The total overhead cost variance may be separated into:

- Variable overhead cost variance = Recovered variable overheads – Actual variable overheads

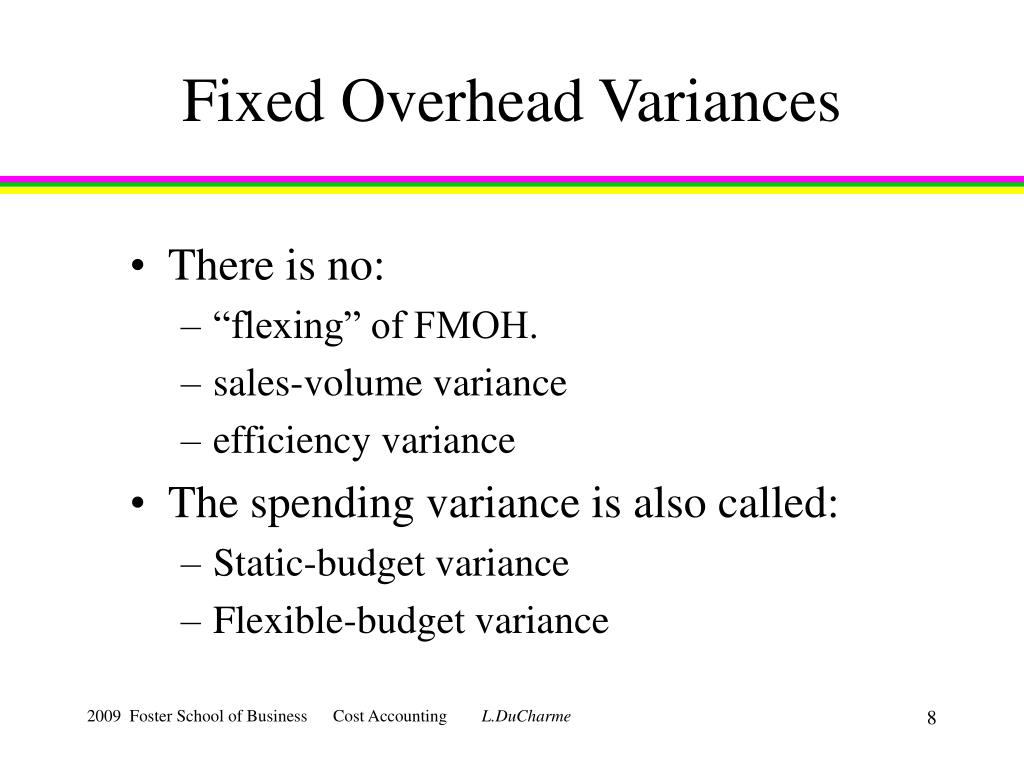

- Fixed overhead cost variance = Recovered fixed overheads – Actual fixed overheads

- Variable overhead cost variance = Recovered variable overheads – Actual variable overheads.

- Fixed overhead cost variance = Recovered fixed overheads – Actual fixed overheads.

What is the formula for fixed overhead volume variance?

Thus, the variance is created due to variance in the actual production against the budgeted production. It can be calculated using the following formula: Fixed Overhead Volume Variance = Applied Fixed Overheads – Budgeted Fixed Overhead How to Provide Attribution? Article Link to be Hyperlinked

How do you calculate variable overhead efficiency?

- Standard variable manufacturing overhead rate/price = SR

- Total actual hours worked during the period = AH

- Standard hours estimated for actual production = SH

How to calculate unexplained variance?

We can also calculate this value using the following formula:

- Unexplained variation = 1 – R2

- Unexplained variation = 1 – 0.96617

- Unexplained variation = .0338

How do I calculate my small business overhead rate?

To calculate the overhead rate per employee, follow the steps below:

- Calculate the labor cost which includes not just the weekly or hourly pay but also health benefits, vacation pay, pension and retirement benefits paid by the employer.

- Compute the total overheads of the business.

- Divide the overhead costs by the number of billable hours. ...

How to Calculate Variable Overhead Rate Variance?

The variable overhead rate variance can be calculated by using the formula below:

Why is it so hard to figure out the cause of variable overhead rate variance?

It is too toilsome to figure out the exact cause behind a variable overhead rate variance because one cannot put a finger on one specific overhead that was way more than the estimate. In an organization there are multiple departments, and the manager of each department uses his own judgment while making calculations.

What is a favorable variable manufacturing overhead rate variance?

Favorable variable manufacturing overhead rate variance shows that an entity incurred alower expense than the budgeted cost.

Why is variable overhead analysis important?

Variance analysis of variable overheads assists a company to know the expenses that will be incurred in the future and that is to be incurred at a particular rate. These costs must be paid as soon as they are incurred or on the statement of financial position a current liability balance would increase. It is important for a company that it must increase its liquidity as per the expenses estimated.

What is favorable variance?

A favorable variance is the actual variable overhead expenses incurred per labor hour that were not as much as budgeted.

Why is overhead variance important?

Variable overhead rate variance helps in foreshadowing the amount of labor and the wage rate that will be required for future needs.

Why is variance important in accounting?

Variable overhead rate variance is an important indicator when comparing different forms of accounting, management of inventory, outsourcing certain aspects of the business or even when trying to work with new suppliers .

Why is the efficiency graph favorable?

Explanation: The result is favorable because our actual hours are less than our budgeted hours. It means that the company employees have completed their work earlier than expected. And that’s why the efficiency graph goes higher and in the end, the result is a favorable one.

How many hours does it take to make an iPhone?

For example, the actual hours to produce an iPhone is 15 hours. It gives information about the efficiency of a certain department. The results that arise from variable overhead efficiency variance is can be termed as a favorable or unfavorable variance. For example, the company spends 5 more hours to produce an iPhone.

How to calculate variable overhead efficiency variance?

The formula for variable overhead efficiency variance = SR × (AH – SH)

What is unfavorable variance?

While if the actual hours worked are higher than the budgeted hours estimated by management, we called it unfavorable variance. Or we can say the performance needs to be reviewed.

What is standard hours?

The standard hours are the total number of hours required to complete the production target during a particular period. For example, standard labor hours to produce an iPhone is 10 hours. This is an important management tool used to compare the budgeted hours allowed on the standard rate with actual hours worked on the standard rate.

Why should a favorable variable be kept in mind?

The reasons for the favorable variable should be kept in mind so that the company can evaluate the best information from their calculation. Because sometimes it’s not the hard work of the department which results in favorable variance, sometimes there are other factors also, which are not in control of the management.

How many hours are allowed for production?

Estimated or budgeted hours allowed for production = 11,000hours