This requires the following steps:

- Calculate the present value of the note, discounted based on the market rate of interest.

- Multiply the market rate of interest by the present value of the note to arrive at the amount of interest income.

- Record the interest income as a credit to interest income and a debit to an asset account for the investment in the note. ...

How do you calculate interest receivable on a note?

Thus, when calculating interest receivable on a note, it's important that you calculate interest based on a 360-day year. Suppose a company issues a $10,000 note at 9% annual interest to your company that will mature in 60 days.

How do you record an honored note on accounts receivable?

Recording Notes Receivable Transactions. Assuming that no adjusting entries have been made to accrue interest revenue, the honored note is recorded by debiting cash for the amount the customer pays, crediting notes receivable for the principal value of the note, and crediting interest revenue for the interest earned.

How do you record interest revenue on a promissory note?

Notice that the entry does not include interest revenue, which is not recorded until it is earned. If a customer signs a promissory note in exchange for merchandise, the entry is recorded by debiting notes receivable and crediting sales.

How do you record interest payable on a loan?

Borrower’s guide on how to record interest payable. When you take out a loan or line of credit, you owe interest. You must record the expense and owed interest in your books. To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account.

Is interest included in notes receivable?

Stated interest: A note receivable generally includes a predetermined interest rate; the maker of the note is obligated to pay the interest amount due, in addition to the principal amount, at the same time that they pay the principal amount.

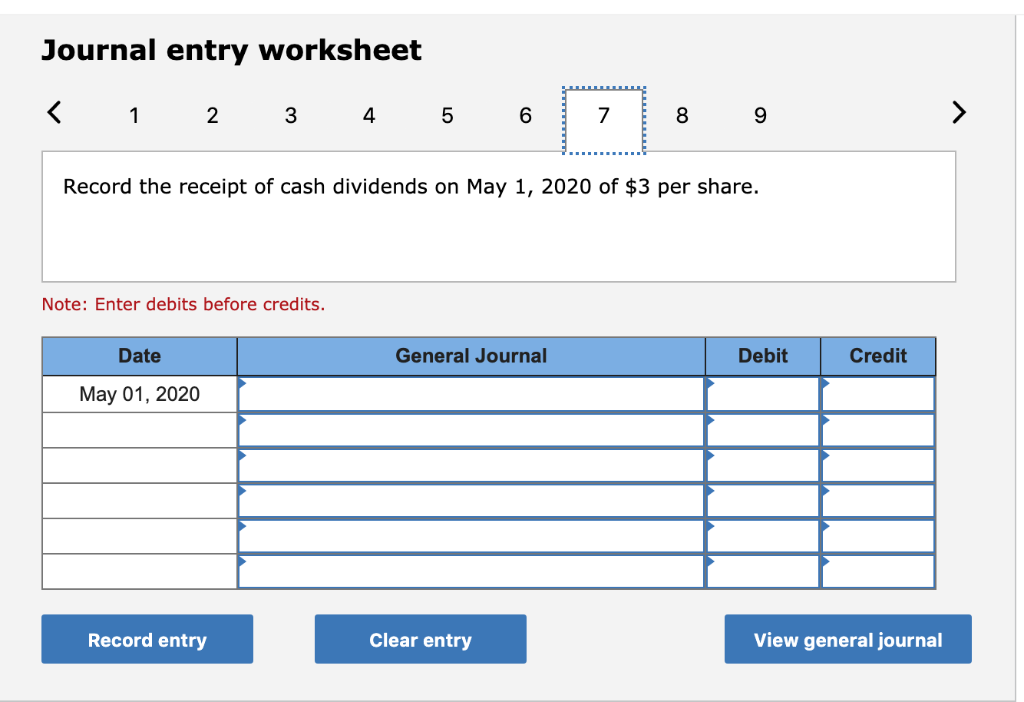

What is the journal entry for notes receivable?

What is the journal entry for interest on a note receivable? The journal entry for interest on a note receivable is to debit the interest income account and credit the cash account.

What is the interest receivable used to record?

Interest receivable is a balance sheet account that reflects the interest income a business has earned but for which a customer or debtor has yet to pay, reports Accounting Coach. This type of account is commonly used by businesses that charge interest on loans and credit lines offered to customers.

How do you Journalize accrued interest on notes payable?

1:042:18Adjusting Entry Example: Accrued Interest Expense - YouTubeYouTubeStart of suggested clipEnd of suggested clipWe must first figure out how much interest they owe. So how do we calculate. Interest I use theMoreWe must first figure out how much interest they owe. So how do we calculate. Interest I use the acronym pert. Principal times rate times. Time. Please note that the interest rate is always an annual

What is interest receivable?

Interest receivable refers to the interest that has been earned by investments, loans, or overdue invoices but has not actually been paid yet. Put another way, interest receivable is the expected interest revenue a company will receive.

What is the entry for interest received?

When the company receives the interest payment, it can make the journal entry by debiting the cash account for the interest and crediting the interest receivable account. After this journal entry, the interest receivable that the company has recorded in the prior period adjusting entry will be eliminated.

What is the journal entry for interest?

An accrued interest journal entry is a method of recording the amount of interest on a loan that has already occurred but is yet to be paid by the borrower and yet to be received by the lender. Accrued interest is the interest gained on outstanding debts over a particular financial period.

What is the journal entry for interest accrued?

The accrued interest for the party who owes the payment is a credit to the accrued liabilities account and a debit to the interest expense account. The liability is rolled onto the balance sheet as a short-term liability, while the interest expense is presented on the income statement.

What is interest receivable?

Interest receivable is an amount that has been earned by the person, but the same has not been received yet. Once the interest income is accrued (becomes receivable), the journal entry should be passed to record it on the date when it became due and the date when the payment against the same is received, then on that date receipt entry should be passed in the books of accounts.

When is the entry to record the disbursement of loan and interest income receivable?

Entry to record the disbursement of loan and interest income receivable. For the year ending December 2018. For the year ending December 2019 , Entry to record the receipt of interest income.

When should interest income be recorded in the books of accounts?

Once the interest income is accrued (becomes receivable), the journal entry should be passed to record it on the date when it became due and the date when the payment against the same is received, then on that date receipt entry should be passed in the books of accounts.

When was the interest payment sent to the employee?

However, at the end of the year, the principal and interest were not paid by the employee. On January 01, 2019 check was sent by the employee for the payment of the interest portion of the three months. Analyze the treatment of the interest received by the company and pass the necessary journal entries in the books of the bank.

Is interest accrued for one month?

ending in 2018, on December 31, 2018, interest has already been accrued for the one month period. The same is to be recognized by the company in its books of accounts, even if interest has not been received yet. Calculation of Interest income to be recognized in accounting year ending on 2018.

Does interest get accrued in 2018?

The interest portion got accrued. in accounting year ending in 2018 but not received. So the bank will recognize its income of interest in the accounting year ending in 2018 and record the receipt of the same in the accounting year in which the income is actually received.

What is a note receivable?

What are Notes Receivable? Notes receivable are a balance sheet item, that records the value of promissory notes. Promissory Note A promissory note refers to a financial instrument that includes a written promise from the issuer to pay a second party – the payee –. that a business is owed and should receive payment for.

Who makes a note payable?

Maker: The person who makes the note and therefore promises to pay the note’s holder. To a maker, the note is classified as a note payable. Notes Payable Notes payable are written agreements (promissory notes) in which one party agrees to pay the other party a certain amount of cash. Payee: The person who holds the note ...

Is a promissory note a current asset?

If the note receivable is due within a year, then it is treated as a current asset on the balance sheet. If it is not due until a date that is more than one year in the future, then it is treated as a non-current asset on the balance sheet.

Is a company's balance sheet a note payable?

It is not unusual for a company to have both a Notes Receivable and a Notes Payable account on their statement of financial position. Balance Sheet The balance sheet is one of the three fundamental financial statements. These statements are key to both financial modeling and accounting. . Notes Payable is a liability as it records ...

Is interest on notes receivable recognized on the income statement?

The interest income on notes receivable is recognized on the income statement. Therefore, when payment is made on a note receivable, both the balance sheet and the income statement are affected.

Is a note receivable a predetermined interest rate?

To a payee, the note is classified as a note receivable. Stated interest: A note receivable generally includes a predetermined interest rate; the maker of the note is obligated to pay the interest amount due, in addition to the principal amount, at the same time that they pay the principal amount.

Do notes receivable have to be paid off before maturity date?

Notes receivable are not usually subject to prepayment penalties, so the maker of the note is free to pay off the note on or before the note’s stated due, or maturity, date.

How is a note receivable recorded?

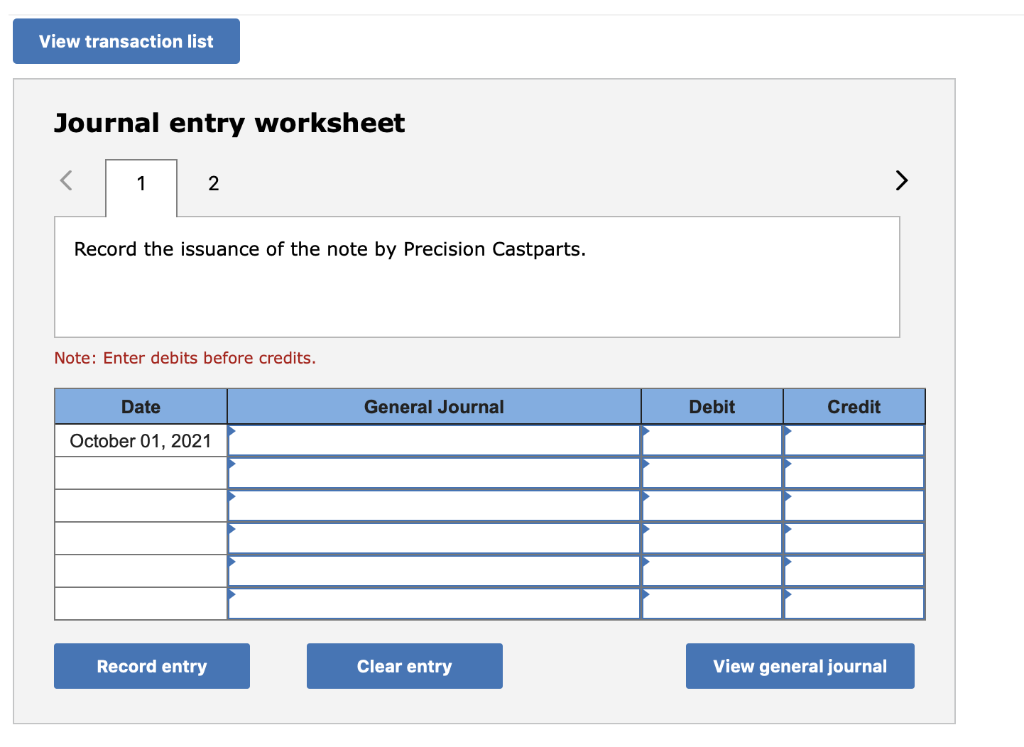

The accounting for notes receivable is simple. When a note is received from a receivable, it is recorded with the face value of the note by making the following journal entry: A note receivable earns interest revenue for the holder.

When did Western receive 5% note?

On October 1, 2014, the Western company received a 120 day, 5% note from Southern company in the settlement of an account of $45,000. The Western company collected the note at maturity. The company makes adjusting entries only at the end of the year.

How to calculate accrued interest?

Once you know these three pieces of information, you can plug them into the accrued interest formula: Accrued Interest = [Interest Rate X (Time Period / 365)] X Loan Amount.

What is accrued interest?

Accrued interest is interest that’s accumulated but not yet been paid. Because it’s accrued and not yet paid, it can be a payable (if you’re the borrower) or receivable (if you’re the lender). When you accrue interest as a lender or borrower, you create a journal entry to reflect the interest amount that accrued during an accounting period. ...

How often do you need to keep a record of your imputed interest?

After figuring out the length of the loan, the starting value and market interest rate, you will need to keep a record of that interest amount every year to determine your imputed interest.

What is imputed interest?

Imputed interest applies to all financial transactions that have favorable interest terms that may cause unrealistic tax implications. For example, an interest-free loan from family or friends, or discounted bonds purchased at less than face value, will likely require you to determine the imputed interest rate to report to the IRS.

What is the IRS AFR?

The IRS publishes imputed tax rates each month. This is known as the Applicable Federal Rate or AFR. This is supposed to prevent exploitation of taxable income.

Do you have to record a loan transaction with a lower interest rate than the market rate?

If the stated interest rate, or the interest rate you will be paying on the loan, is substantially lower than the market interest rate, or none at all, Internal Revenue Service rules still want you to record the transaction using an interest rate that is close to the market rate. That’s for tax purposes.