How to prepare an unadjusted trial balance

- The first step of preparing an unadjusted trial balance is making a format: one column for the account name, the second column for debit, and the third for credit.

- After preparing the format take the balances from the general ledger and record them into the unadjusted trial balance

- Then write the balances in respective debit and credit columns.

How do you prepare an adjusted trial balance?

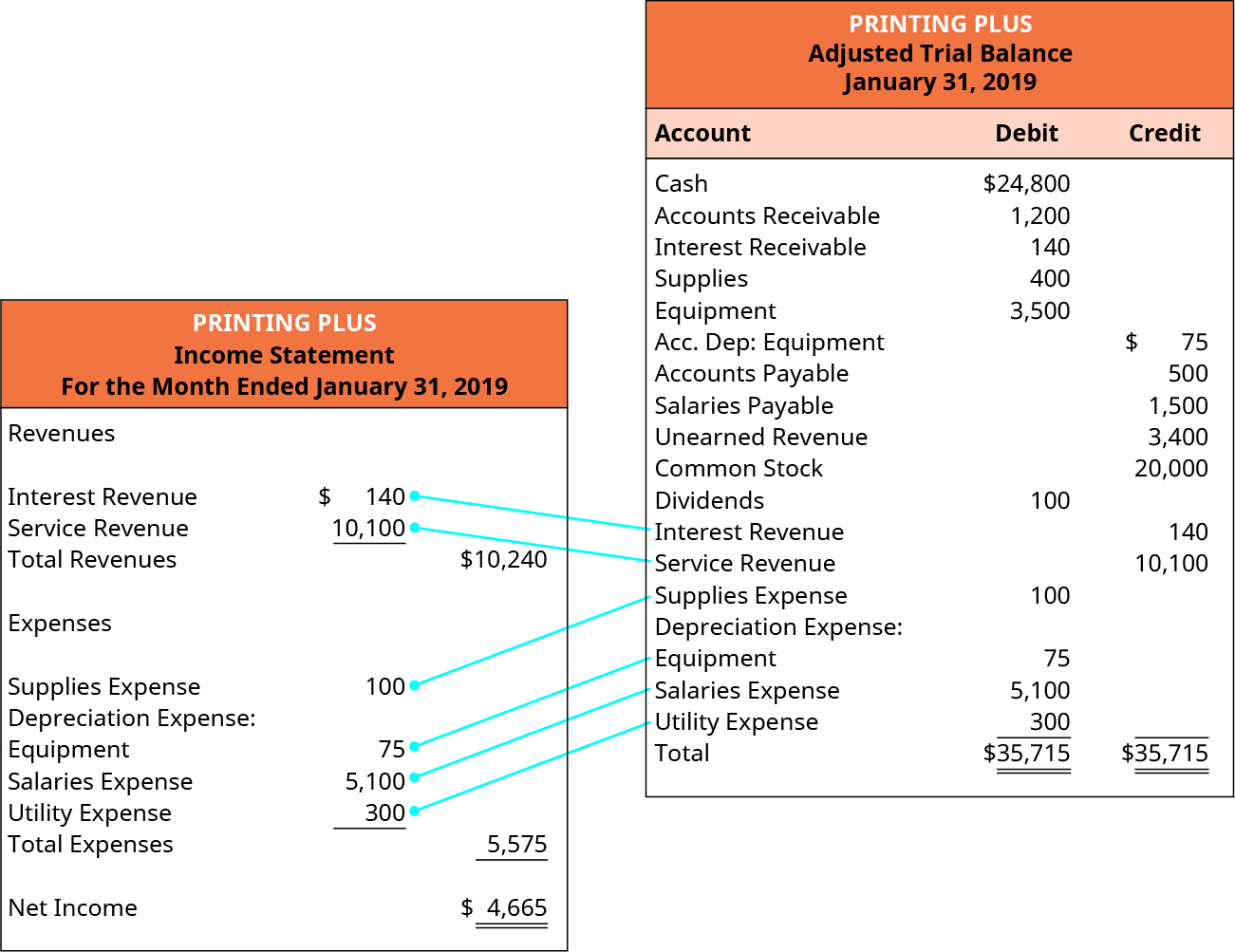

Adjusted trial balance is prepared using one of the two methods explained below: First method – inclusion of adjusting entries into ledger accounts: The first method is similar to the preparation of an unadjusted trial balance. But this time the ledger accounts are first adjusted for the end of period adjusting entries and then account balances are listed to prepare adjusted trial balance.

What are the steps in preparing a trial balance?

- Prepare a worksheet with three columns: for account names, debit quantity and credit quantities.

- Total up the credit amounts and debit amounts for each ledger account separately. ...

- If the quantity on the debit side of an account is higher than the credit quantity, post the difference in the credit column of the trial balance.

Why is it necessary to complete an adjusted trial balance?

The reason for preparing the adjusted trial balance is to ensure the adjusting entries were done correctly. This is the last step before preparing financial statements that are used by you, your creditors and your shareholders to monitor the performance of your business.

What are the main objectives of preparing trial balance?

- Trial Balance also helps in detecting the clerical errors namely mixing up of figures, fault in posting, etc.

- Trial Balance also helps in preparing the final Accounts. Trial Balance also provides the Balances for the financial statements.

- Trial Balance is also being used as a summary of all Accounting records which is very useful for bookkeepers. ...

What goes into an unadjusted trial balance?

An unadjusted trial balance is a listing of all the accounts found in a general ledger. It is prepared at the end of the period (e.g. month, quarter, year) before any adjusting entries are made. It is usually used as a starting point for analyzing account balances.

How do you prepare an adjusted and unadjusted trial balance?

Here are the steps used to prepare an adjusted trial balance:Run an unadjusted trial balance. This provides an initial summary of your general ledger accounts prior to entering any adjusting entries.Make any adjusting entries that are needed. ... Run the adjusted trial balance.

How do you make an unadjusted trial balance worksheet?

0:107:22Unadjusted Trial Balance - YouTubeYouTubeStart of suggested clipEnd of suggested clipNow. When you start to do your trial balance you're going to need some headers at the very top thereMoreNow. When you start to do your trial balance you're going to need some headers at the very top there now the first header is always going to be the company's name in this case we have seek a company.

How do you prepare adjusted trial balance?

2:294:59Adjusted Trial Balance - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe next thing you're going to do is add up all the debits. And add up all the credits and doubleMoreThe next thing you're going to do is add up all the debits. And add up all the credits and double check do they balance. And this ensures that we didn't make a mistake posting our journal entries to

What is unadjusted trial balance adjusted trial balance?

Summary: 1. Adjusted trial balance is used after all the adjustments have been made to the journal while an unadjusted trial balance is used when the entries are not yet considered final in a certain period. 2.An unadjusted trial balance is basically used before all the adjustments will be made.

Does the unadjusted trial balance balance?

The unadjusted trial balance is the listing of general ledger account balances at the end of a reporting period, before any adjusting entries are made to the balances to create financial statements.

How do you write an unadjusted trial balance example?

To complete the unadjusted trial balance, add the balances in the debit column and, separately, add those in the credit column. Write each respective total on the last line of the table in the appropriate column. The total debit balance should equal the total credit balance.

When preparing an unadjusted trial balance do you use a periodic?

When preparing an unadjusted trial balance using a periodic inventory system, the amount shown for Merchandise Inventory is: The beginning inventory amount. Which of the following accounts is used in the periodic inventory system but not used in the perpetual inventory system?

How do you make an unadjusted trial balance in Excel?

0:104:57Accounting Cycle Example #2: Creating an Unadjusted Trial BalanceYouTubeStart of suggested clipEnd of suggested clipThe name of the company the name of the trial balance we're working with and the date that theseMoreThe name of the company the name of the trial balance we're working with and the date that these balances were updated. So let's go ahead and go down the line in our different general ledger accounts.

What is adjusted trial balance in accounting with example?

What is an adjusted trial balance? An adjusted trial balance lists the general ledger account balances after any adjustments have been made. These adjustments typically include those for prepaid and accrued expenses, as well as non-cash expenses like depreciation. It's that simple.

How do you prepare adjusting entries?

Here are examples on how to record each type of adjusting entry....How to prepare your adjusting entriesStep 1: Recording accrued revenue. ... Step 2: Recording accrued expenses. ... Step 3: Recording deferred revenue. ... Step 4: Recording prepaid expenses. ... Step 5: Recording depreciation expenses.

How do you write an unadjusted trial balance example?

To complete the unadjusted trial balance, add the balances in the debit column and, separately, add those in the credit column. Write each respective total on the last line of the table in the appropriate column. The total debit balance should equal the total credit balance.

How do you prepare adjusting entries?

Here are examples on how to record each type of adjusting entry....How to prepare your adjusting entriesStep 1: Recording accrued revenue. ... Step 2: Recording accrued expenses. ... Step 3: Recording deferred revenue. ... Step 4: Recording prepaid expenses. ... Step 5: Recording depreciation expenses.

Why is an adjusted trial balance prepared?

Well, the purpose of preparing an adjusted trial balance is to ensure that the financial statements for the period are accurate and up-to-date. It corrects any errors to make the statements compatible with the requirements of an applicable accounting framework.

What is the difference between an adjusted and unadjusted trial balance check all that apply?

The adjusted trial balance is a list of accounts and their balances after adjusting entries have been posted. The adjusted trial balance generally has more accounts listed than the unadjusted trial balance. The adjusted trial balance is used to prepare financial statements.

What is an unadjusted trial balance?

The unadjusted trial balance is a list of ledger accounts and their balances that is prepared after the preparation of general ledger but before the preparation of adjusting entries. It is the third step of accounting cycle and is usually prepared at the end of accounting period.

How many columns are there in an unadjusted trial balance?

The unadjusted trial balance consists of three columns. All account names are written in the first column, the debit balances are written in the second column and the credit balances are written in the third column. The accounts are listed in the order in which they appear in the general ledger.

What does it mean when a trial balance is not in agreement?

If they aren’t in agreement, it means that the trial balance has been prepared incorrectly or the journal entries have not been transferred to the ledger accounts accurately.

What are some examples of errors that will not be detected by trial balance?

Examples of errors that will not be detected by trial balance: The transaction is not correctly analyzed and recorded. For example, the receipt of cash is erroneously debited to another account instead of cash. A transaction is completely omitted from the journal or ledger. The debit and credit amounts of a journal entry are equally overstated.

Can you prepare unadjusted trial balance from the ledger accounts of the Moon Service Inc.?

We can prepare unadjusted trial balance from the ledger accounts of the Moon Service Inc. prepared on the general ledger page.

Is an unadjusted trial balance acceptable?

Unadjusted trial balance is not suitable for preparing acceptable financial statements. Income statement, balance sheet and other financial statements prepared on the basis of this trial balance may not comply with the applicable financial reporting frameworks such as IFRSs and GAAPs.

Is a transaction completely omitted from the journal or ledger?

A transaction is completely omitted from the journal or ledger. The debit and credit amounts of a journal entry are equally overstated. The debit and credit amounts of a journal entry are equally understated. We may conclude that if the trial balance is balanced, the errors may or may not exist; and if the trial balance is not balanced, ...

What is an Unadjusted Trial Balance?

An unadjusted trial balance is a listing of all the business accounts that are going to appear on the financial statements before year-end adjusting journal entries are made. That is why this trial balance is called unadjusted.

Where are debit and credit columns calculated?

Both the debit and credit columns are calculated at the bottom of a trial balance. As with the accounting equation, these debit and credit totals must always be equal. If they aren’t equal, the trial balance was prepared incorrectly or the journal entries weren’t transferred to the ledger accounts accurately.

What is double entry accounting?

In accordance with double entry accounting, both of the debit and credit columns are equal to each other. Managers and accountants can use this trial balance to easily assess accounts that must be adjusted or changed before the financial statements are prepared. After the accounts are analyzed, the trial balance can be posted to ...

What order are accounts listed on a balance sheet?

Accounts are usually listed in order of their account number. Most charts of accounts are numbered in balance sheet order, so the unadjusted trial balance also displays the account numbers in balance sheet order starting with the assets , liabilities, and equity accounts and ending with income and expense accounts.

How to do a trial balance?

How Do You Prepare a Trial Balance? 1 Before you start off with the trial balance, you need to make sure that every ledger account is balanced. The difference between the sum of all the debit entries and the sum of all the credit entries provides the balance. 2 Prepare an eight-column worksheet. The column headers should be for the account number, account name and the corresponding columns for debit and credit balances. 3 For every ledger account, transfer to the trial balance worksheet the account number and account name along with the account balance in the appropriate debit or credit column 4 Add up the amounts of the debit column and the credit column. Ideally, the totals should be the same in an error-free trial balance. When the totals are same, you may close the trial balance. 5 If there is a difference, accountants have to locate and rectify the errors.

How many methods are there to prepare a trial balance?

There are two primary methods of preparing the trial balance.

What is a temporary suspense account?

Before the errors can be identified and corrected, a temporary suspense account is created to match the trial balance totals temporarily. Once the errors are located, adjusting entries are posted to the trial balance. Once this is done, the trial balance is considered an adjusted trial balance.

What is trial balance in double entry?

In a double-entry account book, the trial balance is a statement of all debits and credits.

What is the purpose of trial balance?

The purpose of a trial balance is to ensure all the entries are properly matched. If the trial balance totals do not match, it could be the result of a discrepancy or accounting error. This is an unadjusted trial balance.

Why do businesses prepare a trial balance?

Businesses prepare a trial balance regularly, usually at the end of the reporting period to ensure that the entries in the books of accounts are mathematically correct. It is also important to note that even when the trial balance is considered balanced, it does not mean there are no accounting errors.

Why are trial balance accounts listed in a specific order?

The trial balance accounts are listed in a specific order to help in the preparation of financial statements.