How to calculate net working capital

- Add up all current assets. Total all of your company's current assets. ...

- Subtract accounts payable. Subtract the current liabilities from the total assets, starting with accounts payable. ...

- Subtract expenses. Subtract remaining liabilities from the difference you calculate between current assets and accounts payable.

- Evaluate the results. ...

How do you calculate change in net working capital?

How to calculate net working capital

- Add up all current assets. Total all of your company's current assets. ...

- Subtract accounts payable. Subtract the current liabilities from the total assets, starting with accounts payable. ...

- Subtract expenses. Subtract remaining liabilities from the difference you calculate between current assets and accounts payable.

- Evaluate the results. ...

What will cause a change in net working capital?

- Selling shares

- Increasing profits

- Selling assets

- Incurring new debt

How to calculate change in net working capital?

Steps to Follow

- Step# 1. Current assets are business assets that can be converted into cash within the period of one fiscal year.

- Step# 2. Current liabilities are current business obligations that must be paid within the period of one fiscal year.

- Step# 3. Working capital (WC) is the leftover amount after paying all current obligations. ...

- Step# 4. ...

- Step# 5. ...

- Step# 6. ...

What is the formula for change in net working capital?

What are Changes in Net Working Capital?

- Formula. ...

- Change in Net Working Capital Calculation (Colgate) Below is the Snapshot of Colgate’s 2016 and 2015 balance sheet. ...

- Analysis of the Changes in Net Working Capital. ...

- Conclusion. ...

- Recommended Articles. ...

How do you calculate net operating capital?

Net operating working capital (NOWC) is the excess of operating current assets over operating current liabilities. In most cases it equals cash plus accounts receivable plus inventories minus accounts payable minus accrued expenses.

How do you calculate percentage change in working capital?

The formula to calculate changes in net working capital is – Working Capital of current year Less Working Capital of Last Year. Another formula is – Change in Current Assets of two periods Less Change in Current Liabilities of those two periods.

What is the change in working capital?

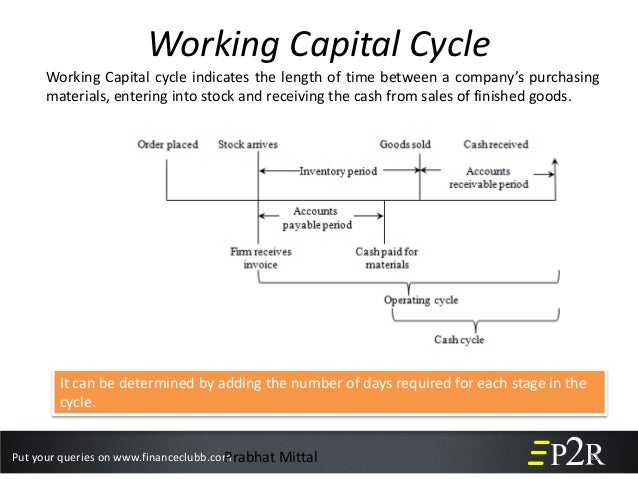

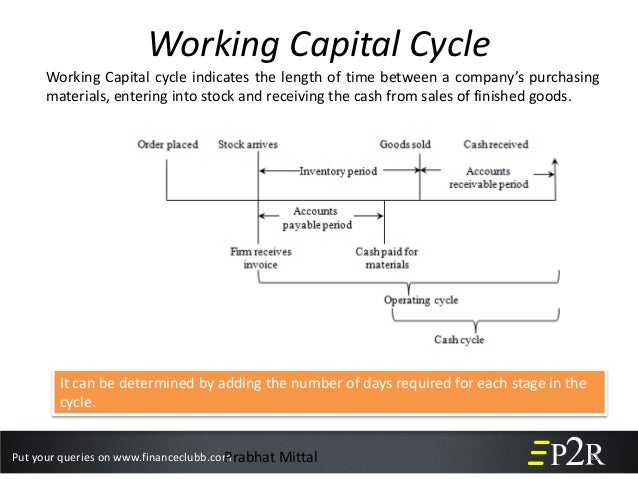

A change in working capital is the difference in the net working capital amount from one accounting period to the next. A management goal is to reduce any upward changes in working capital, thereby minimizing the need to acquire additional funding.

Why do you subtract Change in net working capital?

You subtract the change in NWC capital from free cash flow because when figuring out the cash flow that is available to investors - you must account for the money that is invested into the business through NWC.

Net Working Capital (NWC) Definition

The net working capital metric is a measure of liquidity that helps determine whether a company can pay off its current liabilities with its current assets on hand.

Change in Net Working Capital (NWC) Formula

Since we have defined net working capital, we can now explain the importance of understanding the changes in net working capital (NWC).

Increasing vs Decreasing Change in NWC

If a company’s change in NWC has increased year-over-year (YoY), this implies that either its operating assets have grown and/or its operating liabilities have declined from the preceding period.

Excel Template Download

Now that we’ve described the formulas for calculating net working capital and change in NWC, we’re ready to move on to an example calculation in Excel.

Change in Net Working Capital (NWC) Example Calculation

In our hypothetical scenario, we’re looking at a company with the following balance sheet data.

What does it mean when net working capital has increased?

Since the change in net working capital has increased, it means that change in current assets is more than a change in current liabilities. So current assets have increased. It means that the company has spent money to purchase those assets. So this increase is basically cash outflow for the company.

What does it mean when a company has a positive change in net working capital?

So if the change in net working capital is positive, it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. So a positive change in net working capital is cash outflow.

What does negative change in net working capital mean?

Similarly, negative change in net working capital means that current liabilities has increased in this period. So this can be in the form of increased payables etc. which means that we have cash inflow. So negative change in the working capital is cash inflow.

Why is working capital important?

Net Working capital is very important because it is a good indicator regarding how efficiently a business operation is and solvent the business is in short-run. If a company is not able to meet its short term liabilities with current assets, they will not have any other option but to use noncurrent assets and because of which it will lead to operational and financial problems.

What is net working capital?

Net Working capital, in very simple terms, is basically the amount of fund which a business needed to run its operations on a daily basis. In other words, it is the measure of liquidity of business and its ability to meet short term expenses.

Is working capital increase bad for business?

For example, a business is expanding and therefore they have increased their short term liabilities to meet the demand. So that is not bad for business.

Is negative working capital bad?

On the same line, Negative working capital does not mean that it is bad. It can be the case that the company has purchased something to expand its business.

What is net working capital?

Net working capital (NWC) is the difference between a business's current assets, current liabilities and inventory and measures the business's liquidity. Net working capital also includes net operating working capital, which is the difference between a company's current operating assets and operating liabilities.

Why is net working capital important?

A company's net working capital includes funds that the company invests in its regular business operations. Net working capital is necessary for covering operational costs, reinvesting in the business and determining a company's profitability. Consider the following additional reasons net working capital is so critical for businesses:

How to calculate net working capital

Essentially, you can find net working capital by subtracting current liabilities from current assets. The following steps provide additional insight into how to calculate net working capital:

What is the net working capital ratio?

The net working capital ratio measures the proportion of a business's short-term net cash to its assets. You can find the net working ratio with this simple calculation:

What are changes to net working capital?

A company's net working capital can experience changes, too, which can affect cash flow. For instance, new projects, business expansion and cash usage are changes in processes that can affect the net working capital. Several more changes that can affect the net working capital include:

Advantages and disadvantages of net working capital

Managing net working capital comes with advantages and disadvantages. Consider the following pros and cons when calculating your net working capital:

How to increase net working capital

The following approaches are effective for increasing the net working capital: