Method 1 Using the Simple Interest Formula

- Determine the total amount borrowed. Interest is paid on the total amount of money borrowed, also known as the principal.

- Convert the interest rate to a decimal value. Interest rates are typically expressed as a percentage.

- Use the correct time period for the length of the loan. ...

- Find the total interest owed using the formula . ...

What is the formula for simple interest?

Simple Interest Formula. The simple interest for a given amount can be calculated by the following formula, Simple Interest = (P×R×T)/100. Where, P = Principal amount. R = Rate of interest. T = Time period.

How do you calculate interest on a simple loan?

the simple interest calculator is a simple and easy online tool to calculate the interest amount. to calculate the simple interest, you need to input three essential details in the simple loan calculator - principal amount time period interest rate put the values in the following formula - a = p (1 + (r*t)) where, a = amount p = principal

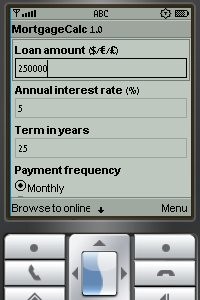

How to calculate loan payments in 3 Easy Steps?

Sample Calculator

- Method 1 Method 1 of 3: Using an Online Calculator Download Article. Open an online loan calculator. ...

- Method 2 Method 2 of 3: Calculating Loan Payments Manually Download Article. Write down the formula. ...

- Method 3 Method 3 of 3: Understanding How Loans Work Download Article. Understand fixed-rate versus adjustable-rate loans. ...

How to calculate an interest payment using Microsoft Excel?

Using Excel formulas to figure out payments and savings

- Figure out the monthly payments to pay off a credit card debt. ...

- =PMT (17%/12,2*12,5400) The rate argument is the interest rate per period for the loan. ...

- Figure out monthly mortgage payments. ...

- =PMT (5%/12,30*12,180000) The rate argument is 5% divided by the 12 months in a year. ...

- Find out how to save each month for a dream vacation. ...

How to calculate interest on a monthly payment?

Use the =PMT function to determine interest payments. Excel already knows the equation for calculating monthly payments, with interest. You just have to give it the information it needs to make the calculation. Click on an empty box, then locate the function bar. It is located right above the spreadsheet and labeled "fx." Click inside of it and write "=PMT ("

How to calculate interest on a loan?

Now that you have the monthly payment, you can determine how much interest you will pay over the life of the loan. Multiply the number of payments over the life of the loan by your monthly payment. Then subtract the principal amount you borrowed.

How to find the number of payments on a loan?

Imagine that your monthly payments are on a loan with a 30 year term. To find the number of payments, simply multiply 30 by 12. You'll be making 360 payments.

How to figure out the total amount of a loan?

To figure out the total amount you will pay over the life of your loan, all you have to do is multiply the payment amount by the total number of payments. In the example, you'd multiply $506.69 by 360 to get $182,408. This is the total amount you'll pay over the loan's term.

How long do you have to pay off a mortgage?

Term: Usually in months, this is how long you have to pay the loan off. For mortgages it is often calculated in years. Make sure to find out if there are any penalties for paying off the loan earlier than the stated term.

What is the principal amount of a loan?

Principal: The amount of your loan. If you loan is $5,000, the principal is $5,000.

How long does it take to pay off a payday loan?

Payday Loans: 350-500% These loans are very dangerous if you can't pay them off within 1-2 weeks. These loans are regulated by the state, which means that some of them have caps on the interest they can charge while others do not have a limit.

What is the formula for simple interest?

The simple interest formula is I = PRT:

What is a simple interest loan?

With a simple interest loan, the amount you're borrowing is the principal, the length of the loan is the term, the money you pay for the privilege of borrowing is the interest and the date on which the loan is to be paid in full is its maturity date.

How to calculate simple interest?

Simple Interest (SI) is a way of calculating the amount of interest that is to be paid on the principal and is calculated by an easy formula, which is by multiplying the principal amount with the rate of interest and the number of periods for which the interest has to be paid. How to Provide Attribution?

How to calculate equated monthly amount in Excel?

We can calculate the equated monthly amount in excel using the PMT function Using The PMT Function The PPMT function in Excel is a financial function that calculates the payment for a given principal and returns an integer result. This function can be used to calculate the principal amount of an installment for any period. read more.

Is compound interest less than simple interest?

Returns calculated under simple interest will always be less than returns calculated under compound interest as it ignores the concept of compounding.

Is interest paid on savings bank accounts based on simple interest?

Also, the interest paid on savings bank accounts and term deposits by banks is also based on simple interest.

What is simple interest?

In the most basic terms, simple interest is the calculation showing how much will be paid in total interest on funds borrowed over a specific period of time. Simple interest can be calculated on money that you borrow, money that you lend, and even funds that you deposit in an interest-bearing account.

Why is simple interest important?

Understanding the concept of simple interest is imperative if you want to stay on top of your finances. Knowing how your debt, and your savings, will grow over time – and how much you’ll either pay or earn in interest – can guide many of your financial decisions.

What is the daily compounding rate for 6.00%?

If you know an account’s APR, you can figure out the compounding rate from that by simply dividing: a 6.00% APR that’s compounded once a month means a monthly compounding rate of 0.5% (0.06/12). If that same lender compounded once a day instead, the daily compounding rate would be 0.016% (0.06/365).

What is the principal amount of a loan?

When you borrow money – whether that’s in the form of a financed car or a personal loan deposited into your checking account – your initial debt amount is called the principal. If you take out a $10,000 loan or buy a $10,000 car, your principal balance is an easy $10,000.

What is an installment account?

Installment accounts are loans that are given one time and then paid off each month until the balance reaches 0, according to the agreed loan terms. This is different from a revolving account, such as a credit card, where you can continue to add to the balance and don’t have a set time frame for total repayment.

What is the APR of a loan?

Then, you’ll need to know how much you’ll be charged for the debt. This is referred to as the APR, or annual percentage rate , and determines how much the lender will charge you each year in exchange for letting you borrow money. A loan’s APR is not the same as its interest rate, however. To figure that out – and calculate ...

What is principal in finance?

Principal is the amount you borrowed, the rate represents the interest rate you agreed to, and the number of periods refers to the length of time in question.

Calculating Interest: Principal, Rate, and Time Are Known

When you know the principal amount, the rate, and the time, the amount of interest can be calculated by using the formula:

Calculating Interest Earned When Principal, Rate, and Time Are Known

Calculate the amount of interest on $8,700.00 when earning 3.25 percent per annum for three years. Once again, you can use the I = Prt formula to determine the total amount of interest earned. Check with your calculator.

Calculating Interest When the Time Is Given in Days

Suppose you want to borrow $6,300 from March 15, 2004, until January 20, 2005, at a rate of 8 percent. The formula will still be I = Prt; however, you need to calculate the days.

Find the Principal When You Know the Interest, Rate, and Time

What amount of principal will earn interest of $175.50 at 6.5 percent in eight months? Once again, use the derived formula of:

Calculator Use

Calculate simple interest on the principal only, I = Prt. Simple interest does not include the effect of compounding.

Simple Interest Formulas and Calculations

This calculator for simple interest-only finds I, the simple interest where P is the Principal amount of money to be invested at an Interest Rate R% per period for t Number of Time Periods. Where r is in decimal form; r=R/100. r and t are in the same units of time.

How to calculate monthly interest rate?

Monthly Interest Rate Calculation Example 1 Convert the annual rate from a percent to a decimal by dividing by 100: 10/100 = 0.10 2 Now divide that number by 12 to get the monthly interest rate in decimal form: 0.10/12 = 0.0083 3 To calculate the monthly interest on $2,000, multiply that number by the total amount: 0.0083 x $2,000 = $16.60 per month 4 Convert the monthly rate in decimal format back to a percentage (by multiplying by 100): 0.0083 x 100 = 0.83% 5 Your monthly interest rate is 0.83%

How to calculate interest rate for a week?

For a quarterly rate, divide the annual rate by four. For a weekly rate, divide the annual rate by 52.

What is APY in savings?

The APY accounts for compounding, which is the interest you earn as your account grows due to interest payments. APY will be higher than your actual rate unless the interest is compounded annually, so APY can provide an inaccurate result. That said, APY makes it easy to quickly find out how much you’ll earn annually on a savings account with no additions or withdrawals. 5

What is the monthly rate of 0.0083?

Convert the monthly rate in decimal format back to a percentage (by multiplying by 100): 0.0083 x 100 = 0.83%

What is periodic interest rate?

Whatever period you choose, the rate you use in calculations is called the periodic interest rate. You’ll most often see rates quoted in terms of an annual rate, so you typically need to convert to whatever periodic rate matches your question or your financial product. 1 .

How to convert annual rate to decimal?

Convert the annual rate from a percent to a decimal by dividing by 100: 10/100 = 0.10

What is the average credit card interest rate in 2021?

The average credit card interest rate was 20.25% in July 2021. You can expect to pay a few more points for store credit cards. Business and student credit cards will help you minimize your interest rate.

How is interest calculated on a simple interest loan?

With a simple interest loan, interest is calculated based on your outstanding loan balance on your payment due date.

What is a simple interest loan?

If you’re shopping for a loan, check whether the loan you’re considering is a simple interest loan. Compared with other types of loans, a simple interest loan can help you save money on interest charges — particularly if you pay it back early.

How is simple interest different from precomputed interest?

With a precomputed loan, the interest is determined at the start of the loan — rather than as you make payments — and rolled into your loan balance.

Why is it important to know how interest is calculated on a loan before you sign a contract?

It’s important to know how interest is calculated on a loan before you sign a contract, because it can affect how much total interest you pay. Let’s take a look at how a simple interest loan works, and how this type of interest differs from compound and precomputed interest. Check your Approval Odds for a loan Get Started.

How much of your first loan payment goes toward interest?

With your first payment, just under $42 — or roughly 22% of your payment — would go toward interest. But with your final loan payment, just 78 cents would go toward interest. Let’s take a look at how you would pay down your principal each year with this loan. Remember, this is just one example. When you’re looking into loans, it’s good to ask the lender how your payments will be divided between interest and principal repayment.

What are the benefits of simple interest?

Key benefit of simple interest loans. A key benefit of simple interest loans is that you could potentially save money in interest. With a simple interest loan, you can typically reduce the total interest you pay by …. Making more than your minimum monthly payment toward your principal. Making extra payments toward your principal.

What is compound interest?

With a compound interest loan, interest is added to the principal — on top of any interest that’s already accumulated. A compound interest loan will usually cost you more in interest than a simple interest loan with the same annual percentage rate.