How a Subordination Agreement Works Individuals and businesses turn to lending institutions when they need to borrow funds. The lender is compensated when it receives interest payments on the loaned amount, unless and until the borrower defaults on her payments.

Who is the grantee on a subordination agreement?

The grantee is the person receiving the property. With a deed of trust, it’s not the lender; rather, the grantee is the trustee who holds legal title while the borrower performs his duty of repayment to the mortgage lender. … In some states, the lender is called the beneficiary on the deed of trust.

What is a subordination fee in a mortgage?

What is a subordination fee in a mortgage? A subordination agreement is an instrument that allows a first lien or interest to be paid off and allows another first mortgage company to come in and be the first priority lien holder. It is very common for the borrower to pay subordination fees.

What is a subordinate lienholder?

What is a subordinate lien? Being "subordinate" means they can be paid only after more senior liens are released. In other words, if the mortgage lender has the primary lien, that lender must be paid in full before any subordinate liens are paid.

What is a subordination of a loan?

What is subordination? Subordination is the process of ranking home loans ( mortgage, HELOC or home equity loan) by order of importance. When you have a home equity line of credit, for example, you actually have two loans – your mortgage and HELOC. Both are secured by the collateral in your home at the same time.

What happens when you subordinate a loan?

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

Can a lender refuse to subordinate?

If the property's value drops or the refinanced loan is greater than the previous loan, the second lender may refuse to subordinate. As such, homeowners may face difficulty in refinancing the mortgage. Additionally, due to the risk involved, second mortgages usually carry a higher interest rate.

Why would a mortgage subordination be requested?

The lien gives the lender the legal right to repossess your home in the event of mortgage default, bankruptcy or foreclosure. If there are no other liens on the property, the lender is the only lien holder on the deed. Mortgage subordination only comes into play when you have multiple liens on the property.

What is a subordination agreement Example?

Example of a Subordination Agreement The business files for bankruptcy and its assets are liquidated at market value—$900,000. The senior debtholders will be paid in full, and the remaining $230,000 will be distributed among the subordinated debtholders, typically for 50 cents on the dollar.

How long does it take to subordinate a loan?

Often, all the information needed will be available from your mortgage lender and the title company. The process usually takes approximately 25 business days.

How does a subordinate mortgage work?

A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. For example, your first home loan (primary mortgage) is repaid first, with any remaining funds paying off additional liens, including second mortgages, HELOCs and home equity loans.

Who prepares a subordination agreement?

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

What does it mean when a loan is subordinated?

Subordinate financing is debt financing that is ranked behind that held by secured lenders in terms of the order in which the debt is repaid. "Subordinate" financing implies that the debt ranks behind the first secured lender, and means that the secured lenders will be paid back before subordinate debt holders.

Can you subordinate a first mortgage?

Still, there are situations in which your first mortgage may be placed in a subordinate position, whether by your request (and your lender's agreement) or by law. Any mortgages that are recorded after your first purchase loan are usually subordinate loans.

What does it mean when a lease is subordinate to a mortgage?

Subordination of lease refers to the tenant's consent to subordinate his or her rights over a property to the rights of the bank holding the mortgage on the property. A subordination of lease agreement is created for this purpose.

Who benefits from a subordination clause in a Deed of Trust?

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.

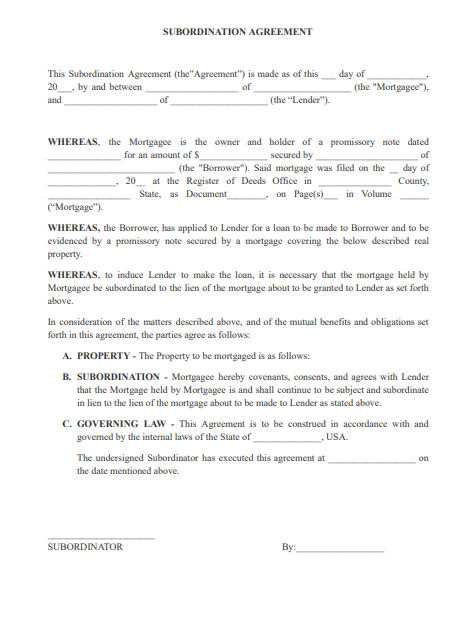

What should be in a subordination agreement?

Subordination agreement is a contract which guarantees senior debt will be paid before other “subordinated” debt if the debtor becomes bankrupt.

What does it mean when a lease is subordinate to a mortgage?

Subordination of lease refers to the tenant's consent to subordinate his or her rights over a property to the rights of the bank holding the mortgage on the property. A subordination of lease agreement is created for this purpose.

What is the meaning of subordinate lien?

Subordinate Liens means Liens in favor of Lender, securing all or any portion of the Obligation, including, but not limited to, Rights in any Collateral created in favor of Lender, whether by mortgage, pledge, hypothecation, assignment, transfer, or other grant or creation of Liens.

Can you subordinate a first mortgage?

Still, there are situations in which your first mortgage may be placed in a subordinate position, whether by your request (and your lender's agreement) or by law. Any mortgages that are recorded after your first purchase loan are usually subordinate loans.

What is a subordinate lien holder?

What is a Subordinate lienholder? A Subordinate lienholder, according to Florida Statute 45.032 (1)(b), “means the holder of a subordinate lien shown on the face of the pleadings as an encumbrance on the property.” This is any company or entity that has a secondary lien placed on a person's property.

What is subordination?

Subordination is the process of ranking home loans ( mortgage, HELOC or home equity loan) by order of importance. When you have a home equity line of credit, for example, you actually have two loans – your mortgage and HELOC. Both are secured by the collateral in your home at the same time. Through subordination, lenders assign a “lien position” to these loans. Generally, your mortgage is assigned the first lien position while your HELOC becomes the second lien.

What is subordination in mortgage?

Subordination is the process of ranking home loans ( mortgage, HELOC or home equity loan) by order of importance. When you have a home equity line of credit, for example, you actually have two loans – your mortgage and HELOC. Both are secured by the collateral in your home at the same time. Through subordination, lenders assign a “lien position” ...

How does subordination affect refinancing?

Refinancing is the process of paying off your old mortgage and replacing it with a better one. When your mortgage is paid in full, the second lien (HELOC) automatically bumps up in priority. Your HELOC becomes the first lien, and your new mortgage becomes the second lien.

What happens when you have two mortgage lenders?

Some financial institutions charge a subordination fee and/or other fees, such as appraisal fees. Delays can occur, especially if you have two lenders.

Is subordination seamless?

Most subordination agreements are seamless. In fact, you may not realize what’s happening until you’re asked for a signature. Other times, delays or fees may take you by surprise. Here are a few important notes about the subordination process. Subordination agreements are prepared by your lender.

What is a Subordination Agreement?

A subordination agreement is a legal document that establishes one debt or claim as ranking behind another in priority for repayment. The priority of debt repayment can become very important if a company or individual defaults on their debt repayment obligations and declares bankruptcy.

When is subordination used?

Subordination agreements are used when borrowers are trying to acquire additional funds while already having other loan agreements . It is generally used by property owners to take out a second or junior mortgage on their property to refinance their property.

Why would other lenders agree to subordinate?

One might think why would other lenders agree to subordinate? Since conventional first-mortgage lenders do not agree to refinance a loan unless they are ensured priority in case of repayment, the only way refinancing works is through a subordination agreement. It provides ensured priority repayment to the first lender.

What happens if a party refuses to sign an executory subordination agreement?

In cases where the party refuses to sign the executory subordination agreement, a contract claim violation can occur.

What happens when multiple liens are placed on a property?

When multiple liens against a property exist, a subordinate agreement will set lien priority. Often lien priority will be decided based on date of mortgage, the first mortgage receiving priority over others. Some other liens, such as property tax liens also receive automatic priority.

What happens to a subordination agreement when there is a foreclosure?

Therefore, a subordination agreement will adjust new loans’ priority so that when there is a foreclosure, it gets paid off in order of priority.

Do lenders of subordinated debts have to pay back their debt?

Lenders of superior debts will have the legal right to full repayment before lenders of subordinated debts receive their repayments. In a case where the debtor doesn’t have the funds to make all repayments, the subordinate lenders might receive less or no repayments at all .

What Is a Subordination Agreement?

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

Why do lenders require subordination agreements?

The lender might require a subordination agreement to protect its interests should the borrower place additional liens against the property, such as if she were to take out a second mortgage . The "junior" or second debt is referred to as a subordinated debt.

Why would shareholders in a subordinated company receive nothing in the liquidation process?

Shareholders in the subordinated company would receive nothing in the liquidation process because shareholders are subordinate to all creditors. Subordinated debts are riskier than higher priority loans, so lenders typically require higher interest rates as compensation for taking on this risk.

When does a second in line creditor collect?

A second-in-line creditor collects only when and if the priority creditor has been fully paid.

When do individuals and businesses turn to lending institutions?

Individuals and businesses turn to lending institutions when they need to borrow funds. The lender is compensated when it receives interest payments on the loaned amount, unless and until the borrower defaults on her payments.

Who must acknowledge a signed agreement?

The signed agreement must be acknowledged by a notary and recorded in the official records of the county to be enforceable.

Is an unsecured bond a secured bond?

Unsecured bonds without collateral are deemed to be subordinate to secured bonds. Should the company default on its interest payments due to bankruptcy, secured bondholders would be repaid their loan amounts before unsecured bondholders. The interest rate on unsecured bonds is typically higher than that of secured bonds, earning higher returns for the investor should the issuer make good on its payments.

When is a subordination agreement used?

Rather, for legal purposes, a subordination agreement is used when a creditor agrees that another loan has priority for repayment over its own loan. To explore this concept, consider the following subordination definition.

What is subordination clause?

Referred to as a “subordination clause” when placed within a larger contract, such an agreement effectively makes one claim in the contract senior to any other claims that may be added later. Subordination clauses are commonly used in mortgage contracts, where the original mortgage takes priority over any new loans against the property. Should repayment become an issue, such as in bankruptcy, the subordinate loans would take a backseat to the original mortgage, and may not be paid at all.

How did Moorfield use subordination clause?

Moorfield used this legislation in an attempt to get out of the subordination clause in DBN’s mortgage with Intervest. The trial court agreed with the general contractor’s argument, and ruled in its favor. When Intervest appealed the decision, the appellate court interpreted the law as prohibiting a property owner from impairing the mechanic’s lien rights of a general contractor, and prohibits a general contractor from impairing the mechanic’s lien rights of a sub-contractor.

What is loan subordination?

Loan subordination can be a terrific tool to obtain funding for the purpose of improving the property, or somehow creating more profit potential for all involved. Used improperly, loan subordination can be a deadly financial device for the lender that agreed to subordinate. Think of loan subordination like a piece of rope.

What happens if a small creditor subordinates a loan?

If the small creditor agrees to subordinate his loan, the opportunity will look much more tempting to the large lender. Essentially, in such an example of subordination, the small lender is promising the large lender that its claim will get first dibs on whatever money is available to repay debts, should the project go bad.

What is the law in California that protects subcontractors and suppliers from having their interests pushed aside by the heavy?

In California, the law specifically protects subcontractors and suppliers from having their interests pushed aside by the heavy hitters , such as lenders. In fact, California’s Civil Code section 3262, prevents a subcontractor or supplier from waiving its right to pursue a mechanic’s lien, as it states:

Why does Tom agree to the loan subordination?

Because having a brand new home on the land will greatly increase its value, Tom agrees to the loan subordination. Now this lot valued at $50,000 has a $50,000 first construction loan (from the bank), and a $50,000 second land loan on it (from Tom).

What is subordination clause?

A subordination clause serves to protect the lender in case you default. If a default happens, the lender would have the legal standing to repossess the home and cover their loan’s outstanding balance first. If there are other subordinate mortgages involved, the secondary liens will take the backseat in this process.

What Is Mortgage Subordination?

Subordination itself is the act of placing something in a lower-ranking position.

Can a refinance move forward?

Sometimes, the refinance can move forward if the original subordinate loan agrees to a new subordinate clause. However, it might not always work out. One way around this is to refinance both loans into a single mortgage that doesn’t have any subordinate clause issues.

Can subordinate liens be recouped?

With that, the subordinate liens would only have the chance to recoup their costs after the primary lender has been taken care of. In some cases, the value of the home won’t be enough to cover all of the liens. With that, subordinate lenders are in a riskier financial position than the primary mortgage. Great news!

Is a mortgage subordination clause important?

At first glance, it might seem like this claus e is only important to the lender. But a mortgage subordination clause can have other impacts on your finances. Here’s what to watch out for.

Can mortgage subordination clauses be used to lower interest rates?

If you want to take advantage of lower interest rates by refinancing a mortgage, mortgage subordination clauses could present a roadblock.

Does mortgage subordination affect liens?

As the borrower, mortgage subordination won’t necessarily affect you unless you plan to put additional liens on the property.

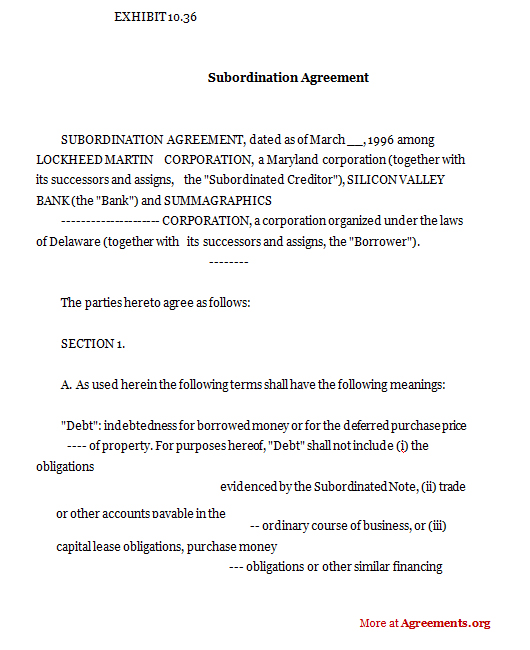

What Is A Subordination Agreement?

How A Subordination Agreement Works

- Individuals and businesses turn to lending institutions when they need to borrow funds. The lender is compensated when it receives interest payments on the loaned amount, unless and until the borrower defaults on her payments. The lender might require a subordination agreement to protect its interests should the borrower place additional liens agai...

Example of A Subordination Agreement

- Consider a business that has $670,000 in senior debt, $460,000 in subordinated debt, and total asset value of $900,000. The business files for bankruptcy and its assets are liquidated at market value—$900,000. The senior debtholders will be paid in full, and the remaining $230,000 will be distributed among the subordinated debtholders, typically for 50 cents on the dollar. Shareholde…

Types of Subordination Agreements

- Subordination agreements can be used in a variety of circumstances, including complex corporate debt structures. Unsecured bonds without collateral are deemed to be subordinate to secured bonds. Should the company default on its interest payments due to bankruptcy, secured bondholders would be repaid their loan amounts before unsecured bondholders. The interest rat…

Special Considerations

- Subordination agreements are most common in the mortgage field. When an individual takes out a second mortgage, that second mortgage has a lower priority than the first mortgage, but these priorities can be upset by refinancing the original loan. The mortgagor is essentially paying it off and receiving a new loan when a first mortgage is refinanced, so the new, most-recent loan is no…