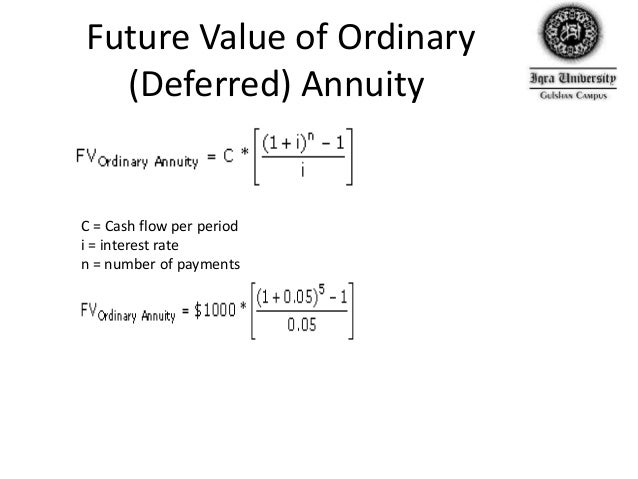

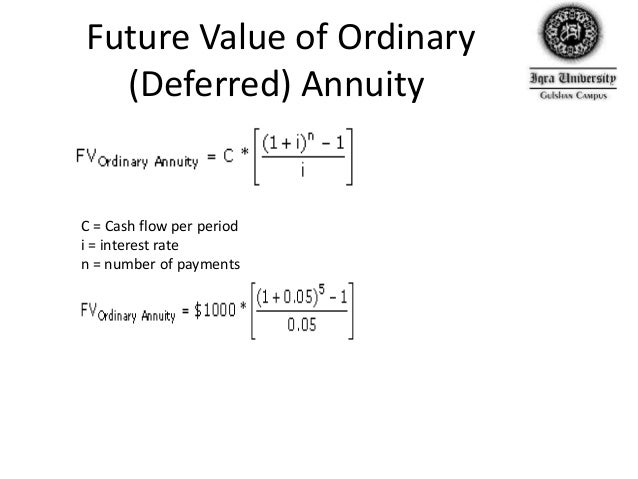

- Define the periodic payment you will do ( P ), the return rate per period ( r ), and the number of periods you are going to contribute ( n ...

- Calculate: (1 + r)ⁿ minus one and divide by r.

- Multiply the result by P and you will have the future value of an annuity. Also, you can try the Omni Calculator future value of annuity tool.

What is the formula for the present value of annuity?

What is the Formula to Calculate Annuity of Ordinary and Due?

- PVA Ordinary = Present value of an ordinary annuity

- r = Effective interest rate

- n = Number of periods

How do you calculate future value of annuity due?

- Future Value of a Growing Annuity (g ≠ i): FVA = PMT / (i - g) * ( (1 + i) ^ n - (1 + g) ^ n)

- Future Value of a Growing Annuity (g = i): FVA = PMT * n * (1 + i) ^ (n - 1)

- Future Value of an Annuity with Continuous Compounding (m → ∞) FVA = PMT / (eʳ - 1) * (eʳᵗ - 1)

What is the future value of an ordinary annuity?

To sum up, the future value of an ordinary annuity is the future returns of periodic equal cash flows occur at the end of each period. We can calculate the future returns of such annuity by using the future value of an ordinary table, the detail formula as well as in Excel spreadsheets.

How to calculate FVA?

FVA Due = P * [(1 + i) n – 1] * (1 + i) / i Relevance and Use of Future Value of an Annuity Formula The concept of the future value of the annuity is an interesting topic as it captures the time value of money and how the timing of payment during a given period makes a difference to the overall future value of money.

How do you calculate future factor?

Also called the Future Amount of One or FV Factor, the Future Value Factor is a formula used to calculate the Future Value of 1 unit today, n number of periods into the future. The FV Factor is equal to (1 +i)^n where i is the rate (e.g. interest rate or discount rate) and n is the number of periods.

What is the future value interest factor for an annuity?

The future value of an annuity is the value of a group of recurring payments at a certain date in the future, assuming a particular rate of return, or discount rate. The higher the discount rate, the greater the annuity's future value.

How do you calculate future value example?

Future value is what a sum of money invested today will become over time, at a rate of interest. For example, if you invest $1,000 in a savings account today at a 2% annual interest rate, it will be worth $1,020 at the end of one year. Therefore, its future value is $1,020.

How much does a $50000 annuity pay per month?

approximately $219 each monthA $50,000 annuity would pay you approximately $219 each month for the rest of your life if you purchased the annuity at age 60 and began taking payments immediately.

How do you calculate annuity interest?

Ultimately, to calculate the interest rate in an ordinary annuity, the equation is expressed A = P(1 + rt).

What is the present value of the simple annuity of ₱ 5000.00 payable semi annually for 10 years if money is worth 6% compounded semi annually?

1. Find the present value and the amount (future value) of an ordinary annuity of P5,000 payable semi-annually for 10 years if money is worth 6% compounded semi-annually. 1. Answer: P = P74,387.37, F = P134,351.87 2.

What is future value of an annuity due?

What is the future value of an annuity due? The future value of annuity due is the estimated total value of a series of cash payments made at the beginning of a payment period.

What is the future value of annuity?

Consequently, “future value of annuity” refers to the value of these series of payments at some future date.

How to calculate the effective rate of interest?

Step 1: Firstly, calculate the value of the future series of equal payments, which is denoted by P. Step 2: Next, calculate the effective rate of interest, which is basically the expected market interest rate divided by the number of payments to be done during the year . I denote it.

What is the future value of an annuity?

The future value of an annuity is the total value of payments at a specific point in time. The present value is how much money would be required now to produce those future payments.

When are annuities due?

In ordinary annuities, payments are made at the end of each period. With annuities due, they're made at the beginning of the period.

What is recurring annuity?

Recurring payments, such as the rent on an apartment or interest on a bond, are sometimes referred to as "annuities.". In ordinary annuities, payments are made at the end of each period. With annuities due, they're made at the beginning of the period. The future value of an annuity is the total value of payments at a specific point in time.

Why are annuities higher in value?

The reason the values are higher is that payments made at the beginning of the period have more time to earn interest. For example, if the $1,000 was invested on January 1 rather than January 31 it would have an additional month to grow. The formula for the future value of an annuity due is as follows:

What is an annuity payment?

These recurring or ongoing payments are technically referred to as "annuities" (not to be confused with the financial product called an annuity, though the two are related).

What is present value?

In contrast to the future value calculation, a present value (PV) calculation tells you how much money would be required now to produce a series of payments in the future, again assuming a set interest rate.

Why are the value of a stock higher?

The reason the values are higher is that payments made at the beginning of the period have more time to earn interest. For example, if the $1,000 was invested on January 1 rather than January 31 it would have an additional month to grow.

Calculator Use

Use this calculator to find the future value of annuities due, ordinary regular annuities and growing annuities.

Future Value Annuity Formulas

You can find derivations of future value formulas with our future value calculator.

How is the Future Value of an Annuity Derived?

The future value of an annuity is the future value of a series of cash flows. The formula for the future value of an annuity, or cash flows, can be written as

What happens if the rate of an annuity does not change?

2. The first payment is one period away. 3. The periodic payment does not change. If the rate or periodic payment does change, then the sum of the future value of each individual cash flow would need to be calculated to determine the future value of the annuity. If the first cash flow, or payment, is made immediately, ...

What is future value of annuity?

The future value of annuity calculator is a compact tool that helps you to compute the value of a series of equal cash flows at a future date. In other words, with this annuity calculator, you can estimate the future value of a series of periodic payments. You can also use it to find out what is an annuity payment, periods, or interest rate if other values are given. Besides, you can read about different types of annuities, and get some insight into the the analytical background.

How to differentiate annuities from the view of the present calculator?

The most important way to differentiate annuities from the view of the present calculator is the timing of the payments.

What is an annuity?

Annuity refers to a specific type of financial construction that involves a series of payments over a certain period of time, regardless of the direction of the flow of the money (i.e., the money being paid to you or you paying the money to someone else). Annuities must also satisfy two conditions: that the payments are equal and are made at fixed intervals. For example, 200 dollars paid at the end of each of the next ten years is a 10-year annuity.

What is contingent annuity?

Since this kind of annuity is only paid under particular circumstances, it is called a contingent annuity (i.e., it is contingent on how long the annuitant lives for).

How does an advanced payment affect an annuity?

The advanced payments have an immediate effect on the future value of the annuity as the money stays in your bank for longer, and therefore earns interest for one additional period. Therefore with the annuity due, the future value of the annuity is higher than with the ordinary annuity. The graph also serves to visually explain how ...

What is variable annuity?

There are fixed annuities, where the payments are constant, but there are also variable annuities that allow you to accumulate the payments and then invest them on a tax-deferred basis. There are also equity-indexed annuities were payments are linked to an index.

What are the two conditions for an annuity?

Annuities must also satisfy two conditions: that the payments are equal and are made at fixed intervals. For example, 200 dollars paid at the end of each of the next ten years is a 10-year annuity. If you happen to deal with an annuity, there are two aspects to be considered: the present and the future value of the annuity. ...

How does this future value of annuity calculator work?

This form can help you estimate the FV of a series of fixed annuity payments by considering these variables:

Example of two calculations

Case 1: Let’s consider an ordinary annuity with a payment per month of $1,000, over 5 years (which translates into 5 * 12 = 60 time periods) with 0.5% monthly compound interest rate. This will result in:

What is an annuity formula?

What is the Annuity Formula? An annuity in very simple terms, is basically a contract between two parties wherein one party pays the lump sum amount at the start or series of payment initially and in return will get the period payment from the other party.

What is the present value of annuity at 50?

Present Value of Annuity at Year 50 = $10,000 * ( (1 – (1 + 10%) -25) / 10%)

What does an annuity do?

The annuity also gives investors the flexibility of making payments and that can be done in lump sum amount, monthly, quarterly, etc.

Why are annuities important?

Annuities are a great financial instrument for the investors who want to secure their future and want to have constant income coming in once they retire. Although annuity is a secure stream of payment which one gets to buy this financial instrument is not relevant for everyone.

What is fixed annuity?

Fixed Annuity: It is the traditional financial instrument which we discussed above. You invest a specific amount and the institution will guarantees you fixed periodic payments.

Do annuities provide fixed income?

Annuities, as we discussed above, provide a fixed series of payments once you pay the amount to the financial institutes. But how institutes able to pay the investor the fixed amount on a periodic basis is that they invest that amount in the financial instruments which are high in quality and provide fixed-income to the institutes. These instruments are generally high rated bonds and T-bills.