The formula used to calculate operating profit is: Operating Profit = Gross Profit - Operating Expenses - Depreciation - Amortization Where: Gross Profit is calculated as Revenue - Cost of Goods Sold (COGS

Cost of goods sold

Cost of goods sold (COGS) refer to the carrying value of goods sold during a particular period. Costs are associated with particular goods using one of several formulas, including specific identification, first-in first-out (FIFO), or average cost. Costs include all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition.

What is the formula for operating profit?

The operating profit would be = (Gross profit – Labour expenses – General and Administration expenses) = ($270,000 – $43,000 – $57,000) = $170,000 Using the operating margin formula, we get – Operating Profit Margin formula = Operating Profit / Net Sales * 100 Or, Operating Margin = $170,000 / $510,000 * 100 = 1/3 * 100 = 33.33%. Colgate Example

What is the equation for gross profit?

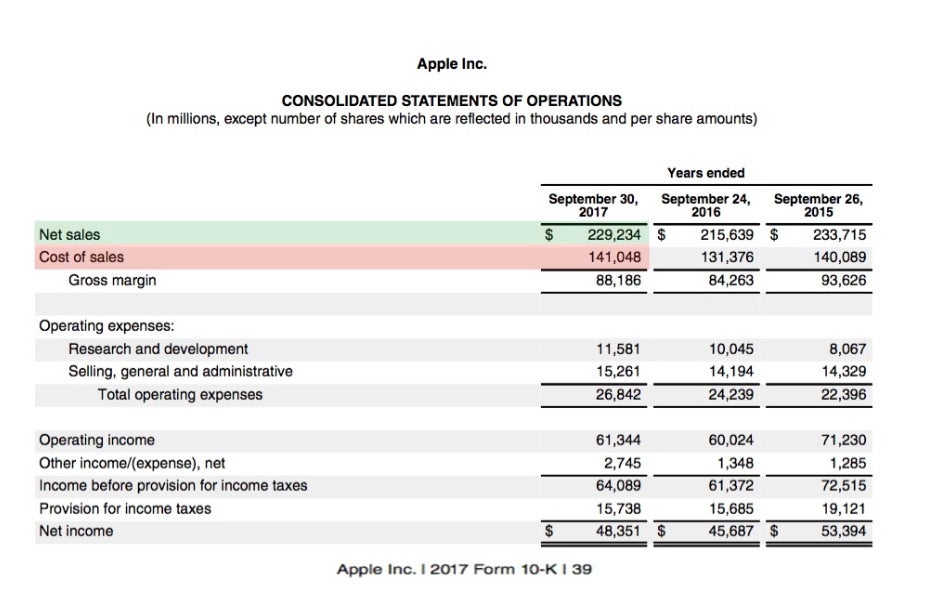

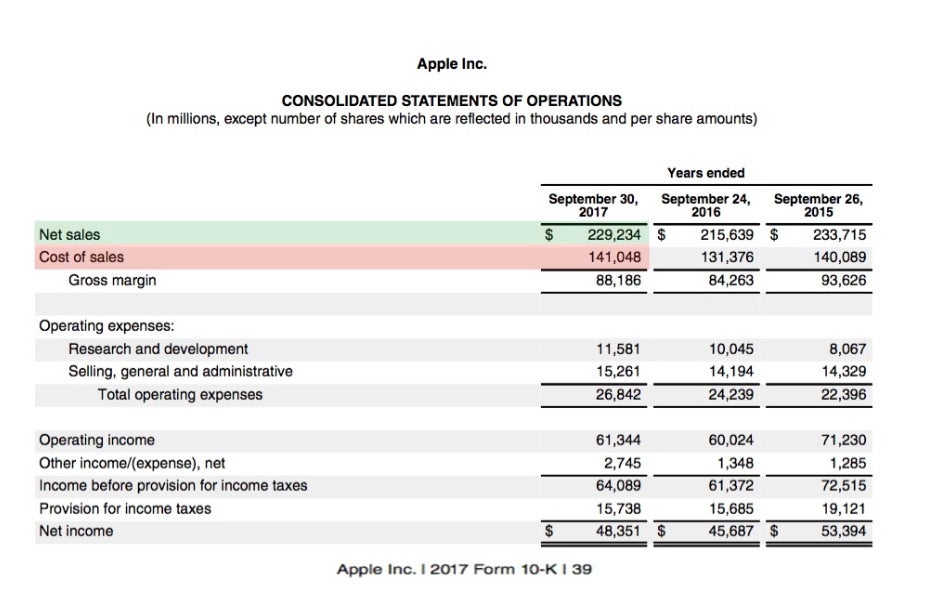

Gross Profit = Revenue - Cost of Revenue; Operating Income = Gross Profit - Operating Expenses; Net Profit = Operating Income - Other Costs

How do I work out gross profit?

- Cost of goods sold: Cost of goods sold is the direct cost of producing or purchasing inventory for resale. ...

- Gross profit: Gross profit reflects the amount of revenue remaining after your cost of goods sold has been subtracted.

- Revenue: Revenue is the income your business earns from the goods and services it sells.

How to calculate a percentage profit for my business?

So either increases the sales or lower the costs/expenses.

- Sales and Expenses

- Profit percentage Equation = (Net Sales – Expenses) / Net Sales or 1 – (Expenses / Net Sales)

- So if the ratio of Expenses to Net sales could be minimized, a higher profit % could be achieved.

- So either increases the sales or lower the costs/expenses.

How do I calculate gross profit from operating income?

There are three formulas to calculate income from operations:Operating income = Total Revenue – Direct Costs – Indirect Costs. OR.Operating income = Gross Profit – Operating Expenses – Depreciation – Amortization. OR.Operating income = Net Earnings + Interest Expense + Taxes.

How do you calculate gross profit from net profit and operating profit?

Here's the gross profit formula:Gross profit = Revenue – Cost of goods sold (COGS)Operating profit = Revenue – cost of goods sold – operating expenses – depreciation – amortization.Net profit = Total revenues – total expenses.

How do you calculate profit from operating margin?

To calculate a company's operating profit margin ratio, divide its operating income by its net sales revenue:Operating Profit Margin = Operating Income / Sales Revenue.Operating Income (EBIT) = Gross Income - (Operating Expenses + Depreciation & Amortization Expenses)More items...•

What is the equation for gross income?

Gross income is calculated as the total amount of revenue earned before subtracting expenses like costs, interest, and taxes.

Is net operating income the same as gross profit?

Net income is gross profit minus all other expenses and costs as well as any other income and revenue sources that are not included in gross income. Some of the costs subtracted from gross to arrive at net income include interest on debt, taxes, and operating expenses or overhead costs.

How do I calculate gross profit percentage?

A company's gross profit margin percentage is calculated by first subtracting the cost of goods sold (COGS) from the net sales (gross revenues minus returns, allowances, and discounts). This figure is then divided by net sales, to calculate the gross profit margin in percentage terms.

What is meant by operating profit?

Operating profit is the total income a company generates from sales after paying off all operating expenses, such as rent, employee payroll, equipment and inventory costs. The operating profit figure excludes gains or losses from interest, taxes and investments.

How do you calculate a company's profit?

Profit is revenue minus expenses. For gross profit, you subtract some expenses. For net profit, you subtract all expenses. Gross profits and operating profits are steps on the road to net profits.

Is profit margin the same as operating margin?

Gross profit margin and operating profit margin are two metrics used to measure a company's profitability. The difference between them is that gross profit margin only figures in the direct costs involved in production, while operating profit margin includes operating expenses like overhead.

What Is the Gross Profit Formula?

To fully understand gross profit, however, you have to understand the difference between variable and fixed expenses.

What is gross profit?

Gross profit is the revenue a business brings in after covering the expenses required to make a sale. Simply put, gross profit is a business’s total sales, less the cost of goods sold.

Why is gross profit misleading?

Because gross profit can rise while gross profit margins can fall, it can be misleading to simply calculate just gross profit without considering the gross profit margin.

How does gross profit affect the bottom line?

Since gross profit is the difference between total sales and the cost of what you are selling, increasing gross profit directly impacts your bottom line .

What is the difference between gross profit and gross profit margin?

[1] Whereas gross profit is a dollar amount, the gross profit margin is a percentage.

What does it mean to increase gross profit?

If you run a service-based business rather than a retail business, increasing your gross profit also means you can earn a larger profit doing the same amount of work.

How does increasing efficiency affect gross profit?

Anything you can do to increase efficiency or decrease costs directly improves your gross profit, meaning you can make more money without having to increase sales. Increasing gross profit is critical in a competitive market where other businesses are selling the same product or service as you.

How to calculate operating profit?

The equation for operating profit can be derived by using the following steps: Step 1: Firstly, determine the revenue earned by the company from the core business operations. For this, all the amount earned by the company from the sale of the goods or provision of the services with respect to the core business operations is added together.

What is operating profit?

Operating profit is the profit generated from the core business after deducting all the related operating expenses, depreciation, and amortization from its revenue but before deducting interest and taxes. Also, operating profit does not include profits earned by the company from its ancillary investments. The term“operating profit formula” refers ...

What is the difference between operating expenses and depreciation?

It includes the cost of material, labor, and overheads. Operating Expenses are the expenses incurred by the company with respect to its normal business operation, excluding the cost of goods sold. Depreciation is the reduction value of an asset due to normal nature wear and tear.

How to calculate cost of goods sold?

The cost of goods sold will be calculated by adding the cost of direct material, cost of direct labor, and cost of direct overhead.

What is amortization in finance?

Amortization is the amount of reduction in the value of the loan or of the intangible assets. Intangible Assets Intangible Assets are the identifiable assets which do not have a physical existence, i.e., you can't touch them, like goodwill, patents, copyrights, & franchise etc.

What is revenue from core operations?

Revenue from core operations is the total value of the amount earned by the company from the sale of the goods or provision of the services with respect to the core business operations.

Is selling general or administrative expenses included in operating profit?

Selling, general, and the administrative expenses will be part of the operating expenses of the company and hence will be considered while calculating the operating profit. Lastly, Operating profit is calculated before deducting the expenses related to interest and taxes.

What is operating profit?

An operating profit is the total income earned from the operations of a company before taxes, interest charges or other expenses are calculated. This number is typically calculated as a percentage to show the amount of revenue brought in from operations versus the money spent to keep the operations running. This formula can be used ...

How does operating profit help a business?

Additionally, the operating profit can help analyze how a business is performing over an extended period by tracking the operating profit on a trend line. The lower the operating income, the more likely the company will need additional funding to continue to operate.

Why is operating profit important?

To begin, this formula helps determine how the core operations of a business are performing when taxes and financing are excluded. This enables a business to examine its profitability potential and identify where any changes need to be made to improve profit-making abilities.

What is the formula for gross income?

As the formula for gross income is: revenue - costs of goods sold, the formula for operating profit can also be simplified to: gross profit - operating expenses - day-to-day expenses (depreciation, amortization). The total you come up with will give you the operating profit of a business. Related: 16 Accounting Jobs That Pay Well.

What is the most important component of profitability?

An important component to determining the profitability of a company is the operating profit, or operating profit margin . This calculation is commonly used to determine a business' profitability in terms of operations as well as a benchmark when comparing a company to similar companies in the same industry. In this article, we discuss what an operating profit is, how to calculate it and explore the advantages and disadvantages of using this formula in business.

What happens when a company's operating profit is higher?

The higher a company's operating profit, the less of a risk it will be for investors and creditors and the more likely it is that the company will receive steady funding. Related: Learn About Being a Business Analyst.

Why is the cash flow formula not accurate?

A major disadvantage is that this formula does not always accurately indicate a business' cash flow or economic value because it is an accounting metric. This formula does not account for fluctuations in working capital or capital expenditures and therefore may not fully depict the total value of a company.

How to calculate gross profit?

The gross profit formula is calculated by subtracting the cost of goods sold from the net sales where Net Sales is calculated by subtracting all the sales returns, discounts and the allowances from the Gross Sales and the Cost Of Goods Sold (COGS) is calculated by subtracting the closing stock from the sum of opening stock and the Purchases Made During the Period.

What is gross income?

It can also be called gross income Gross Income The difference between revenue and cost of goods sold is gross income, which is a profit margin made by a corporation from its operating activities. It is the amount of money an entity makes before paying non-operating expenses like interest, rent, and electricity. read more, and as stated earlier, the same can be calculated by subtracting the cost of goods sold from net sales or net revenue.

What is cost of goods sold?

Cost of Goods Sold = Opening Stock Opening Stock Opening Stock is the initial quantity of goods held by an organization during the start of any financial year or accounting period. It is equal to the previous accounting period's closing stock, valued in accordance with appropriate accounting standards based on the nature of the business. read more + Purchases – Closing Stock

Is cost of sales inclusive of raw material and labor costs?

Note: The cost of sales is inclusive of raw material and labor costs.

Does GP include fixed costs?

GP shall only include those costs which are variable in nature, and it will never account for the fixed costs.

What is gross profit?

Gross profit is the total revenue minus the expenses directly related to the production of goods for sale, called the cost of goods sold. Derived from gross profit, operating profit reflects the residual income that remains after accounting for all the costs of doing business. Net income reflects the total residual income ...

Why is gross profit considered gross?

While gross profit is technically a net measurement of profit, it is referred to as gross because it does not include debt expenses, taxes, or all of the other expenses involved in running the company. 3:01.

What are the three financial metrics?

Gross profit, operating profit, and net income are all types of earnings that a company generates. However, each metric represents profit at different parts of the production cycle and earnings process. All three financial metrics are located on a company's income statement and the order in which they appear help show the relationship to each other and their importance.

What is profit in accounting?

Profit is generally understood to refer to the cash that is left over after accounting for expenses. Though both gross profit and operating profit fit this definition in the simplest sense, the kinds of income and expenses that are accounted for differ in important ways.

What expenses are included in COGS?

In addition to COGS, this includes fixed-cost expenses such as rent and insurance, variable expenses, such as shipping and freight, payroll and utilities, as well as amortization and depreciation of assets. All the expenses that are necessary to keep the business running must be included.

Where is net income on a statement?

Since net income is the last line located at the bottom of the income statement, it's also referred to as the bottom line . Net income reflects the total residual income that remains after accounting for all cash flows, both positive and negative.

Does COGS include indirect expenses?

COGS does not include indirect expenses, such as the cost of the corporate office. COGS is a key metric since it directly impacts a company's gross profit, which is calculated as follows:

How to calculate gross profit?

Gross profit is calculated as: Gross profit = Revenue - Cost of Goods Sold. Revenue is the total amount of sales generated in a period. You'll often hear analysts refer to revenue as the top line for a company and that's because it sits at the top of the income statement.

What is gross profit?

Gross profit is the income earned by a company after deducting the direct costs of producing its products. For example, if you sold $100 worth of widgets and it cost $75 for your factory to produce them, then your gross profit would be $25. Gross profit is calculated as:

What are the two most common reportable income figures?

Two of the most common reportable income figures are gross profit and operating income. Though similar, both shine a different light on certain aspects of a business.

What is COGS in manufacturing?

COGS includes both direct labor costs, and any costs of materials used in producing or manufacturing a company's products. Gross profit measures how well a company generates profit from its direct labor and direct materials. Gross profit doesn't include non-production costs such as administrative costs for the corporate office.

How does operating income help investors?

For investors, the operating income helps separate out the earnings for the company's operating performance by excluding interest and taxes, which are deducted later to arrive at net income.

What are operating expenses?

These operating expenses include selling, general and administrative expenses (SG&A), depreciation, and amortization, and other operating expenses. Operating income does not include money earned from investments in other companies or non-operating income, taxes, and interest expenses.

What is revenue in accounting?

Revenue is the total amount of sales generated in a period. You'll often hear analysts refer to revenue as the top line for a company and that's because it sits at the top of the income statement. As you work your way down the income statement, costs are subtracted from revenue to ultimately calculate net income or the bottom line .

How to find gross profit from income statement?

Using a company’s income statement, find the gross profit total by starting with total sales and subtracting the line item "cost of goods sold." This gives you the company’s profit after covering all production costs, but before paying any administrative or overhead costs, along with anything else that doesn't directly factor into producing the company’s widgets.

How to determine gross profit margin?

Gross profit margin shows how efficiently a company is running and is determined by subtracting the cost it takes to produce a good from the total revenue that is made. Net profit margin measures the profitability of a company by taking the amount from the gross profit margin and subtracting other operating expenses.

What is gross profit margin?

Updated May 26, 2021. At its core, the gross profit margin measures a company's process efficiency. It tells managers, investors, and others the amount of sales revenue that remains after subtracting the company’s cost of goods sold. Any money left over goes to pay selling, general, and administrative expenses.

Why is gross margin important?

The gross margin serves as a useful metric within industries and sectors because it allows for a better apples-to-apples comparison among competitors. A company that sustains higher gross profit margins than its peers almost always has better processes and more sound operations.

How to find the gross margin range?

You can find the proper gross margin range for an industry by reading reports from research analysts, rating agencies, statistical services, and other financial data providers. Many brokerage firms also have research tools you can use.

What is the average gross margin?

If you are looking at the income statement of a business and find its gross margin often averaged around 3% to 4%, but the most recent year saw its margins quickly shoot up to 25%, it should warrant a serious look. There may be a good reason for the increase, but you want to know where, how, and why that money is being made.

Why do airlines hedge oil prices?

Certain airlines hedge the price of fuel when they expect oil prices to rise. This allows these firms to get much higher earnings per flight than other airlines. 3 The benefit has limits because those hedging contracts expire. Therefore, the profit boost will not last.

Steps to Calculate Gross Profit

Examples

- Example #1

ABC limited has given you the below details for their manufacturing financial details. You are required to calculate Gross Profit from the above details. 1. Revenue: 5950560.00 2. Raw Materials: 11901012.00 3. Labor Charges: 16066366.20 4. Cost of Sales: 44628795.00 You are r… - Example #2

An ltd and B ltd are two close competitors bidding in an auction to win the contract of $10 million. The bidding details are supposed to be kept secret. One of the key conditions for any of them to win the auction is that their gross profit figure should not be above 10% of the size of the contrac…

Gross Profit Formula

- VIP tv manufacturing is into the business of making smart android television. Therefore, an internal auditInternal AuditInternal audit refers to the inspection conducted to assess and enhance the company's risk management efficacy, evaluate the different internal controls, and ensure that the company adheres to all the regulations. It helps the management and board of directors to id…

Relevance and Uses

- It can also be called gross incomeGross IncomeThe difference between revenue and cost of goods sold is gross income, which is a profit margin made by a corporation from its operating activities. It...

- GP shall only include variable costs, which will never account for the fixed costs.

- It will assess the business’s efficiency, like how it uses its supplies and labor to produce servi…

- It can also be called gross incomeGross IncomeThe difference between revenue and cost of goods sold is gross income, which is a profit margin made by a corporation from its operating activities. It...

- GP shall only include variable costs, which will never account for the fixed costs.

- It will assess the business’s efficiency, like how it uses its supplies and labor to produce services or goods.

- The higher the gross profit ratio to sales, the more efficient the business will attract competition.

Recommended Articles

- This has been a guide to Gross Profit Formula. Here we discuss how to calculate gross profit using its formula, examples, and downloadable excel template. You can learn more about financial analysis from the following articles – 1. Profit FormulaProfit FormulaThe profit formula evaluates the net gain or loss of an organization in a particular accounting period. It is compute…