Net present value (NPV) is an economic measure that adds all potential outflows and inflows of an investment in today's dollars. A positive NPV means the investment is worthwhile; an NPV of 0 indicates the inflows and outflows are balanced; and a negative NPV means the investment is not desirable.

How do you calculate the NPV?

What Is the Net Present Value (NPV) & How Is It Calculated?

- Cash Flows

- Discount Rate / Interest Rate

- Residual value

- Infinite Series of Cash Flows / Perpetuity

- Expected Market Value / Salvage Value as Residual Value

- Project Residual Value of 0

- Negative Residual Value due to Disposal Cost

- Calculate the Net Cash Flows per Period

- Set and Agree the Discount Rate

- Determine the Residual Value

How to calculate NPV with taxes?

NPV of the Investment The NPV of the investment in the asset is the sum of the present values of each of the cash flows. NPV = PV investment + PV depreciation + PV reduced costs NPV = -20,000 + 3,465 + 24,949 NPV = 8,414 The positive NPV means that the investment in the project should be undertaken. NPV and Taxes Example with a Salvage Value

What does NPV Tell Me?

Net Present Value Formula

- The R represents the net cash flow for each time period.

- The i is the discount rate that will be used to find the present value of the future cash flows. ...

- The n represents the time period you’re looking at to value the asset.

What are the advantages and disadvantages of NPV?

NPV Advantages and Disadvantages. The advantages of the net present value includes the fact that it considers the time value of money and helps the management of the company in the better decision making whereas the disadvantages of the net present value includes the fact that it does not considers the hidden cost and cannot be used by the company for comparing the different sizes projects.

How do you interpret NPV results?

A positive NPV indicates that the projected earnings generated by a project or investment—discounted for their present value—exceed the anticipated costs, also in today's dollars. It is assumed that an investment with a positive NPV will be profitable. An investment with a negative NPV will result in a net loss.

What is a good NPV value?

If a project's NPV is positive (> 0), the company can expect a profit and should consider moving forward with the investment. If a project's NPV is neutral (= 0), the project is not expected to result in any significant gain or loss for the company.

Is it better if NPV is higher or lower?

When comparing similar investments, a higher NPV is better than a lower one. When comparing investments of different amounts or over different periods, the size of the NPV is less important since NPV is expressed as a dollar amount and the more you invest or the longer, the higher the NPV is likely to be.

Is a high NPV good?

Investment Size A higher NPV doesn't necessarily mean a better investment. If there are two investments or projects up for decision, and one project is larger in scale, the NPV will be higher for that project as NPV is reported in dollars and a larger outlay will result in a larger number.

How do you interpret NPV and IRR?

If a project's NPV is above zero, then it's considered to be financially worthwhile. IRR estimates the profitability of potential investments using a percentage value rather than a dollar amount. Each approach has its own distinct advantages and disadvantages.

What does it mean when NPV is negative?

Additionally, a negative NPV means that the present value of the costs exceeds the present value of the revenues at the assumed discount rate. Any investment will produce a negative NPV if the applied discount rate is high enough.

Why does higher discount rate lower NPV?

Higher discount rates result in lower present values. This is because the higher discount rate indicates that money will grow more rapidly over time due to the highest rate of earning.

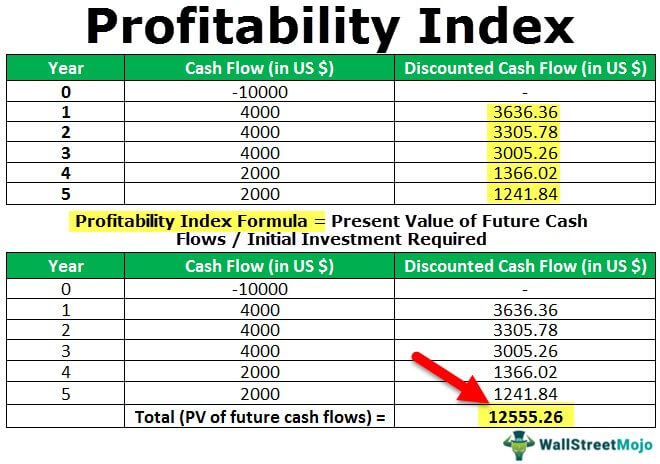

Is a higher profitability index better?

It is calculated as the ratio between the present value of future expected cash flows and the initial amount invested in the project. A higher PI means that a project will be considered more attractive.

Why does NPV go down as discount rate goes up?

NPV is the sum of periodic net cash flows. Each period's net cash flow -- inflow minus outflow -- is divided by a factor equal to one plus the discount rate raised by an exponent. NPV is thus inversely proportional to the discount factor – a higher discount factor results in a lower NPV, and vice versa.

Why is NPV important in capital budgeting?

There are two reasons for that. One, NPV considers the time value of money, translating future cash flows into today's dollars. Two, it provides a concrete number that managers can use to easily compare an initial outlay of cash against the present value of the return.

What is NPV analysis?

NPV analysis is a form of intrinsic valuation and is used extensively across finance. and accounting for determining the value of a business, investment security, capital project, new venture, cost reduction program, and anything that involves cash flow.

What is the NPV of a security?

For example, if a security offers a series of cash flows with an NPV of $50,000 and an investor pays exactly $50,000 for it, then the investor’s NPV is $0. It means they will earn whatever the discount rate is on the security. Ideally, an investor would pay less than $50,000 and therefore earn an IRR that’s greater than the discount rate.

What is XNPV function?

The XNPV function =XNPV () allows for specific dates to be applied to each cash flow so they can be at irregular intervals. The function can be very useful as cash flows are often unevenly spaced out, and this enhanced level of precision is required.

What are the two functions of net present value?

Excel offers two functions for calculating net present value: NPV and XNPV. The two functions use the same math formula shown above but save an analyst the time for calculating it in long form.

What does negative net present value mean?

If the net present value of a project or investment, is negative it means the expected rate of return that will be earned on it is less than the discount rate (required rate of return or hurdle rate#N#Hurdle Rate Definition A hurdle rate, which is also known as minimum acceptable rate of return (MARR), is the minimum required rate of return or target rate that investors are expecting to receive on an investment. The rate is determined by assessing the cost of capital, risks involved, current opportunities in business expansion, rates of return for similar investments, and other factors#N#). This doesn’t necessarily mean the project will “lose money.” It may very well generate accounting profit (net income), but since the rate of return generated is less than the discount rate, it is considered to destroy value. If the NPV is positive, it creates value.

What is the most commonly used method for evaluating investment opportunities?

While net present value (NPV) is the most commonly used method for evaluating investment opportunities, it does have some drawbacks that should be carefully considered.

Why is the first point necessary?

The first point (to adjust for risk) is necessary because not all businesses, projects, or investment opportunities have the same level of risk. Put another way, the probability of receiving cash flow from a US Treasury bill is much higher than the probability of receiving cash flow from a young technology startup.

What does NPV mean in investment?

If the NPV of a project or investment is positive, it means that the discounted present value of all future cash flows related to that project or investment will be positive, and therefore attractive.

What is NPV in capital budgeting?

NPV is used in capital budgeting to compare projects based on their expected rates of return, required investment, and anticipated revenue over time. Typically, projects with the highest NPV are pursued. For example, consider two potential projects for company ABC:

What is the net present value of a project?

Net present value (NPV) is a method used to determine the current value of all future cash flows generated by a project, including the initial capital investment. It is widely used in capital budgeting to establish which projects are likely to turn the greatest profit.

What Is NPV?

First of all, what exactly is NPV? Net present value (NPV) is defined as an investment measure that tells an investor whether the investment is achieving a target yield at a given initial investment. NPV also quantifies the adjustment to the initial investment needed to achieve the target yield assuming everything else remains the same. Formally, the net present value is simply the summation of cash flows (C) for each period (n) in the holding period (N), discounted at the investor’s required rate of return (r):

What does NPV mean?

There are only 3 possible categories NPV will fall into: Positive NPV. If NPV is positive then it means you’re paying less than what the asset is worth.

What is net present value?

The net present value is simply the present value of all future cash flows, discounted back to the present time at the appropriate discount rate, less the cost to acquire those cash flows. In other words NPV is simply value minus cost.

What is NPV in investment?

First of all, what exactly is NPV? Net present value (NPV) is defined as an investment measure that tells an investor whether the investment is achieving a target yield at a given initial investment. NPV also quantifies the adjustment to the initial investment needed to achieve the target yield assuming everything else remains the same. Formally, the net present value is simply the summation of cash flows (C) for each period (n) in the holding period (N), discounted at the investor’s required rate of return (r):

What does a negative NPV mean?

Negative NPV. If NPV is negative then it means that you’re paying more than what the asset is worth. Zero NPV. If NPV is zero then it means you’re paying exactly what the asset is worth. NPV Examples. Let’s take a look at a few examples to see exactly how to calculate and interpret the net present value or the NPV.

What is NPV in real estate?

What is NPV and How Does It Work? The Net Present Value, abbreviated simply as NPV, is one of the most important concepts in finance and commercial real estate. Compared to the Internal Rate of Return , the concept of NPV is easy to understand, yet it’s also still commonly misunderstood by many commercial real estate and finance professionals.

When is NPV equal to zero?

Why is this? Well, intuitively if you think about the IRR as the actual return you get from a given set of cash flows, and the discount rate as what you want the return to be from the same set of cash flows, then when these are both equal, NPV will be zero. This means what you want to earn on an investment (discount rate) is exactly equal to what the investment’s cash flows actually yield (IRR), and therefore value is equal to cost.

What is the NPV based on?

The calculation of the NPV is based on the discounting of all deposits and payouts caused by the particular investment.

What is NPV in investing?

The net present value (NPV) is an indicator for dynamic investment calculation. Investors use the NPV to determine the value of future deposits and payouts at the present time. In this way funds from different calculation periods for comparable and different investment opportunities can be weighed against each other with respect to their profitability.

What are the strengths and weaknesses of Net Present Value?

When calculating the NPV according to the method given above, all time intervals for the investment period are considered independently . The NPV method thus counts among the dynamic methods for accounting. Compared to static methods, this offers the advantage of modeling more complex circumstances, for example, different cash flows in the time intervals or a change in the discount interest rate.

What is investment calculation?

The investment calculation is used within the framework of investment planning and includes various calculation methods that enable a rational assessment of investment projects. In economics, we differentiate between static and dynamic investment calculations. While static methods are oriented toward a typical average year for investment, dynamic methods take into account the entire investment period. As a result, they also capture fluctuations in the deposits and payouts generated by the investment over the course of the various observation periods. The calculation of the net present value is one of the dynamic investment calculation methods.

Why is the present net value so popular?

The present net value enjoys great popularity, above all due to the relatively simple calculation method. The indicator is unambiguous and leaves no room for interpretation. However, critics question the net present value’s validity.

How to find net present value?

In order determine this, add the present values for all the investment period’s time intervals and then subtract the investment sum.

How is the present value of future payments determined?

The present value of future payments is determined through discounting. This allows to you reduce the amount by the interest income that an alternative investment in the same amount would generate over the respective period.

What does plotting NPV show?

Plotting this NPV Profile on a graph will show us the relationship between these projects. Using these points, we can also calculate the crossover rate, i.e., the rate at which the NPV of both projects is equal.

Where are NPV Profiles Used?

NPV (Net Present Value) profiles are used by the companies for capital budgeting. Capital budgeting Capital Budgeting Capital budgeting is the planning process for the long-term investment that determines whether the projects are fruitful for the business and will provide the required returns in the future years or not. It is essential because capital expenditure requires a considerable amount of funds. read more is the process that the business uses to decide which investments are profitable. The motive of these businesses is to make profits for their investors, creditors, and others. This is only possible when the investment decisions they make results in increasing the equity. Other tools used are IRR, profitability index, payback period, discounted payback period Discounted Payback Period The discounted payback period is when the investment cash flow paybacks the initial investment, based on the time value of money. It determines the expected return from a proposed capital investment opportunity. It adds discounting to the primary payback period determination, significantly enhancing the result accuracy. read more, and accounting rate of return.

What is the relationship between a discount rate and a NPV?

The relationship between the discount rate and NPV is inverse. When the discount rate is 0%, the NPV profile cuts the vertical axis. NPV profile is sensitive to discount rates. Higher discount rates indicate the cash flows occurring sooner, which are influential to NPV. The initial investment is an outflow as it is the investment in the project.

What happens if Project Y is taken up at higher rates?

Another important point to be considered is that if Project Y is taken up at higher rates, than the project will have a negative NPV and therefore be unprofitable

What is the deciding factor in a scenario where two projects are mutually exclusive?

Consider a scenario where there are two projects which are mutually exclusive. In this case, the discount rate becomes the deciding factor. In our above example, when the rates are lower, project B performs better. Lower rates are to the left of the crossover rate.

What is the crossover rate of Project A and Project B?

As discussed above, somewhere around 15% is the crossover rate. This is depicted in the graph where the two lines of Project A and Project B meet.

What is the deciding factor to differentiate between two projects?

If two projects are mutually exclusive, the discount rate is considered as the deciding factor to differentiate between the projects.

How to use NPV?

Step 2: Establish a series of cash flows (must be in consecutive cells). Step 3 : Type “=NPV (“ and select the discount rate “,” then select the cash flow cells and “)”.

What is NPV formula?

What is the NPV Formula? The NPV formula is a way of calculating the Net Present Value (NPV) of a series of cash flows based on a specified discount rate. The NPV formula can be very useful for financial analysis and financial modeling when determining the value of an investment (a company, a project, a cost-saving initiative, etc.).

What is NPV in Excel?

The main use of the NPV formula is in Discounted Cash Flow (DCF) modeling in Excel. In DCF models#N#DCF Model Training Free Guide A DCF model is a specific type of financial model used to value a business. The model is simply a forecast of a company’s unlevered free cash flow#N#an analyst will forecast a company’s three financial statements#N#Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows. These three core statements are#N#into the future and calculate the company’s Free Cash Flow to the Firm#N#Valuation Free valuation guides to learn the most important concepts at your own pace. These articles will teach you business valuation best practices and how to value a company using comparable company analysis, discounted cash flow (DCF) modeling, and precedent transactions, as used in investment banking, equity research,#N#(FCFF). Additionally, a terminal value#N#Terminal Value Terminal Value (TV) is the estimated present value of a business beyond the explicit forecast period. TV is used in various financial tools#N#is calculated at the end of the forecast period. Each of the cash flows in the forecast and terminal value are then discounted back to the present using a hurdle rate#N#Hurdle Rate Definition A hurdle rate, which is also known as minimum acceptable rate of return (MARR), is the minimum required rate of return or target rate that investors are expecting to receive on an investment. The rate is determined by assessing the cost of capital, risks involved, current opportunities in business expansion, rates of return for similar investments, and other factors#N#of the firm’s weighted average cost of capital ( WACC#N#WACC WACC is a firm’s Weighted Average Cost of Capital and represents its blended cost of capital including equity and debt.#N#).

How is TV used in financial tools?

is calculated at the end of the forecast period. Each of the cash flows in the forecast and terminal value are then discounted back to the present using a hurdle rate.

Can financial analysts calculate net present value?

Most financial analysts never calculate the net present value by hand nor with a calculator, instead, they use Excel.

What is the interest rate that makes the NPV zero?

Side Note: the interest rate that makes the NPV zero (in the previous example it is about 14%) is called the Internal Rate of Return.

What is net present value?

A Net Present Value is when you add and subtract all Present Values:

Is a positive net present value good or bad?

A Net Present Value (NPV) that is positive is good (and negative is bad).