How Do I Calculate Ad Valorem?

- 1.. Learn the assessed value of your property. The tax assessor's office in most counties makes the assessment at the...

- 2.. Research local exemptions that may reduce the assessed value of your property. In California, for example, many...

- 3.. Find out the assessment rate. Many counties don't tax the total value of your property, according...

Who pays ad valorem taxes?

- Divide 9.5 / 1,000 to get 0.0095

- Multiply 0.0095 x 300,000 to get 2,850

- Your property taxes are $2,850

Is ad valorem deductible?

ad valorem. Gold watches ... the provision allowing a deduction for rent of houses should be stricken out, and people residing in their own houses should be charged with their rental value ...

How to see what is my ad valorem tax?

Visit

- Sunday: closed

- Monday - Friday: 8:00 a.m. - 4:30 p.m.

- Saturday: closed

Can you write off ad valorem tax?

You can deduct ad valorem taxes from your federal tax return if there is a state or local tax owed to the state and to the local government. A deduction cannot be claimed for any part except the ad valorem part. Taxes are claimed for periods that apply to them, which include both the current and previous tax years.

What is the formula for ad valorem tax?

How is ad valorem tax calculated? It is calculated by multiplying the property's assessed value with the tax rates applied. For example, if A buys a car worth $1000 and the rate applied is 4%, the tax applicable is 1000*4/100 = 1000*0.04 = $40.

What is ad valorem tax example?

Summary. An ad valorem tax is a tax that is based on the assessed value of a property, product, or service. The most common ad valorem tax examples include property taxes on real estate, sales tax on consumer goods, and VAT on the value added to a final product or service.

What percent is ga ad valorem tax?

6.6%The current TAVT rate is 6.6% of the fair market value of the vehicle.

What is ad valorem tax in simple terms?

What is an ad valorem tax? An ad valorem tax is a form of taxation based on the value of a transaction or a property, either real estate or personal property. It is generally calculated as a percentage of the value of the property, rather than on size, weight, or quantity. Ad valorem is Latin for “according to value.”

How is ad valorem property tax calculated quizlet?

Ad valorem taxes are based on the value of land and the improvements to the land. "Ad valorem" is a Latin term which means "according to valuation." The primary source of general revenues on which local governments operate normally is from _____ taxes.

What is ad valorem fees?

an ad valorem payment, rate, or tax is calculated according to the price of a product or service, rather than at a fixed rate: Companies receive subsidies in the form of simple ad valorem payments based on the size of their export sales.

How do I calculate my ad valorem tax in Georgia?

How is TAVT calculated? The TAVT is calculated by multiplying the fair market value by the rate in effect on the date of purchase. A reduction is made for the trade-in when the sale was made by a dealer, but not when the sale was made by a private individual.

How do you calculate sales tax on a car?

0:001:12How To Calculate Sales Tax - How To Find Out How Much ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe formula for calculating sales tax on something is sales tax equals the cost of the item. TimesMoreThe formula for calculating sales tax on something is sales tax equals the cost of the item. Times the sales.

How is tax tag and title calculated in GA?

Tax, title and license fees charged when purchasing a vehicle in Georgia are:Tax: 7% of the vehicle's Fair Market Value.Title: $18.License Registration: $20.

Is the ad valorem tax deductible?

You can deduct only the Ad Valorem Tax portion of the annual auto registration on your Federal Schedule A. The new Title Ad Valorem Tax (TAVT) does not appear to be deductible for Federal or Georgia purposes. In order to be deductible as a personal property tax, it must be imposed on an annual basis.

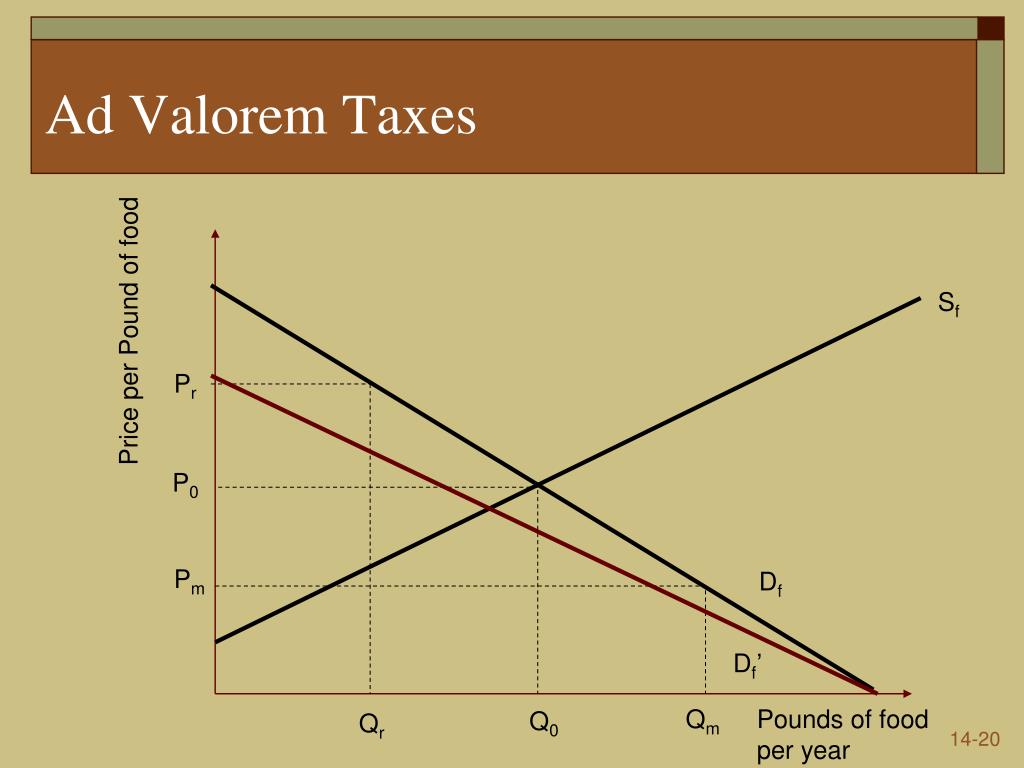

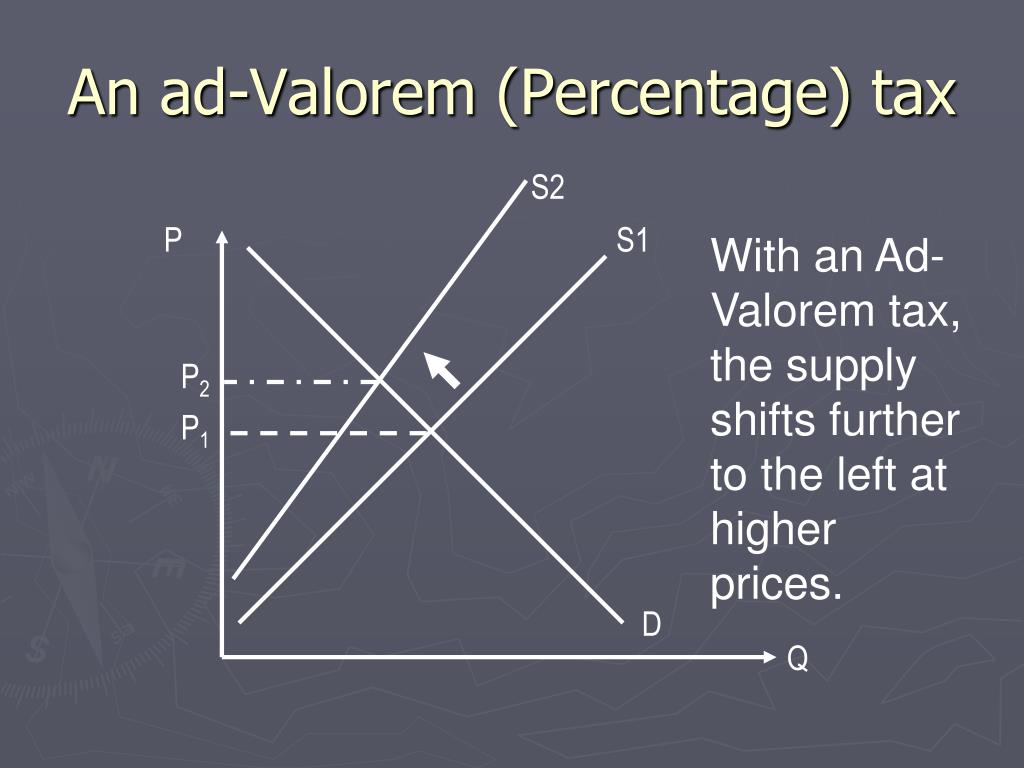

What is the difference between specific tax and ad valorem tax?

An ad Valorem tax places a proportionately higher tax on expensive goods. This can encourage consumers to switch from expensive alcohol and expensive cigarettes – to cheaper varieties. A specific tax increases the price of all equally and has a bigger effect on reducing overall demand.

Is income tax ad valorem tax?

Ad valorem taxes (mainly real property tax and sales taxes) are a major source of revenues for state and municipal governments, especially in jurisdictions that do not employ a personal income tax. Virtually all state and local sales taxes in the United States are ad valorem.

How is ad valorem tax computed?

The authorities then use the valuations to set a tax rate and impose an ad valorem tax on the property owners. This tax is computed by multiplying the assessed value ...

What is an ad valorem tax?

Summary. An ad valorem tax is a tax that is based on the assessed value of a property, product, or service. The most common ad valorem tax examples include property taxes on real estate, sales tax on consumer goods, and VAT on the value added to a final product or service. Ad valorem taxes comprise one of the primary sources of revenue for state, ...

What is property tax?

Property tax. Property tax is an ad valorem tax that the owner of real estate or other commercial and residential properties pays on the value of their property. The term “property” refers to land, personal property (such as a car or aircraft), and improvements to land (immovable man-made improvements). Tax authorities may hire evaluators ...

How does VAT differ from sales tax?

VAT differs from sales tax because the latter is charged on the total value of the goods or services. It is an indirect tax that is collected from a different party than the one who bears the cost of the tax.

What is sales tax?

Sales tax. Sales tax is a tax charged at the point of purchase of certain goods and services. The tax may be included in the price of the product or added at the point of sale. Sales tax is charged as a percentage by tax authorities.

What is fair market value?

The concept of fair market value refers to the estimated price of the property that a willing buyer and a willing seller, who both possess a reasonable knowledge of all facts about the property, would accept without being under any compulsion to buy or sell. The price should be a reasonable one for both parties.

Who determines the fair market value of a property?

Tax authorities often hire professional appraisers to determine the value of a property. They conduct a routine inspection of the property under consideration as part of the valuation process to calculate the fair market value.

What is ad valorem tax?

Key Takeaways. An ad valorem tax is a tax based on the assessed value of an item, such as real estate or personal property. The most common ad valorem taxes are property taxes levied on real estate. The Latin phrase ad valorem means "according to value.". So all ad valorem taxes are based on the assessed value of the item being taxed.

How does ad valorem work?

How Ad Valorem Tax Works. The Latin phrase ad valorem means "according to value.". 1 All ad valorem taxes are levied based on the determined value of the item being taxed. In the most common application of ad valorem taxes, which are municipal property taxes, the real estate of property owners is periodically assessed by a public tax assessor ...

What is property ad valorem?

Property ad valorem taxes —i.e. property taxes —are usually levied by local jurisdictions, such as counties or school districts. Ad valorem taxes are generally levied on both real property (land, buildings and other structures) and major personal property, such as a car or boat.

What is fair market value?

Fair market value is the estimated sales price of the property, assuming a transaction between a willing buyer and a willing seller who both have reasonable knowledge of all pertinent facts about the property, and in a situation where neither party has a compulsion to complete the transaction.

Who levies ad valorem taxes?

Property ad valorem taxes are usually levied by a municipality but may also be levied by other local government entities, such as counties, school districts, or special taxing districts, also known as special purpose districts. Property owners may be subject to ad valorem taxes levied by more than one entity; for example, ...

Can property owners pay ad valorem taxes?

Property owners may be subject to ad valorem taxes levied by more than one entity; for example, both a municipality and a county. Ad valorem property taxes are typically a major, if not the major, revenue source for both state and municipal governments, and municipal property ad valorem taxes are commonly referred to as simply "property taxes.". ...

When is ad valorem tax assessed?

Ad valorem taxes can be assessed once when an item is first purchased or brought across country lines. They also can be a periodic tax, as with real estate. Ad valorem taxes in the U.S. are often levied at the state, county, city, or school district levels.

How does ad valorem tax work?

How Ad Valorem Tax Works. Some ad valorem taxes will be assessed at different, recurring frequencies. For instance, you are charged sales tax just once when you purchase a product like the hair dryer mentioned. Property taxes, on the other hand, are often levied annually or quarterly on the same item.

What is the most common type of ad valorem tax?

The most common type of ad valorem tax in the U.S. is property tax —one of the main sources of revenue for local governments at the county or city level. One of the complex elements of ad valorem taxes is that not everyone agrees on the assessed values assigned to their property. To decide your tax rate, an official assessor evaluates your ...

What is ad valorem tax?

Updated June 17, 2021. Ad valorem taxes are taxes that are levied as a percentage of the assessed value of a piece of property. Examples of values that could be used to determine an ad valorem tax include the price of a product for a sales tax, or the assessed value of a home for a property tax. Ad valorem is Latin for “according to value,” ...

How does an assessor determine the tax rate?

To decide your tax rate, an official assessor evaluates your property—similar to how an appraiser would evaluate it during a home sale process—and reaches an assessed value. If the property is believed to be worth more now than in the past, your tax bill will rise.

What is an example of a tax that is not ad valorem?

An example of a tax that is not ad valorem would be a specific tax, such as 50 cents per gallon of gas. In this case, the assessed value of the gasoline wouldn’t have an impact on the total cost of the tax.

Is estate tax ad valorem?

There are, however, ad valorem taxes that are only assessed at a certain value or higher. For instance, the U.S. federal estate tax is an ad valorem tax on the value of the estate, but is levied progressively. This means there are higher percentages of tax owed depending on how much of the estate’s value is above the exemption rate, ...

What is ad valorem tax?

Ad Valorem tax simply means a tax charged by state and municipal governments that depends on the assessed value of the asset such as real assets or personal property.

What are some examples of ad valuem taxes?

It depends on the assessed value of the property. Some examples of Ad Valorem taxes are Property Tax, Sales Tax on consumer goods, and Value Added Tax on the final product. It is considered more progressive, but it is a bit complicated because sometimes assessing the value of a property can be a tough task.

What is VAT in business?

The VAT#N#VAT Value-added tax (VAT) refers to the charges imposed whenever there is an accretion to a product's usefulness or value throughout its supply chain , i.e., from its manufacturing to its final selling point. It is an indirect tax levied on the product consumption. read more#N#is charged on value added by business or labor. While sales tax is charged on the full value of the property, VAT is charged on value-added or profit by business. The VAT is usually charged on the consumer of the goods. For example, if a consumer is buying some goods, then he/she is paying VAT for the entire production process of those goods.

What is the tax base?

Tax Base Tax base refers to the total value of the income or assets of an individual or firm which is taxable by the government or the relevant taxing authority. This taxable amount is used to evaluate the tax liability of the individual or company. read more. for that district is $50 million, and the tax requirement is $2 million.

Who do tax authorities hire?

Tax authorities usually hire property evaluators to assess the value of a property and then charge tax based on that. For example, if a person has constructed a garage in its property, then though the size of the property has not been changed, the value of property gets increased, and tax authorities will charge tax based on that value.

Is sales tax a percentage?

In contrast to property tax, Sales tax is charged only at the time of purchase of a property. It is charged as a percentage to the value of a property—sales tax rates varied by country.

Is VAT a sales tax?

read more. is charged on value added by business or labor. While sales tax is charged on the full value of the property, VAT is charged on value-added or profit by business. The VAT is usually charged on the consumer of the goods.

Determining Ad Valorem Tax Values

- Fair market value of the property

Tax assessments for determining ad valorem taxes are calculated as of January 1st. The tax is levied as a percentage of the assessed property value, which is also known as the fair market value. The concept of fair market value refers to the estimated price of the property that a willin… - Valuation process

Tax authorities often hire professional appraisers to determine the value of a property. They conduct a routine inspection of the property under consideration as part of the valuation process to calculate the fair market value. Some of the determining factors of fair market value include t…

Examples of Ad Valorem Tax

- Ad valorem taxes often form the main sources of revenues for state and municipal governments. The government unit may require any business or individual owning an asset or doing business within its jurisdiction to pay ad valorem tax. The most common ad valorem taxes are:

Summary

- An ad valorem tax is a tax that is based on the assessed value of a property, product, or service. The most common ad valorem tax examples include property taxes on real estate, sales tax on consumer goods, and VAT on the value added to a final product or service. Ad valorem taxes comprise one of the primary sources of revenue for state, county, and municipal governments.

Other Resources

- CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™certification program, designed to help anyone become a world-class financial analyst. To keep learning and advancing your career, the additional CFI resources below will be useful: 1. Progressive Tax System 2. Permanent/Temporary Differences in Tax Accounting 3. Deferred Ta…