The annual compounding method uses the following formula: Total = [Principal x (1 + Interest)] ^Number of years The return on investment is obtained by deducting the principal amount from the total returns obtained using the above formula.

What is CAGR in business?

What is compound annual growth rate?

- CAGR stands for compound annual growth rate, and it is a measure of an investment's average past performance over a long period of time.

- CAGR doesn't predict how an investment will perform in the future.

- CAGR has its limitations and doesn't necessarily reflect an investment's actual performance.

How do you calculate bond return?

- Face/par value which is the amount of money the bond holder expects to receive from the issuer at the maturity date as agreed.

- Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond’s par value.

- Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly.

What is the annual compound rate of return?

The compound annual growth rate isn’t a true return rate, but rather a representational figure. It is essentially a number that describes the rate at which an investment would have grown if it had grown at the same rate every year and the profits were reinvested at the end of each year.

What is CAGR growth rate?

What is CAGR? The Compound Annual Growth Rate (CAGR) is the annualized rate of growth in the value of an investment or financial metric, such as revenue, over a specified time period. CAGR provides the growth rate as if the changes occurred evenly at the same rate over each individual period, so the CAGR effectively “smoothens” the growth rate.

How do you calculate compounded return?

Compound interest is calculated by multiplying the initial loan amount, or principal, by the one plus the annual interest rate raised to the number of compound periods minus one.

How do you return compound interest?

You can calculate compound interest with a simple formula. It is calculated by multiplying the first principal amount by one and adding the annual interest rate raised to the number of compound periods subtract one. The total initial amount of your loan is then subtracted from the resulting value.

How do compound returns work?

Compound interest occurs when interest gets added to the principal amount invested or borrowed, and then the interest rate applies to the new (larger) principal. It's essentially interest on interest, which over time leads to exponential growth.

How do investors get compounding returns?

When the value of a stock grows over time, an investor sees the potential to earn compound interest if those profits are reinvested. With cash dividend payments, compound returns are not automatic, as they are paid out in cash but an investor can add the payouts back in in order to potentially earn additional returns.

Where can I put my money to earn compound interest?

To take advantage of the magic of compound interest, here are some of the best investments:Certificates of deposit (CDs) ... High-yield savings accounts. ... Bonds and bond funds. ... Money market accounts. ... Dividend stocks. ... Real estate investment trusts (REITs)

What will 10000 be worth in 20 years?

With that, you could expect your $10,000 investment to grow to $34,000 in 20 years.

How quickly does compound interest work?

The Rule of 72 is an easy compound interest calculation to quickly determine how long it will take to double your money based on the interest rate. Simply divide 72 by the interest rate to determine the outcome. At a 2% interest rate, it would take 36 years to double your money.

What banks have compound interest accounts?

Compare savings accounts by compound interestNameAPYInterest compoundingQuontic Bank Money Market Finder Rating: 4.6 / 5: ★★★★★2.00%DailyUFB Rewards Money Market Account Finder Rating: 2.9 / 5: ★★★★★2.21%DailyFirst Citizens Online Savings0.03%DailyCIT Bank Money Market Finder Rating: 3.9 / 5: ★★★★★1.30%Daily9 more rows•7 days ago

Is compound interest a good thing?

Compound interest makes your money grow faster because interest is calculated on the accumulated interest over time as well as on your original principal. Compounding can create a snowball effect, as the original investments plus the income earned from those investments grow together.

How can I double my money without risk?

Below are five possible ways to double your money, ranging from the low risk to the highly speculative.Get a 401(k) match. Talk about the easiest money you've ever made! ... Invest in an S&P 500 index fund. ... Buy a home. ... Trade cryptocurrency. ... Trade options. ... How soon can you double your money? ... Bottom line.

Are ETF returns compounded?

The most common format here is for the fund to invest in stocks which pay dividends. It then uses those dividends to buy more shares of stock, so that during the following cycle you will receive more dividends (since you hold more shares). Exchange Traded Funds (ETFs) - Compound return ETFs are also common.

Do stocks compound monthly?

Compounding periods can be annual, monthly, or even daily, as is done with your savings bank accounts, where the interest is calculated as compound interest.

What does compound annual return mean?

The compounded annual return is the rate of return on your investment taking into consideration the compounding effect of the investment for each year. This is a much more accurate measure of performance than the average annual return.

Are stock returns compounded monthly?

Compounding periods can be annual, monthly, or even daily, as is done with your savings bank accounts, where the interest is calculated as compound interest.

How does investment compound interest work?

Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested, earning you more interest. As a wise man once said, “Money makes money. And the money that money makes, makes money.” Compound interest accelerates the growth of your savings and investments over time.

What is the average rate of return on compound interest?

Interest rate From January 1, 1970 to December 31st 2021, the average annual compounded rate of return for the S&P 500®, including reinvestment of dividends, was approximately 11.3% (source: www.spglobal.com). Since 1970, the highest 12-month return was 61% (June 1982 through June 1983).

How to calculate compound return?

To calculate the compound return on an investment, first figure out the factor by which the original investment multiplied, which is sometimes known as the total return. For example, if $1,000 became $3,200 in 10 years, then the multiplying factor (the total return) is 3,200/1,000 or 3.2. Next, take the 10th root of 3.2 (the multiplying factor) and you get a compound return of 1.1233498. (If you have forgotten your algebra, here’s a quick reminder – just compute 3.2 raised to the 1/10 power.) The fractional part of this value, .1233, is known as the annualized return. To check that this works, note that 1.1233498 raised to the 10th power equals 3.2.

What is 950% return?

To think of this in percentages, a 950% gain includes your initial investment of 100% (by definition) plus a gain of 8 50%.

Do you have to replace *cell* with the address of the cell?

Of course you will have to replace ‘*cell*’ by the appropriate address of the cell that contains the date on which you bought the security.

What are Compounding Investment Returns?

Compounding Investment returns is the ability of an asset to create earnings, which are then reinvested or remain invested with the objective of creating their own earnings, that is referred to as compounding.

How Do Investment Products offer Compound Returns?

In order to generate compound returns, an asset must fulfill a few fundamental requirements:

How Do Investors Earn Compound Returns?

Earning compound returns as an investor then means either investing in dividend stocks or selling some of your winners occasionally to realize those returns and then reinvest the money …or doing both.

Why is compounding a return more strategic?

The other way of earning those compound returns is a little more strategic because it involves selling some investments to buy others. The idea here is that you can’t earn a compound return on your investments until you reinvest that money, so earning a return then reinvesting it for a compounded return.

What is the best compound return investment?

Rental real estate is the best compound return investment I’ve used and you can build a million-dollar portfolio by putting your rents to work buying more properties. It takes more work than the other investments but this is one every investor should check out.

What is compound interest?

When most people talk about compound interest, they’re talking about their savings account. The interest paid by the bank on your savings adds up and earns interest every year.

What is the impact of compounding interest on savings?

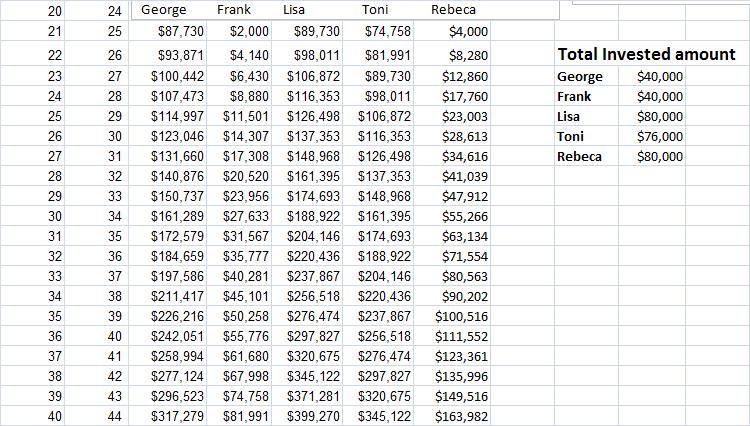

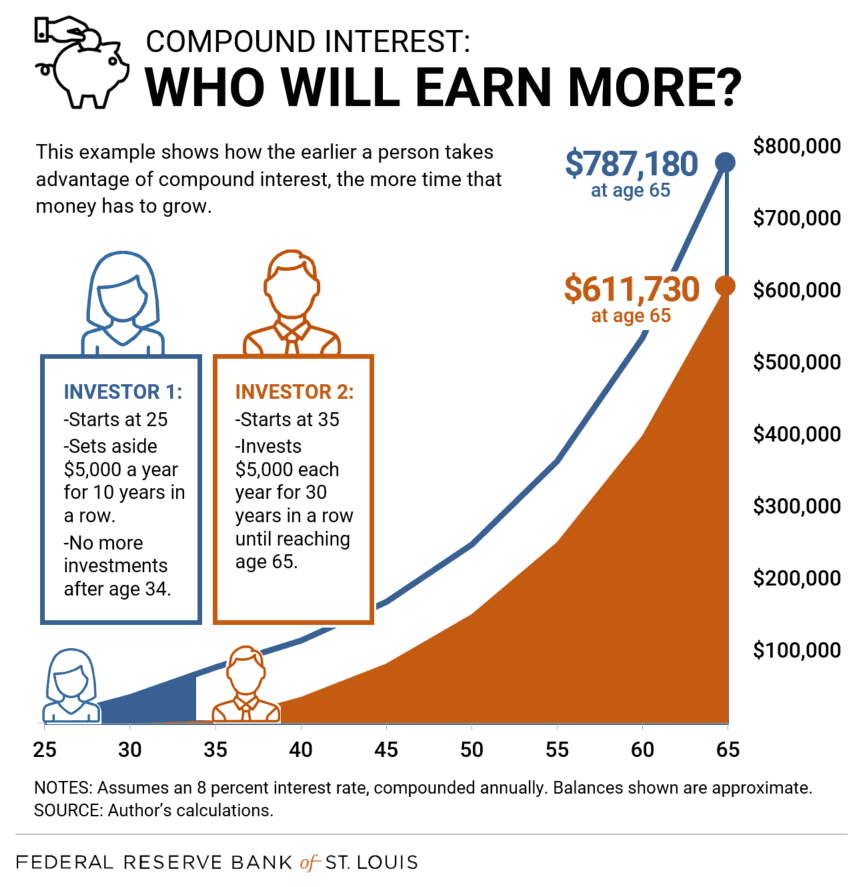

The amount you see at the end of your saving or investing time frame can be massively impacted by compounding interest. Several factors influence the value of compounded returns, including the time period, the interest or rate of return, the original investment or savings amount, and if additional contributions are made. To illustrate, consider how changes to the example above impact the end amount (see chart below).

What is compound interest?

Compound interest is the interest income that accrues on an initial sum of money and any accumulated interest over time. This might compare to what some call "simple interest," which is simply the interest that grows only on a principal amount.

What is the snowball effect of compounding?

This snowball effect of compounding makes early saving or investing, particularly in tax-advantaged retirement accounts, that much more enticing since the earlier you start investing, the more compounded returns you can hope to make.

Do stocks have higher returns?

Stocks have historically provided higher returns than less volatile asset classes. But keep in mind that there may be a lot of ups and downs and there is a generally higher risk of loss in stocks than in investments like bonds. Over the short term, the stock market is unpredictable, but over the long term, it has historically trended up.

Does higher number of years of saving/investing lead to higher compounded returns?

Higher number of saving/investing years can lead to higher compounded returns.