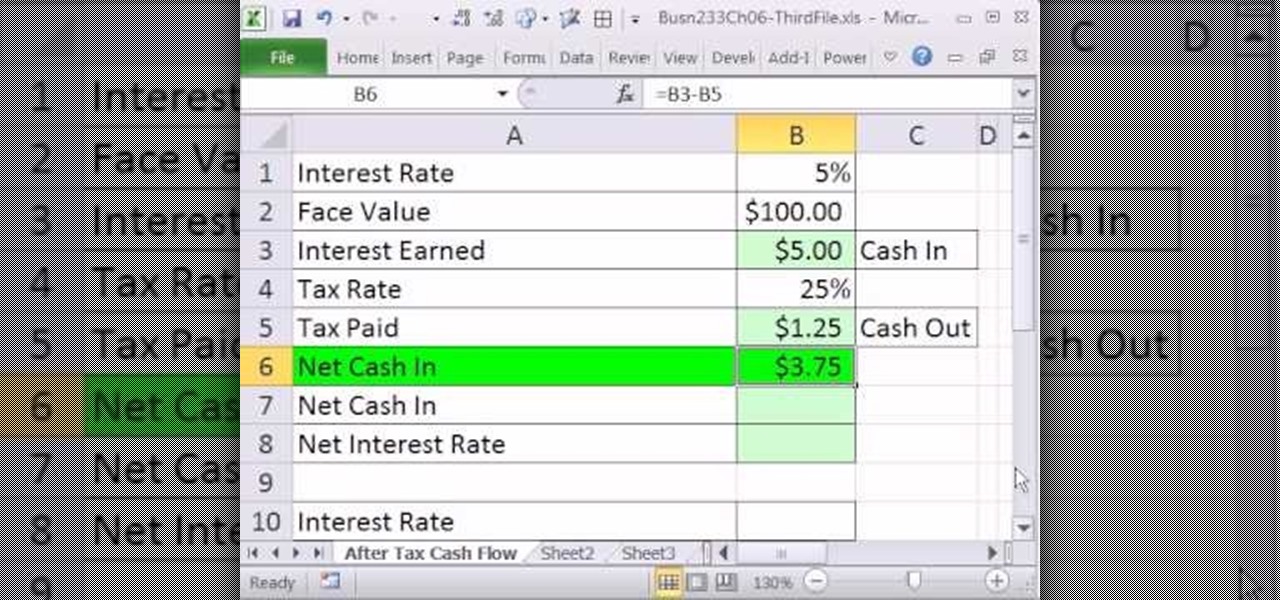

To calculate interest expense, follow these steps:

- Determine the amount of principal outstanding on the loan during the measurement period.

- Determine the annualized interest rate, which is listed in the loan documents.

- Determine the time period over which the interest expense is being calculated.

- Use the interest formula to arrive at the interest expense. The formula is:

How to calculate your interest expense?

Use the CUMIPMT function.

- rate here means your monthly interest rate. ...

- nper stands for "number of periods" and is asking for your total number of payments. ...

- pv means "present value." Input your principal (amount borrowed) here.

- start_period and end_period represent your timeframe for calculating interest. ...

How to calculate and use the interest coverage ratio?

Interest coverage ratio (ICR) = EBIT / Interest expenses. It indicates the number of times an entity could cover the yearly interest payments on its debts from its EBIT, which can be translated as the capacity to support its interest expenses.

How to calculate business interest expense?

To calculate interest expense, follow these steps: Determine the amount of principal outstanding on the loan during the measurement period. Determine the annualized interest rate, which is listed in the loan documents. Determine the time period over which the interest expense is being calculated. Use the interest formula to arrive at the ...

What is the formula for interest earned ratio?

Times Interest Earned Ratio Formula = EBIT/Total Interest Expense The Times interest earned is easy to calculate and use. The numerator of the formula has EBIT EBIT Earnings before interest and tax (EBIT) refers to the company's operating profit that is acquired after deducting all the expenses except the interest and tax expenses from the revenue.

What is interest expense ratio?

The interest coverage ratio is defined as the ratio of a company's operating income (or EBIT—earnings before interest or taxes) to its interest expense. The ratio measures a company's ability to meet the interest expense on its debt with its operating income.

What is a good interest expense percentage?

The lower the percentages the better, a business or farm should be no higher than 5% to be considered strong. A Interest-Expense ratio higher than 10% indicates that the business or farm is spending too much of its gross income paying interest on borrowed money.

How do you calculate interest expense on financial statements?

You can find interest expense on your income statement, a common accounting report that's easily generated from your accounting program. Interest expense is usually at the bottom of an income statement, after operating expenses. Sometimes interest expense is its own line item on an income statement.

How do you calculate monthly interest expense?

Monthly Interest Rate Calculation ExampleConvert the annual rate from a percent to a decimal by dividing by 100: 10/100 = 0.10.Now divide that number by 12 to get the monthly interest rate in decimal form: 0.10/12 = 0.0083.More items...

What is a safe interest cover ratio?

Overall, an interest coverage ratio of at least two is the minimum acceptable amount. In most cases, investors and analysts will look for interest coverage ratios of at least three, which indicate that the business's revenues are reliable and consistent.

What is a strong interest coverage ratio?

Overall, an interest coverage ratio of at least two is the minimum acceptable amount. In most cases, investors and analysts will look for interest coverage ratios of at least three, which indicate that the business's revenues are reliable and consistent.

How do I convert APR to monthly rate?

To calculate monthly interest from APR or annual interest, simply multiply the interest for the month by 12.

What is a good depreciation to sales ratio?

The Depreciation-Expense Ratio intimates the amount of income that is required to maintain the capital being used by the business or farm. The lower the percentages the better, a business or farm should be no higher than 5% to be considered strong.

What is interest expense in cash flow statement?

Interest expense is the cost of borrowing money. Under the accrual method of accounting, interest expense is reported on a company's income statement in the period in which it is incurred. Hence, interest expense is one of the subtractions from a company's revenues in calculating a company's net income.

Is interest expense Same as finance cost?

Finance costs are usually understood to be referred to interest costs. Usually they are thought to refer to interest expense on short-term borrowings (for example bank overdraft and notes payable) and long-term borrowings (for example term loans and real estate mortgages).

What Increases interest expense?

A higher interest expense means that the company is paying more to its debtors. In general, a company's capital structure with a heavier debt focus will have higher interest expenses. Liquidity ratios such as EBIT/Interest Expense can help investors see if increasing Interest Expenses are problematic.

What is the interest expense to debt ratio?

The interest expense to debt ratio is the rate of interest a business is paying on its total debt. It is a solvency ratio that can help determine i...

Why is the interest expense to debt ratio important?

The interest expense to debt ratio is important because it shows how much it costs the company to borrow money. It can also help you understand if...

How do you calculate the interest expense to debt ratio?

To calculate the interest expense to debt ratio, divide the company's total interest expense by its total debt. This will give you a percentage. Th...

What is a good interest expense to debt ratio?

Generally, a good interest expense to debt ratio is anything below 1.0. However, this varies from company to company depending on their industry an...

What is an example of an interest expense to debt ratio?

An example of the interest expense to debt ratio is if a company has $1,000 in total interest expense and $10,000 in total debt, the interest expen...

What is interest expense?

Interest Expense. Interest expense is one of the core expenses found in the income statement. Income Statement The Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or.

What transaction generates interest expense?

However, another transaction that generates interest expense is the use of capital leases. When a firm leases an asset from another company, the lease balance generates an interest expense that appears on the income statement.

Where does the Expense Appear on the Income Statement?

Below is an example of where interest expense appears on the income statement:

How does a company finance its assets?

A company must finance its assets either through debt or equity. With the former, the company will incur an expense related to the cost of borrowing. Understanding a company’s interest expense helps to understand its capital structure and financial performance.

Where is interest found in SG&A?

Interest is often found as a separate line item below EBIT (Earnings Before Interest and Taxes). Alternatively, some companies may list interest in the SG&A section, depending on their accounting practices.

Is interest deductible on income statement?

Interest is a reduction to net income on the income statement, and is tax-deductible for income tax purposes . Thus, there is a tax savings, referred to as the tax shield. Tax Shield A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed.

Is EBIT a pre-tax income?

EBIT is also known as Operating Profit, while EBT is also known as Pre-Tax Income or Pre-Tax Profit. Interest, therefore, is typically the last item before taxes are deducted to arrive at net income. Net Income Net Income is a key line item, not only in the income statement, but in all three core financial statements.

What is interest expense?

Interest expense is the cost of the funds that have been loaned to a borrower. It may be associated with a variety of financing instruments, including loans, convertible debt, lines of credit, and bonds. To calculate interest expense, follow these steps:

What happens when interest is paid on an invoice?

When the interest is paid, the accounts payable account is debited to flush out the amount, and the cash account is credited to show that funds were expended.

Is interest expense a debit or credit?

Once calculated, interest expense is usually recorded by the borrower as an accrued liability. The entry is a debit to interest expense (expense account) and a credit to accrued liabilities (liability account).

What is interest expense ratio?

Interest-Expense Ratio is a measurement of financial efficiency and is determined based on information derived from a business’ or farm operations financial statements specifically using the financials that determine gross farm income. Financial efficiency refers to how effectively a business or farm is able to generate income. Looking at the financial efficiency of a business or farm assists the owner (s) in determining how the various aspects of the business such as production, financing, marketing, etc. effects the gross income of the business.

How many ratios are there in financial institutions?

There is a minimum of 21 different ratios and indicators that can be looked at by many financial institutions. You cannot look at a single ratio and determine the overall health of a business or farming operation. Multiple ratios and indicators must be used along with other information to determine the total and overall health ...

What is expense ratio calculator?

The expense ratio calculator is a fantastic tool that helps you to understand how much you will pay for the performance of your exchange-traded funds (ETF) investments. In other words, it simplifies even the most effortless security, the ETFs. In this article, we will cover what an ETF is and how the expense ratio is related to it. We will also discuss what is a good ETF expense ratio and conclude by comparing it to famous ones: the SPY ETF and the ARKK ETF.

What is the expense ratio?

The expense ratio is a fee charged by mutual funds and ETF providers for the concept of managing the assets in the fund. We can call it the maintenance fee of the investment. It usually ranges between 0.1 to 1%, but it can go as low as 0.045%, like in the SPY case, and up to 2.95%, like in the case of Global X SuperDividend® Alternatives ETF ( NASDAQ: ALTY ).

How much does the expense ratio cost you?

First, considering a certain expense ratio and then without it. Consequently, we will have two future values for the total investment, which, after being subtracted, will result in the total cost.

What does n mean in investment?

n = Duration of investment, or the amount of time we will leave our money to grow;

Is inflation a yearly rate?

Whenever it is possible to predict inflation through the duration of the investment, we should consider it as a yearly interest rate we should beat. If you are interested in to a calculator that includes effects of inflation, see investment calculator.

Does compound interest have a significant effect on money?

It is clear to see that the compound interest effect over time of the Effective investment return can do a significant effect on your money.

Is ETF performance minus expense ratio?

However, that's not the money you receive. The actual performance of your investment is the ETF/fund performance minus the Expense ratio you will have to pay every year.

What is expense ratio?

An Expense Ratio is the fee charged by a fund (either a mutual fund or ETF) for managing the fund’s assets. A fund’s expense ratio is listed as a percentage, and represents the percent of your investment that you are charged for investing in the fund.

How Much Do High Expense Ratios Cost Investors?

Investors pay hundreds of millions of dollars in investment related fees every year.

How much would investors pay in fees if $224.4 billion was invested in a fund?

If that $224.4 billion was invested in a fund with an expense ratio of 0.67% instead of 0.035%, investors would be paying $1.5 billion in fees – more than $1.45 billion more!

Does expense ratio add potential?

This assumes that any added expense ratio does not add any potential for out performance. This should only be used to compare similar investments.

What is interest expense?

Interest Expense Interest expense arises out of a company that finances through debt or capital leases. Interest is found in the income statement, but can also.

Where is interest expense found?

Interest Expense Interest expense arises out of a company that finances through debt or capital leases. Interest is found in the income statement , but can also

What is the cost of debt?

Cost of Debt The cost of debt is the return that a company provides to its debtholders and creditors. Cost of debt is used in WACC calculations for valuation analysis.

What is the primary use of interest coverage ratio?

Primary Uses of Interest Coverage Ratio. ICR is used to determine the ability of a company to pay its interest expense on outstanding debt. ICR is used by lenders, creditors, and investors to determine the riskiness of lending money to the company. ICR is used to determine company stability – a declining ICR is an indication ...

What does it mean when a company has a lower ratio?

Intuitively, a lower ratio indicates that less operating profits are available to meet interest payments and that the company is more vulnerable to volatile interest rates.

What is trend analysis of ICR?

Trend analysis of ICR gives a clear picture of the stability of a company in regard to interest payments.

Why do Harry's Bagels calculate times interest earned ratio?

Harry’s Bagels wants to calculate its times interest earned ratio in order to get a better idea of its debt repayment ability. Below are snippets from the business’ income statements:

What is EBIT in accounting?

Earnings Before Interest & Taxes (EBIT) – represents profit that the business has realized, without factoring in interest or tax payments. Interest Expense – represents the periodic debt payments that a company is legally obligated to make to its creditors. Generally speaking, the higher the TIE ratio, the better.

What are the red boxes in the TIE formula?

The red boxes highlight the important information that we need to calculate TIE , namely EBIT and Interest Expense. Using the formula provided above, we arrive at the following figures: