The Discounted Payback Period (DPP) Formula and a Sample Calculation

- The Discounted Payback Period (or DPP) is X + Y/Z

- In this calculation:

- X is the last time period where the cumulative discounted cash flow (CCF) was negative,

- Y is the absolute value of the CCF at the end of that period X,

- Z is the value of the DCF in the next period after X.

How to calculate discounted payback period (DPP)?

What is the Discounted Payback Period?

- Understanding Discounted Payback Period. The discounted payback period is used to evaluate the profitability and timing of cash inflows of a project or investment.

- Discounted Payback Period Formula. There are two steps involved in calculating the discounted payback period. ...

- Practical Example. ...

- Payback Periods. ...

- Pros and Cons of Discounted Payback Period. ...

How to calculate the discount payback period?

What is the Payback Period?

- Payback Period Formula. ...

- Download the Free Template. ...

- Using the Payback Method. ...

- Drawback 1: Profitability. ...

- Drawback 2: Risk and the Time Value of Money. ...

- Internal Rate of Return (IRR) Internal Rate of Return (IRR) The Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of a project ...

How to find discounted payback on Excel?

We have made it easy for you to use and get the right DPP figures:

- Choose your currency from the list (this step is optional)

- Key in the amount of your investment

- Put in the discount rate and the years of cash flow

- The last step is to input the annual cash flow for each year

- Then click "Calculate" to see the answer.

How to find the discounted payback period?

- Year 0: – $150,000 / (1+0.10) ^0 = $150,000

- Year 1: $70,000 / (1+0.10) ^1 = $63,636.36

- Year 2: $60,000 / (1+0.10) ^2 = $49,586.78

- Year 3: $60,000 / (1+0.10) ^3 = $45,078.89

What is the formula for calculating payback?

To calculate the payback period you can use the mathematical formula: Payback Period = Initial investment / Cash flow per year For example, you have invested Rs 1,00,000 with an annual payback of Rs 20,000. Payback Period = 1,00,000/20,000 = 5 years. You may calculate the payback period for uneven cash flows.

What is the formula for discounted rate?

Discount Rate Formula First, the value of a future cash flow (FV) is divided by the present value (PV) Next, the resulting amount from the prior step is raised to the reciprocal of the number of years (n) Finally, one is subtracted from the value to calculate the discount rate.

How do you calculate discounted payback in Excel?

0:003:06Discounted Payback Period.mp4 - YouTubeYouTubeStart of suggested clipEnd of suggested clipOkay so I know that my formula is negative PV the rate which is 5%. Period which is the year so yourMoreOkay so I know that my formula is negative PV the rate which is 5%. Period which is the year so your zero payment. And zero future value is what I'm gonna get so as for year zero 60,000.

What is discounted back value?

Reducing a future payment or receipt to its present equivalent by taking account of the interest, which when added to the present equivalent for the relevant number of years would equate to the future payment or receipt.

How do you calculate discount in accounting?

The discount rate may be expressed as either a percentage or a decimal number. For example, the discount rate can be expressed as either 2% or . 02. The formula can be expressed algebraically as CD = P*R where CD = the cash discount, P = the price, and R = the discount rate expressed as a decimal.

What is the formula for DCF in Excel?

What is the Discounted Cash Flow DCF Formula? The discounted cash flow (DCF) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate (WACC) raised to the power of the period number.

How do you calculate discount rate for NPV?

There are two primary discount rate formulas - the weighted average cost of capital (WACC) and adjusted present value (APV). The WACC discount formula is: WACC = E/V x Ce + D/V x Cd x (1-T), and the APV discount formula is: APV = NPV + PV of the impact of financing.

How do you calculate discounted payback period for uneven cash flows?

0:125:03Discounted Payback Period Method - YouTubeYouTubeStart of suggested clipEnd of suggested clipWithin a specific time frame so this is basically the same thing as the regular payback method onlyMoreWithin a specific time frame so this is basically the same thing as the regular payback method only we're taking into consideration the time value of money by discounting the cash flows.

What is the discounted payback period?

The discounted payback period is the time it will take to receive a full recovery on an investment that has a discount rate.

How do you calculate discounted payback period?

The formula for discounted payback period is: DCF = C / (1+r)n where: C = actual cash flow r = discount rate n = period of the individual cash flow

What is the difference between payback period and discounted payback period?

The main difference between the two periods is that discounted payback period takes into account the time value of money. Payback period does not f...

Is payback period affected by discount rate?

For a conventional project, the answer is no. The payback period will be the same whether or not you apply a discount rate. However, for a discount...

What is the main advantage of the discounted payback period method over the regular payback period m...

The main advantage of the discounted payback period method over the regular payback period is that it takes into account the time value of money. T...

How to calculate discount payback period?

Discounted payback period refers to the time period required to recover its initial cash outlay and it is calculated by discounting the cash flows that are to be generated in future and then totaling the present value of future cash flows where discounting is done by the weighted average cost of capital or internal rate of return.

What is discounted payback period?

Discounted Payback Period = Year before the discounted payback period occurs + (Cumulative cash flow in year before recovery / Discounted cash flow in year after recovery)

How long is the payback period for a 10% discount?

In this case, the discounting rate is 10% and the discounted payback period is around 8 years, whereas the discounted payback period is 10 years if the discount rate is 15%. But the simple payback period is 5 years in both cases. So, this means as the discount rate increases, the difference in payback periods of a discounted pay period and simple payback period increases.

Why is a discounted payback period better than a simple payback period?

The discounted payback period is a better option for calculating how much time a project would get back its initial investment; because, in a simple payback period, there’s no consideration for the time value of money.

How to find present value of a value?

Please note the formula of present value – PV = FV / (1+i) ^n

Is there a formula for finding out the payback period?

It can’t be called the best formula for finding out the payback period. But from the perspective of capital budgeting and accuracy, this method is far superior to a simple payback period; because in a simple payback period, there is no consideration for the time value of money and cost of capital.

Discounted Payback Period Formula

Example

- We will go step by step. First, we will find out the present value of the cash flow. Let’s look at the calculations. Please note the formula of present value – PV = FV / (1+i) ^n 1. Year 0: – $150,000 / (1+0.10) ^0 = $150,000 2. Year 1: $70,000 / (1+0.10) ^1 = $63,636.36 3. Year 2: $60,000 / (1+0.10) ^2 = $49,586.78 4. Year 3: $60,000 / (1+0.10) ^3 = $45,078.89 Now, we will calculate the cumulat…

Discounted Payback Period Calculation in Excel

- Let us now do the same example above in Excel. This is very simple. You need to provide the two inputs of Cumulative cash flow in a year before recovery and Discounted cash flow in a year after recovery. You can easily calculate the period in the template provided.

Use and Relevance

- The discounted payback period is a better option for calculating how much time a project would get back its initial investment; because, in a simple payback period, there’s no consideration for the...

- It can’t be called the best formula for finding out the payback period.

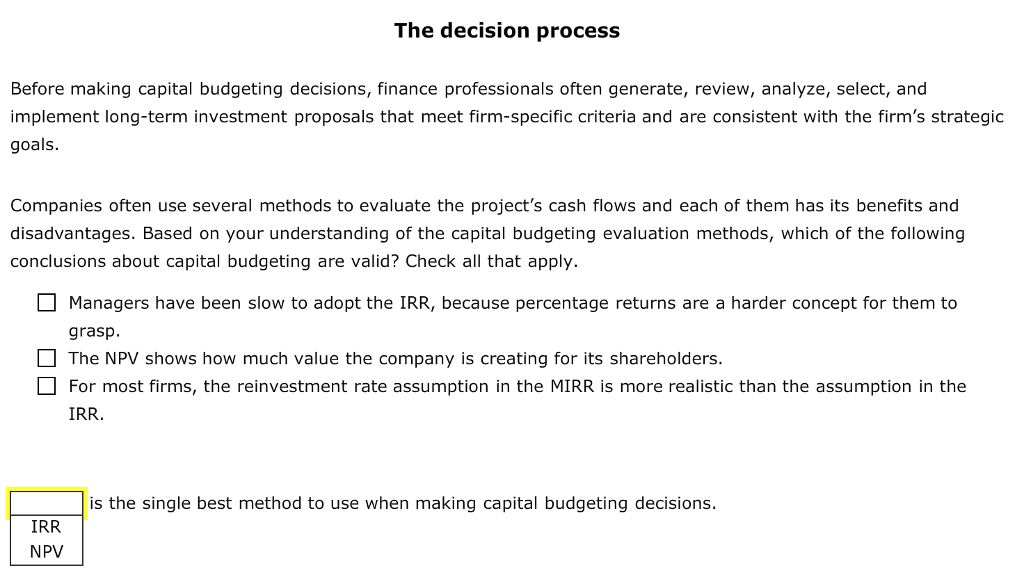

- But from the perspective of capital budgetingCapital BudgetingCapital budgeting is the plann…

- The discounted payback period is a better option for calculating how much time a project would get back its initial investment; because, in a simple payback period, there’s no consideration for the...

- It can’t be called the best formula for finding out the payback period.

- But from the perspective of capital budgetingCapital BudgetingCapital budgeting is the planning process for the long-term investment that determines whether the projects are fruitful for the busine...

- Many managers have been shifting their focus from a simple payback period to a discounted payback period to find a more accurate estimation of tenure for recouping the initial investments of their...

Recommended Articles

- This has been a guide to the discounted payback period and its meaning. Here we learn how to calculate a discounted period using its formula along with practical examples. Here we also provide you with a discounted payback period calculator with a downloadable excel template. 1. Discount on Bonds Payable 2. DCF Formula 3. Reporting Period Meaning 4. Calculate Average P…