Principal Amount, solve for P P = I / rt

- Calculate rate of interest in decimal, solve for r r = I / Pt

- Calculate rate of interest in percent R = r * 100

- Calculate time, solve for t t = I / Pr

How do you calculate payment in Excel?

Steps Download Article

- Launch Microsoft Excel and open a new workbook.

- Save the workbook file with an appropriate and descriptive name. ...

- Create labels in cells A1 down to A4 for the variables and result of your monthly payment calculation.

- Enter the variables for your loan or credit card account in the cells from B1 down to B3 to create your Excel formula.

What is formulas in Excel?

In this accelerated training, you'll learn how to use formulas to manipulate text, work with dates and times, lookup values with VLOOKUP and INDEX & MATCH, count and sum with criteria, dynamically rank values, and create dynamic ranges. You'll also learn how to troubleshoot, trace errors, and fix problems. Instant access. See details here.

What are the components of a loan?

Loans have four primary components: the amount, the interest rate, the number of periodic payments (the loan term) and a payment amount per period. You can use the PMT function to get the payment when you have the other 3 components.

How many periods are there in a 5 year loan?

nper - the number of periods comes from cell C7; 60 monthly periods for a 5 year loan.

What is formulas in Excel?from exceljet.net

In this accelerated training, you'll learn how to use formulas to manipulate text, work with dates and times, lookup values with VLOOKUP and INDEX & MATCH, count and sum with criteria, dynamically rank values, and create dynamic ranges. You'll also learn how to troubleshoot, trace errors, and fix problems. Instant access. See details here.

What are the components of a loan?from exceljet.net

Loans have four primary components: the amount, the interest rate, the number of periodic payments (the loan term) and a payment amount per period. One use of the RATE function is to calculate the periodic interest rate when the amount, number of payment periods, and payment amount are known.

How to add interest paid in Excel?

Add up the total interest paid over the life of the loan in cell E5 by entering the following formula, without quotation marks: "= (-E4*E3)+E1. In this step we must add the Amount Financed (E1) - this may seem counterintuitive, but because Excel correctly treats our calculated Payment as a cash outflow and assigns it a negative value, we must add back the Amount Financed to reach a Total Interest Paid amount."

How to calculate the amount financed in cell B6?

Calculate the amount financed in cell B6 by entering "=B1-B2-B3-B4+B5" in the cell, without quotation marks, and pressing "Enter. "

What is Excel used for?

Microsoft's Excel spreadsheet program can be used for many different types of business and personal applications. For instance, you can use Excel to calculate car loan transactions and payment amounts as well as the total interest paid over the life of a loan. In addition, you can use Excel to compare multiple scenarios in order to make sound financial decisions. Here's how to calculate a car loan in Excel before you make a commitment.

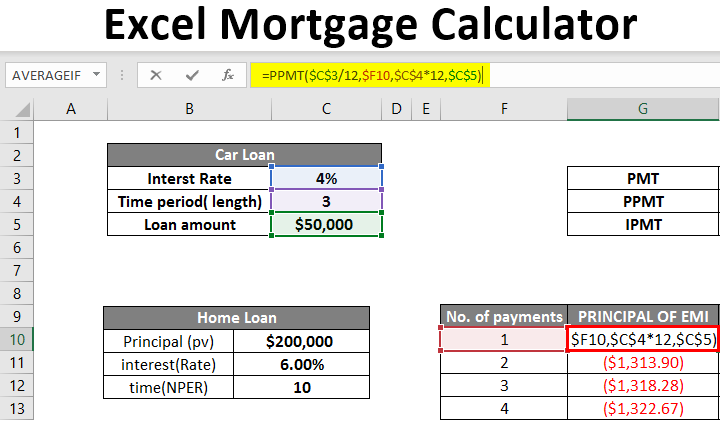

PPMT Function in Excel to Calculate Principal

The PPMT function returns the calculated value of the principal amount of a given amount (e.g. total investments, loans etc.) for a given period of time.

IPMT Function in Excel to Calculate Interest

The IPMT function returns the calculated value of the interest amount of a given amount (e.g. investments, loans etc.) for a given period of time.

Calculate the Principal and Interest on a Loan in Excel

In this section, you will learn how to calculate principal with PPMT function and interest with IPMT function based on a loan taken in Excel.

Things to Remember

The period of interest is referred to as the parameter, per. It must be a numeric value from 1 to the total number of periods (nper).

Conclusion

This article explained in detail how to calculate principal and interest on a loan in Excel. I hope this article has been very beneficial to you. Feel free to ask if you have any questions regarding the topic.

How to calculate simple interest?

Many of us just need a calculator to compute simple interest. You merely multiply the daily interest rate by the principal by the number of days that elapse between payments.

How to calculate compounding period per year?

Keep in mind, if it's an annual rate, then the number of compounding periods per year is one, which means you're dividing the interest rate by one and multiplying the years by one. If compounding occurs quarterly, you would divide the rate by four, and multiply the years by four.

What is the original loan amount?from financeformulas.net

The original loan amount is essentially the present value of the future payments on the loan , much like the present value of an annuity. It is important to keep the rate per period and number of periods consistent with one another in the formula. If the loan payments are made monthly, then the rate per period needs to be adjusted to ...

What are some examples of specialized loans that do not apply to this formula?from financeformulas.net

Examples of specialized loans that do not apply to this formula include graduated payment, negatively amortized, interest only, option, and balloon loans. An adjustable rate loan will use the formula shown but will need to be recalculated based on the remaining balance and remaining term for each new rate change.

How to calculate average payment period?from myaccountingcourse.com

The average payment period formula is calculated by dividing the period’s average accounts payable by the derivation of the credit purchases and days in the period.

What is an unsecured loan?from calculator.net

An unsecured loan is an agreement to pay a loan back without collateral. Because there is no collateral involved, lenders need a way to verify the financial integrity of their borrowers. This can be achieved through the five C's of credit, which is a common methodology used by lenders to gauge the creditworthiness of potential borrowers.

How to calculate the payment on an annuity?from financeformulas.net

The payment on a loan can also be calculated by dividing the original loan amount (PV) by the present value interest factor of an annuity based on the term and interest rate of the loan. This formula is conceptually the same with only the PVIFA replacing the variables in the formula that PVIFA is comprised of.

What are the different types of loans?from calculator.net

A loan is a contract between a borrower and a lender in which the borrower receives an amount of money (principal) that they are obligated to pay back in the future. Most loans can be categorized into one of three categories: 1 Amortized Loan: Fixed payments paid periodically until loan maturity 2 Deferred Payment Loan: Single lump sum paid at loan maturity 3 Bond: Predetermined lump sum paid at loan maturity (the face or par value of a bond)

What happens when you default on a secured loan?from calculator.net

In other words, defaulting on a secured loan will give the loan issuer the legal ability to seize the asset that was put up as collateral. The most common secured loans are mortgages and auto loans.

How to calculate interest portion in amortization table?from wallstreetmojo.com

The interest portion reflected in the amortization table is calculated by multiplying the outstanding opening principal by the monthly rate of interest. The monthly rate of interest can be calculated by dividing the yearly rate of interest by twelve. The outstanding principal is always mentioned in the amortization schedule. As the exceptional principal keeps on decreasing with each monthly repayment, the interest portion will also fall.

What is amortization schedule in Excel?from amortizationschedule.org

Amortization Schedule Excel is a loan calculator that outputs an amortization schedule in excel format. The amortization schedule has all the monthly payments for your loan with breakdown for interest, principle and remaining balance.

How does Amortization Table Work?from wallstreetmojo.com

The loan amortization schedule Loan Amortization Schedule Loan amortization schedule refers to the schedule of repayment of the loan. Every installment comprises of principal amount and interest component till the end of the loan term or up to which full amount of loan is paid off. read more reflects the monthly installment and the breakup of principal repayment and interest in each installment. Although the monthly installment will be the same for each month, the separation of principal repayment and interest will be different for each month because loan outstanding will differ each month. By referring to this table, a person can be aware of future payments and the due loan amount.

What does the installment number represent?from wallstreetmojo.com

Installment Number: It reflects the wise serial number of installments. The last installment number represents the tenure of the loan.

Is a loan disbursement lump sum?from wallstreetmojo.com

The loan disbursement is done as a lump-sum-amount.

How to find percentage change in Excel?from techwalla.com

Click on any cell in the worksheet where you want the percentage change to appear. The formula for this operation has two components. First, you need Excel to subtract the first number from the second number to find the difference between them. Secondly, Excel needs to divide this difference by the first value. For example, if your savings account went from $10,000 to $12,000 in one month, the difference is $2,000. Dividing $10,000 by $2,000 gives you the percentage difference of 20 percent.

What is formulas in Excel?from exceljet.net

In this accelerated training, you'll learn how to use formulas to manipulate text, work with dates and times, lookup values with VLOOKUP and INDEX & MATCH, count and sum with criteria, dynamically rank values, and create dynamic ranges. You'll also learn how to troubleshoot, trace errors, and fix problems. Instant access. See details here.

What is savings calculator?from vertex42.com

Our Savings Calculator is a free spreadsheet that is simple to use and much more powerful than most online calculators that you'll find. It will estimate the future value of your savings account with optional periodic deposits. It also includes a yearly table that lets you add specific annual deposits that may be different from year to year. You can also choose to randomize the annual interest rates within the Min/Max values you specify so you can get an idea of what a fluctuating market might do to your savings.

How to find the percentage difference between two numbers?from techwalla.com

First, you need Excel to subtract the first number from the second number to find the difference between them. Secondly, Excel needs to divide this difference by the first value. For example, if your savings account went from $10,000 to $12,000 in one month, the difference is $2,000. Dividing $10,000 by $2,000 gives you the percentage difference ...

How to subtract discount from regular price?from techwalla.com

The formula =SUM (B6-B7) subtracts the discount from the regular price.

How many periods are there in a 5 year loan?from exceljet.net

nper - the number of periods comes from cell C7; 60 monthly periods for a 5 year loan.

How to add discount to total in Excel?from techwalla.com

Open a new blank workbook in Excel. Enter some items in Column A that are being discounted. Beneath those items in Column A, add the words "Discount" and then "Total." Enter the normal price beside each item in column B.