How to Make the Most Money When Selling Your Home

- Make sure you can afford to sell ...

- Work with a local real estate agent ...

- Set a competitive asking price ...

- Time it right ...

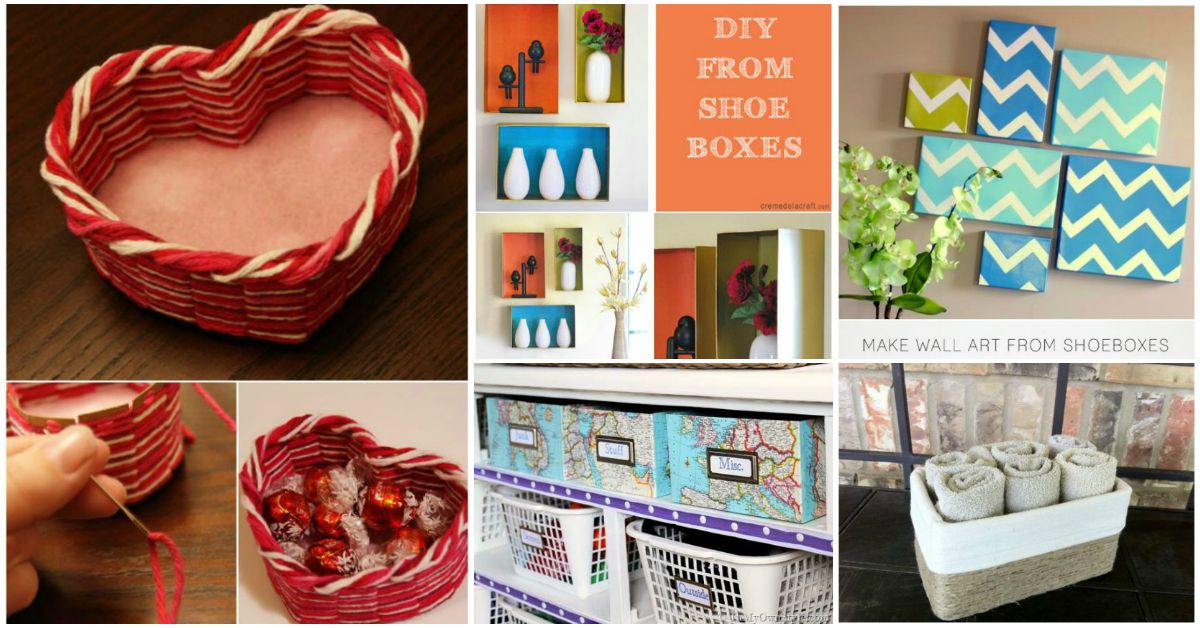

- Spruce up your home to help you sell for more ...

- Enhance your listing with staging and professional photography ...

- Carefully consider offers, and be prepared to negotiate ...

What is the best way to sell my house?

Spruce up your home to attract buyers (and possibly add to the price)

- Mowing the lawn

- Cleaning your windows

- Getting your front door and driveway spick and span

- Well-maintained fences and walls

How to sell your home fast in 12 Easy Steps?

- Send potential buyers to your buyers’ website (via the url in your ad)

- Let technology (like iFlip) send the PDF to the buyer with all the details automatically

- Program/setup your autoresponder to automatically build rapport, sift & sort, and warm up buyers for future deals

When is the best time to sell your house?

You should wait to sell if:

- You’re unable to afford a new home at current prices.

- Your income is unstable or you have bad credit and need a mortgage to buy a home.

- Your home needs significant repairs or upgrades.

What is required to sell my own house?

- You don’t have the time or resources to revamp or clean your home

- Your property has been disused for years and requires extensive repairs

- The paperwork involved in the process is too time-consuming

- Buyers keep backing out of bank loans

- People withdraw their offers

- You need to sell your home as quickly as possible

How does the money work when you sell your house?

Selling A House FAQ Once your house sells, the amount of money the buyer purchased it for is used to pay off your remaining mortgage, the seller's and buyer's agents' commission, and any other fees or taxes from the transaction. After that, any money left over is profit and becomes yours.

When you sell a house do you get the money the same day?

A wire transfer can take between 24 to 48 hours to process, but is usually available in your account within one business day. Meanwhile, a paper check could be available right at the time of closing but will need to be deposited and cleared, and a bank can often hold that deposit for up to seven days.

How long after you sell your house do you get your money?

The standard settlement period is six weeks, although this can vary.

When you sell a house do you get all the money?

You'll have to cover the remainder of your loan out of the proceeds of the sale. For example, if you owe $400,000 on your mortgage and sell your home for $500,000, you'll have to give at least $400,000 right back to the lender. You'll likely have to add prorated interest you've accrued to the total balance, too.

How long does a bank transfer from Solicitor take?

Depending on the method of payment used this could happen on the same day as the money was transferred or it could take up to 4 working days if a cheque has been used. Your solicitors will normally aim to get your money to you within 24 hours of the sale being settled and completion occurring.

What not to do after closing on a house?

7 things not to do after closing on a houseDon't do anything to compromise your credit score.Don't change jobs.Don't charge any big purchases.Don't forget to change the locks.Don't get carried away with renovations.Don't forget to tie up loose ends.Don't refinance (at least right away)

How long does a wire transfer take after closing?

Domestic wire transfer: Due to EFAA regulations, most bank-to-bank wire transfers between accounts in the U.S. are completed within 24 hours. Some banks make wired funds available to recipients immediately, especially on transfers between accounts at the same institution.

Do you pay taxes when you sell a house?

If you owned and lived in the home for a total of two of the five years before the sale, then up to $250,000 of profit is tax-free (or up to $500,000 if you are married and file a joint return). If your profit exceeds the $250,000 or $500,000 limit, the excess is typically reported as a capital gain on Schedule D.

How Much Money Do You Get When You Sell Your House?

Once you’ve factored in all the money you had to spend actually selling your house, you’ll be left with the net proceeds. So in general, the net proceeds will be the sale price minus your sale prep costs, closing costs, or the amount of your mortgage payoff.

Other Common Expenses

In addition to the above factors, there are other elements that buyers should keep in mind as they’re figuring out how much money they’ll make from their sale.

How to Start Calculating Your Profit

Once you think you have a good grasp on the charges you can expect it will be much easier to estimate your sales proceeds. First, you should consider the value of your home. The home’s location and market conditions will factor into this, as well the overall quality and upkeep of the house.

Getting Professional Help

The truth is, crunching the numbers on your own can be stressful and time-consuming, and it’s pretty important to get it right. When you try to do it on your own, you can run the risk of miscalculating and throwing your budget off track.

How much does a home owner spend on selling a house?

According to a Zillow and Thumbtack analysis, the average U.S. homeowner spends $20,871 in extra or “hidden” costs related to selling a home. Your net proceeds can be impacted by many different types of costs, which should be subtracted from the sale price.

How to determine the value of a home?

1. Determine home value and potential sale price. The typical U.S. home has an estimated value of $226,300, but the value of your home may be much higher or lower depending on factors like the quality of the home, location and local market conditions. Your first step is determining the fair market value of your home.

What are closing costs?

“Closing costs” is an umbrella term for a wide variety of charges, taxes and fees required to close the sale of a home. Here are some of the most common expenses: 1 Commissions 2 Title insurance 3 Transfer tax 4 Escrow fees 5 Prorated property taxes 6 HOA fees 7 Mortgage points (also called discount points) 8 Attorney fees

What does it mean when you have less equity in your home?

The less equity you have, the higher your mortgage payoff amount in relation to your sale price. Fewer than 10% of U.S. homeowners are in negative equity in their home, which is also called being underwater. This means that they owe more money than their home is worth.

What is the payoff amount for a mortgage?

The mortgage payoff amount is how much you still owe on your home. You should also include paying off any home equity loans or lines of credit you’ve taken against the property. If you’ve owned your home for a long time or if your home value has increased significantly, your mortgage payoff amount will be substantially lower than your sale price (which means more money in your pocket).

How much does it cost to move out of your home?

Factor in how much it will cost to move out of your home, including things like truck rentals, professional movers, packing materials, storage and temporary housing costs. Local moves of under 100 miles with two movers and one truck usually cost between $80 and $100 per hour, plus an additional $25 or $50 per hour for additional movers.

How much does a discount broker owe?

If you opt for a discount broker, you might owe slightly less (4% to 5%), depending on the scope of their services. You can also save on agent commission by selling for sale by owner (FSBO), but you may still have to pay 3% to the buyer’s agent.

Why do buyers put money on the market?

The buyers part with this money to show the seller they are committed to buying the property, and to prove they can back up their offer with money. The seller then takes the property off the market. And this first payment will be put toward the total cost of the home.

Who divvies up the proceeds from a sale?

The closing agent (escrow) will divvy up the proceeds from the sale. Of which, if there is a mortgage, that bank will get what is needed to pay the loan in full, the agents commissions, any service providers that are being paid from closing proceeds, as well as the seller to get whats left over. This is all spelled out in ...

How does the down payment go down?

Here’s how it goes down: The buyers make the remaining down payment—minus earnest money—at closing. This is also when closing costs are paid.

What is escrow in real estate?

Escrow provides the third party mechanism by which all monies in a real estate transaction are handled fairly and according to the purchase agreement. Escrow provides for all parties to pay or be paid on a specific date (the closing date).

What does escrow pay after closing?

Immediately after the transaction closes, escrow pays the seller the full purchase price in the form of a cashier’s check or wire transfer—minu s any fees, taxes, or real estate commissions, which the seller is required to pay. (See more on wire transfers below.)

What happens if you cancel a sale for no reason?

However, if the buyers flake, cancel the sale for no legitimate reason, or miss key dates in the contract, the seller may have the right to keep the money.

How long does it take to close a home loan?

The entire closing process can take anywhere from 30 days to three months, but the average time is 50 days. Closing occurs when all of these steps have been completed and the loan is approved.

What questions do most homeowners have when selling a home?

A common question most homeowners have when selling a home is: How much of the proceeds should I plan to lose to taxes? Thanks to favorable tax laws, the answer is a lot less than you may think.

How long do you have to own a house to qualify for a home equity loan?

To qualify, you must have owned your house for two years and have used it as your main residence for at least two of the five years prior to your date of sale. If you owned and lived in the home for less than a year, you will likely owe taxes known as short-term capital gains.

How much does a nursing home cost in 2020?

That has partly to do with the average life expectancy increasing but also the increase of care trends. The average annual cost of a private room in a nursing home jumped from $65,185 in 2004 to $105,850 in 2020, and the cost of a home caretaker jumped from $38,095 to $53,768, according to a survey by Genworth.

What to do before you get paid for a home sale?

Before you get paid: Get through closing. Negotiations, the home inspection, more negotiations, the home appraisal, even more negotiations—this is everything you’ll have to go through (plus some!) to receive your home sale proceeds.

How to get money in your hands and get out the door?

According to Smith, the fastest way to get the money in your hands and get out the door is by a good, old-fashioned check.

What do you bring to a closing table?

Your real estate agent will bring the closing documents that you need to sign. But there are some things that you’re on the hook for as well. To make it through closing quickly and get paid on time, don’t forget to bring these things to the closing table: Your photo ID. Receipts of repairs made after the inspection.

What should a check reflect on a home sale?

The check should reflect your net proceeds, or the total amount you take away from selling the home after accounting for your mortgage payoff, fees, and taxes as outlined in your seller’s settlement statement.

How to get money out of your hands?

According to Smith, the fastest way to get the money in your hands and get out the door is by a good, old-fashioned check. “So if they’re taking their funds via check, they can take it with them at the closing table,” she says.

Do you have to show up for a deed meeting?

However, it’s not always necessary for the seller to show up. In the event that the listing agent can prepare to have you sign the deed and transfer documents ahead of time, you might be able to skip the meeting altogether. (Talk to your agent about what they recommend for your situation).

Do you get paid after closing on a $300000 home?

Sorry to burst your bubble—if you sold your home for $300,000, you aren’t going to get paid $300,000 after closing. There are fees (also known as closing costs) that come with selling a home. Let’s break it down.

How to figure out how much you can afford to buy a house?

Trying to figure out how much you can reasonably spend on a house? Use SmartAsset’s home affordability calculator. This takes into account your annual income, including your debt payments, to determine how much house you can afford.

How much is tax free on a house sale?

If you’ve lived in your house for two of the five years directly before the sale, the first $250,000 of any profit you make on the home is tax-free. The tax-free amount increases to $500,000 if you are married and you and your spouse file a joint tax return.

How long do you have to own a home to qualify for a tax break?

You must have owned the home you are selling for at least two years. If you’ve owned the home for less time, you do not qualify for the tax break.

Do you have to pay taxes on a sale of a home?

The Bottom Line. While it’s possible you’ll have to pay taxes on the sale of your home, chances are you won’t have to . If you meet a few simple requirements, up to $250,000 of profit on the sale of your home is tax-free. This figure jumps to $500,000 if you are a married couple filing jointly.

Is selling a house for profit a tax issue?

Selling a home for profit can sometimes create a complicated tax situation. We discuss the rules surrounding capital gains taxes on selling a house.

Is selling a house a major change?

Or, perhaps, you’re buying a housein a different part of the country because of a new job. No matter what your reason is, selling the place you’ve called home is a big deal.

Do you get a tax break if you own a second home?

If you’ve owned the home for less time, you do not qualify for the tax break. You must have used the home as your primary residence for at least two of the past five years. This means that second homes, such as vacation homes and pure rental properties, will likely not qualify for this tax break.