What is an example of perpetual inventory?

The most common perpetual inventory system example is the usage of wireless barcode scanners in a grocery store. It records all scanned transactions on the system immediately as they occur. This way, firms can easily compute the current and required stockpile.

What are the 2 perpetual inventory records?

The meaning of perpetual inventory is that it deals with the record of the physical quantities of the stocks and its valuation. There are two principles to determine the inventory of a firm, which are the periodic inventory system and the perpetual inventory record system.

How do you record cost of goods sold in a perpetual inventory system?

The cost of goods sold is calculated by adding the beginning inventory and purchases to obtain the cost of goods available for sale and then deducting the ending inventory.

Do you still have to count inventory in a perpetual system?

Annual Physical Inventory Count Companies that use a perpetual system may still conduct an annual physical inventory. In the periodic inventory system, physical counts are used to determine the amount of goods sold. In the perpetual system, a year-end physical inventory validates the inventory records.

How often do you count inventory with the perpetual system?

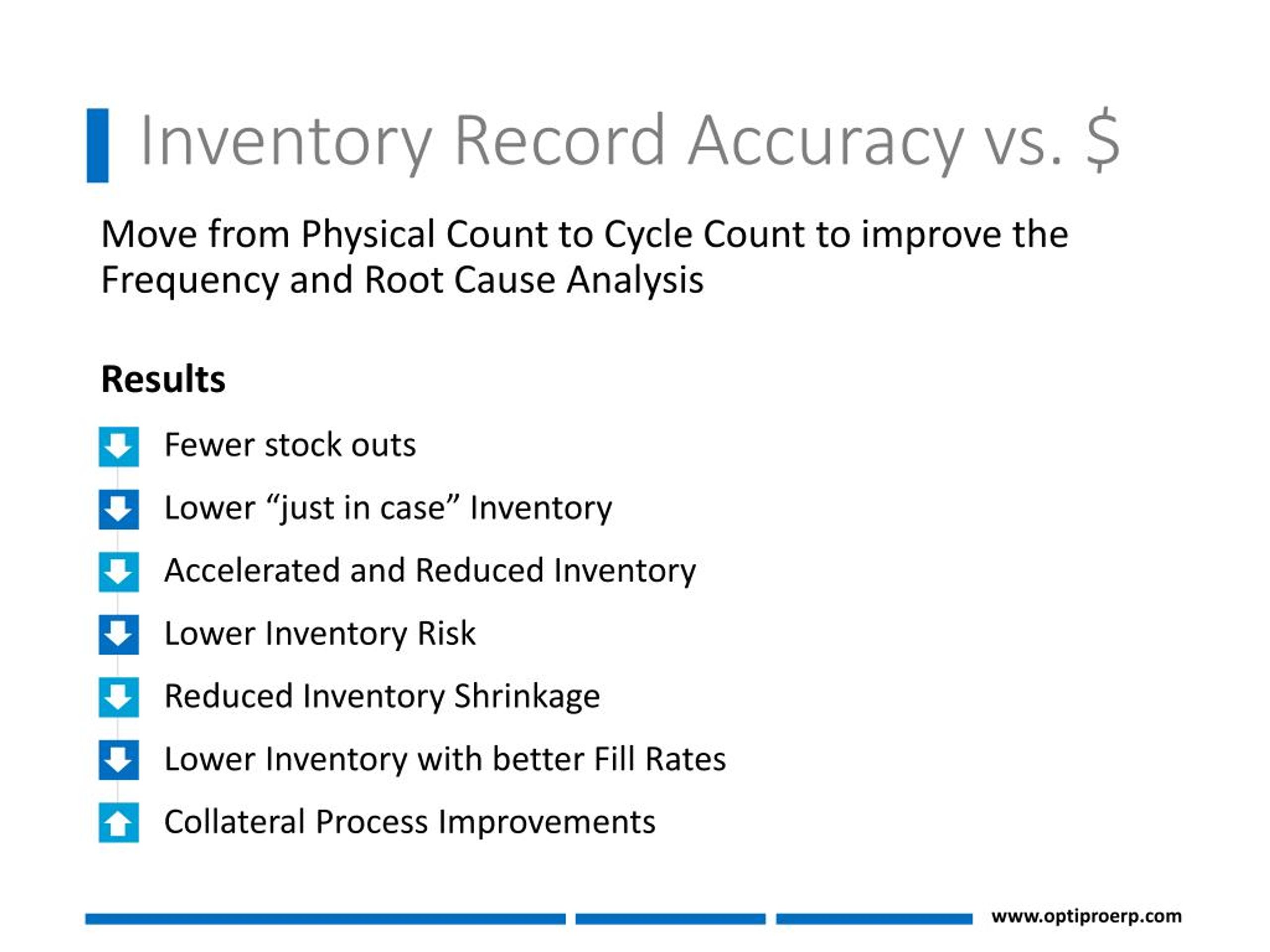

every dayBusinesses that use the perpetual inventory system employ cycle counting to maintain the accuracy of records. This process counts a portion of the inventory every day and compares the quantity against inventory records.

What does a perpetual inventory system require?

Transaction records A perpetual inventory system requires software to continuously track thousands of records in real-time. It's impossible to maintain records manually. But, you could manually track transactions in a periodic inventory system, as it only needs updating every period.

When inventory is sold in a perpetual inventory system?

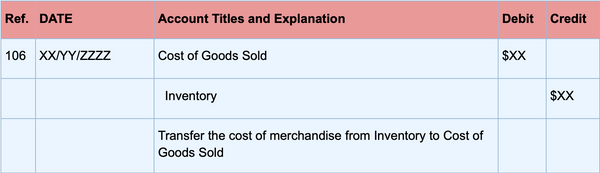

Under a perpetual system, two journal entries are recorded when a product is sold: The sale amount is debited to Accounts Receivable or Cash and is credited to Sales. The cost of merchandise sold is debited to the cost of goods sold (COGS) account and credited to Inventory.

When the perpetual inventory system is used in what account are purchases recorded?

In a perpetual inventory system, purchases are recorded in the Merchandise Inventory account. In a periodic inventory system, purchases are recorded in the Purchases account. Identify the four special journals typically used by a business. Purchases journal, cash payments journal, sales journal, cash receipts journal.

What is not recorded in perpetual inventory system?

Perpetual inventory systems track the sale of products immediately through the use of point-of-sale systems. The perpetual inventory method does not attempt to maintain counts of physical products.

How do you set up and manage a perpetual inventory system?

Guide to Establishing a Perpetual Inventory Management SystemImplement a Point-of-Sale System.Update the Cost of Goods Sold.Adjust Reorder Points.Generate Purchase Orders.Integrate Received Products.

Why do most companies use perpetual inventory system?

A perpetual inventory system recognizes changes in inventory levels, as soon as a sale or purchase takes place. This constant inventory tracking provides businesses with the advantage of always knowing which goods may be running low so that they can respond on time and avoid stock-outs or shortages.

What are the 2 types of inventory accounting?

Two types of inventory are periodic and perpetual inventory. Both are accounting methods that businesses use to track the number of products they have available.

What are the 2 inventory systems?

There are two systems to account for inventory: the perpetual system and the periodic system. With the perpetual system, the inventory account is updated after every inventory purchase or sale.

What are the 2 most common methods of inventory valuation?

Inventory valuation allows you to evaluate your Cost of Goods Sold (COGS) and, ultimately, your profitability. The most widely used methods for valuation are FIFO (first-in, first-out), LIFO (last-in, first-out) and WAC (weighted average cost).

What are the two entries under perpetual system to record a sale transaction?

Sales revenue and sales return entries require 2 entries: one for the customer side (accounts receivable and sales) and one for the inventory side (cost of goods sold and inventory).

What Is Perpetual Inventory?

Perpetual inventory is a continuous accounting practice that records inventory changes in real-time, without the need for physical inventory, so th...

What Is a Perpetual Inventory System?

A perpetual inventory system is a program that continuously estimates your inventory based on your electronic records, not a physical inventory. Th...

What Is the Periodic Inventory System?

The periodic inventory system, also called the noncontinuous system, is a method companies use to account for their products. Based on a specified...

Who Uses a Perpetual Inventory System?

Large businesses with enormous quantities of inventory favor perpetual inventory systems. Perpetual inventory systems can also be ideal for emergin...

When Would You Use a Perpetual Inventory System?

Perpetual inventory systems are helpful for those who always need to understand margins and profitability. A large business with many products or a...

How Is Inventory Tracked Under a Perpetual Inventory System?

A perpetual inventory system tracks goods by updating the product database when a transaction, such as a sale or a receipt, happens. Every product...

What is Perpetual Inventory?

Perpetual inventory is a method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software. Perpetual inventory provides a highly detailed view of changes in inventory with immediate reporting of the amount of inventory in stock, and accurately reflects the level of goods on hand. Within this system, a company makes no effort at keeping detailed inventory records of products on hand; rather, purchases of goods are recorded as a debit to the inventory database. Effectively, the cost of goods sold includes such elements as direct labor and materials costs and direct factory overhead costs.

Why is perpetual inventory important?

A perpetual inventory system is superior to the older periodic inventory system because it allows for immediate tracking of sales and inventory levels for individual items, which helps to prevent stockouts .

What is periodic inventory report?

Inventory reports are accessed online at any time, which makes it easier to manage inventory levels and the cash needed to purchase additional inventory. A periodic system requires management to stop doing business and physically count the inventory before posting any accounting entries.

Why do businesses need to count inventory?

The inventory counts are performed frequently to prevent theft of assets, not to maintain inventory levels in the accounting system.

Does perpetual inventory count physical products?

The perpetual inventory method does not attempt to maintain counts of physical products. Perpetual inventory systems are in contrast to periodic inventory systems, in which reoccurring counts of products are utilized in record-keeping.

Who is Peggy James?

Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals.

Who is James Chen?

James Chen, CMT, is the former director of investing and trading content at Investopedia. He is an expert trader, investment adviser, and global market strategist. Peggy James is a CPA with 8 years of experience in corporate accounting and finance who currently works at a private university.

What is perpetual inventory?

Explanation. Perpetual inventory system provides a running balance of cost of goods available for sale and cost of goods sold. Under this system, no purchases account is maintained because inventory account is directly debited with each purchase of merchandise.

What are some examples of expenses that are debited to inventory account?

These expenses are, therefore, also debited to inventory account. Examples of such expenses are freight-in and insurances etc. Each time the merchandise is sold, the related cost is transferred from inventory account to cost ...

What does return of washing machine do to the supplier?

The return of washing machines to the supplier decreases the cost of inventory and accounts payable. The following entry would be made to record this decrease:

Why do merchandising companies use perpetual inventory?

The common reasons of such difference include inaccurate record keeping, normal shrinkage, and shoplifting etc. Both merchandising and manufacturing companies use perpetual inventory system. Merchandising companies use this system to maintain the record of merchandising inventory and manufacturing companies use to account for purchase and issue ...

How often is inventory count corrected?

The accuracy of this balance is periodically assured by a physical count – usually once a year. If a difference is found between the balance in inventory account and a physical count, it is corrected by making a suitable journal entry. The common reasons of such difference include inaccurate record keeping, normal shrinkage, and shoplifting etc.

What is the net price method used by Metro?

The Metro company uses net price method to record the purchase of inventory. The following journal entry would be made in the books of Metro company to record the purchase of merchandise: (2). On the same day, Metro company pays $320 for freight and $100 for insurance.

Does Metro offer a discount?

The Metro company does not allow any discount to customers. The sale of 4 washing machines transfers the cost of inventory from inventory account to cost of goods sold account. Two journal entries would be made; one for the sale of 4 washing machines and one for the transfer of cost from inventory account to cost of goods sold account: ...

What is the Perpetual Inventory Method?

The perpetual inventory method is a method of accounting for inventory that records the movement of inventory on a continuous (as opposed to periodic) basis. It has become more popular with the increasing use of computers and perpetual inventory management software.

How often should you count inventory?

Differences will arise due to accounting errors, theft, shrinkage etc. An inventory count is normally carried out at least once a year to allow for discrepancies to be investigated and corrected,

Is perpetual inventory more expensive?

Although the perpetual inventory system can be more expensive and time consum ing to maintain, it has the advantage that the accounting records always reflect the levels of inventory on hand at any point in time, allowing real time management of inventory.

Who is Michael Brown?

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping . He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

How to show raw materials have moved to the work in process phase?

To show that raw materials have moved to the work-in-process phase, debit your Work-in-process Inventory account to increase it, and decrease your Raw Materials Inventory account with a credit.

How to record an increase in cash?

Say a customer pays for a product in cash. Debit your Cash account to record the increase in cash. To account for how much the item cost you to make, debit your Cost of Goods Sold account. You also need to credit your Revenue account to show an increase from the sale, and credit your Inventory account to reduce it. Your journal entry should look something like this:

What is a perpetual inventory?

Mixture of both methods. Perpetual inventory is an accounting method that records the sale or purchase of inventory through a computerized point-of-sale (POS) system. With perpetual inventory, you can regularly update your inventory records to avoid issues, like running out of stock or overstocking items.

What is asset in accounting?

An asset is physical or non-physical property that adds value to your business. As you know by now, debits and credits impact each type of account differently. Assets are increased by debits and decreased by credits. For reference while you’re making inventory journal entries, check out this chart:

Why is inventory so expensive?

Inventory can be expensive, especially if your business is prone to inventory loss, or inventory shrinkage. Inventory loss can occur if an item or product gets damaged, expires, or is stolen.

When an item is ready to be sold, what is the transfer?

When an item is ready to be sold, transfer it from Finished Goods Inventory to Cost of Goods Sold to shift it from inventory to expenses.

Can you record inventory journal entries in your books?

Recording inventory journal entries in your books doesn’t have to be a painful process. Patriot’s online accounting software makes it a breeze to record income and expenses so you can get back to business. Try it for free today!

What is Perpetual Inventory?

- Perpetual inventory is a method of accounting for inventory that records the sale or purchase of i…

A perpetual inventory system is distinguished from a periodic inventory system, a method in which a company maintains records of its inventory by regularly scheduled physical counts.

Understanding Perpetual Inventory

- A perpetual inventory system is superior to the older periodic inventory system because it allows for immediate tracking of sales and inventory levels for individual items, which helps to prevent stockouts. A perpetual inventory does not need to be adjusted manually by the company's accountants, except to the extent it disagrees with the physical inventory count due to loss, brea…

How Perpetual and Periodic Inventory Systems Work

- A point-of-sale system drives changes in inventory levels when inventory is decreased, and cos…

Perpetual inventory systems track the sale of products immediately through the use of point-of-sale systems. - The perpetual inventory method does not attempt to maintain counts of physical products.

Perpetual inventory systems are in contrast to periodic inventory systems, in which reoccurring counts of products are utilized in record-keeping.

Factoring in Economic Order Quantity

- Using a perpetual inventory system makes it much easier for a company to use the economic order quantity (EOQ) to purchase inventory. EOQ is a formula managers use to decide when to purchase inventory, and EOQ considers the cost to hold inventory, as well as the firm’s cost to order inventory.

Examples of Inventory Costing Systems

- Companies can choose from several methods to account for the cost of inventory held for sale, but the total inventory cost expensed is the same using any method. The difference between the methods is the timing of when the inventory cost is recognized, and the cost of inventory sold is posted to the cost of sales expense account. The first in, first out (FIFO) method assumes the ol…