What is the formula for calculating the contribution margin?

Formula for Contribution Margin. In terms of computing the amount: Contribution Margin = Net Sales Revenue – Variable Costs. OR. Contribution Margin = Fixed Costs + Net Income. To determine the ratio: Contribution Margin Ratio = (Net Sales Revenue -Variable Costs ) / (Sales Revenue) Sample Calculation of Contribution Margin

How to calculate an EBITDA margin?

What is EBITDA Margin?

- EBITDA Margin Formula

- Starbucks Example. The EBITDA Margin Calculation EBITDA Margin is an operating profitability ratio that helps all stakeholders of the company get a clear picture of the company's operating profitability and ...

- Colgate Example. ...

- Drawbacks. ...

- Industry EBITDA Margin. ...

What is contribution margin and how is it calculated?

What is the Contribution Margin?

- Contribution Margin Formula. To calculate this ratio, all we need to look at are the net sales and the total variable expenses. ...

- Example. Good Company has net sales of $300,000. ...

- Uses. ...

- Contribution Margin Calculator

- Calculate Contribution Margin in Excel (with excel template) You can easily calculate the ratio in the template provided.

- Recommended Articles. ...

How to calculate an overall contribution margin ratio?

How to Calculate Contribution Margin?

- Determine Net Sales. The first step to calculate the contribution margin is to determine the net sales of your business. ...

- Calculate Total Variable Cost. The next step is to determine the variable costs associated with producing goods or services. ...

- Determine Contribution Margin. ...

- Calculate Contribution Margin Ratio. ...

How do you calculate contribution margin per unit?

You can easily calculate the ratio in the template provided.The contribution margin ratio per unit formula would be = (Selling price per unit – Variable cost per unit)The contribution would be = (Margin per Unit * Number of Units Sold)The contribution ratio would be = margin / Sales.More items...

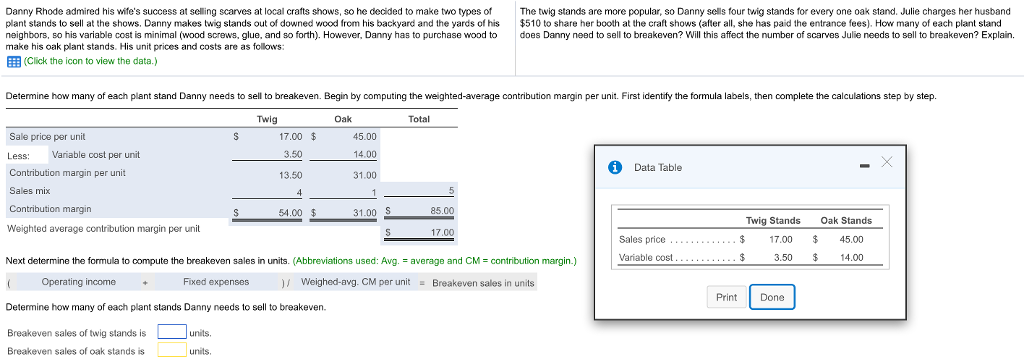

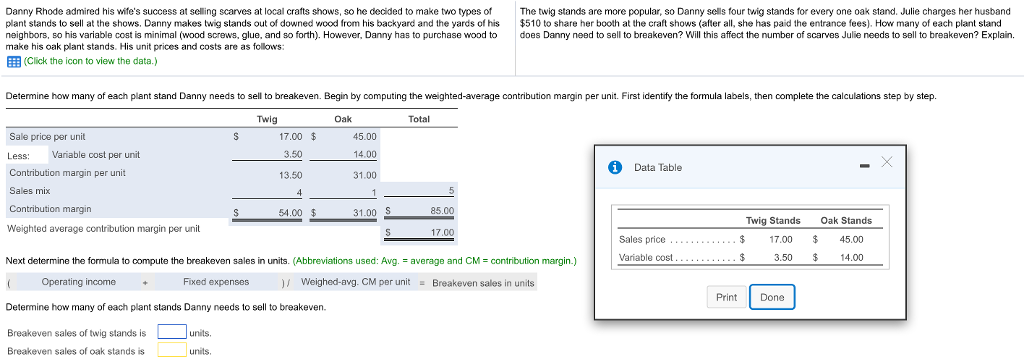

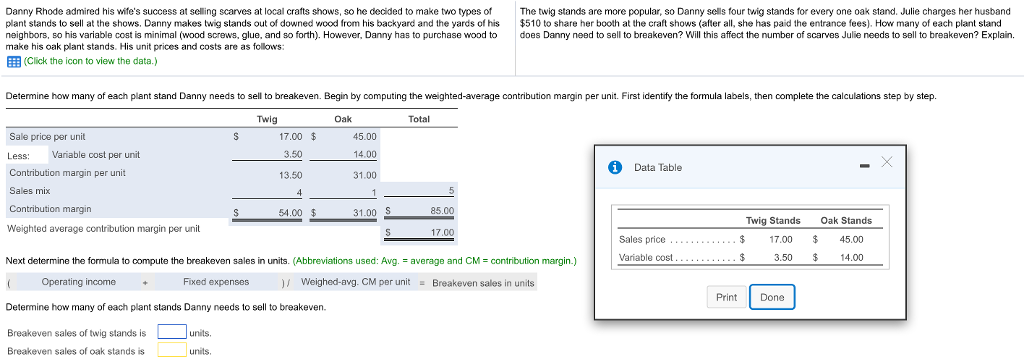

What is the weighted average unit contribution margin?

The weighted average contribution margin is the average amount that a group of products or services contribute to paying down the fixed costs of a business. The concept is a key element of breakeven analysis, which is used to project profit levels for various amounts of sales.

What is average contribution per unit?

To calculate the contribution per unit, summarize all revenue for the product in question and subtract all variable expenses from these revenues to arrive at the total contribution margin, and then divide by the number of units produced or sold to arrive at the contribution per unit.

How do you calculate average contribution margin ratio?

How to Calculate Contribution MarginNet Sales – Variable Costs = Contribution Margin.(Product Revenue – Product Variable Costs) / Units Sold = Contribution Margin Per Unit.Contribution Margin Per Unit / Sales Price Per Unit = Contribution Margin Ratio.

How do you calculate weighted average margin in Excel?

To calculate the weighted average in Excel, you must use the SUMPRODUCT and SUM functions using the following formula: =SUMPRODUCT(X:X,X:X)/SUM(X:X) This formula works by multiplying each value by its weight and combining the values. Then, you divide the SUMPRODUCT but the sum of the weights for your weighted average.

What is UCM in accounting?

The term “unit contribution margin” refers to the dollar amount of selling price per unit earned in excess of the variable cost per unit. In other words, the unit contribution margin (UCM) measures the amount of selling price that covers those costs that are fixed in nature.

What is the shop's sales mix?

Sales mix percentage is the number of one product's sales divided by the number of total products sold.

How do you calculate weighted average break-even point?

The break-even point in units is equal to total fixed costs divided by the weighted average contribution margin per unit (WACMU). The break-even point can be computed as: total fixed costs divided by the weighted average contribution margin ratio (WACMR).

What is contribution margin?

Contribution margin refers to the sales revenue a business earns from a particular type of product minus its variable expenses. When the business offers several different products, the weighted average contribution margin, or WACM, helps determine the number of products the business has to sell to break even. The weighted average contribution margin ratio formula takes into account the costs the business has to pay to produce and sell the products, as well as the price of each product.

How to calculate WACM?

To finish using the WACM formula, divide your total contribution margin by the total number of products you expect to sell to calculate the WACM. For example, with $209,000 total contribution margin and 10,000 products (6,000 pairs of sandals + 4,000 pairs of shoes), your weighted average contribution margin will be $20.90 per product unit (from $209,000/10,000).

How to calculate break even point?

To calculate your break-even point, divide your fixed costs by your weighted average contribution margin. For example, if your fixed cost is $100,000 and your weighted average contribution margin is $20.90, you will break even if you sell 4,785 units (from $100,000/$20.90). To calculate your break-even point, divide your fixed costs by your ...

How to calculate sales revenue for each product type?

Multiply the number of each product type you expect to sell by their sales prices to get the sales revenue for each product type. For example, if you sell 6,000 pairs of sandals for $20 a pair, you will get sales revenue of $120,000 from sandals. At $25 a pair, the 4,000 pairs of shoes will earn you $100,000.

What is variable cost?

Variable cost refers to the cost a business has to pay to produce or sell one unit of an item. For example, you may have to give a commission of 5% to the sales associate every time he sells one item. The commission expense represents the variable cost of each item.

What is the Weighted Average Contribution Margin?

The weighted average contribution margin is the average amount that a group of products or services contribute to paying down the fixed costs of a business. The concept is a key element of breakeven analysis, which is used to project profit levels for various amounts of sales.

Example of the Weighted Average Contribution Margin

ABC International has two product lines, each of which is responsible for 50% of sales. The contribution from Line A is $100,000 and the contribution from Line B is $50,000. In aggregate, ABC sold 15,000 units.

What is the most important use of weighted average unit contribution margin?

The most important use for the weighted average unit contribution margin is in the calculation of the break even point for a multiple product business.

What is the unit contribution margin?

The unit contribution margin for a product is the difference between the selling price and the cost price. So for example, if a business sells only one product with a selling price of 20.00 and a cost of 7.00, then the unit contribution margin for the product and the business is 20.00 – 7.00 = 13.00.

What is the resultant unit contribution?

The resultant unit contribution is known as the weighted average unit contribution margin.

How to calculate contribution margin?

Calculate the contribution margin per unit of each product by subtracting the variable costs per unit from the unit-selling price -- that is the price you sell a single unit for. For instance, with a variable cost per unit of $10 and a unit-selling price of $20, the contribution margin per unit would be $10.

How to calculate variable cost per unit?

Calculate the variable costs per unit by dividing the total variable costs -- which are found on the firm's income statement -- by the number of units produced. For example, if you have variable costs of $10,000 to produce 1,000 units, then the variable cost per unit is $10.

How to calculate market share?

Calculate your market share in volume by dividing the number of units that you produce for the market by the number of units produced in the overall market. For example, if you produce 12,000 units per year and the overall market produces 48,000 units annually, you have a 25 percent market share. If the exact market volume is not publicly available, you need to estimate it based on the number of competitors you have and what you estimate their production levels to be.