How to Trade With the Momentum indicator

- Momentum-oscillator-indicator. You can use momentum indicators to determine if an instrument is being overbought or oversold by measuring the rate and the magnitude of price movements.

- Stock Momentum Indicator. Momentum tends to stay above 0 during an uptrend and below 0 during a downtrend. ...

- Momentum Day Trading. ...

- Conclusion. ...

What is the best momentum indicator?

– A Full Guide To Understand How To Use One of The Best Momentum Technical Indicators The TTM Squeeze indicator is one of the most useful momentum indicators we can use in the market to help us identify the entry and exit point in a trading system.

What are common momentum indicators?

- A momentum indicator, like the RSI that signals when the market has become overbought and oversold.

- A trend filter, to ensure that we trade in the direction of the prevailing market trend. ADX is a strong contender.

- A market sentiment indicator that ensures that the overall sentiment is either bullish or bearish, depending on your strategy.

How to use price action to identify momentum?

you need to know where price action momentum can happen and the places that this can happen are support and resistance levels, Fibonacci levels, confluence levels, pivots etc. you need to know the signs or the price action signals that indicate that momentum be be increasing or slowing down and the most basic element is the candlestick.

How to put a moving average on an indicator?

- 10-SMA, for fast moving short-term trades

- 20-SMA, for slightly longer term momentum on short-term trades

- 50-day SMA, which represents just a bit underneath a quarter

- 100-day SMA, which represents half a year

- 200-day SMA, which represents roughly one year of trading based upon trading hours

What does the momentum indicator tell you?

Momentrum indicators are technical analysis tools used to determine the strength or weakness of a stock's price. Momentum measures the rate of the rise or fall of stock prices. Common momentum indicators include the relative strength index (RSI) and moving average convergence divergence (MACD).

What is the best setting for momentum indicator?

The preferred settings for the best forex momentum indicator is 40 periods. The Williams %R runs on a scale from -100 to zero. A reading in the vicinity of -100 is an indication that the instrument is oversold.

How do you use momentum indicator in Crypto?

Trading the Momentum Indicator on the crypto marketsRiding the Trend. The simplest way to use this indicator, is to follow the trajectory of the Momentum line. ... Trading Extremes. Opposite to the previous trading strategy, you can use the Momentum indicator to buy low and sell high. ... Divergence.

How is momentum indicator used in forex trading?

Momentum is measured by continually taking price differences for a fixed time period. For example, to create a 10-day period momentum line, you would subtract the closing price from 10 days ago from the most recent closing price. It compares where the current price is in relation to where the price was in the past.

How do you trade with momentum?

Momentum investing is a trading strategy in which investors buy securities that are rising and sell them when they look to have peaked. The goal is to work with volatility by finding buying opportunities in short-term uptrends and then sell when the securities start to lose momentum.

How do you trade momentum for a living?

How to start momentum tradingIdentify the asset you are interested in.Devise a momentum trading strategy based on technical indicators and analysis.Practise trading in a risk-free environment using an IG demo account.Start trading on live markets by opening an account with IG.

How does momentum gauge option buying?

How to Gauge Momentum for Option Buying?Time your Option buying to capture the momentum.Detailed learnings on how to identify momentum using indicators and price action.Live analysis of price action and execution using price action.Pre-market analysis to identify key levels and important support and resistance.More items...

Does momentum work in crypto?

The correlations of returns between a momentum portfolio of cryptocurrencies and traditional assets are lower than the correlations between traditional assets. There- fore, investors should consider a momentum portfolio of cryptocurrencies as a vehicle of risk diversification and/or hedging.

Is RSI a momentum indicator?

The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between zero and 100. Traditionally the RSI is considered overbought when above 70 and oversold when below 30.

Which EMA is best for 5 min chart?

Rules for a Long Trade Go long 10 pips above the 20-period EMA. For an aggressive trade, place a stop at the swing low on the five-minute chart. For a conservative trade, place a stop 20 pips below the 20-period EMA.

What time frame is best for day trading?

The opening 9:30 a.m. to 10:30 a.m. Eastern time (ET) period is often one of the best hours of the day for day trading, offering the biggest moves in the shortest amount of time. A lot of professional day traders stop trading around 11:30 a.m. because that is when volatility and volume tend to taper off.

What is momentum indicator?

The momentum indicator is a tool that traders use to determine the momentum that a financial instrument (stock, options, futures, currencies, etc) has when it is gaining or falling in the market. Simply put, momentum indicator compares the current price with the previous price from a given number of periods ago.

Why is RSI considered a momentum indicator?

The RSI is deemed to be a momentum indicator because it compares the current price change to recent price changes. A higher reading, implies a faster change in price. The moving average convergence divergence is an indicator that hovers around zero. It is a measure of both momentum and trend.

Is the SPX a good measure of momentum?

Some traders consider the SPX to be a more accurate measure of momentum in the markets as a whole because it is value-weighted and has broad representation.

Why is momentum indicator weak?

The weakness in the indicator is that timing is not necessarily a product of the Momentum, the reason for attaching a “lagging” moving average to confirm the Momentum signal. The Momentum indicator is regarded as an excellent gauge of market strength.

Who created the momentum indicator?

The creator of the Momentum indicator is unknown, but Martin Pring has written much about the indicator. It attempts to measure the momentum behind price movements for the underlying currency pair over a period of time.

Is momentum an oscillator?

The Momentum indicator is classified as an “oscillator” since the resulting curve fluctuates between values about a “100” centerline, which may or may not be drawn on the indicator chart. Overbought and oversold conditions are imminent when the curve reaches maximum or minimum values.

What is the momentum indicator?

Instead of focusing upon price, RSI is an oscillator that looks at the difference between the average gains and average losses of a stock over a specific time period. The RSI has a scale between 0 and 100, where a value of zero occurs when there have been no gains in the time period, and 100 having only gains.

What is stochastic oscillator?

Stochastics are another useful oscillator for investors monitoring momentum. Similar to RSI, they measure the difference between moving averages. However, stochastics utilize a formula that considers the closing price, the low price and the high price of a stock over a certain period of time.

Figuring Out the Momentum

The momentum of a price is pretty easy to find. There are a couple of versions of the formula, but whichever one is used, the momentum (M) is a comparison between the current closing price (CP) and a closing price "n" periods ago (CPn). 1 You determine the value of "n." Version 1: M = CP – CPn Version 2: M = (CP / CPn) * 100

Trading Use

The momentum indicator can be used to provide trade signals, but it is better used to help confirm the validity of trades based on price actions such as breakouts or pullbacks. There are a few ways you can look at the indicator to see where a stock might go.

Notes of Caution

The momentum indicator isn't going to provide much insight beyond what can be seen just by looking at the price chart itself. If the price is quickly moving higher, it will be visible on the price chart as well as on the momentum indicator.

Frequently Asked Questions (FAQs)

The stochastic momentum indicator is a variation of the stochastic oscillator, which traders use to gauge whether a stock is overbought or oversold. The readings range from -100 to 100, with 100 representing the most overbought condition.

What are Momentum Indicators?

As we have discussed above momentum indicators help us in analysing the rate of speed at which the stock prices fall or rise.

How to trade with Momentum Indicators?

The momentum indicators are used in providing trade signals, but it is better used to help confirm the validity of trades based on price actions such as breakouts or pullbacks.

Top 5 Momentum Indicators

Below are some of the popular momentum indicators which help the traders in gauging the speed of the prices:

Advantages of trading with Momentum Indicators

The momentum indicators are useful for spotting shifts in the buying or selling of stocks, mainly through divergence.

Disadvantages

One should try to use momentum indicators with other indicators like volume or volatility or with the price actions as sometimes it may give false indicators.

Bottomline

Momentum indicators are important tools for the trader, but they are rarely used in isolation. It is more used with other technical indicators which reveal the directions of trends as discussed above.

Elearnmarkets

Elearnmarkets (ELM) is a complete financial market portal where the market experts have taken the onus to spread financial education. ELM constantly experiments with new education methodologies and technologies to make financial education effective, affordable and accessible to all. You can connect with us on Twitter @elearnmarkets.

Categories of indicators: Leading vs lagging

While you may be eager to jump into the individual indicators, let’s first take a quick step back and look at the big picture.

Using trend & momentum indicators together

After looking at these six indicators and the charts, I’m sure you’ll be wanting to know which is the golden indicator to use and the parameters for it.

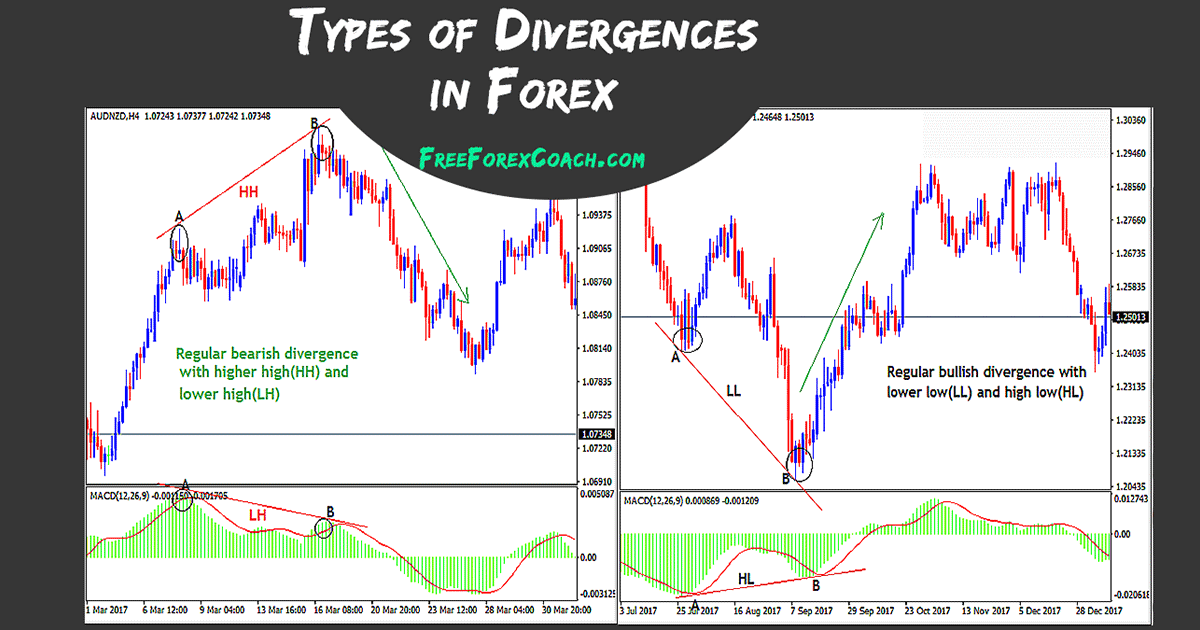

Understanding Divergence

- Divergence occurs when, for example, the price of a stock is continually moving downward, following along with the momentum indicator being used (which signals strong momentum), but then the momentum indicator turns to the upside or no longer continues to follow the downwar…

Popular Momentum Indicators

- There are a variety of momentum indicators that traders can utilize. However, there are a few that are very popular with traders and widely used.

Final Word

- Momentum indicators are vital tools for traders and analysts; however, they are rarely used in isolation. It is more common to utilize them with other technical indicators that reveal the directions of trends. Once a direction’s been determined, momentum indicators are valuable because they indicate the strength of price movement trends and when they are coming to an e…

Additional Resources

- Thank you for reading CFI’s guide on Momentum Indicators. To keep advancing your career, the additional resources below will be useful: 1. Momentum Investing 2. Pivot Points 3. Speed Lines – Technical Analysis 4. Technical Analysis – A Beginner’s Guide