Follow these steps to calculate the return on assets:

- Take the net profit figure from the income statement of the entity. This should be the net after-tax figure, not one of the earlier profit subtotals listed higher in the income statement.

- Take the total assets figure from the balance sheet of the entity. ...

- Divide the net profits by the total assets figure to arrive at the return on assets. ...

What is the formula for calculating net asset?

Net operating assets can also be calculated by using a financing approach. The following formula is used for the calculation: Net Operating Assets = equity + Short-term and Long-Term Non-Operating Debts (Non-Current Operating Assets) – Financial Assets and investments – Excess cash and cash equivalents. Example

What is ideal return on Assets Ratio?

Usually, an ROA ratio, or return on assets ratio, is considered "good" if it is above five percent. However, ROA ratios should be looked at historically for the company being evaluated as well as against companies that are similar in business type and product line when doing peer company comparisons.

How to find total assets formula?

- Determine your total operating expenses. First, calculate all of your operating assets from your balance sheet. ...

- Determine your total operating liabilities. This total can be found on the income statement as well, and it represents all of the outgoing payments you make to support revenue generation. ...

- Plug these values into the formula and subtract. ...

How do you calculate return on Assets Ratio?

Key Takeaways

- Return on assets is a metric that indicates a company's profitability in relation to its total assets.

- ROA can be used by management, analysts, and investors to determine whether a company uses its assets efficiently to generate a profit.

- You can calculate a company's ROA by dividing its net income by its total assets.

How do you calculate return on assets example?

To find the company's return on assets using its net income and average total assets, simply divide the company's net income ($150,000) by its average total assets ($800,000). 150,000 / 800,000 = 0.1875.

Is return on assets the same as return on net assets?

Return on net assets is a variation of the traditional return on assets ratio that uses fixed assets and net working capital in its calculation as opposed to total assets. The RONA ratio is used to determine the efficiency and effectiveness of a company's use of its assets.

What is a good return on net assets?

An ROA of 5% or better is typically considered good, while 20% or better is considered great. In general, the higher the ROA, the more efficient the company is at generating profits. However, any one company's ROA must be considered in the context of its competitors in the same industry and sector.

What is the formula for return on average assets?

The return on average assets shows an organization's ability to generate profits using its assets. An ROA provides an average of revenues, while the ROTA provides an exact total of profits from overall total assets. This is the formula for return on average assets: ROAA = (Net income) / (Average total asset value)

What is net assets formula?

Net assets are the value of a company's assets minus its liabilities. It is calculated ((Total Fixed Assets + Total Current Assets) – (Total Current Liabilities + Total Long Term Liabilities)).

Can return on net assets be negative?

Return on assets (ROA) is one way to measure success: how much income do your business assets generate for you? It's possible to have a negative ROA, but that isn't necessarily a sign of mismanagement.

Is a higher or lower ROE better?

The higher a company's ROE percentage, the better. A higher percentage indicates a company is more effective at generating profit from its existing assets. Likewise, a company that sees increases in its ROE over time is likely getting more efficient.

Is a high ROA good?

The higher the ROA percentage, the better, because it indicates a company is good at converting its investments into profits.

How do you interpret the return on assets ratio?

The Return on Assets (ROA) ratio shows the relationship between earnings and asset base of the company. The higher the ratio, the better it is. This is because a higher ratio would indicate that the company can produce relatively higher earnings in comparison to its asset base i.e. more capital efficiency.

How do you calculate return on assets in Excel?

To calculate a company's ROA, divide its net income by its total assets....Example of How to Calculate the ROA Ratio in Excel"March 31, 2015," into cell B2."Net Income" into cell A3."Total Assets" into cell A4."Return on Assets" into cell A5."=23696000" into cell B3."=9240626000" into cell B4.

What is return on assets and return on equity?

ROE and ROA are important components in banking for measuring corporate performance. Return on equity (ROE) helps investors gauge how their investments are generating income, while return on assets (ROA) helps investors measure how management is using its assets or resources to generate more income.

What does return on average assets mean?

Key Takeaways Return on average assets (ROAA) shows how well a company uses its assets to generate profits and works best when comparing to similar companies in the same industry. ROAA formula uses average assets to capture any significant changes in asset balances over the period being analyzed.

Is return on net worth same as return on equity?

Return on Equity, called Return on Net Worth, shows a company's profitability by calculating how much shareholders earn for their investment in the firm. For instance, ROE shows you how companies utilise shareholders' money. It is determined by measuring a company's net profit by its net worth.

What is the formula for return on invested capital?

To calculate return on invested capital (ROIC), you divide net operating profit after tax (NOPAT) by invested capital.

What is return on assets and return on equity?

ROE and ROA are important components in banking for measuring corporate performance. Return on equity (ROE) helps investors gauge how their investments are generating income, while return on assets (ROA) helps investors measure how management is using its assets or resources to generate more income.

Is net assets the same as net income?

Net Assets – The value of assets after certain liabilities are deducted. Net Revenue – Revenue after refunds, returns, or other items are deducted. Net Earnings – The bottom line that remains after deducting all expenses from revenues. Net Income – Same as net earnings.

What is return on net assets?

Return on net assets is commonly used for capital-intensive companies and is an important ratio looked at by investors and analysts to determine how effective and efficient a company is at generating a profitable return on its net assets.

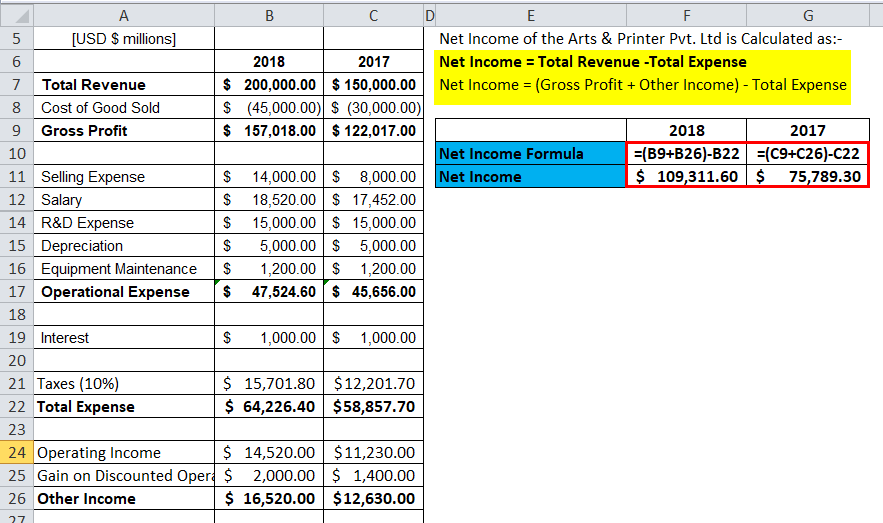

What is net income?

Net income is a company’s income minus the cost of goods sold. Cost of Goods Sold (COGS) Cost of Goods Sold (COGS) measures the “direct cost” incurred in the production of any goods or services. It includes material cost, direct. , expenses, and taxes for the accounting period.

What is RONA ratio?

The return on net assets (RONA) ratio, a measure of financial performance, is an alternative metric to the traditional return on assets ratio. RONA measures how well a company’s fixed assets and net working capital perform in terms of generating net income. Return on net assets is commonly used for capital-intensive companies and is an important ratio looked at by investors and analysts to determine how effective and efficient a company is at generating a profitable return on its net assets.

Why is increasing RONA desirable?

On a trended basis, an increasing RONA is desirable, as it is an indicator of improving profitability and financial efficiency. One important thing to note is the potential for management to distort its RONA.

What is net working capital?

Net working capital is the difference between the company’s current assets and current liabilities.

Is a higher return on net assets ratio good?

There is no “ideal” return on net assets ratio number, but a higher ratio is preferable. It is important to compare the RONA of a company to peer companies. For example, a company with a RONA of 40% may look good in isolation, but that figure may actually appear poor when compared to an industry benchmark of 70%.

What Is Return on Net Assets (RONA)?

Return on net assets (RONA) is a measure of financial performance calculated as net profit divided by the sum of fixed assets and net working capital. Net profit is also called net income .

What does higher return on net assets mean?

The higher the return on net assets, the better the profit performance of the company. A higher RONA means the company is using its assets and working capital efficiently and effectively, although no single calculation tells the whole story of a company's performance. Return on net assets is just one of many ratios used to evaluate a company's financial health .

What is RONA ratio?

Net profit is also called net income . The RONA ratio shows how well a company and its management are deploying assets in economically valuable ways; a high ratio result indicates that management is squeezing more earnings out of each dollar invested in assets.

What is RONA in manufacturing?

RONA is an especially important metric for capital intensive companies, which have fixed assets as their major asset component. In the capital-intensive manufacturing sector, RONA can also be calculated as:

How to calculate net working capital?

Net working capital is calculated by subtracting the company's current liabilities from its current assets. It is important to note that long-term liabilities are not part of working capital and are not subtracted in the denominator when calculating working capital for the return on net assets ratio.

What is RONA in accounting?

Return on net assets (RONA) compares a firm's net profits to its net assets to show how well it utilizes those assets to generate earnings.

What are the components of RONA?

The three components of RONA are net income, fixed assets, and net working capital. Net income is found in the income statement and is calculated as revenue minus expenses associated with making or selling the company's products, operating expenses such as management salaries and utilities, interest expenses associated with debt, and all other expenses.

How to calculate return on net operating assets?

The return on net operating assets (Rona) formula can be determined using the time value of money Time Value Of Money The Time Value of Money (TVM) principle states that money received in the present is of higher worth than money received in the future because money received now can be invested and used to generate cash flows to the enterprise in the future in the form of interest or from future investment appreciation and reinvestment. read more relationship as described below:

What is net income?

Net income is defined as the residual income earned by the business. It is the end value a business gets when all the operational overheads, the cost of running a business are deducted from the revenue generated by the business. It can be found in the income statement section of the business.

What are current liabilities?

The current liabilities Current Liabilities Current Liabilities are the payables which are likely to settled within twelve months of reporting. They're usually salaries payable, expense payable, short term loans etc. read more are obligations that the business has to pay within 12 months or the current financial year of the business. They are composed of notes payable, account payable Account Payable Accounts payable is the amount due by a business to its suppliers or vendors for the purchase of products or services. It is categorized as current liabilities on the balance sheet and must be satisfied within an accounting period. read more and current portion of long-term debt Current Portion Of Long-term Debt Current Portion of Long-Term Debt (CPLTD) is payable within the next year from the date of the balance sheet, and are separated from the long-term debt as they are to be paid within next year using the company’s cash flows or by utilizing its current assets. read more, accruals, etc. These are deducted from the current assets to arrive at the networking capital, which in turn can be utilized to calculate the return on net assets.

What is the RONA of a business?

If a business incurs significant one-time losses, then it can be adjusted to the net income earned by the business to derive the value of the return on net assets (RONA).

What is RONA in financial terms?

What is Return on Net Assets (RONA)? Return on net assets (RONA) is defined as the financial ratio. Financial Ratio Financial ratios are indications of a company's financial performance. There are several forms of financial ratios that indicate the company's results, financial risks, and operational efficiency, such as the liquidity ratio, ...

What is non-current asset?

Non-current Assets Non-current assets are long-term assets bought to use in the business, and their benefits are likely to accrue for many years. These Assets reveal information about the company's investing activities and can be tangible or intangible.

What are physical assets?

Physical assets are defined as the fixed assets which the business employs in running business operations. These could be in the form of the production plant, machinery, business property, investment property, or equipment. These are non-current assets#N#Non-current Assets Non-current assets are long-term assets bought to use in the business, and their benefits are likely to accrue for many years. These Assets reveal information about the company's investing activities and can be tangible or intangible. Examples include property, plant, equipment, land & building, bonds and stocks, patents, trademark. read more#N#and can be found in the balance sheet section of the business.

How to calculate return on assets?

There are two separate methods you can use to calculate return on assets. The first method is to divide the company's net income by its total average assets. The second method is to multiply the company's net profit margin by its asset turnover rate.

How to find return on assets?

To find the company's return on assets using its net income and average total assets, simply divide the company's net income ($150,000) by its average total assets ($800,000). 150,000 / 800,000 = 0.1875. Then convert the resulting quotient to represent the company's return on assets as a percentage (0.1875 x 100 = 18.75%). The company's return on assets is 18.75%.

How to find the product of net profit margin and asset turnover?

Finally, find the product of the company's net profit margin and asset turnover by multiplying the two numbers together (Net Profit Margin x Asset Turnover). If needed, you can round the numbers for the company's net profit margin and asset turnover to make the calculation easier. Convert the resulting answer to represent the company's return on assets in percentage form.

How to find the net profit margin?

You will need to begin by finding the company's net profit margin. This is done by dividing the company's net income by its total revenue, with the net income being the numerator and the total revenue being the denominator (Net Income/Total Revenue).

How to find the quotient of a company's net income?

Finally, find the quotient of the company's net income and total assets by dividing the company's net income by its total assets, with the net income being the numerator and the total assets being the denominator (Net Income / Total Assets). If needed, you can round the numbers for net income and total assets to make the calculation easier. Convert the resulting answer into percentage form to represent the company's return on assets.

Why use return on assets percentage?

You can also use the company's return on assets percentage to compare the company to similar companies. However, it is important to make sure you are comparing numbers for companies that are similar in size and are in a similar industry. This will allow you to compare how well a company is performing compared to other companies.

What is ROA in accounting?

Return on assets (ROA) is a ratio that tells you how much of a profit a company earns from its resources and assets. This information is valuable to a company's owners and management team and investors because it is an indication of how well the company uses its resources and assets to generate a profit. Return on assets is represented as a percentage. For example, if a company's ROA is 7.5%, this means the company earns seven and a half cents per dollar in assets.

What is the return on assets?

Return on assets can be used to gauge how asset-intensive a company is: The lower the return on assets, the more asset-intensive a company is . An example of an asset-intensive company would be an airline company. The higher the return on assets, the less asset-intensive a company is.

Where is net income/loss found on income statement?

Net income/loss is found at the bottom of the income statement and divided into total assets to arrive at ROA.

What is Net Income?

Net income is the net amount realized by a firm after deducting all the costs of doing business in a given period. It includes all interest paid on debt, income tax due to the government, and all operational and non-operational expenses.

What is ROA in accounting?

Return on Assets (ROA) is a type of return on investment (ROI)#N#ROI Formula (Return on Investment) Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. It is most commonly measured as net income divided by the original capital cost of the investment. The higher the ratio, the greater the benefit earned.#N#metric that measures the profitability of a business in relation to its total assets#N#Types of Assets Common types of assets include current, non-current, physical, intangible, operating, and non-operating. Correctly identifying and#N#. This ratio indicates how well a company is performing by comparing the profit ( net income#N#Net Income Net Income is a key line item, not only in the income statement, but in all three core financial statements. While it is arrived at through#N#) it’s generating to the capital it’s invested in assets. The higher the return, the more productive and efficient management is in utilizing economic resources. Below you will find a breakdown of the ROA formula and calculation.

What is the ROA of $10 million?

A: $10 million divided by $50 million is 0.2, therefore the business’s ROA is 20%. For every dollar of assets the company invests in, it returns 20 cents in net profit per year.

Why do companies use ROA?

Below are some examples of the most common reasons companies perform an analysis of their return on assets. 1. Using ROA to determine profitability and efficiency. Return on assets indicates the amount of money earned per dollar of assets.

Is return on assets compared across industries?

It is important to note that return on assets should not be compared across industries. Companies in different industries vary significantly in their use of assets. For example, some industries may require expensive property, plant, and equipment (PP&E)#N#PP&E (Property, Plant and Equipment) PP&E (Property, Plant, and Equipment) is one of the core non-current assets found on the balance sheet. PP&E is impacted by Capex,#N#to generate income as opposed to companies in other industries. Therefore, these companies would naturally report a lower return on assets when compared to companies that do not require a lot of assets to operate. Therefore, return on assets should only be used to compare with companies within an industry. Learn more about industry analysis#N#Industry Analysis Industry analysis is a market assessment tool used by businesses and analysts to understand the complexity of an industry. There are three commonly used and#N#.

How to calculate net assets?

Total assets also equals to the sum of total liabilities and total shareholder funds. Total Assets = Liabilities + Shareholder Equity read more#N#of an organization or the firm , minus its total liabilities. The number of net assets can be tallied out with the shareholder’s equity of a business. One of the easiest ways to calculate net assets is by using the below formula.

What is the asset net of the total liabilities?

Assets net of the total liabilities will net to the owner’s equity. Essentially, the shareholders. The Shareholders A shareholder is an individual or an institution that owns one or more shares of stock in a public or a private corporation and, therefore, are the legal owners of the company.

How do owners increase their net assets?

If desired, owners can increase their net assets in a few several ways. They can make new investments in the firm or in the company, or the management or the owners can simply leave excess profits in the bank account of the company rather than calling for distribution or dividend. If owners or shareholders or stockholders withdraw money out of business say in the form of a distribution or dividend Dividend Dividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the company’s equity. read more, their nets assets shall decrease. The ratio of liabilities to total assets shall go up as the owners took out the cash , which is part of an asset, from the firm or the business.

Which step is total assets from total liabilities?

In the last step, we need to just deduct the total calculated in step 1, which is total assets from total liabilities, which was calculated in step2.

Who owns the assets that do not have outstanding mortgages?

or the stockholders of the firm or the company or the business owns the assets which shall not have outstanding loans. This would be the same as home with a mortgage loan upon it. The equity or the net assets in the home is the value of the home and subtracting the outstanding mortgage loan.

What is total liabilities?

Total liabilities can include total borrowings, provisions, current, and other non-current liabilities. . In the last step, we need to just deduct the total calculated in step 1, which is total assets from total liabilities, which was calculated in step2.

What is Return on Net Operating Assets?

A company can generate profits from mainly two types of activities. The prime source of income comes from operating activities through sales. The secondary source of income for any business comes from financial activities. Financial activities may include investing in marketable securities and bank interests etc.

What is Net Operating Asset (NOA)?

Net operating assets refer to the assets of the business that involve only in the business operation. Thus, the term NOA results from the operating assets minus operating liabilities. That means the net operating assets are the difference between a business’s operating assets and operating liabilities.

What is the RNOA ratio?

The RNOA Ratio provides an important indication of a company’s efficiency without relying on financial investments. The shareholders can analyze the company’s utilization of operational assets against the net income. However, it may take specialized skills to differentiate the net financial assets and net operating assets.

What is NOA in accounting?

By now, you understand the NOA, which is the difference between the operating assets and operating liabilities. You also know the definition of operating assets and operating liabilities. Now, it is time to jump into the return on net operating assets and how to calculate it.

What is the main source of profits for a company?

The operating income of a company remains the main source of profits through sales. Hence the net operating assets provide the efficient use of assets employed in the business. The company management can improve only operating efficiency by providing useful resources to the operational staff. Investing returns usually correlate with external macroeconomic factors such as the interbank interest rates and inflation rates.

What are operating assets?

Operating assets are assets of a business that are used in the business operation to generate revenue for the company. The operating assets include the company’s cash and cash equivalents, inventory, trade receivable, prepaid expenses, property plant and equipment, and some other intangible assets required for the operation. However, it does not include any financial assets, such as financial instruments, long-term investments, loans, etc.

Why is ratio analysis important?

In a percentage figure, the analyst can compare the performance of the companies of different sizes. Such analyses are particularly useful for growing companies who benchmark the industry standards.

What Is Return on Net Assets (RON?

- Return on net assets (RONA) is a measure of financial performance calculated as net profit divid…

The RONA ratio shows how well a company and its management are deploying assets in economically valuable ways; a high ratio result indicates that management is squeezing more earnings out of each dollar invested in assets. RONA is also used to assess how well a compan… - Return on net assets (RONA) compares a firm's net profits to its net assets to show how well it u…

A high RONA ratio indicates that management is maximizing the use of the company's assets.

The Formula for Return on Net Assets Is

- \begin {aligned}&RONA=\frac {\text {Net profit}} {\text { (Fixed assets}+NWC)}\\&NWC=\text {Current Assets }-\text {Current Liabilities}\\&\textbf {where:}\\&RONA=\text {Return on net assets}\\&NWC=\text {Net working capital}\end {aligned} RON A = (Fixed assets + N W C)Net profit N W C = Current Assets − Current Liabilities where: RON A = Return on net assets N W C = …

How to Calculate RONA

- The three components of RONA are net income, fixed assets, and net working capital. Net incom…

Fixed assets are tangible property used in production, such as real estate and machinery, and do not include goodwill or other intangible assets carried on the balance sheet. Net working capital is calculated by subtracting the company's current liabilities from its current assets. It is importan…

What Does RONA Tell You?

- The return on net assets (RONA) ratio compares a firm's net income with its assets and helps in…

In the capital-intensive manufacturing sector, RONA can also be calculated as: - \text {Return on Net Assets}=\frac {\text {Plant Revenue}-\text {Costs}} {\text {Net Assets}} Retu…

Interpreting Return on Net Assets

Example of RONA

- Assume a company has revenue of $1 billion and total expenses including taxes of $800 million…

Further, the company's fixed assets amount to $800 million. Adding fixed assets to net working capital yields $1 billion in the denominator when calculating RONA. Dividing the net income of $200 million by $1 billion yields a return on net assets of 20% for the company.

Components of Return on Net Operating Assets

Return on Net Assets Formula

- The return on net operating assets (Rona) formula can be determined using the time value of moneyTime Value Of MoneyThe Time Value of Money (TVM) principle states that money received in the present is of higher worth than money received in the future because money received now can be invested and used to generate cash flows to the enterprise in the...

Advantages

- It is useful for the manufacturing business as it helps them collect and maintain information on sales, assets, and operational costs at the plant level.

- It helps the investor know whether the business is a good investment option or not.

- A high ratio always signifies that the company is highly efficient in driving good business.

Disadvantages

- Since the metric is derived using fixed assets. Therefore, the method of depreciationDepreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tang...

- A wrong depreciation method can severely skew the profitability ratio or RONA.

- Suppose the business earns loss from unusual and unpredictable events. It can also skew th…

- Since the metric is derived using fixed assets. Therefore, the method of depreciationDepreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tang...

- A wrong depreciation method can severely skew the profitability ratio or RONA.

- Suppose the business earns loss from unusual and unpredictable events. It can also skew the return on operating assetsmetric since such losses would be adjusted to the net income and can, therefore...

- It does not account for intangible assetsIntangible AssetsIntangible Assets are the identifiable assets which do not have a physical existence, i.e., you can't touch them, like goodwill, patents, c...

Important Points

- It helps the business determine its ability to create and derive value creation for the longer-term horizon.

- It helps the business determine how well they utilize physical and net assets.

- A high RONA is generally regarded as a favorable metric for the business.

- It is one of the comprehensive measures wherein net income is compared with the business’…

- It helps the business determine its ability to create and derive value creation for the longer-term horizon.

- It helps the business determine how well they utilize physical and net assets.

- A high RONA is generally regarded as a favorable metric for the business.

- It is one of the comprehensive measures wherein net income is compared with the business’s physical assets.

Conclusion

- Return on Net Assets is regarded as the performance metric, which compares the net income generated by the business over the physical assets utilized by the business. It helps analysts and business knowledge determine whether the company can drive an efficient business operation to generate good economic value. The investors utilize this ratio to determine whether they would …

Recommended Articles

- This article has been a guide to Return on Net Assets. Here we discuss components, the formula of return on net assets (RONA), along with examples, advantages & disadvantages. You can learn more financial analysis from the following articles – 1. Netback 2. ROCE Formula 3. Rate of Return on Investment 4. Examples of Return on Equity 5. ROI Examples