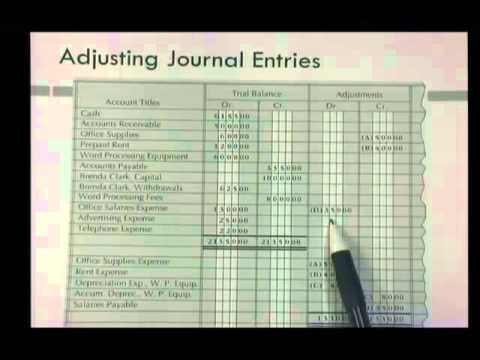

Some of the necessary steps for recording adjusting entries are:

- You must identify the two or more accounts involved One of the accounts will be a balance sheet account The other account will be an income statement account

- You must calculate the amounts for the adjusting entries

- You will enter both of the accounts and the adjustment in the general journal

Full Answer

How do you do adjusting entries in accounting?

Here are examples on how to record each type of adjusting entry.Step 1: Recording accrued revenue. ... Step 2: Recording accrued expenses. ... Step 3: Recording deferred revenue. ... Step 4: Recording prepaid expenses. ... Step 5: Recording depreciation expenses.

What is adjusting entries in accounting with example?

Examples include utility bills, salaries, and taxes, which are usually charged in a later period after they have been incurred. When the cash is paid, an adjusting entry is made to remove the account payable that was recorded together with the accrued expense previously.

What are the 5 adjusting entries?

Adjustments entries fall under five categories: accrued revenues, accrued expenses, unearned revenues, prepaid expenses, and depreciation.

What are the steps in adjusting the accounts?

The 8 Steps of the Accounting CycleStep 1: Identify Transactions. ... Step 2: Record Transactions in a Journal. ... Step 3: Posting. ... Step 4: Unadjusted Trial Balance. ... Step 5: Worksheet. ... Step 6: Adjusting Journal Entries. ... Step 7: Financial Statements. ... Step 8: Closing the Books.

What are the basic adjusting entries?

These entries are only made when using the accrual basis of accounting. There are three main types of adjusting entries: accruals, deferrals, and non-cash expenses. Accruals include accrued revenues and expenses. Deferrals can be prepaid expenses or deferred revenue.

How do you prepare an adjusting entry from a trial balance?

Here are the steps used to prepare an adjusted trial balance:Run an unadjusted trial balance. This provides an initial summary of your general ledger accounts prior to entering any adjusting entries.Make any adjusting entries that are needed. ... Run the adjusted trial balance.

Which of the following is an example of adjusting entry?

Recording the payment of wages to employees.

Why do we adjust journal entries?

Adjusting journal entries are used to adjust the financial statements and bring them into compliance with relevant accounting standards, such as GAAP or IFRS.

What is the main purpose of adjusting entries?

Adjusting entries may be made to correct errors, but their primary goal is to record passive transactions that may not be captured in operations. Adjusting entries reconcile inventories with the books, record depreciation, or note revenues earned on deposits paid by customers among other accrued activities.

What are the 4 types of adjusting entries?

Four Types of Adjusting Journal Entries Accrued expenses. Accrued revenues. Deferred expenses. Deferred revenues.

What is the first step in the analysis process involved in making an adjusting entry?

Three steps of preparing adjusting journal entries Step 1: Identify the original journal entries that have been made during the period. Step 2: Identify the correct account balances. Step 3: Analyze the differences between correct and current balances and prepare journal entries to adjust such differences.

What are the 4 closing entries?

The four closing entries are, generally speaking, revenue accounts to income summary, expense accounts to income summary, income summary to retained earnings, and dividend accounts to retained earnings.

What is an example of an adjustment?

The definition of adjustment is the act of making a change, or is the change that was made. An example of an adjustment is the time that it takes for a person to become comfortable living with someone else. The settlement of how much is to be paid in cases of loss or claim, as by insurance.

Which of the following is an example of adjusting entry?

Recording the payment of wages to employees.

What are the 4 types of adjusting entries?

Four Types of Adjusting Journal Entries Accrued expenses. Accrued revenues. Deferred expenses. Deferred revenues.

What are adjusting entries and why are they required?

Adjusting entries are necessary to update all account balances before financial statements can be prepared. These adjustments are not the result of physical events or transactions but are rather caused by the passage of time or small changes in account balances.

Why do you need to adjusting entries for a matching principle?

This is an accounting system called the accrual basis of accounting. The accrual basis of accounting states that expenses are matched with related revenues and are reported when the expense is incurred , not when cash changes hand . Therefore, adjusting entries are required because of the matching principle in accounting.

How many types of adjustments are there?

There are four specific types of adjustments:

What is accrual revenue?

Accruals: Revenues earned or expenses incurred that have not been previously recorded

When cash is received prior to earning revenue by delivering goods or services, the company records a journal entry to recognize?

When cash is received prior to earning revenue by delivering goods or services, the company records a journal entry to recognize unearned revenue.

What is interest expense?

Interest Expense Interest expense arises out of a company that finances through debt or capital leases. Interest is found in the income statement, but can also. for the month of December and include that value even though the expense was not actually paid (i.e., an exchange in cash).

When are adjusting entries made?

When adjusting entries are made? Adjusting entries are usually made at the end of an accounting period. They can however be made at the end of a quarter, a month or even at the end of a day depending on the accounting requirement and the nature of business carried on by the company.

What is the purpose of adjusting entries?

The purpose of adjusting entries is to assign appropriate portion of revenue and expenses to the appropriate accounting period. By making adjusting entries, a portion of revenue is assigned to the accounting period in which it is earned and a portion of expenses is assigned to the accounting period in which it is incurred.

What is an adjusting entry for accruing unpaid expenses?

Adjusting entries for accruing unpaid expenses: Unpaid expenses are expenses which are incurred but no cash payment is made during the period. Such expenses are recorded by making an adjusting entry at the end of accounting period. It is known as accruing the unpaid expenses.

How is cash recorded in accounting?

Such receipt of cash is recorded by debiting cash and crediting a liability account known as unearned revenue account. This procedure is known as postponement or deferral of revenue. At the end of accounting period the unearned revenue is converted into earned revenue by making an adjusting entry for the value of goods or services provided during the period.

What is an adjusting entry?

Definition and explanation: Adjusting entries (also known as end of period adjustments) are journal entries that are made at the end of an accounting period to adjust the accounts to accurately reflect the revenues and expenses of the current period. The preparation of adjusting entries is the fourth step of accounting cycle and comes after ...

What is the fourth step of the accounting cycle?

The preparation of adjusting entries is the fourth step of accounting cycle and comes after the preparation of unadjusted trial balance.

How is revenue recognized in accounting?

According to accrual concept of accounting, revenue is recognized in the period in which it is earned and expenses are recognized in the period in which they are incurred. Some business transactions affect the revenue and expenses of more than one accounting period. For example, a service providing company may receive service fee from its clients for more than one period or it may pay some of its expenses for many periods in advance. All revenue received or all expenses paid in advance cannot be reported on the income statement of the current accounting period. They must be assigned to the relevant accounting periods and must be reported on the relevant income statements.

Why do you adjust your entries in accrual accounting?

If you're using an accrual accounting system, money doesn't necessarily change hands at that time of the accounting entry; the purpose of adjusting entries is to show when the money was officially transferred, and to convert your real-time entries to entries that accurately reflect your accrual accounting system.

Why do we need to adjust entries?

The purpose of adjusting entries is to accurately assign revenues and expenses to the accounting period in which they occurred. Whenever you record your accounting journal transactions, they should be done in real time. If you're using an accrual accounting system, money doesn't necessarily change hands at that time of the accounting entry;

What are some examples of accrued expenses?

Accrued Expenses: A good example of accrued expenses is wages paid to employees. When a business firm owes wages to employees at the end of an accounting period, they make an adjusting entry by debiting wage expenses and crediting wages payable. Unearned Revenues: Unearned revenues refer to payments for goods to be delivered in ...

What is accumulated depreciation on the balance sheet?

The accumulated depreciation account on the balance sheet is called a contra-asset account , and it's used to record depreciation expenses. When an asset is purchased, it depreciates by some amount every month. For that month, an adjusting entry is made to debit depreciation expense and credit accumulated depreciation by the same amount.

What is accumulated depreciation?

Accumulated depreciation is the accumulated depreciation of a company's assets over the life of the company. The accumulated depreciation account on the balance sheet is called a contra-asset account, and it's used to record depreciation expenses. When an asset is purchased, it depreciates by some amount every month.

When are adjusted entries made in accounting journals?

Adjusting entries are made in your accounting journals at the end of an accounting period after a trial balance is prepared. After adjusted entries are made in your accounting journals, they are posted to the general ledger in the same way as any other accounting journal entry.

How to prepare an adjusted trial balance?

Prepare the Adjusted Trial Balance. After you make your adjusted entries, you'll post them to your general ledger accounts, then prepare the adjusted trial balance. This process is just like preparing the trial balance except the adjusted entries are used. Make sure to correct any errors you've found.

What is the purpose of adjusting entries?

The purpose of adjusting entries is to show when money changed hands and to convert real-time entries to entries that reflect your accrual accounting.

What is an adjusting entry?

Adjusting entries must involve two or more accounts and one of those accounts will be a balance sheet account and the other account will be an income statement account. You must calculate the amounts for the adjusting entries and designate which account will be debited and which will be credited.

What is depreciation in accounting?

Depreciation is the process of assigning a cost of an asset, such as a building or piece of equipment over the economic or serviceable life of that asset. Adjusting entries for depreciation are a little bit different than with other accounts. A company has to consider accumulated depreciation. Accumulated depreciation refers to ...

What is an adjustment journal entry?

Adjusting journal entries are accounting journal entries that update the accounts at the end of an accounting period. Each entry impacts at least one income statement account (a revenue or expense account) and one balance sheet account (an asset-liability account) but never impacts cash.

How often are contra-asset accounts recorded?

In the contra-asset accounts, increases are recorded every month. Assets depreciates by some amount every month as soon as it is purchased. This is reflected in an adjusting entry as a debit to the depreciation expense and equipment and credit accumulated depreciation by the same amount.

What is accumulated depreciation?

Accumulated depreciation refers to the accumulated depreciation of a company’s asset over the life of the company. On a company’s balance sheet, accumulated depreciation is called a contra-asset account and it is used to track depreciation expenses. In the contra-asset accounts, increases are recorded every month.

What is adjusting entry for a service performed in one month but billed in the next month?

For any service performed in one month but billed in the next month would have adjusting entry showing the revenue in the month you performed the service.

What is an adjusting journal entry?

An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. It is a result of accrual accounting. and follows the matching and revenue recognition principles. Generally, adjusting journal entries are made for accruals and deferrals, as well as estimates.

What are the three types of adjusting journal entries?

The three most common types of adjusting journal entries are accruals, deferrals, and estimates.

What are non-cash items in accrual accounting?

There are also many non-cash items in accrual accounting for which the value cannot be precisely determined by the cash earned or paid, and estimates need to be made. The entries for the estimates are also adjusting entries, i.e., impairment of non-current assets, depreciation expenses, and allowance for doubtful accounts.

What is accrued expense?

An accrued expense is the expense that has been incurred (goods or services have been consumed) before the cash payment has been made. Examples include utility bills, salaries, and taxes, which are usually charged in a later period after they have been incurred. When the cash is paid, an adjusting entry is made to remove the account payable ...

What is bad debt expense journal entry?

Sometimes, at the end of the fiscal period, when a company goes to prepare its financial statements, it needs to determine what portion of its receivables is collectible. The portion that a company believes is uncollectible is what is called “bad debt expense.” The

What is a debit asset account?

When expenses are prepaid, a debit asset account is created together with the cash payment. The adjusting entry is made when the goods or services are actually consumed, which recognizes the expense and the consumption of the asset. Prepaid insurance premiums and rents are two common examples of deferred expenses.

When is an adjusting entry made?

When the cash is paid, an adjusting entry is made to remove the account payable that was recorded together with the accrued expense previously.

How Do I Make an Adjusting Entry?

Even though you are “adjusting” your business’s financial records, making an adjusting entry involves a proactive approach rather than a reactive one. This means that you will not need to go “back in time” to correct or alter any data. Instead, you will merely input a new entry with the “amended” data.

Why is it important to adjust entries?

Regardless of a business’s size, adjusting entries are important because they provide a reliable way of ensuring that financial statements remain: accurate, presentable, and in compliance with GAAP.

What is an adjustment in accounting?

Adjusting entries, also known as account adjustments, are entries that are recorded in a company’s general ledger at the end of a specified accounting period. This can be on a monthly, quarterly, or annual basis.

Why do businesses need to have an adjustment entry?

Adjusting entries exist to ensure that a business’s financial records remain accurate, presentable, and reliable, and are commonly a prerequisite to satisfying important Generally Accepted Accounting Principles (GAAP).

What is an unadjusted journal?

Accounts in a business’s entry journal are commonly established in an “unadjusted” format, and business owners or accountants then implement adjusting entries towards the end of an accounting period.

What is accrued revenue?

Accrued revenue is any revenue that your business has earned in a previous accounting time period but that you have not recognized until a later one.

How many steps are involved in the accounting cycle?

The accounting cycle involves eight steps. It begins as soon as a business transaction occurs and ends with “closing the books.”

What is an adjusting journal entry?

A business needs to record the true and fair values of its expenses, revenues, assets, and liabilities. Adjusting entries follows the accrual principle of accounting and make necessary adjustments which are not recorded during the previous accounting year. The adjusting journal entry generally takes place on the last day of the accounting year and majorly adjusts revenues and expenses.

When does an adjusting journal entry take place?

The adjusting journal entry generally takes place on the last day of the accounting year and majorly adjusts revenues and expenses.

What is an adjusted trial balance?

Adjusted Trial Balance Adjusted Trial Balance is a statement which incorporates all the relevant adjustments. Although it is not a part of financial statements, the adjusted balances are carried forward in the different reports that form part of financial statements. read more

When does Azon end its accounting year?

Azon ends its accounting year on June 30. The company took a loan of $100,000 for one year from its bank on May 1, 2018, @ 10% PA for which interest payments have to be made at the end of every quarter.

Is the end of the accounting period an adjusting entry?

Note: Not all end of the accounting period entries are adjusting entries. For example, entry for some purchases or sales made on the last day of the accounting period is a primary purchase-sales journal and not an adjusting entry.

Who needs to take care of this adjusting transaction before closing the accounting records of 2018?

The accountant of the company needs to take care of this adjusting transaction before closing the accounting records of 2018.

Can prepaid insurance be adjusted against income statement?

As per the accrual principle, only 1-month expenses can be adjusted against the income statement, and the remaining paid balance will increase the assets of the balance sheet as prepaid insurance. Prepaid Insurance Prepaid Insurance is the unexpired amount of insurance premium paid by the company in an accounting period.

An Example of Adjusting Entries

Four Types of Adjusting Journal Entries

- There are four specific types of adjustments: 1. Accrued expenses 2. Accrued revenues 3. Deferred expenses 4. Deferred revenues These adjusting entries are depicted in the following tables with specific examples and journal entries.

Additional Resources

- Hopefully this has been a helpful guide to adjusting entries, and in particular, the journal entries that are required. To keep learning and developing your career we recommend the additional CFI resources below: 1. Journal Entries 2. T Accounts 3. Income statement template 4. How to link the 3 statements