How to Calculate Mortgage Interest for Each Year

- 1. Write down the initial balance of the mortgage at the beginning of the year on the top of the first column. ...

- 2. Calculate the rate of interest you are paying for each payment period. ...

- 3. Multiply the first number by the second, and enter this in the third column. ...

How do you calculate annual interest on a loan?

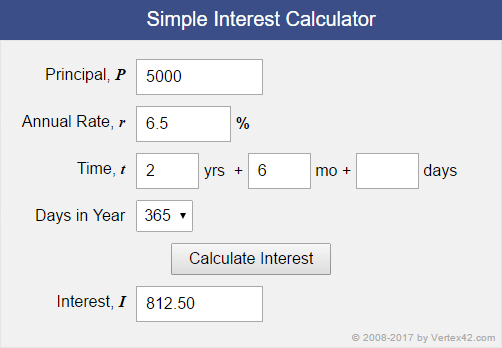

You can calculate your total interest by using this formula: Principal loan amount x Interest rate x Time (aka Number of years in term) = Interest. For example, if you take out a five-year loan ...

How do you calculate interest rates on a mortgage?

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly and over the life of the loan

- Tallying how much you actually pay off over the life of the loan versus the principal borrowed, to see how much you actually paid extra

How to calculate an effective annual interest rate?

- EAR = (1 + (nominal rate / number of compounding periods)) ^ (number of compounding periods) − 1

- For Bank A, this would be: 10.47% = (1 + (10% / 12)) x 12 − 1

- For Bank B, this would be: 10.36% = (1 + (10.1% / 2)) x 2 − 1

How to calculate monthly mortgage payment?

- You can calculate a monthly mortgage payment by hand, but it's easier to use an online calculator.

- You'll need to know your principal mortgage amount, annual or monthly interest rate, and loan term.

- Consider homeowners insurance, property taxes, and private mortgage insurance as well.

- Click here to compare offers from refinance lenders »

How are mortgage payments calculated?

How Mortgage Payments Are Calculated. With most mortgages, you pay back a portion of the amount you borrowed (the principal) plus interest every month. Your lender will use an amortization formula to create a payment schedule that breaks down each payment into principal and interest. 1.

What happens when the mortgage rate goes up?

When the rate goes up or down, the lender recalculates your monthly payment, which will then remain stable until the next rate adjustment occurs. As with a fixed-rate mortgage, when the lender receives your monthly payment, it will apply a portion to interest and another portion to principal.

How long does it take for a mortgage to be paid off?

If you make payments according to the loan's amortization schedule, the loan will be fully paid off by the end of its set term, such as 30 years. If the mortgage is a fixed-rate loan, each payment will be an equal dollar amount. If the mortgage is an adjustable-rate loan, the payment will change periodically as the interest rate on the loan changes.

What is the largest financial transaction in 2021?

Updated Jul 8, 2021. Buying a home with a mortgage is the largest financial transaction most of us will enter into. Typically, a bank or mortgage lender will finance 80% of the price of the home, and you agree to pay it back—with interest—over a specific period.

How much is a mortgage of $200,000?

Example: A $200,000 fixed-rate mortgage for 30 years ( 360 monthly payments) at an annual interest rate of 4.5% will have a monthly payment of approximately $1,013. (Real-estate taxes, private mortgage insurance, and homeowners insurance are additional and not included in this figure.) The 4.5% annual interest rate translates into a monthly interest rate of 0.375% (4.5% divided by 12). So each month you’ll pay 0.375% interest on your outstanding loan balance.

How long does a mortgage loan last?

The monthly payment also remains the same for the life of loan. Loans often have a repayment life span of 30 years, although shorter lengths, of 10, 15, or 20 years, are also widely available. Shorter loans have larger monthly payments but lower total interest costs.

What are the two types of mortgages?

Two basic types of mortgages are fixed and adjustable-rate loans. The interest rate on your mortgage will depend on such factors as the type of loan and how long a loan term (such as 20 or 30 years) you sign up for.

How does a mortgage lender work out interest?

As mentioned, most lenders work out your interest on a monthly basis and advertise the rate on an annual calculation. With a daily interest or simple interest mortgage, interest will be added to your balance each month based on the number of days in the coming month.

What is APR in mortgage?

The annual percentage rate (APR) is the mortgage interest rate plus other charges, which could include fees, charges and discounts. By the way, a representative APR is the APR at least 51% of successful applicants get.

When do they take the balance of a mortgage?

In the first year of your mortgage, they’ll take the balance from the date they lend it to you and calculate what they expect you to have to pay until 31st December.

How does a bank work with interest?

Basically, your bank will work it so that you have the same monthly payments throughout the term, but a higher percentage of that will be interest at the start of the term, while at the end of the term, the interest proportion will be lower and the amount you repay of the loan higher.

What is interest rate?

Put simply, an interest rate’s how much it costs to borrow the cash. Most mortgage interest rates are annual rates, however interest is calculated monthly, but it’s quite simple to work out how much you’ll pay in interest:

Does interest rate drop when you pay off a loan?

But it doesn’t. And that’s because of lovely amortization.

What is a Mortgage Principal?

When looking at mortgages, the mortgage principal is the amount of money that you owe and will need to pay back. For example, perhaps you bought a home for $500,000 after closing costs and made a down payment of $100,000. You will only need to borrow $400,000 from a bank or mortgage lender in order to finance the purchase of the home. This means that when you get a mortgage and borrow $400,000, your mortgage principal will be $400,000.

What is Mortgage Interest?

Interest is charged by lenders in exchange for allowing you to borrow money. For borrowers, mortgage interest is charged based on your mortgage principal balance. The mortgage interest charged is included in your regular mortgage payments. This means that with every mortgage payment, you will be paying both your mortgage principal and your mortgage interest.

How many biweekly mortgage payments are there in a year?

There are 12 months in a year, which will result in only 12 mortgage payments if you were to make monthly payments. There are 52 weeks in a year, which will result in 26 bi-weekly mortgage payments. This creates an additional 2 bi-weekly mortgage payments, or the equivalent of an extra monthly mortgage payment, every year.

Why is my mortgage payment smaller?

As your principal payments lower your principal balance, your mortgage will become smaller and smaller over time. A smaller principal balance will result in less interest being charged. However, since your monthly mortgage payment stays the same, this means that the amount being paid towards your principal will become larger and larger over time. This is why your initial monthly payment will have a larger proportion going towards interest compared to the interest payment near the end of your mortgage term.

Why do you have to pay off your mortgage biweekly?

Making more mortgage payments with bi-weekly mortgage payments will allow you to make more payments, resulting in your mortgage being paid off sooner. Choosing bi-weekly payments can let you pay off your mortgage a few years earlier, while also saving you in mortgage interest.

Why is it important to understand your mortgage payment structure?

It’s important to understand your mortgage payment structure so that you can find ways to save money. Let's take a look at mortgage payments and their payment breakdowns.

How to calculate interest on a mortgage?

To calculate interest paid on a mortgage, you will first need to know your mortgage balance, the amount of your monthly mortgage payment, and your mortgage interest rate. For example, you might want to calculate mortgage interest for a mortgage of $500,000 with monthly payments of $2,500 at a 3% mortgage rate .

How much you'll pay will depend on the type of loan you choose

- Buying a home with a mortgage is the largest financial transaction most of us will make. Typical…

Mortgages can be the biggest financial transaction most people ever make. - Two basic types of mortgages are fixed and adjustable-rate loans.

The interest rate on your mortgage will depend on such factors as the type of loan and the length of the loan term (such as 20 or 30 years).

How Mortgage Payments Are Calculated

- With most mortgages, you pay back a portion of the amount you borrowed (the principal) plus in…

If you make payments according to the loan's amortization schedule, the loan will be fully paid off by the end of its set term, such as 30 years. If the mortgage is a fixed-rate loan, each payment will be an equal dollar amount. If the mortgage is an adjustable-rate loan, the payment will change p…

Fixed-Rate v Adjustable-Rate Mortgages

- Banks and lenders primarily offer two basic types of loans:

Fixed rate: The interest rate does not change. - Adjustable rate: The interest rate will change under defined conditions (also called a variable-rat…

Here’s how the two types work.

Fixed-Rate Mortgages

- With this type of mortgage, the interest rate is locked in for the life of the loan and does not chan…

Example: A $200,000 fixed-rate mortgage for 30 years (360 monthly payments) at an annual interest rate of 4.5% will have a monthly payment of approximately $1,013. (Real-estate taxes, private mortgage insurance, and homeowners insurance are additional and not included in this fi…

Adjustable-Rate Mortgages (ARM

- Because the interest rate on an adjustable-rate mortgage is not permanently locked in, the mont…

As with a fixed-rate mortgage, when the lender receives your monthly payment, it will apply a portion to interest and another portion to the principal. - Lenders often offer lower interest rates for the first few years of an ARM, which are sometimes c…

If you're considering an ARM, find out how its interest rate is determined; many are tied to a certain index, such as the rate on one-year U.S. Treasury bills, plus a certain additional percentage or margin. Also, ask how often the interest rate will adjust. For example, a five-to-one-year ARM …

Interest-Only Loans

- A much rarer third option—usually reserved for wealthy homebuyers or those with irregular incomes—is an interest-only mortgage . As the name implies, this type of loan gives you the option to pay only interest for the first few years, resulting in lower monthly payments. 4 It might be a reasonable choice if you expect to own the home for a relatively short time and intend to se…

Jumbo Mortgage Loans

- A jumbo mortgage is usually for amounts over the conforming loan limit, $548,250 in 2021 and …

Jumbo loans can be either fixed or adjustable. The interest rates on them tend to be slightly higher than those on smaller loans of the same type. - Interest-only jumbo loans are also available, though usually only for the very wealthy. They are st…

Even with a fixed-rate mortgage, your monthly payment can change if it also includes taxes or insurance.

Don't Forget Taxes, Insurance, and Other Costs

- If you're buying a home, you'll also need to consider some other items that can significantly add to your monthly mortgage payment, even if you manage to get a great interest rate on the loan itself. For example, your lender may require that you pay for your real estate taxes and insurance as part of your mortgage payment. The money will go into an escrow account, and your lender will pay t…