3-Step DuPont Analysis Formula.

- Net Profit Margin = Net Income ÷ Revenue.

- Asset Turnover = Revenue ÷ Average Total Assets.

- Equity Multiplier = Average Total Assets ÷ Average Shareholders’ Equity.

- Equity multiplier = Total Assets / Total Shareholders' Equity.

- Equity Multiplier = $ 540,000 / $ 500,000 = 1.08.

How do you calculate equity multiplier?

- Equity multiplier = Total Assets / Total Shareholders’ Fund

- Equity multiplier = 200 / 40

- Equity multiplier = 5

How to calculate equity multiples?

- Assume an investor purchases a property for $100,000

- Assume the investor used a loan for $50,000, implying a required equity investment of $50,000

- Assume that property pays $7,000 a year in net operating income

- Assume annual interest payments on the loan of $2,500

- Assume the investor sells the property for $165,000 after six years

How to find the equity multiplier?

What is the Equity Multiplier?

- Equity Multiplier Formula. How to Provide Attribution? ...

- Equity Multiplier Examples. Let’s say that Company Z has total assets of $100,000. ...

- Interpretation. ...

- Auto Manufacturer Example. ...

- Global Banks Multipliers. ...

- Discount Stores Multipliers. ...

- Extension to Dupont Analysis. ...

How to calculate the debt ratio using the equity multiplier?

What is Equity Multiplier?

- Leverage Analysis. When a firm is primarily funded using debt, it is considered highly leveraged, and therefore investors and creditors may be reluctant to advance further financing to the company.

- Equity Multiplier Formula. ...

- Calculating the Debt Ratio Using the Equity Multiplier. ...

- DuPont Analysis. ...

- The Relationship between ROE and EM. ...

How do you calculate the equity multiplier?

The equity multiplier formula is calculated as follows:Equity Multiplier = Total Assets / Total Shareholder's Equity. ... Total Capital = Total Debt + Total Equity. ... Debt Ratio = Total Debt / Total Assets. ... Debt Ratio = 1 – (1/Equity Multiplier) ... ROE = Net Profit Margin x Total Assets Turnover Ratio x Financial Leverage Ratio.More items...•

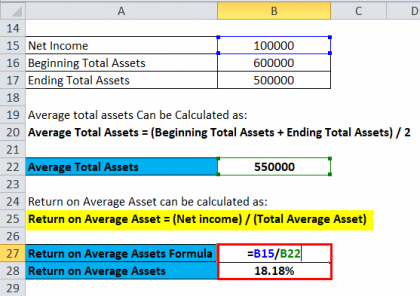

How do you calculate equity in Excel?

Put the formula for "Return on Equity" =B2/B3 into cell B4 and enter the formula =C2/C3 into cell C4. Once that is completed, enter the corresponding values for "Net Income" and "Shareholders' Equity" in cells B2, B3, C2, and C3.

How do you calculate multiple equity in Excel?

In order to calculate the equity multiple for a property, one can use the formula provided below:7.5% * 5 years = 37%$300,000/$4 million = 7.5% Cash on Cash Return.$300,000 * 5 years + $4 million = $5.5 million/$4 million = 1.37.Equity Multiple = Total Cash Distributions/Total Equity Invested.

What does an equity multiplier of 1.5 mean?

Debt ratio = 1 - (1 / Equity Multiplier) So, if a firm has an equity multiplier of 1.5, this means it has a debt to equity ratio of: Debt ratio = 1 - (1 / 1.5) = 0.33333333333 or 0.33. Help improve Study.com.

How is equity percentage calculated?

Divide the total equity by the asset's value and multiply by 100 to determine the equity percentage.

How do you calculate cost of equity on a balance sheet?

Cost of equity, Re = (next year's dividends per share/current market value of stock) + growth rate of dividends. Note that this equation does not take preferred stock into account. If next year's dividends are not provided, you can either guess or use current dividends.

Is equity multiplier a percentage?

The equity multiplier is a financial leverage ratio that measures the amount of a firm's assets that are financed by its shareholders by comparing total assets with total shareholder's equity. In other words, the equity multiplier shows the percentage of assets that are financed or owed by the shareholders.

What is 2x equity?

That's what it means to have an equity multiple of 2x. You've increased your original investment by a factor of 2. In other words, you've doubled your money.

How do you calculate multiples?

A multiple is simply a ratio that is calculated by dividing the market or estimated value of an asset by a specific item on the financial statements.

What does an equity multiplier of 2.5 mean?

This means the company's assets are worth 2.5 times its stockholders' equity, which suggests the company may be using too much leverage, depending on its industry.

What is the value of equity multiplier?

It is calculated by dividing a company's total asset value by its total shareholders' equity. Generally, a high equity multiplier indicates that a company is using a high amount of debt to finance assets.

What does an equity multiplier of 8 mean?

First, let's Calculate the equity multiplier. Or, Assets To Shareholder Equity = $400,000 / $50,000 = 8. That means the 1/8th (i.e., 12.5%) of total assets are financed by equity, and 7/8th (i.e., 87.5%) are by debt. Now, let's calculate the ROE under DuPont Formula.

What is equity multiplier?

Equity multiplier formula calculates total assets to total shareholders equity; this ratio is the financial leverage of a company that determines how many times the equity of a company does a company have as compared to its assets.

What does it mean when the equity multiplier is higher?

If the equity multiplier ratio is higher, it indicates that the company is too dependent on the debt for its financing. It also means that investing in the company would be too risky for an investor.

What are some examples of current assets?

It comprises inventory, cash, cash equivalents, marketable securities, accounts receivable, etc. read more.

Which has higher multiplier: Facebook or Godaddy?

We note from the above graph that Godaddy has a higher equity multiplier at 6.73x, whereas Facebook’s Equity Multiplier is lower at 1.09x.

Can you know the real picture of a company by just looking at one ratio?

As you can’t know the real picture of the company by just looking at one ratio, you don’t know much by only looking at the equity multiplier ratio. It would help if you also looked at dividend-related ratios, profitability ratios, debt-equity ratio, and other financial ratios to have a holistic view of the approach of the company. And looking at all ratios will also give you a solid base to make a prudent decision.

What is the Equity Multiplier?

The Equity Multiplier measures the proportion of a company’s assets funded by its equity shareholders as opposed to debt providers.

Equity Multiplier Formula

The formula for calculating the equity multiplier consists of dividing a company’s total asset balance by its total shareholders’ equity.

DuPont Analysis & Equity Multiplier

The equity multiplier is one of the ratios that make up the DuPont analysis, which is a framework to calculate the return on equity (ROE) of companies.

High vs Low Equity Multiplier

Higher equity multipliers typically signify that the company is utilizing a high percentage of debt in its capital structure to finance working capital needs and asset purchases.

Equity Multiplier Calculator Excel Template

Now, we can move on to a modeling exercise to calculate the equity multiplier of a company.

Equity Multiplier Calculation Example

For our illustrative scenario, we will calculate the equity multiplier of a company with the following financials.

How to calculate equity multiplier?

You can calculate it by dividing the total assets of the company with the total shareholder equity. It is also used to highlight the levels of debt.

How does this equity multiplier formula work?

Equity multiplier formula works as a financial statement. In this financial analysis is done to find the use of debt in the company . In any finance company you will see that the company assets are equal to the debt plus equity. Although debt is not refrained from the equity formula but it is a numerator of the equity multiplier formula which has debts too.

How to calculate the Debt Ratio Using the Equity Multiplier?

Debt ratio and equity multiplier are most importantly used to measure the level of debt of the company. When companies finance their assets these two sources play the most vital role. The Debt to equity ratio formula is

What is a good debt to equity ratio?

A good debt to equity ratio is the proportion of the assets of the company which are dealt through debts. It can be calculated through this method.

What is a low and negative equity multiplier?

Negative equity multiplier shows that the company is not established enough on taking debts. It means the servicing cost of debt should be decreased to the lowest rates.

Why is equity multiplier important?

The equity multiplier is very useful as it helps creditors to analyse the debt of the company and equity financing strategy.

How many inputs are needed for equity multiplier?

In the equity multiplier formula you need five two inputs or equity multiplier and total assets. By this, you can easily find out the equity multiplier ratio in the following excel chart.

How to calculate equity value?

Equity value is calculated by multiplying the total shares outstanding by the current share price.

What is the equity formula?

The equity formula is most commonly used in the Price to earnings ratio or the P/E ratio. Although this ratio only gives the value of equity as multiples. The other ratio called the EV/EBITDA ratio gives the firm’s value as opposed to equity value. The price to earnings ratio or the P/E ratio is defined as the price per share divided by the earnings per share.

Why is equity value important?

The equity value formula is a very important tool for investors as it provides information as to what amount will they get if they had to sell the business. This formula essentially exhibits the market value of the company’s shares. Kindly note that here the value of shares is being calculated and hence the equity part of the company is being valued. If I need to value the whole company, in that case, I will also have to value the debt taken by the company.

What does it mean when the equity formula keeps shooting upwards?

If the equity formula value keeps on shooting upwards, it means that the investor sentiment towards a particular stock is also strengthening. But some companies with bad businesses also rise because of a market frenzy.

What does the number of shares mean?

The number of shares denotes the total shares in circulation (outstanding).

Can a company have a high equity value?

Some companies can have a high equity value just for some time (some companies with bad business gain due to a market frenzy) that might not be stable. The other peculiarity about the equity value formula is that there is no real money involved but it is all about the share price.

What is equity multiplier?

The equity multiplier is also used to indicate the level of debt financing that a firm has used to acquire assets and maintain operations. A high multiplier indicates that a significant portion of a firm’s assets are financed by debt, while a low multiplier shows that either the firm is unable to obtain debt from lenders or ...

What is debt ratio and equity multiplier?

Both the debt ratio and equity multiplier are used to measure a company’s level of debt. Companies finance their assets through debt and equity, which form the foundation of both formulas.

What is leverage ratio?

Leverage Ratios A leverage ratio indicates the level of debt incurred by a business entity against several other accounts in its balance sheet, income statement, or cash flow statement. Excel template

What is the relationship between ROE and equity multiplier?

Any increase in the value of the equity multiplier results in an increase in ROE. A high equity multiplier shows that the company incurs a higher level of debt in its capital structure and has a lower overall cost of capital.

Why is a lower multiplier considered more favorable?

A lower multiplier is considered more favorable because such companies are less dependent on debt financing and do not need to use additional cash flows to service debts like highly leveraged firms do.

What is stockholder equity?

Stockholders Equity Stockholders Equity (also known as Shareholders Equity) is an account on a company's balance sheet that consists of share capital plus. . It is calculated by dividing the company’s total assets by the total shareholder equity.

Where to find shareholder equity?

The values for the total assets and the shareholder’s equity are available on the balance sheet and can be calculated by anyone with access to the company’s annual financial reports.

How to calculate equity multiple?

Equity Multiple Formula = Present Value of the Property / Amount Invested

What is equity multiple?

Equity Multiple is the process by which the total return on equity investment of a real estate is measured. So if this multiple on a particular investment is 2 times in 5 years, then it means that the equity that the person has invested will double in size in 5 years.

What is the most common measure of return in the real estate industry?

The most common measuring mechanism of return in the case of the real estate industry is equity multiple. Equity means the money invested from a pocket, or in other terms, the actual investor’s money that got invested. Multiple means folds. It shows how much fold your money has increased that you have invested in real estate.

Why is equity multiple important?

It helps to gauge the ROI made by your own money. If you have taken debt and it has helped to increase the return, then this multiple will increase. Every Industry has got a specific kind of measuring mechanism which helps them to portray the real return of investing in that industry. The most common measuring mechanism of return in the case of the real estate industry is equity multiple.

Does the equity multiple compare to the return from the market?

It doesn’t compare the return with the return from the market. It shows how many folds your investment has gone up. So this return is more investor specific. It will change from investor to investor if an investor has invested a higher amount for a similar property than another investor. Then the equity multiple of the investor who has spent more will be less.

Examples of Equity Multiplier Formula

Explanation of Equity Multiplier Formula

- There are two main components that need to be discussed in equity multiplier formula total assets and common shareholders’ equity- Total assets are simply meant all current assets (debtors, inventories, prepaid expenses etc.) and non-current assets (building, machinery, plants, furniture etc) of the company’s balance sheet. Common Shareholder’s Equity includes common …

Significance and Use of Equity Multiplier Formula

- Equity Multiplier Formula helps investors to know whether a company invests more in equity or more in debts.

- Higher Equity multiplier ratio indicates that the company is much dependent on the debt for its financing source. It also indicates that it would be risky for investing in such a company.

- When Company is mainly sourced by equity and debt financing is low it means equity multipli…

- Equity Multiplier Formula helps investors to know whether a company invests more in equity or more in debts.

- Higher Equity multiplier ratio indicates that the company is much dependent on the debt for its financing source. It also indicates that it would be risky for investing in such a company.

- When Company is mainly sourced by equity and debt financing is low it means equity multiplier ratio is also low. While Multiplier ratio is low company does not have much financial leverage to build...

- For purposes of testing the financial strength of a company, the equity multiplier formula is used most. This formula results higher or lowers equity multiplier ratio. A higher amount of debts or l...

Recommended Articles

- This is a guide to Equity Multiplier formula. Here we discuss its uses along with practical examples. we also provide you with equity multiplier calculator along with a downloadable excel template. You may also look at the following articles to learn more – 1. Key Differences of Debt and Equity 2. Is Equity Value Important To Firm? 3. Guide to Equity Research Career 4. Example…

Explanation

Examples

Equity Multiplier – GoDaddy vs. Facebook

Uses

Calculate Equity Multiplier in Excel

- Let us now do the same example above in Excel. It is very simple. You need to provide the two inputs of Total Assets and Equity Multiplier. Then, you can easily calculate the equity multiplier ratio in the template provided. First, we will find out the total assets. Now, We will find the equity multiplier.

Recommended Articles