What is the downside of a triple net lease?

Cons of Triple Net Leases For landlords who are locked into a long-term lease, they lose the ability to increase the rent if property values in the area increase. In the long-term, this can limit earning potential.

How do you calculate a triple net lease?

Calculating a Triple Net Lease Triple net leases are calculated by adding the yearly taxes on the property and the insurance for the space together and dividing that amount by the building total rental square footage.

Is a triple net lease a good investment?

NNN Properties in California are an excellent investment option. They offer greater cash flow, appreciation potential, and diversification. If you're looking for a safe investment that will pay off over time then it's definitely worth considering NNN properties in California!

What is the purpose of a triple net lease?

A triple net lease, also known as an NNN Lease, is a lease in which the tenant agrees to pay their pro-rata share of all expenses associated with property maintenance, taxes, and insurance, in addition to a predetermined base rental rate. These expenses are commonly referred to as operating expenses.

What is an average return on triple net lease?

You can realistically expect a 5–7% ROI, a healthy monthly income, and tax benefits that preserve capital. NNN investments balance the high-risk nature of the stock market and create a dependable wealth strategy.

What maintenance is included in a triple net lease?

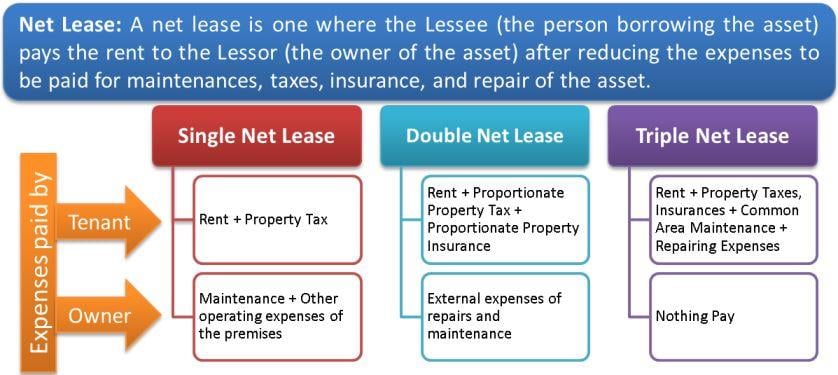

Double Net: Tenant pays rent plus property taxes and insurance. Triple Net: tenant pays rent, property taxes, insurance, and maintenance fees.

How is triple net lease income taxed?

Deferred Capital Gains Taxes The most common deduction that triple net lease investors can claim is a deferred capital gains tax. This deduction allows investors to defer paying taxes on any capital gains generated by the sale of a property.

Can you negotiate a triple net lease?

There are many areas where a tenant can negotiate a NNN lease to make it more favorable. First, the base rental amount becomes a key negotiating term. If the tenant is taking on all responsibility and risk of the landlord's overhead, then the tenant may be able to negotiate a more favorable base rental amount.

How is NNN rent calculated?

Calculating NNN Leases Dividing the yearly base amount by 12 months will give you $5,000 as the monthly base amount. As for the NNN or other expenses, the landlord advertised $5. You multiply $5 with the square footage (2,000 sq. ft.) to get an annual fee of $10,000.

Does a tenant pay utilities in a triple net lease?

Key Takeaways. With a triple net lease (NNN), the tenant agrees to pay the property expenses such as real estate taxes, building insurance, and maintenance in addition to rent and utilities.

What is an example of a triple net lease?

Triple net lease, triple net, or NNN, is a type of commercial real estate lease where the tenant or lessee pays the full expenses of the property. This includes real estate taxes, building insurance, and maintenance, in addition to the cost of rent and utilities.

Are Triple Net properties worth it?

Triple net properties are one of the most attractive real estate investments for a variety of reasons: they can offer low risk, minimal responsibilities for the landlord, and long-term passive income.

How is NNN rent calculated?

Calculating NNN Leases Dividing the yearly base amount by 12 months will give you $5,000 as the monthly base amount. As for the NNN or other expenses, the landlord advertised $5. You multiply $5 with the square footage (2,000 sq. ft.) to get an annual fee of $10,000.

How do you calculate net lease payments?

How is the NNN Lease Calculated? NNN leases are computed by multiplying the total annual property taxes and insurance for the area by the entire rental square footage of the building.

What is $18 NNN?

What Does NNN Mean? NNN stands for Triple Net rent. In this type of commercial real estate rent, you pay the amount listed and you also have pay additional costs (usually Operating Expenses) on top of that. For example: say the Office Space listing you're interested in says the rent is $24.00 NNN per sqft/year.

How much should NNN be?

Now we have to add on the NNN cost which may range from $1 to $20 a square foot based on the use and costs. It is typical to see a $3 a square foot NNN cost in my area, which would add $15,000 a year or $1,250 a month to the costs. Your base lease rent of $4,166.67 could easily turn into $6,000 a month actual cost.