Record all cash payments in your cash receipts journal. And, enter the cash transaction in your sales journal or accounts receivable ledger. Your cash receipts journal manages all cash inflows for your business. Record all of your incoming cash in your journal. Your cash receipts journal typically includes cash sales and credit categories.

How to record cash receipts in accounting?

Cash receipts accounting steps 1 Make a cash sale#N#Before you can record cash receipts, you need to make a cash sale. When making a cash sale, be sure... 2 Record the cash receipt transaction#N#Your cash receipts journal should have a chronological record of your cash... 3 Create the sales entry More ...

Which column is used to record the receipt of cash?

Every time a cash sale is made, the amount received is entered in this sales column Other accounts: This column is used to record the receipt of cash from sources other than cash sales or credit customers. Examples include the receipt of cash for interest, rent and the sale of old assets etc.

What are the other accounts in the cash receipt journal?

Other accounts: This column is used to record the receipt of cash from sources other than cash sales or credit customers. Examples include the receipt of cash for interest, rent and the sale of old assets etc. Cost of goods sold/inventory: In cash receipt journal, this column is used to record the cost of merchandise sold for cash.

What is the difference between cash book and receipts and payments?

The various cash transactions recorded in cash book that can be grouped together are shown under one account head in receipts and payments account. The receipts and payments account has a debit side to record all receipts and a credit side to record all payments made by non-trading concerns during the period.

What is a cash receipt and payments journal?

A Cash receipts journal is a specialized accounting journal and it is referred to as the main entry book used in an accounting system to keep track of the sales of items when cash is received, by crediting sales and debiting cash and transactions related to receipts.

What is used to record cash receipts?

A cash receipts journal is used by companies to record all cash received from any source. This includes cash sales, receipt of funds from a bank loan, payments from customer accounts, and the sale of assets. Below you can see an example of a typical cash receipts journal.

Where do cash payments get recorded?

Cash purchases are recorded more directly in the cash flow statement than in the income statement. In fact, specific cash outflow events do not appear on the income statement at all.

How do you handle cash receipts?

How to Process Cash ReceiptsApply Cash to Invoices. Access the accounting software, call up the unpaid invoices for the relevant customer, and apply the cash to the invoices indicated on the remittance advice that accompanies each payment from the customer. ... Record Other Cash (Optional) ... Deposit Cash. ... Match to Bank Receipt.

How do you record in a cash receipt journal?

0:293:08The Cash Receipts Journal - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe first step in the journal is to put the date. Next. We put which account is being credited inMoreThe first step in the journal is to put the date. Next. We put which account is being credited in this case it is an individual accounts receivable account for John Henry.

Is cash receipts debit or credit?

A cash receipt is an accounting entry that documents the collection of cash from a customer. Cash receipts typically increase (debits) the company's cash balance on its balance sheet. Simultaneously, they decrease (credits) either accounts receivable or another asset account.

How do you keep record of payment?

Follow these 5 steps to keep track of invoices and payments:Research and Choose an Accounting Software.Follow Best Practices for Invoicing.Follow up on Invoices the Software Flags as Late.Run Reports Regularly.Use the Software to Help Determine Future Financial Strategy.

What is the difference between cash receipts and cash payments?

Cash transactions are ones that are settled immediately in cash. Cash transactions also include transactions made through cheques. Cash transactions may be classified into cash receipts and cash payments....Cash Receipts.Cash receipt from receivable:DebitCashCreditReceivables

What are cash receipts used for?

What are cash receipts used for? Cash receipts are used to create an official record of a cash-based transaction. They may also be used when payment is made via check or store credit.

How do I enter cash receipts in Quickbooks?

Here's how:Click New (+) and select Expense.Enter your cash expense amount and fill in the desired information in the field.Select Save and close or Save and new.

What are cash receipts?

You record cash receipts when your business receives cash from an external source, such as a customer, investor, or bank. And when you collect money from a customer, you need to record the transaction and reflect the sale on your balance sheet. When you collect money from a customer, the cash increases (debits) your balance sheet.

Cash receipts accounting steps

Now that you know a little more about them, it’s time to learn accounting for cash receipts.

Cash receipt journal entry examples

Let’s take a look at a couple of examples of cash receipts. To make sure you have cash receipt accounting down pat, check out the examples below.

Cash receipts procedure

To keep your books accurate, you need to have a cash receipts procedure in place. Your cash receipts process will help you organize your total cash receipts, avoid accounting errors, and ensure you record transactions correctly.

Accounts Payable vs. Accounts Receivable

Accounts payable and accounts receivable are accounting concepts used in accrual accounting to record transactions when cash is not exchanged. Accounts payable Accounts Payable Accounts payable is a liability incurred when an organization receives goods or services from its suppliers on credit.

Is Accounts Payable a Debit or a Credit?

The question above does confuse some due to the terminology used in accounting. For example, accounts payable are considered a debt of a company because they involve the purchase of goods on credit. However, in double-entry accounting, an increase in accounts payable is always recorded as a credit.

The Accounts Payable Process

The accounts payable process looks like an easy task, but it entails very careful scrutiny of invoices because the slightest errors can spell huge losses for a company. In fact, all companies, especially the big and long-standing ones, need to adopt an automated accounts payable system to make sure the following process is accurately performed.

Characteristics of a Well-run Accounts Payable System

An accurate accounts payable process results in accurate financial statements that ultimately lead to the success of a company. A well-run accounts payable system exhibits the following characteristics.

Related Readings

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)® Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career.

Cash Receipts

Cash receipts are accounted for by debiting cash / bank ledger to recognize the increase in the asset.

Cash Payments

Cash payments are accounted for by crediting the cash / bank ledger to account for the decrease in the asset.

Definition and explanation

The receipts and payments account summarizes receipts and payments made by a non-trading concern during a particular period of time (usually one year). Its is used to prepare income and expenditure account of non-trading concerns.

Format

The receipts and payments account has a debit side to record all receipts and a credit side to record all payments made by non-trading concerns during the period. The format of this account is shown below:

Characteristics of receipts and payments account

The important characteristics of a receipts and payments account are given below:

Example

Following is a receipt of payment of account of Zeenat Golf Club – a non-trading concern:

Format

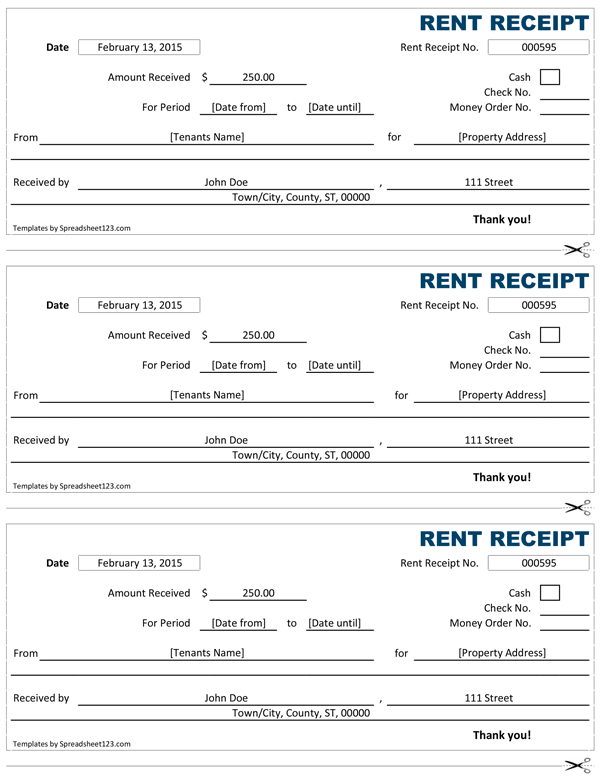

The information in ten columns shown in above format of cash receipts journal is entered as follows:

Example

The following example illustrates how a cash receipt journal is written and how entries from this journal are posted to relevant subsidiary and general ledger accounts.

What information should be included on a purchase invoice?

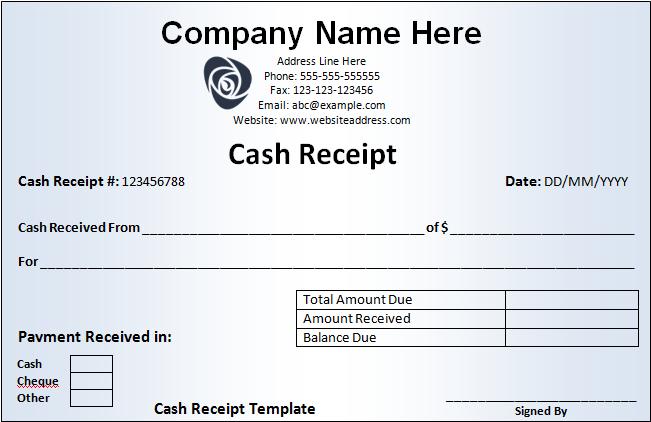

Receipts and other types of source documents can vary massively in their appearance – for example, a run-of-the-mill receipt from a grocery store looks completely different to a purchase invoice, and that will differ again from a salary roster. However, there are four details that should appear on every kind of receipt:

What are the different types of receipts?

A receipt is essentially written proof of any kind of transaction. Invoices are the most common type of receipt. These basically serve to document the demand for a fee or service.

How do I record transactions when bookkeeping?

How exactly does one make an original entry of a transaction? After collecting all these receipts, how should you file them and keep them ordered? There are some fundamental rules to good bookkeeping to which every business must adhere.

Providing additional information

Some additional information must be provided to the tax office. The more thorough your documentation, the more likely it is that the tax office will class the majority of the expenses as tax deductible.