How do you calculate allocation base in accounting?

- Step 1: Determine the total reach of the support department. Say for a large outsourcing company; the main support team...

- Step 2: Find the Allocation Base.

- Step 3: Allocating Overhead to the individual project.

- Step 1: Determine the total reach of the support department. Say for a large outsourcing company, the main support team will be the IT Team that provides technical support to all the employees. ...

- Step 2: Find the Allocation Base. ...

- Step 3: Allocating Overhead to the individual project.

What is the allocation base for product B?

Then 1,600 direct labor hours divided by 3,000 direct labor hours equals an allocation base of about 54 percent for Product B. Multiply the total cost by the allocation base.

How do you calculate labor cost allocation?

Then 1,600 direct labor hours divided by 3,000 direct labor hours equals an allocation base of about 54 percent for Product B. Multiply the total cost by the allocation base. In our example, for Product A, $50,000 times 46 percent equals $23,000. For Product B, $50,000 times 54 percent equals $27,000.

What is the allocation base for direct labor?

Therefore, 1,400 direct labor hours divided by 3,000 direct labor hours equals an allocation base of about 46 percent for Product A. Then 1,600 direct labor hours divided by 3,000 direct labor hours equals an allocation base of about 54 percent for Product B. Multiply the total cost by the allocation base.

What is an example of base cost allocation?

The base can range from direct labor hours to units produced. Calculate the total amount of the costs needing assignment. For example, a company wants to allocate electricity costs for producing two products. Electricity costs are $50,000 for the year.

What is an allocation base example?

Allocation bases are mostly used to assign overhead costs to inventory that is produced. For example, an IT department allocates its expenses according to the number of computers that each department uses. There are three types of allocation bases in Cost accounting: Predefined dimension member allocation bases.

What is the allocation base?

Cost allocation base can be defined as a factor that is the common denominator for systematically linking a cost or group of costs to a cost object such as a department or an activity.

How do you determine allocation cost?

If the auditor's cost is based on the Total Revenue of the organization, then you would divide the total revenue of this program by the total organizational revenue, to calculate the allocation percentage for that cost.

What is the best allocation base for manufacturing overhead?

Though allocation bases can vary, the most commonly used are direct machine hours and direct labor hours. For a labor intensive manufacturing environment, direct labor hours is probably the most accurate base, while in a more automated manufacturing environment, machine hours is probably a better choice.

What is allocation in accounting?

An allocation is the process of shifting overhead costs to cost objects, using a rational basis of allotment. Allocations are most commonly used to assign costs to produced goods, which then appear in the financial statements of a business in either the cost of goods sold or the inventory asset.

What is allocation formula?

Allocation Formula means the uniform methods adoptd by the commission by which insured risk exposures will be apportioned to each state for the purpose of calculating premium taxes due.

What is an example of cost allocation?

Cost allocation is the distribution of one cost across multiple entities, business units, or cost centers. An example is when health insurance premiums are paid by the main corporate office but allocated to different branches or departments.

What is the allocation method?

The benefit allocation method sets aside the money contributed by employer and employee into a fund that is invested to pay the benefit down the line. By contrast, a cost allocation method estimates the overall cost of benefits that will be owed and sets aside that amount.

How does a company decide on an allocation base?

An allocation base is referred to as the basis which is used by an entity to allocate overhead costs. An allocation base is determined by many factors such as machine hours used, power consumed, space occupied, time taken, and number of workers involved.

What is meant by cost allocation?

Cost allocation is the distribution of one cost across multiple entities, business units, or cost centers. An example is when health insurance premiums are paid by the main corporate office but allocated to different branches or departments.

Why should manufacturers use an allocation base?

It's particularly useful for the allocation of overhead costs. An allocation base can take many forms of quantity such as the number of labor hours worked, the number of machine hours used, power consumption, space occupied, the number of computers used, etc.

What is cost allocation?

Cost allocation assigns a specific cost to a project. An example of a cost that needs allocation would be an electric bill for several different projects. A cost object is a task or a job. An example cost object would be manufacturing widgets. There are numerous ways to determine the allocation; however, it is important to not just arbitrarily assign costs. Since there are numerous ways to allocate costs, it is important a company chooses an appropriate base. The base can range from direct labor hours to units produced.

How many direct labor hours are needed for product B?

For Product B, the company needs 1,600 direct labor hours. Therefore, 1,400 direct labor hours divided by 3,000 direct labor hours equals an allocation base of about 46 percent for Product A. Then 1,600 direct labor hours divided by 3,000 direct labor hours equals an allocation base of about 54 percent for Product B.

How to know if an allocation base is appropriate?

A good indicator that an allocation base is appropriate is when changes in the allocation base roughly correspond to changes in the actual cost. Thus, if machine usage declines, so too should the actual cost incurred to operate the machine.

What is cost allocation?

Cost allocations are mostly used to assign overhead costs to produced inventory, as required by several accounting frameworks. The typical allocation process in a multi-department company is: Allocate service department costs to operating departments.

Why should managers be aware of every allocation base being used?

Managers should be aware of every allocation base being used, since it is the basis for overhead charges being assigned to their departments. They may alter the activities of their departments to reduce their use of each allocation base, thereby reducing the costs assigned to their departments.

How does the computer services department allocate its costs?

The computer services department allocates its costs based on the number of personal computers used by each operating department, or by the number of service calls to each operating department.

How to Calculate Allocation Base?

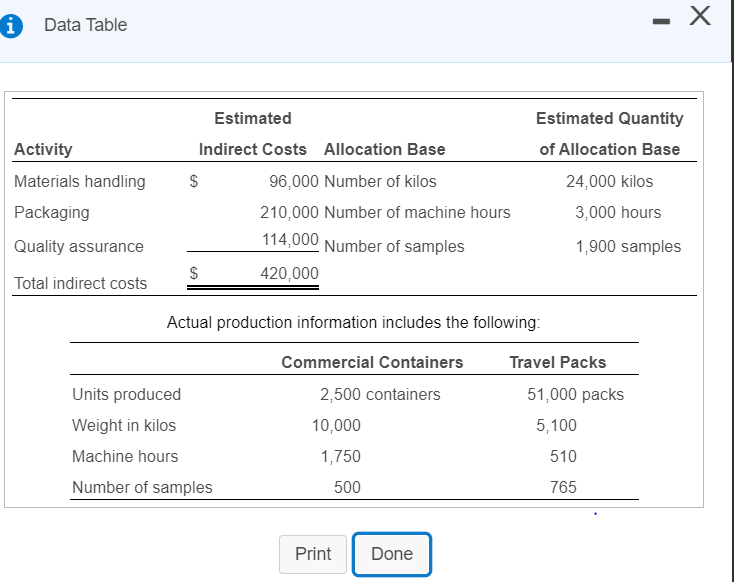

Example

- Company XYZ has its building. Ten projects are running in that building. The company is trying to find the overhead costOverhead CostOverhead cost are those cost that is not related directly on the production activity and are therefore considered as indirect costs that have to be paid even if there is no production. Examples include rent payable, utilities payable, insurance payable, salari…

Allocation Bases For Factory Overhead

- The factory runs on machines and labor. So the Allocation base for machine and labor will be machine hours and labor hours. Suppose a machine costs $100,000 and has a life of 500 hrs. So when the overhead cost of producing the finished product is calculated, then the cost of the machine will have the base of 500 hrs, and per hour cost will be $100,000 / 500 = $200 If a finish…

Advantages

- It acts as the measuring base to allocate the overhead expense to individual products or projects. Assigning recurring overhead expenses without deciding the allocation base would be difficult.

- The decision regarding the cost of the manufactured product or service is easily calculated with the help of this base, which in turn helps to decide the Selling price.

Disadvantages

- At times it is difficult to calculate as the product or service is used by several departments irregularly, and there is no fixed expense for the services.

- Different services have different Allocation Bases, making accounting for the overhead expense tricky and time-consuming. It increases the cost of accounting as high-end software, storage, and audi...

Conclusion

- Allocation Base is the most important technique for allocating overhead expenses to different projects and products. Without this, the cost of service and product will be difficult to calculate. Proper measures should be used to calculate this base and use it in accounting.

Recommended Articles

- This has been a guide to what the allocation base is and its definition. Here we discuss how to calculate the allocation base along with an example, advantages, and disadvantages. You may learn more about financing from the following articles – 1. Cost Allocation 2. Activity Based Costing 3. Predetermined Overhead Rate 4. Factory Overhead