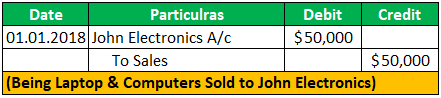

Journal entry for sold merchandise on account

- Perpetual inventory system We can make the journal entry for sold merchandise on account by debiting the sale amount into the accounts receivable and crediting the same amount into the sales revenue. ...

- Periodic inventory system ...

- Cash received for the sold merchandise on account ...

How do I make a sales journal entry?

The process you use to make a sales journal entry depends on how the customer is paying. Take a look at the process for making cash and credit sales journal entries below. When you sell something to a customer who pays in cash, debit your Cash account and credit your Revenue account. This reflects the increase in cash and business revenue.

What is a sales journal in accounting?

Definition and explanation The sales journal (also known as sales book and sales day book) is a special journal that is used to record all credit sales. Every transaction that is entered in sales journal essentially results in a debit to accounts receivable account and a credit to sales account.

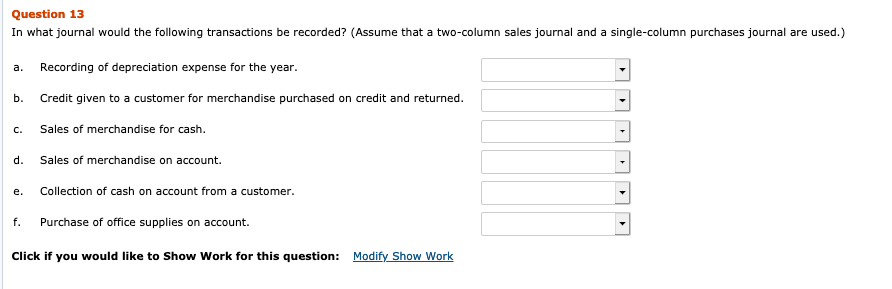

How to journalize transactions in accounting?

Below are the basic methods used to journalize transactions: Purchase journal: You will use this to record all purchases of inventory made on credit. Sales journal: This is where to record the credit sale of merchandise only Cash receipts journal: You will record all types of cash receipts here.

How to post sales journal to general ledger?

Posting to general ledger: At the end of each month or another appropriate period, the column totals of sales journal are posted to relevant general ledger accounts as follows: The total of accounts receivable & sales column is debited to accounts receivable account and credited to sales account in the general ledger.

Which journal is used to record a sales on account?

sales journalA sales journal is a specialized accounting journal and it is also a prime entry book used in an accounting system to keep track of the sales of items that customers(debtors) have purchased on account by charging a receivable on the debit side of an accounts receivable account and crediting revenue on the credit side.

How do you write a journal entry for sales?

Sales Account: When goods are sold, then it is represented as Sales A/c. Journal Entry: Example: Goods sold to Nupur on credit worth ₹2,000.

What is sales on account?

A sale on credit is revenue earned by a company when it sells goods and allows the buyer to pay at a later date. This is also referred to as a sale on account.

What do you debit when a sales on account is made?

At the time of sales on credit, accounts receivable accounts will be debited, which will be shown in the balance sheet of the company as an asset unless the amount is received against such sales, and the sales account will be credited, which will be shown as revenue in the income statement of the company.

What is sales journal example?

Example. The sales journal, sometimes called the credit sales journal, is used to record all sales made on account. The sales journal for the Fortune Store is shown below. All the sales on account for June are shown in this journal; cash sales are recorded in the cash receipts journal.

What is the journal entry for sales on credit?

In the case of credit sales, the respective “debtor's account” is debited, whereas “sales account” is credited with the equal amount....Journal Entry for Credit Sales.Debtor's AccountDebitTo Sales AccountCredit

Is sales on account an asset?

Nope. Sales is NOT a liability, and there is no accounting fiction. Sales are also not an asset. They are an income.

What is the journal entry for paid on account?

When a customer submits a payment on an account, your bookkeeper makes a journal entry of the amount and the transaction is considered "paid on account." This simply means the customer has made a payment – which goes in the accounts receivable ledger – on the full amount owed.

What is the journal entry for purchases on account?

A purchase credit journal entry is recorded by a business in their purchases journal on the date a business purchases goods or services on credit from a third party. The business will debit the purchases account and credit the accounts payable account in the business's Purchases journal.

Which account is debited when goods are sold on credit?

When goods are sold on credit, debtors which is an asset account is debited as money is receivable from the customers and sales which is a revenue account is credited.

What is the double entry for sales?

Double-entry bookkeeping means that every transaction entered both debits and credits different nominal codes. This means that your trial balance always balances. This article shows the debit and credit entries for each transaction type.

How are sales recorded in the general journal?

So a typical sales journal entry debits the accounts receivable account for the sale price and credits revenue account for the sales price. Cost of goods sold is debited for the price the company paid for the inventory and the inventory account is credited for the same price.

What is an example of a journal entry?

An example of a journal entry includes the purchase of machinery by the country where the machinery account will be debited, and the cash account will be credited.

How are sales transactions recorded?

To simplify your bookkeeping, we recommend a combined sales and cash receipts journal. With a journal that combines sales and cash receipts, you record all sales (cash and credit) and all cash receipts, including collection of accounts receivable, in one journal, which your software should be able to accommodate.

How do I record a sales invoice in general journal?

When you send an invoice to a customer, you enter it as a journal entry to the accounting journal. For the journal entry, you document the total amount due from the invoice as a debit in the accounts receivable account. You would also list the total amount due from the invoice as a credit in the sales account.

What is the double entry for sales?

Double-entry bookkeeping means that every transaction entered both debits and credits different nominal codes. This means that your trial balance always balances. This article shows the debit and credit entries for each transaction type.

What is journalizing in accounting?

Journalizing is the practice of documenting a business transaction in accounting records. Record-keeping, especially for accountants, is a detail-oriented skill that requires commitment. Every business transaction is recorded in a journal, also known as a Book of Original Entry, in chronological order. It is a process initiated each time a transaction occurs.

How many different ways to journalize transactions?

For accounting, there are a selection of seven different methods to journalize transactions which serve a different purpose.

Why is journalizing important in accounting?

Journalizing is the foundation for your financial records. Accurate recordkeeping in accounting is vital to success.

How to do a good bookkeeping?

1. Identify transactions. Identify the type of transaction that has occurred. If you are not the sole individual responsible for the transactions, receipts will be submitted to you.

What is double entry accounting?

Double-entry accounting is a more involved and comprehensive approach to bookkeeping you may consider. For every entry you make in an account, you must input an opposite entry in a different one. This system is used most often for completing end-of-year reports, taxes and balancing the books.

What is closing out an account?

It is a process initiated each time a transaction occurs. If a client is closing out an account, you will want to record the payment as it occurs in the Book of Original Entry. Typical information to include is the date, the amount, the account being credited, and a brief description of the transaction itself.

What is debit and credits in journal?

This is the process of recording. A system of debits and credits is utilized to record changes in the balancing of accounts and the equation in the general journal. Traditional journal entry format dictates that debited accounts are listed before credited accounts.

Where do sales journal entries go?

The entries in sales journal must be posted from sales journal to individual accounts in accounts receivable subsidiary ledger and general ledger. The posting procedure is briefly explained below:

What is a sales journal?

Definition and explanation. The sales journal (also known as sales book and sales day book) is a special journal that is used to record all credit sales. Every transaction that is entered in sales journal essentially results in a debit to accounts receivable account and a credit to sales account.

What is the account receivable and sales column?

Accounts receivable & Sales: In this column, the net amount receivable from customers is written. In the general ledger, the accounts receivable account is debited and sales account is credited by the total of this column.

How to indicate that a posting has been made to general ledger accounts?

To indicate that the posting has been made to general ledger accounts, the account numbers of general ledger accounts are written in parentheses below the totals of the relevant columns of sales journal. Consider the following example for a better explanation of the whole procedure.

What is a sales tax payable column?

If a business is collecting sales tax, it is convenient to add a sales tax payable column to its sales journal to record the amount of sales tax collected from customers on each sale. An example of sales journal with a sales tax payable column is given below:

What is cost of goods sold?

Cost of goods sold & inventory: In this column, the cost price of the merchandise sold is entered. In general ledger, the cost of goods sold account is debited and inventory account is credited by the total of this column.

When are individual entries debited?

At the end of each day (or immediately after the transaction has been performed), the individual entries are debited to appropriate accounts in accounts receivable subsidiary ledger.

How many journal entries are there for a sale of merchandise on account?

If we use the perpetual inventory system there are two journal entries for the merchandise sale transaction while there is only one if we use the periodic inventory system.

When is journal entry for cost of goods sold made?

Likewise, the journal entry for the cost of goods sold will only be made at the year end adjusting entry and it will not be for any particular sale transaction but for the whole merchandise inventory sold during the accounting period.

Why do we need to sell merchandise on account?

In the merchandising business, we may need to sell merchandise on account in order to increase the sale volume we can make each year. Likewise, we need to make the journal entry for sold merchandise on account by recording the sale amount that we make into the customer’s account which is our receivable asset instead of recording it into the cash account.

What does the sold merchandise on account mean?

In this journal entry, the sold merchandise on account results in the increase of sales revenue and the increase of accounts receivable. Likewise, both total revenues on the income statement and total assets on the balance sheet increase by the same amount as a result.

When we receive the cash payment for the sold merchandise on account we have made previously, can we make the journal entry to?

Later, when we receive the cash payment for the sold merchandise on account we have made previously, we can make the journal entry to eliminate (or reduce) the customer’s receivable account that we have recorded by debiting the cash account and crediting the accounts receivable.

When is the cost of goods sold recorded?

However, if we use the periodic inventory system, the cost of goods sold will only be calculated and recorded at the end of accounting after we have performed the physical count of merchandise inventory to determine the actual balance on hand.

Is the journal entry for sold merchandise on account the same as the journal entry made under the perpetual inventory system?

Under the periodic inventory system, the journal entry for sold merchandise on account is the same as the journal entry made under the perpetual inventory system above.

Why do companies use sales credit journal entries?

With the help of a sales credit journal entry, the company can check the balance due to its customer on any date. This will help the company monitoring the balance outstanding ...

What is a sales credit journal entry?

Sales Credit Journal Entry refers to the journal entry recorded by the company in its sales journal during the period when any sale of the inventory is made by the company to the third party on credit, wherein the debtors account or account receivable account will be debited with the corresponding credit to the Sales account.

How to show Credit Sales in Financial Statements?

Now we will understand how to show all the above entries in financial statements Financial Statements Financial statements are written reports prepared by a company's management to present the company's financial affairs over a given period (quarter, six monthly or yearly). These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels. read more.

What happens when goods are sold on credit?

When the goods are sold on credit to the buyer, then the account receivable account will be debited, which will lead to an increase in the assets of the company as the amount is receivable from the third party in the future. It leads to the asset creation of the company and shown in the balance sheet of the company unless settled.

How long does it take to pay a customer after selling goods?

At the time of selling the goods, it was decided that the customer will make the full payment against the goods received after 15 days. On 15th August 2019, a customer paid the whole amount to the company. Pass the necessary journal entry to record the sales of the goods on credit and the receipt of cash. Receipt Of Cash A cash receipt is ...

When will cash accounts be credited?

On 15 th August 2019, when the customer paid the whole amount in cash to the company against the goods sold on credit on 1 st August 2019, then the cash accounts will be credited with the corresponding credit in the accounts receivable accounts. The entry to record the receipt against the sales on credit is as follows:

When will account receivable be debited?

On 1 st August 2019, when the goods were sold on credit to the buyer of the goods, then the account receivable account will be debited with the corresponding credit to the Sales account. The entry to record the sales on credit is as follows: On 15 th August 2019, when the customer paid the whole amount in cash to the company against ...

How many steps are there in a sales journal?

The use of the sales journal is a three step process.

What is sales journal total?

At the end of each accounting period (usually monthly), the sales journal totals are used to update the general ledger accounts. As the business is using an accounts receivable control account in the general ledger, the postings are part of the double entry bookkeeping system.

What are the columns in a ledger?

The columns in the diagram are the transaction date (Date), customer name (Customer), accounts receivable ledger folio reference (LF), invoice reference number (Inv), and the monetary amount of the invoice (Amount) highlighted in gray.

What is a sales account credited to?

In this case, the sales account is credited to record the credit sales for the period. Had the sales journal recorded other items such sales tax, delivery fees charged to customers etc, then the credit would have gone to the appropriate tax or income account.

What are sales type columns?

Sale type columns (sales tax, delivery charges etc.) Other. The sale type columns will depend on the nature of business. Some businesses simply have one column to record the sales amount whereas others need additional columns for sales tax, delivery fees charged to customers etc.

Is receivable a double entry bookkeeping?

As the business maintains control accounts in the general ledger, the accounts receivable ledger itself is not part of the double entry bookkeeping , it is simply a record of the amounts owed to each customer.

Does a sales journal include credit sales?

It should be noted that the sales journal only includes credit sales to customers for merchandise and does not for example, include cash sales, sale returns, or credit sales for non merchandise items such as fixed assets. Cash sales are included in another special journal called the cash receipts journal, sale returns are included in ...

What is a sales return journal entry?

The sales return journal entry is required to debit sales returns and allowances account and credit cash or accounts receivable as below: There are usually three circumstances when the company needs to deal with the sales returns and allowances in the accounting transactions. These circumstances may include:

What is sales returns and allowances?

Sales returns and allowances account is the contra account to sale revenues. It offsets the revenue account in the income statement .

Why is sales return important?

Sales return is the transaction or event when customers return purchased goods back to the company due to various reasons, such as the wrong product, late delivery, or the goods are damaged or defective. Hence, accounting for sales return is important in this case. The company may grant a reduction of the purchase price to customers ...

Why don't companies have sales returns?

Some companies may not have sales returns and allowances account for some reasons, e.g. they do not have many transactions, so it is not worth keeping track. In this case, the company usually directly debit sales revenue and credit accounts receivable to reverse the original sale transactions when there are sales returns.

Why is it important to review sales return?

This is due to a big volume or amount of sales return transactions can suggest various problems that may prevent the company from achieving its goal. Those problems may include inferior goods, problems in filling orders, errors in billing customers, late delivery, wrong product shipment, etc.

When goods returned from customers with good condition, are sales returns and allowances recorded as reverse to the sale revenues?

When goods returned from customers with good condition, the sales returns and allowances are recorded as reverse to the sale revenues with the related accounts receivable as in the above journal entry . And the related cost of goods sold with the original amount is revised back to inventory.

Do you reverse inventory when selling goods?

However, the inventory and cost of goods sold need to be reversed back using the fair value of the goods (damaged or defective), not the value firstly recognized when the sale transactions occurred.

When is a journal entry posted in the ledger?

Following journal entry is posted in the ledger accounts when the amount is settled and the company’s bank account is credited with the net amount; i.e. after adjusting commission.

When is a receivable credited?

Accounts receivable account is credited when money is received on a later date.