Term Calculation When investigating different payment amounts (loans with extra payments) you can use the following formula to calculate what your corresponding number of months on the loan will be: n = l o g [ P M T i P M T i − P V] l o g (1 + i)

Full Answer

How long to pay off mortgage with extra payments calculator?

Ultimately, significant principal reduction cuts years off your mortgage term. Extra payments count even after 5 or 7 years into the loan term. If the first few years have passed, it’s still better to keep making extra payments. Another technique is to make mortgage payments every two weeks. This is called a biweekly payment plan.

How do you calculate your mortgage loan payoff?

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly and over the life of the loan

- Tallying how much you actually pay off over the life of the loan versus the principal borrowed, to see how much you actually paid extra

How to pay off your mortgage in 5-7 years?

How to Pay Off Your Mortgage in Seven Years

- Understand how a mortgage works. In most cases, your monthly payments stay the same but the balance you owe goes down. That’s because your payments include principal and interest.

- Get so excited. In order to pay off your mortgage in seven years or faster, you have to be on a mission. ...

- Do the math. In order to pay off your mortgage in seven years, there are only two remaining steps. ...

- Make it happen. Now you’re ready for the easy and fun part. You are already committed to paying off your mortgage in seven years or less.

How do you calculate the monthly payment on a loan?

Monthly Interest Rate Calculation Example

- Convert the annual rate from a percent to a decimal by dividing by 100: 10/100 = 0.10

- Now divide that number by 12 to get the monthly interest rate in decimal form: 0.10/12 = 0.0083

- To calculate the monthly interest on $2,000, multiply that number by the total amount: 0.0083 x $2,000 = $16.60 per month

How do I calculate my mortgage payoff with extra payments?

But there's more than one way to pay off the mortgage early:Add extra to the monthly payments, as discussed in this article.A structured way to add extra: Divide your monthly principal payment by 12, then add that amount to each monthly payment.More items...

What happens if you pay extra on a loan?

When you make an extra payment or a payment that's larger than the required payment, you can designate that the extra funds be applied to principal. Because interest is calculated against the principal balance, paying down the principal in less time on a fixed-rate loan reduces the interest you'll pay.

Does my amortization schedule change with extra payments?

How extra payments affect your amortization schedule. You do have the option to pay extra toward your mortgage, which will alter your amortization schedule. Paying extra can be a good way to save money in the long run, because the money will go toward your principal, not the interest.

How much do I save by paying extra principal?

How much can I save by prepaying my mortgage?Payment methodPay off loan in …Total interest saved*Extra $608.02 paymentMinimum every month30 years$013 payments a year*25 years, 9 months$16,018$100 extra every month22 years, 6 months$27,9442 more rows•Nov 11, 2021

Do extra payments automatically go to principal?

Generally, national banks will allow you to pay additional funds towards the principal balance of your loan. However, you should review your loan agreement or contact your bank to find out their specific process for doing so.

How do I make sure extra payment goes to principal?

Phone payments: You can call your lender to make an additional payment toward your principal. Have your account information ready. Most importantly, tell the person you're speaking with that you want to apply your additional payment to your principal. Make sure to receive confirmation.

What happens if I pay 2 extra mortgage payments a year?

The additional amount will reduce the principal on your mortgage, as well as the total amount of interest you will pay, and the number of payments. The extra payments will allow you to pay off your remaining loan balance 3 years earlier.

Is it better to pay lump sum off mortgage or extra monthly?

Making a lump-sum payment always saves you money on interest. And depending on how you handle it, the payment will either shorten the time it takes to pay off your mortgage or reduce your monthly payment amount.

How many years does an extra mortgage payment take off?

The truth is, if you can scrape together the equivalent of one extra payment to put toward your mortgage each year, you'll take — on average — four to six years off your loan. You'll also save tens of thousands of dollars in interest payments.

What are the disadvantages of principal prepayment?

But then there are the downsides as well. Some mortgages come with a “prepayment penalty.” The lenders charge a fee if the loan is paid in full before the term ends. Making larger monthly payments means you may have limited funds for other expenses.

What happens if I pay an extra $500 a month on my mortgage principal?

Throwing in an extra $500 or $1,000 every month won't necessarily help you pay off your mortgage more quickly. Unless you specify that the additional money you're paying is meant to be applied to your principal balance, the lender may use it to pay down interest for the next scheduled payment.

Is it good to pay off a loan early?

You have a little extra money and you'd love to pay off your personal loan early. Doing so will save you on interest and put a few extra dollars to spend in your pocket each month. So, should you repay your personal loan ahead of schedule? Paying off debt is generally good for your finances—and good for your credit.

Does it hurt to pay off a loan early?

Yes, it could be possible to pay off your personal loan early—and the idea of saving money on interest doesn't hurt. But first, it's worth taking some time to make sure you won't be charged a penalty for paying off your loan ahead of time.

Can you be penalized for paying off a loan early?

While most personal loan lenders don't charge you to pay off your loan early, some may charge a prepayment penalty if you pay off your loan ahead of schedule. Prepayment penalties typically start out at around 2% of the outstanding balance if you repay your loan during the first year after applying and qualifying.

Do I pay less interest if I pay off my loan early?

1. If I pay off a personal loan early, will I pay less interest? Yes. By paying off your personal loans early you're bringing an end to monthly payments, which means no more interest charges.

What is a payoff calculator?

A loan payoff calculator that helps you learn how making extra payments to your loan’s principal saves time and money on the loan. Plus links for go-to lenders who allow principal only payments.

Why is it important to make extra payments on a loan?

The earlier you start making extra payments on the loan, the better because most loans are amortized. Amortization is the upfront payment of interest on the loan that decreases over time. So, at the beginning of the loan, most of your monthly payment goes to interest, and very little of it goes toward the principal. Over the life of the loan, more and more of your monthly payment goes to the actual principal on the loan.

Why do lenders only pay principal?

Principal only payments mean the lender won’t get as much profit over the length of the loan, keeping more of your hard-earned money in your bank account. This is also why not all lenders allow early payments on their loans.

How long does it take to compare loans?

You can browse and compare loans that fit your needs, and the process takes just a couple of minutes. Lenders are competing for your business, and you can chat (and haggle!) with them directly. Plus, any prepayment is automatically applied to the principal of the loan.

Do you have to make additional principal payments?

When you make additional principal-only payments, you’re paying only the debt that you owe. Yes, normal payments with principal and interest still need to be made, but those extra payments can chip away major chunks of the loan.

Does prepayment apply to principal?

Plus, any prepayment is automatically applied to the principal of the loan.

How long will it take to pay off my loan?

When you repay a loan, you pay back the principal or capital (the original sum borrowed from the bank) as well as interest (the charges applied by the bank for their profit, which grow over time). Interest growing over time is the really important part: the faster you pay back the principal, the lower the interest amount will be.

How long does it take to write off a student loan?

Depending on the year in which you took out your loan, it will simply be written off after 25 years, 30 years, or when you turn 65. Phew. For this reason, repaying a student loan in the UK can be considered to work a bit like a ‘graduate tax’, applied in a similar way as income tax or national insurance.

How to round up savings?

Try downloading a ‘round-up’ savings app such as Acorns, Qoins, Digit or Chime. These apps link to your bank cards, and whenever you make a purchase online or in-store, they round it up to the nearest dollar or pound to siphon the difference into your savings (or in some cases, directly onto loan repayments). So if you spend $3.80 on a coffee, the app calls it $4 and moves $0.20 across to your savings. For each purchase, the difference feels negligible, but it all adds up quickly in your savings. You can use our Savings Goal Calculator to work out how long it might take to reach a target figure.

How to see if you're paying for subscriptions?

Go through your bank statements to see if you’re paying for any subscriptions you don’t actually use. TV channels, magazine subscriptions, domain name renewals, premium delivery services, audiobooks… Anything that you don’t actually use can be cancelled, and you can reallocate that money to pay off the principal of your loan.

Do you have to pay off a loan if you are not earning?

So when you’re not earning — or not earning much — you don’t need to make any loan repayments. Of course, interest still accrues over this time, so any ‘downtime’ where you’re not paying off your loan means that there will be more to repay in the long run.

What is monthly loan payment?

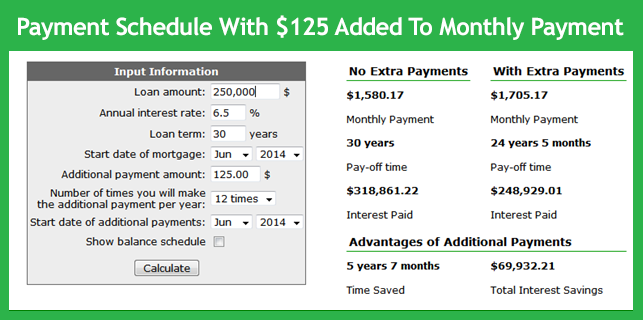

Monthly loan payment for original payment and payment with extra amount. Number of payments remaining on the original loan and the loan with extra payments. Total interest for your original loan and the loan with extra payments.

Can you pay off a loan faster?

However, there may be a way for you to decrease the total amount of interest you will pay on your loan and pay off your loan faster with small additional monthly payments toward your debt.

Do you pay interest on a loan?

By nature, loans cause you to pay a sometimes significant amount of money in interest. However, there may be a way for you to decrease the total amount of interest you will pay on your loan and pay off your loan faster with small additional monthly payments toward your debt. Use this calculator to see how extra payments will affect your loan.

What is extra payment?

Extra payments are additional payments in addition to the scheduled mortgage payments. Borrowers can make these payments on a one-time basis or over a specified period, such as monthly or annually. Extra payments can possibly lower overall interest costs dramatically.

How long does it take to pay off a 500.00 loan?

By paying extra $500.00 per month, the loan will be paid off in 15 years and 8 months. It is 9 years and 4 months earlier. This results in savings of $108,886.04 in interest.

When do prepayment penalties become void?

If the lender includes these possible fees in a mortgage document, they usually become void after a certain period, such as after the fifth year. Borrowers should read the fine print or ask the lender to gain a clear understanding of how prepayment penalties apply to their loan. FHA loans, VA loans, or any loans insured by federally chartered credit unions prohibit prepayment penalties.

What is financial opportunity cost?

Financial opportunity costs exist for every dollar spent for a specific purpose. The home mortgage is a type of loan with a relatively low interest rate, and many see mortgage prepayments as the equivalent of low-risk, low-reward investment.

What is the difference between interest and principal on a mortgage?

Principal and Interest of a Mortgage. A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender's charge to borrow the money. This interest charge is typically a percentage of the outstanding principal.

Where to find unpaid principal balance?

The unpaid principal balance, interest rate, and monthly payment values can be found in the monthly or quarterly mortgage statement.

Do you pay a prepayment penalty on a mortgage?

Some lenders may charge a prepayment penalty if the borrower pays the loan off early. From a lender's perspective, mortgages are profitable investments that bring years of income, and the last thing they want to see is their money-making machines compromised.

Calculator Use

Use this calculator to determine 1) how extra payments can change the term of your loan or 2) how much additional you must pay each month if you want to reduce your loan term by a certain amount of time in months. Try different loan scenarios for affordability or payoff. Create amortization schedules for the new term and payments.

Term Calculation

When investigating different payment amounts (loans with extra payments) you can use the following formula to calculate what your corresponding number of months on the loan will be:

Payment Calculation

When investigating different terms (months) you can use the following formula to calculate what your corresponding monthly payment amounts will be:

Why do you pay extra on a loan?

Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan. The earlier you begin paying extra the more money you'll save.

How to save money on a home loan?

Save Thousands in Interest Expenses by Paying Your Loan Off Early With Additional Payments. When it comes to a home mortgage loan, you can actually pay off the loan much more quickly and save a great deal of money by simply paying a little extra each month.

How to build equity in your home faster?

Want to build your home equity quicker? Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan. The earlier you begin paying extra the more money you'll save.

Why are the US 10-year Treasury rates falling?

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today's low rates may benefit from recent rate volatility.

Is it a good idea to pay off your mortgage early?

Paying off your mortgage early isn't always a no-brainer. Though it can help many people save thousands of dollars, it's not always the best way for most people to improve their finances.

Can mortgage debt be deducted from income tax?

Further, unlike many other debts, mortgage debt can be deducted from income taxes for those who itemize their taxes.

Can you make a one time payment to your principal?

You can also make one-time payments toward your principal with your yearly bonus from work, tax refunds, investment dividends or insurance payments. Any extra payment you make to your principal can help you reduce your interest payments and shorten the life of your loan.

How fast will I pay off a mortgage?

How fast you'll pay off a mortgage if you make extra payments depends on several factors, chief among them are:

How many unknowns can a calculator calculate?

The calculator will calculate any one of four unknowns.

Do you have to apply interest on an extra payment if you are auditing your lender?

Some lenders may not do this, particularly if you make the extra payment on a date other than a scheduled due date.