Most banks will automatically remove PMI when the loan balance has reached 78-80% of the value of the original purchase price. In other words, if someone buys a house for $100,000 and puts $10,000 down (giving you a $90,000 mortgage), once the mortgage is paid down to $80,000 the bank will automatically remove PMI.

Should I pay down mortgage to get rid of PMI?

Yes. You can refinance your loan to get rid of PMI. In order to do this, your new mortgage balance must be 80% of your home's appraised value or lower. If you take out a conventional mortgage and put less than 20% down, your mortgage lender will normally add PMI to your monthly payment. That PMI payment does not protect you, the borrower.

How to avoid PMI without 20% down?

How to Avoid PMI Without Putting 20 Percent Down Reason for Private Mortgage Insurance. Mortgage lenders have set the 80 percent loan-to-value level as the maximum to be loaned on a home without some form of additional security for ... Piggyback Mortgage Option. ... Lender Paid Mortgage Insurance. ... Compare Choices for Short and Long Term. ...

How much to put down to avoid PMI?

Ways to avoid PMI

- Make a 20% down payment. A larger down payment offers advantages beyond lowering the monthly mortgage payment and avoiding PMI.

- Pay a higher interest rate. ...

- Get an 80-10-10 loan. ...

- Military member or veteran? ...

- Explore state housing finance agency programs. ...

Does PMI go away automatically?

When does PMI go away? Most banks will automatically remove PMI when the loan balance has reached 78-80% of the value of the original purchase price. In other words, if someone buys a house for $100,000 and puts $10,000 down (giving you a $90,000 mortgage), once the mortgage is paid down to $80,000 the bank will automatically remove PMI.

How to get PMI off of a house?

How long does it take to remove PMI?

How to track your home value on Zillow?

When does PMI get removed?

Can I refinance my mortgage with 20% LTV?

Can you remove PMI if the bar is green?

Is it hard to get rid of PMI?

See 2 more

How do you know when to drop PMI?

You have the right to request that your servicer cancel PMI when you have reached the date when the principal balance of your mortgage is scheduled to fall to 80 percent of the original value of your home. This date should have been given to you in writing on a PMI disclosure form when you received your mortgage.

How long does it take for PMI to fall off?

Alternatively, PMI can be canceled at your request once the equity in your home reaches 20% of the purchase price or appraised value. “Or, PMI will be terminated once you reach the midpoint of your amortization. So, for a 30-year loan, at the midway point of 15 years PMI should automatically cancel,” Baker says.

Can PMI be removed before 2 years?

You can request PMI cancellation before it automatically terminates — when the principal loan balance reaches 80% of the home's original value (the date you're expected to reach 80% should be listed on your PMI disclosure form or provided by your lender).

Can I get rid of PMI without refinancing?

Lender-paid mortgage insurance is required no matter how much equity you have built up in your home. That means you'll have to pay your private mortgage insurance for the duration of your loan. The only way to cancel PMI is to refinance your mortgage.

Can you get PMI removed early?

You may be able to get rid of PMI earlier by asking the mortgage servicer, in writing, to drop PMI once your mortgage balance reaches 80% of the home's value at the time you bought it.

Can PMI be removed after 1 year?

“In order to get your private mortgage insurance removed, you may need to be on the loan for a minimum of 12 months,” shares Helali. “After you've been on the loan for one year, the lender should automatically dissolve the PMI when you have 22% equity in the home.”

How to Get Rid of PMI: Tips to Ditch Private Mortgage Insurance

Most people with private mortgage insurance want to know how to get rid of it. And for good reason: PMI tacks on a substantial extra fee to your already massive mortgage payments. Lenders ...

What is PMI calculator?

PMI Calculator Mortgage is a very useful online tool that can help borrowers, who want to calculate exact costs, expenses and payment of their mortgage. It can give them a whole financial picture of their loan.

How much PMI is required for a mortgage?

In other words, if the loan is to be more than 80% of the value of the home, PMI will typically be required. PMI is most commonly paid in monthly installments as part of your mortgage payment. How much the PMI payment will depend on the loan amount, credit score, and loan term.

What is PMI loan insurance?

One of those kinds of loan insurance is Private Mortgage Insurance or PMI. It has to be paid in case that a person borrows more than 80 % of the value of the real estate. Which means that down payment or the portion of the money that is given in cash at the time of purchase is less than 20 %.

Can I cancel PMI if I pay 20 percent of my equity?

Because in the moment when 20 % of equity is paid he or she can request PMI cancellation from a bank or other lender of a loan. With a help of Calculator a borrower can determinate the moment, when paying for private mortgage insurance is no longer necessary, due to the amount of money that was already paid. That moment can be calculated ...

Do banks have to pay PMI?

Banks and other lenders of the loans do not like to risk, so they protect themselves with the Private Mortgage Insurance (PMI). The borrower is required to pay for it until he or she does not pay enough to lend money back to the bank. After that, his or her loan is not considered as a high risk anymore, so paying private mortgage insurance is not necessary .

Does PMI apply to FHA?

There are several types of mortgage insurance, but PMI only applies to conventional non-government lending. You may have also heard of MIP (mortgage insurance premium) and UFMIP (upfront mortgage insurance premium). But these apply only to FHA financing.

Do you have to pay mortgage insurance if your down payment is higher?

If the amount of down payment is higher, a borrower does not have to pay private mortgage insurance. With the use of quality designed online Calculator it is possible to get exact information, how much will a monthly payment of a conventional mortgage be.

How to stop paying PMI?

If you are current on payments, your lender or servicer must end the PMI the month after you reach the midpoint of your loan’s amortization schedule. (This final termination applies even if you have not reached 78 percent of the original value of your home.) The midpoint of your loan’s amortization schedule is halfway through the full term of your loan. For 30-year loans, the midpoint would be after 15 years have passed.

How much of the original value of a home is due to PMI?

You have the right to request that your servicer cancel PMI when you have reached the date when the principal balance of your mortgage is scheduled to fall to 80 percent of the original value of your home. This date should have been given to you in writing on a PMI disclosure form when you received your mortgage. If you can't find the disclosure form, contact your servicer.

Can I remove PMI from my mortgage?

When can I remove private mortgage insurance (PMI) from my loan? Federal law provides rights to remove PMI for many mortgages under certain circumstances. Some lenders and servicers may also allow for earlier removal of PMI under their own standards.

Does Fannie Mae have PMI cancellation?

Loan investors, including Fannie Mae and Freddie Mac, often create their own PMI cancellation guidelines that may include PMI cancellation provisions beyond what the HPA provides. But these guidelines cannot restrict the rights that the HPA provides to borrowers.

Can I share my PII?

Please do not share any personally identifiable information (PII), including, but not limited to: your name, address, phone number, email address, Social Security number, account information, or any other information of a sensitive nature.

Can I cancel PMI earlier?

You can ask to cancel PMI earlier if you have made additional payments that reduce the principal balance of your mortgage to 80 percent of the original value of your home. For this purpose, “original value” generally means either the contract sales price or the appraised value of your home at the time you purchased it, whichever is lower (or, if you have refinanced, the appraised value at the time you refinanced).

How much down do you have to pay for PMI?

You typically are required to pay PMI if you put less than 20% down.

How much down payment do I need to avoid PMI?

Typically you'll need to make a 20% down payment to avoid PMI on a conventional mortgage. Even if private mortgage insurance is required to close your home loan, you can get rid of PMI later.

How much is PMI?

The average cost of private mortgage insurance, or PMI, for a conventional home loan ranges from 0.58% to 1.86% of the original loan amount per year, according to Genworth Mortgage Insurance, Ginnie Mae and the Urban Institute. The calculator estimates how much you'll pay for PMI, which can help you determine how much home you can afford.

What percentage of down payment is required for PMI?

If this percentage is under 20% , it’s likely that you’ll have to pay for private mortgage insurance.

How does credit score affect PMI?

Your credit score, debt-to-income ratio and loan-to-value ratio, or LTV, can affect your PMI rate. Borrowers with low credit scores, high DTIs and smaller down payments will typically pay higher mortgage insurance rates. Building your credit score, paying down debt and putting down as much as you can afford may reduce your PMI costs.

What is the average PMI rate for a mortgage?

If you’re not sure what your mortgage insurance rate will be, choose a rate somewhere in the middle of the typical range — 0.58% to 1.86%. Enter a loan term. The 30-year term is the most common, especially among first-time home buyers.

What is down payment on a home?

Enter a down payment amount. This is the amount of cash you plan to pay upfront for the home.

How much down do I need to pay for PMI?

You can avoid paying PMI by putting 20 percent down on the loan, but you’ll also be able to ditch PMI once you reach 20 percent equity in your house.

How much PMI do I pay at closing?

Unless you pay 20 percent down at closing, if you have a conventional loan you’ll pay PMI. Each year, this will add around 0.03 to 1.5 percent to your mortgage payments. You can request that your lender cancel PMI once you have 20 percent equity in the home, but it’s important to monitor this and make sure it gets done.

What happens if you pay PMI and you do nothing?

The good news is, if you pay PMI and you do nothing whatsoever, your mortgage company eventually will automatically remove it. Under the Homeowners Protection Act, lenders are required to cancel PMI once a mortgage reaches the 78 percent mark. You’ll need to be current on your payments for this to happen.

How much equity do you need to remove mortgage insurance?

If you’ve calculated and determined you have at least 20 percent equity in your home, your next step will be to request removal of your mortgage insurance. Your request must be in writing, and it must follow whatever requirements your lender has in place. This may include providing documentation that there are no liens on your home.

How to keep an eye on your equity?

The easiest way to keep an eye on your equity is to routinely use one of the many mortgage calculators available online . Just plug in some numbers and you’ll have your answer. Your mortgage company should send you an annual statement that lets you know your remaining balance, and the calculator will tell you the percentage you have paid toward PMI removal.

What happens if property values drop?

In other words, if property values in your area have dropped since you moved in, you could face a rejection. Some lenders may even require you to have an appraisal done in order to document your home’s value if you’re requesting that PMI be removed.

When can I cancel my PMI?

So, even if you don’t get that autocancellation, your PMI should be canceled at the 15-year mark if you have a 30-year loan. If your loan is classified as one with high risk, you may have to attain a higher percentage of equity before you can stop paying PMI.

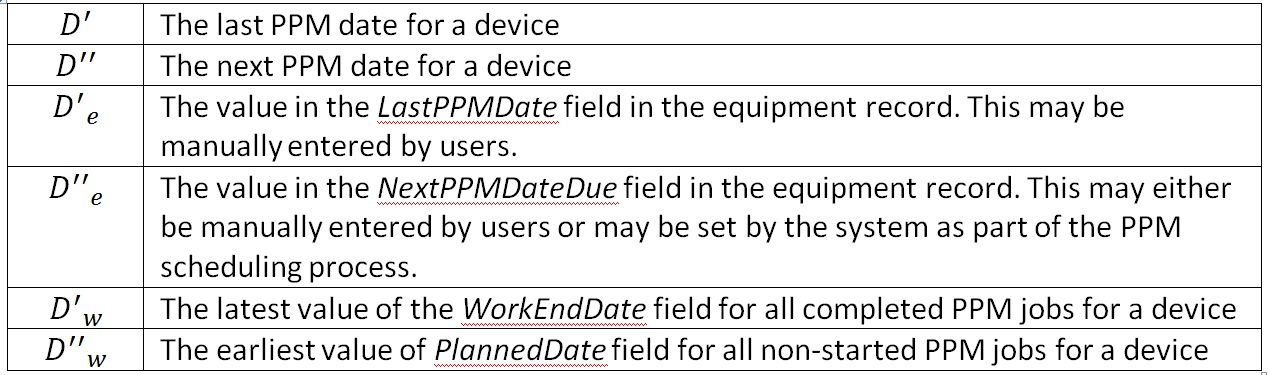

Monthly private mortgage insurance

The most common PMI plan is the borrower's monthly PMI premium. The following PMI chart illustrates the calculation variables for the borrower paid PMI cost.

Monthly PMI calculation

Now that you found the monthly PMI premium, you need to calculate the monthly cost. Staying with the previous example, the loan amount was $95,000 and the credit score is 720.

Annual mortgage insurance premium

Another mortgage insurance option is to have the borrower's annual premium paid once a year (every 12 months).

Single premium mortgage insurance

This mortgage insurance plan pays the entire cost of the mortgage insurance in one lump sum at settlement. The upfront cost is considerably higher than the other MI plans, however, this plan completely eliminates the cost of the mortgage insurance over the life of the mortgage.

Split premium mortgage insurance

This mi program is a blend between the single plan and the monthly plan. There is a modest upfront charge and a reduced monthly premium. As with the single premium, the borrower is permitted to finance the upfront premium, or a third party can pay it. The monthly premium decreases as the upfront payment increases.

How much is PMI on a mortgage?

PMI fees vary, depending on the size of the down payment and the loan, from around 0.3 percent to 1.15 percent of the original loan amount per year. The easiest way to determine the rate is to use a table on a lender's website.

What is PMI insurance?

This article has been viewed 347,446 times. Private mortgage insurance (PMI) is insurance that protects a lender in the event that a borrower defaults on a conventional home loan. Mortgage insurance is usually required when the down payment on a home is less than 20 percent of the loan amount. Monthly mortgage insurance payments are usually added ...

How to calculate mortgage insurance payment?

First, determine the annual mortgage insurance amount. Do this by multiplying the loan amount by the mortgage insurance rate. Here, if the remaining value of your loan was $225,000 and the mortgage insurance rate was .0052 (or .52%) then: $225,000 x .0052 = $1170. Your annual mortgage insurance payment would be $1170.

How to calculate LTV?

The LTV ratio is calculated by taking the amount of money you borrowed on the loan and dividing it by the value of your property. The higher the LTV, the more your mortgage insurance will cost. For the purposes of this article, let's assume a loan amount of $225,000.

How to find the rate of a mortgage?

The easiest way to determine the rate is to use a table on a lender 's website . If you are already working with a lender, you can use the one on your lender's website. If you do not yet have a lender, you can still find a calculator online to estimate the rate. One such calculator can be found at mgic.com/ratefinder.

How much of your mortgage insurance do you have to pay before you can cancel it?

If you have an FHA loan, you need to have paid 22% of the mortgage before you can cancel the insurance. You also need to have made five years of monthly payments before it can be removed.

What is the most popular time period for mortgage insurance?

Shorter loans require lower rates of the mortgage insurance. However, a 30 year loan is the most popular time period. Similarly, fixed loans cost less than adjustable-rate loans.

How much do I pay for PMI?

Your property type, debt-to-income ratio (DTI) and home value may also influence how much you pay for PMI. As a general rule, you can expect to pay 0.5% – 1% of your total loan amount per year in PMI.

Why do I pay less on my PMI?

As a result, you’ll pay more in PMI. Your loan type: You’ll pay less for PMI if you have a fixed-rate loan. This is because fixed-rate loans are more predictable for lenders compared to adjustable rate mortgages.

What Is PMI?

Your lender requires PMI payments when you buy a home with a mortgage and bring less than 20% for a down payment. But what exactly is PMI and what protection does it afford you?

What Does PMI Cover?

PMI helps your lender avoid financial loss if you default on your loan. You don’t gain any type of coverage or benefit from PMI as the buyer outside of the ability to make a down payment lower than 20%. But you don’t have to pay for PMI forever – or even for the duration of your mortgage loan.

How much equity do I need to cancel my BPMI?

You can contact your lender and request that they cancel your BPMI once you’ve built 20% equity in your home. Many lenders will automatically do this once you reach 22% equity. You may want to make extra payments on your loan if you want to stop paying for PMI as soon as possible.

How to get rid of LPMI?

The only way to get rid of LPMI is to reach 20% equity and then refinance your loan. Choosing LPMI means you may have the option to pay all or some of your PMI costs at closing. You’ll get a lower interest rate if you make a partial payment toward your PMI.

What is the benefit of PMI?

As the buyer, the only benefit you get from PMI is the ability to buy a home without waiting until you have the money for a 20% down payment. There are two different types of PMI for conventional loans: borrower-paid mortgage insurance and lender-paid mortgage insurance. BPMI is the most straightforward, simple type of PMI.

How to get PMI off of a house?

You can also get starting removing PMI by proving to your bank that your home has appreciated enough to bring your LTV (Loan to Value) ratio down to 80%. In the same example as above, if your $100,000 house appreciates to $120,000 then your $90,000 mortgage is less than 80% of the home value. BUT... you have to get an appraisal to prove your homes appreciation.

How long does it take to remove PMI?

It can take 4-6 years for PMI to be automatically removed through option (1) above, or longer if the down payment was lower than 10%. Since home values have gone up so much recently, there are probably millions of people who have enough equity to remove their PMI via option (2), but may not know that they can.

How to track your home value on Zillow?

You can track your homes value (and the rest of your finances) for free with Personal Capital. Simply sign up for an account, enter your home as a new asset, and then you will see its Zillow Z-estimate displayed as below. Enter your mortgage as a separate account for the full picture. Then, enter the values you see on your Personal Capital dashboard into the Current Value field in the calculator above.

When does PMI get removed?

Most banks will automatically remove PMI when the loan balance has reached 78-80% of the value of the original purchase price. In other words, if someone buys a house for $100,000 and puts $10,000 down (giving you a $90,000 mortgage), once the mortgage is paid down to $80,000 the bank will automatically remove PMI.

Can I refinance my mortgage with 20% LTV?

Maybe this is obvious, but you can also refinance if you have built up enough equity so that your refinance loan will be over a 20% LTV. I wouldn't necessarily recommend this unless you also want to take cash out for other investments, or you can get a lower interest rate. If you do refinance, LendingTree is a good place to check for rates.

Can you remove PMI if the bar is green?

If one of the bars turns green and says "Yes", you should be able to remove your PMI. If they are both red, you'll see how much more equity you have to build before it can be removed. Here it is, the remove PMI calculator, or more accurately, the "When can I get rid of PMI calculator".

Is it hard to get rid of PMI?

After my first PMI payment, I knew I wanted to get rid of it as quickly as possible. It's actually not that hard to do, but the banks don' t make it easy to do quickly. Here's what I mean: