Full Answer

What is the formula for monthly compound interest?

- A= Monthly compound rate

- P= Principal amount

- R= Rate of interest

- N= Time period

What is the formula for compound interest in Excel?

Where:

- ‘FV’ – future value of the investment; the total value you’ll get at the end of the investment period

- ‘PV’ – present value of the investment; the initial deposit

- ‘i’ – interest rate earned every period

- ‘n’ – number of periods

How do you calculate annual interest rate in Excel?

You can figure out the total interest paid as follows:

- List your loan data in Excel as below screenshot shown:

- In Cell F3, type in the formula, and drag the formula cell’s AutoFill handle down the range as you need. =IPMT ($C$3/$C$4,E3,$C$4*$C$5, $C$2)

- In the Cell F9, type in the formula =SUM (F3:F8), and press the Enter key.

How to calculate average/compound annual growth rate in Excel?

You can do as follows: Besides the original table, enter the below formula into the blank Cell C3 and, and then drag the Fill Handle to the... Select the Range D4:D12, click the Percent Style button on the Home tab, and then change its decimal places with... Average all annual growth rate with entering below formula into Cell F4, and press the Enter key.

How do I calculate monthly compound interest in Excel?

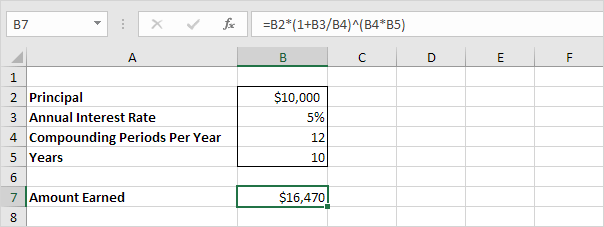

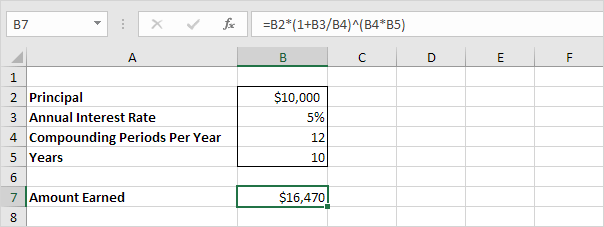

A more efficient way of calculating compound interest in Excel is applying the general interest formula: FV = PV(1+r)n, where FV is future value, PV is present value, r is the interest rate per period, and n is the number of compounding periods.

How do you calculate monthly compounding interest?

The monthly compound interest formula is used to find the compound interest per month. The formula of monthly compound interest is: CI = P(1 + (r/12) )12t - P where, P is the principal amount, r is the interest rate in decimal form, and t is the time.

What Excel function calculates compound interest?

=B1*(1+B2/12)^(B3*12) The Excel compound interest formula in cell B4 of the above spreadsheet on the right once again calculates the future value of $100, invested for 5 years with an annual interest rate of 4%. However, in this example, the interest is paid monthly. This formula returns the result 122.0996594.

What is compound formula in Excel give an example?

Explanation: An easy and straightforward way to calculate the amount earned with an annual compound interest is using the formula to increase a number by percentage: =Amount * (1 + %) . In our example, the formula is =A2*(1+$B2) where A2 is your initial deposit and B2 is the annual interest rate.

What is 6% compounded monthly?

Also, an interest rate compounded more frequently tends to appear lower. For this reason, lenders often like to present interest rates compounded monthly instead of annually. For example, a 6% mortgage interest rate amounts to a monthly 0.5% interest rate.

How many is compounded monthly?

COMPOUND INTERESTCompounding PeriodDescriptive AdverbFraction of one year1 monthmonthly1/123 monthsquarterly1/46 monthssemiannually1/21 yearannually11 more row

How do you do a compound interest spreadsheet?

2:3711:23Making a Compounding Interest Calculator in Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipWe want to say this is going to be equals. And it will be all of our deposits. Multiplied by theMoreWe want to say this is going to be equals. And it will be all of our deposits. Multiplied by the amount of years that we're doing it for so 15 years but we also want to add the initial.

How do I calculate compound interest between two dates in Excel?

interest between 2 dates.xlsx.=IPMT(C5/12,1,C6*C7,C4)=C4*(C8-C7)*(C5/365)

How do I calculate compound interest for recurring deposit in Excel?

Your Rate per Quarter is: 6%/4 = 1.50%. This is because your money is compounded 4 times per year. So, nominal interest is divided by 4 to get the Rate per Quarter....Method 1: Using Excel's FV Function.Interest CompoundedCalculated After (Days or Months)No. of Payments/YearQuarterly34Semi-annually62Yearly1215 more rows

What is the easiest way to calculate compound interest?

For example, if you have an investment that earns 5% compound interest and you want to know how much money you'll have after 3 years, you would plug the following values into the formula: A = P(1 + r/n)^nt. A = 1000(1 + 0.05/1)^3. A = 1000(1.05)^3.

What is a compounded monthly interest rate?

In the real world, interest is often compounded more than once a year. In many cases, it is compounded monthly, which means that the interest is added back to the principal each month. In order to calculate compounding more than one time a year, we use the following formula: A = P ( 1 + r n ) nt.

What is monthly compounding?

Monthly compounding is calculated by principal amount multiplied by one plus rate of interest divided by a number of periods whole raise to the power of the number of periods and that whole is subtracted from the principal amount which gives the interest amount.

Calculating Annual Compound Interest in Excel

To understand the idea of compound interest better, let's begin with a very simple example discussed at the beginning of this tutorial and write a...

General Compound Interest Formula

When financial advisors analyze the impact of compound interest on an investment, they usually consider three factors that determine the future val...

Universal Compound Interest Formula in Excel (Daily, Weekly, Monthly, Yearly Compounding)

Usually, there is more than one way to do something in Excel and a compound interest formula is not an exception :) Although Microsoft Excel provid...

Advanced Compound Interest Calculator For Excel

If for some reason you are not quite happy with the compound interest formula discussed above, you can create your Excel compound interest calculat...

Download Practice Workbook

You can download the free Excel template from here and practice on your own.

Compound Interest with Monthly Compounding Periods

Compound interest is the total interest that includes the original interest and the interest of the updated principal which is evaluated by adding the original principal to the due interest. It is the interest that you get both on your initial principal and on the interest you earn with the passage of each compounding period.

3 Formulas to Calculate Monthly Compound Interest in Excel

In this method, we’ll use the basic mathematical formula to calculate monthly compound interest in Excel.

Conclusion

I hope all of the methods described above will be well enough to use a formula to calculate monthly compound interest in Excel. Feel free to ask any question in the comment section and please give me feedback.

What is compound interest?

In very simple terms, compound interest is the interest earned on interest. More precisely, compound interest is earned on both the initial deposit (principal) and the interest accumulated from previous periods. Perhaps, it might be easier to start with simple interest that is calculated only on the principal amount.

Can you use Excel to calculate compound interest?

Usually, there is more than one way to do something in Excel and a compound interest formula is not an exception :) Although Microsoft Excel provides no special function for calculating compound interest, you can use other functions to create your own compound interest calculator.

How to calculate monthly compounding interest?

Step 1: We need to calculate the amount of interest obtained by using monthly compounding interest. The formula can be calculated as : A = [ P (1 + i)n – 1] – P. Step 2: if we assume the interest rate is 5% per year. First of all, we need to express the interest rate value into the equivalent decimal number.

What is compound interest?

Compound interest is the product of the initial principal amount by one plus the annual interest rate raised to the number of compounded periods minus one. So the initial amount of the loan is then subtracted from the resulting value.

Is compound interest better than investment?

Compound Interest has proven the better tool for investment but it can very dangerous if it’s applicable to your loan amount. You will end up paying more interest on your loan amount.

How to Calculate Compound Interest in Excel Formula? (with Examples)

Let us understand the same using some examples of the Compound Interest Examples Of The Compound Interest To calculate the compound interest in excel, the user can use the FV function and return the future value of an investment. To configure the function, the user must enter a rate, periods (time), the periodic payment, the present value.

Things to Remember about Compound Interest Formula in Excel

We need to enter the interest rate in percentage form (4%) or in decimal form (0.04).

Recommended Articles

This has been a guide to Compound Interest Formula in Excel. Here we discuss how to use the Compound Interest formula in excel along with practical examples and a downloadable excel template. You may learn more about excel from the following articles –

What is compound interest?

When you invest money, you can earn interest on your investment. Say, for example, you invest $3,000 with a 10% annual interest rate, compounded annually. One year from the initial investment (called the principal), you earn $300 ($3,000 x 0.10) in interest, so your investment is worth $3,300 ($3,000 + $300).

How to calculate compound interest in Excel

One of the easiest ways is to apply the formula: (gross figure) x (1 + interest rate per period).

General Compound Interest Formula (for Daily, Weekly, Monthly, and Yearly Compounding)

A more efficient way of calculating compound interest in Excel is applying the general interest formula: FV = PV (1+r)n, where FV is future value, PV is present value, r is the interest rate per period, and n is the number of compounding periods.

FV Function and Compound Interest

Lastly, you can calculate compound interest with Excel’s built-in Future Value Function. Similar to the previous process, the FV function calculates the future value of an investment based on the values of certain variables.