Gross Margin Ratio Conclusion

- Gross margin ratio is an economic term that describes how much profit a business makes per revenue generated.

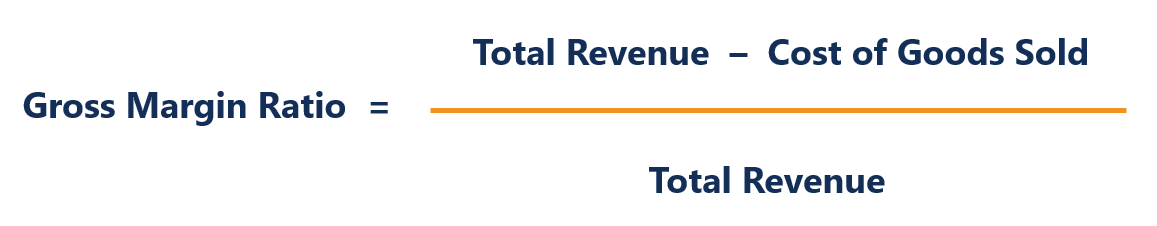

- This formula can be calculated by dividing the gross profit by the net sales.

- Gross margin ratio is fundamental for business managers in making decisions like budgets, pricing, and forecasts.

How do you calculate gross margin in accounting?

The gross margin is mostly expressed as a percentage and is calculated by dividing the gross profit of a company by its net sales or revenue. It is a ratio that expresses the percentage of each dollar (or any other currency that is used by the company) made that the company retains as profit.

What is the gross profit margin ratio?

The gross profit margin ratio, also known as gross margin, is the ratio of gross margin expressed as a percentage of sales. Gross margin, alone, indicates how much profit a company makes after paying off its Cost of Goods Sold. It is a measure of the efficiency of a company using its raw materials and labor during the production process.

What is the difference between gross margin and net margin?

The gross margin represents the amount of total sales revenue that the company retains after incurring the direct costs associated with producing the goods and services sold by the company. The net profit margin is the ratio of net profits to revenues for a company or business segment.

How do analysts use gross profit margin?

Analysts use gross profit margin to compare business models with competitors. More efficient or higher premium companies see higher profit margins. For example, if you have two companies that both make widgets and one company can make the widgets for a fifth of the cost in the same amount of time, that company has the edge on the market.

How do you analyze gross margin ratio?

How do you calculate gross profit margin? The gross profit margin is calculated by subtracting direct expenses or cost of goods sold (COGS) from net sales (gross revenues minus returns, allowances and discounts). That number is divided by net revenues, then multiplied by 100% to calculate the gross profit margin ratio.

What does a high gross margin ratio mean?

A high gross profit margin indicates that a company is successfully producing profit over and above its costs. The net profit margin is the ratio of net profits to revenues for a company; it reflects how much each dollar of revenue becomes profit.

Is a higher gross margin ratio better?

A higher gross profit margin indicates that a company can make a reasonable profit on sales, as long as it keeps overhead costs in control. Investors tend to pay more for a company with higher gross profit.

What does the gross profit ratio tell us?

The gross profit ratio shows the proportion of profits generated by the sale of products or services, before selling and administrative expenses. It is used to examine the ability of a business to create sellable products in a cost-effective manner.

What does a low gross profit ratio mean?

A low gross profit margin means your ratio percentage is below industry norms and potentially down from your company's prior periods. In essence, you aren't generating strong sales prices relative to your cost of goods sold, or COGS, which are your costs to make or acquire products.

How do you know if a company is profitable?

A profit and loss statement, also called an income statement, revenue statement, P&L statement or simply P&L, can help you determine your business's overall financial standing. It's one of the three main financial statements for businesses — the other two are the balance sheet and cash-flow statement.

What is a good profit margin ratio?

10%What is a Good Profit Margin? You may be asking yourself, “what is a good profit margin?” A good margin will vary considerably by industry, but as a general rule of thumb, a 10% net profit margin is considered average, a 20% margin is considered high (or “good”), and a 5% margin is low.

What increases gross margin ratio?

Reduce the cost of goods sold without changing your selling price. A decrease in cost of goods sold will cause an increase in gross profit margin. Finding lower-priced suppliers, cheaper raw materials, using labor-saving technology, and outsourcing, are some ways to lower the cost of goods sold.

Do you want a high gross profit margin?

But in general, a healthy profit margin for a small business tends to range anywhere between 7% to 10%. Keep in mind, though, that certain businesses may see lower margins, such as retail or food-related companies. That's because they tend to have higher overhead costs.

What is a gross margin ratio?

A gross margin ratio is an economic term that describes how much profit a business makes per revenue generated. It is a ratio that gives a snapshot...

How do you calculate gross margin ratio?

To calculate the gross margin ratio, divide the gross profit by the net sales. The formula looks like this: Gross Margin Ratio = Gross Profit / Net...

What is a good ratio of gross margin?

Analysts generally consider a gross margin ratio of 50-70% to be good.

What does the gross margin ratio represent?

The gross margin ratio is a profitability ratio that compares the gross profit to the net sales. The ratio measures how profitable a company sells...

How can a company improve its gross margin ratio?

A company can improve its gross margin ratio by finding cheaper inventory, as this will translate to a cheaper cost of production. The company can...

What is a gross margin ratio?

Also known as "gross profit margin," gross margin ratio is a profitability ratio determined by dividing the amount of a company's gross profit by the amount of its net sales. This translates into the following equation:

How to interpret results

The results of the gross margin ratio represent the percentage of each dollar of revenue a business retains as gross profit. Businesses use their findings with the gross margin to evaluate how production costs relate to their revenues.

Examples of gross margin ratio

Here are some examples that display how to find the gross margin ratio:

What is Gross Profit Margin?

The gross profit margin (also known as gross profit rate, or gross profit ratio) is a profitability metric that shows the percentage of gross profit of total sales.

How does gross margin affect sales?

The gross profit margin may be improved by increasing sales price or decreasing cost of sales. However, such measures may have negative effects such as decrease in sales volume due to increased prices, or lower product quality as a result of cutting costs.

What is a high ratio?

the higher the GP margin, the better; a high ratio means that the company makes huge gross profits to soak up operating and other expenses to come up with a net income.

What part of income statement is gross profit margin?

The gross profit margin uses the top part of an income statement.

Is gross profit higher in year 2 or year 2?

Notice that in terms of dollar amount, gross profit is higher in Year 2. Nonetheless, the gross profit margin deteriorated in Year 2. The cost of sales in Year 2 represents 78.9% of sales (1 minus gross profit margin, or 328/1,168); while in Year 1, cost of sales represents 71.7%.

What is gross profit margin?

Gross profit margin measures company's manufacturing and distribution efficiency during the production process. It is a measurement of how much from each dollar of a company's revenue is available to cover overhead, other expenses and profits.

Why is gross profit margin important?

Gross profit margin can be used to compare a company with its competitors. More efficient firms will usually see a higher margin. Also, it provides clues about company's pricing, cost structure and production efficiency. Therefore, gross profit margin can be used to compare company's activity over time.

How to calculate gross margin percentage?

A company's gross profit margin percentage is calculated by first subtracting the cost of goods sold (COGS) from the net sales (gross revenues minus returns, allowances, and discounts). This figure is then divided by net sales, to calculate the gross profit margin in percentage terms.

What is gross margin?

Gross profit margin is a metric analysts use to assess a company's financial health by calculating the amount of money left over from product sales after subtracting the cost of goods sold (COGS). Sometimes referred to as the gross margin ratio, gross profit margin is frequently expressed as a percentage of sales.

What Does the Gross Profit Margin Tell You?

If a company's gross profit margin wildly fluctuates, this may signal poor management practices and/or inferior products. On the other hand, such fluctuations may be justified in cases where a company makes sweeping operational changes to its business model, in which case temporary volatility should be no cause for alarm.

Does product pricing affect gross margin?

Product pricing adjustments may also influence gross margins. If a company sells its products at a premium, with all other things equal, it has a higher gross margin. But this can be a delicate balancing act because if a company sets its prices overly high, fewer customers may buy the product, and the company may consequently hemorrhage market share.

How do we calculate gross margin?

Gross margin is revenue minus the cost of goods sold (COGS). Gross margin is sometimes used to refer to gross profit margin, which is revenue minus cost of goods sold (or gross profit) divided by revenue.

What Is Gross Margin?

Gross margin is net sales less the cost of goods sold (COGS). In other words, it's the amount of money a company retains after incurring the direct costs associated with producing the goods it sells and the services it provides. The higher the gross margin, the more capital a company retains, which it can then use to pay other costs or satisfy debt obligations. The net sales figure is gross revenue, less the returns, allowances, and discounts.

What is the difference between gross and net profit margin?

Gross margin helps a company assess the profitability of its manufacturing activities, while net profit margin helps the company assess its overall profitability.

What is net profit margin?

While gross margin focuses solely on the relationship between revenue and COGS, the net profit margin takes all of a business's expenses into account. When calculating net profit margins, businesses subtract their COGS, as well as ancillary expenses such as product distribution, sales rep wages, miscellaneous operating expenses, and taxes.

Why do companies use gross margin?

Companies use gross margin to measure how their production costs relate to their revenues. For example, if a company's gross margin is falling, it may strive to slash labor costs or source cheaper suppliers of materials. Alternatively, it may decide to increase prices, as a revenue increasing measure.

Which industries have higher gross margins?

The gross margin varies by industry, however, service-based industries tend to have higher gross margins and gross profit margins as they don't have large amounts of COGS. On the other hand, the gross margin for manufacturing companies will be lower as they have larger COGS.