Chapter 7, Title 11, United States Code

Chapter 7 of the Title 11 of the United States Code governs the process of liquidation under the bankruptcy laws of the United States. Chapter 7 is the most common form of bankruptcy in the United States.

Can I keep my tax refund in Chapter 7 bankruptcy?

Keeping a Refund in Chapter 7 Bankruptcy. If you worried that you'd lose a refund in bankruptcy, there are things you can do to protect it. In most cases, you’ll be able to keep your tax refund if you: protect (exempt) the refund with a bankruptcy exemption.

What happens to my assets when I file Chapter 7 bankruptcy?

When a debtor files for Chapter 7 bankruptcy, all of the person's assets become part of the bankruptcy estate, which is administered (controlled) by the Chapter 7 bankruptcy trustee.

How does filing bankruptcy affect my taxes?

If all or part of the reason you are filing bankruptcy is overdue federal tax debts, you may need to increase your withholding and/or your estimated tax payments. For help determining the proper withholding, visit our online Tax Withholding Estimator.

How long after filing bankruptcy can I keep my tax return?

It can take up to 60 days for the is discharge to be officially in effect. “Can I Keep My Tax Return?” Now that you have a better understanding of how Chapter 7 bankruptcy works, let’s return to the question of tax returns and how they are impacted by filing for bankruptcy.

Do I have to pay taxes on Chapter 7?

During your bankruptcy you must continue to file, or get an extension of time to file, all required returns. During your bankruptcy case you should pay all current taxes as they come due. Failure to file returns and/or pay current taxes during your bankruptcy may result in your case being dismissed.

How do I file my taxes after filing Chapter 7?

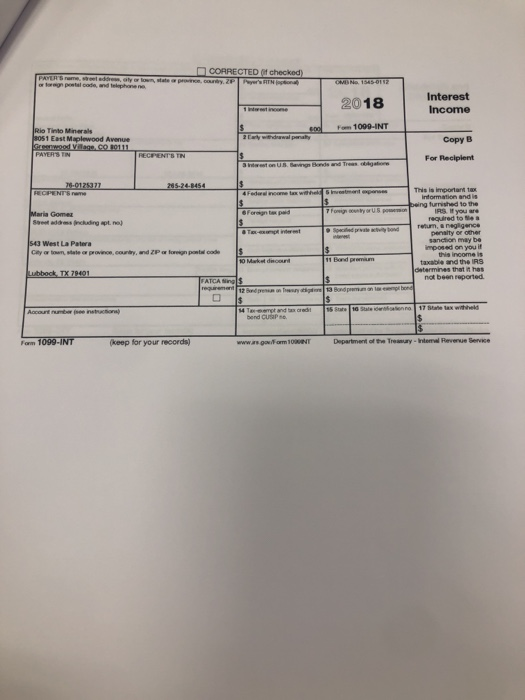

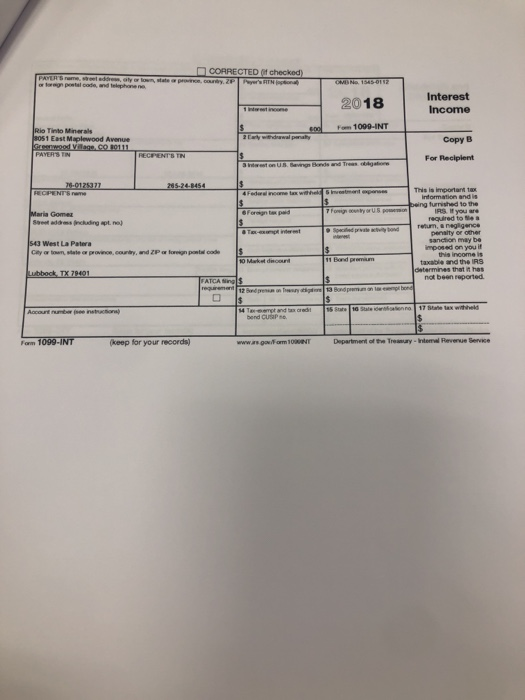

Filing Taxes After Chapter 7 When you file Chapter 7 bankruptcy, you as the debtor are required to file a 1040 tax return per usual. Your trustee will then need to file a Form 1041 for the bankruptcy estate in some cases.

How Will filing Chapter 7 affect me?

You'll still have to pay court-ordered alimony and child support, taxes, and student loans. The consequences of a Chapter 7 bankruptcy are significant: you will likely lose property, and the negative bankruptcy information will remain on your credit report for ten years after the filing date.

What can you not do after filing Chapter 7?

After you file for bankruptcy protection, your creditors can't call you, or try to collect payment from you for medical bills, credit card debts, personal loans, unsecured debts, or other types of debt. Wage garnishments must also stop immediately after filing for personal bankruptcy.

How much cash can I keep in Chapter 7?

For example, typically under Federal exemptions, you can have approximately $20,000.00 cash on hand or in the bank on the day you file bankruptcy. The vast majority of my clients have considerable less than $20,000.00 in the bank the day I file their bankruptcy.

How soon after Chapter 7 can I buy a house?

During a Chapter 7 bankruptcy, a court wipes away your qualifying debts. Unfortunately, your credit will also take a major hit. If you've gone through a Chapter 7 bankruptcy, you'll need to wait at least 4 years after a court discharges or dismisses your bankruptcy to qualify for a conventional loan.

Is it better to file Chapter 7 or 13?

Most people prefer Chapter 7 bankruptcy because, unlike Chapter 13 bankruptcy, it doesn't require you to repay a portion of your debt to creditors. In Chapter 13 bankruptcy, you must pay all of your disposable income—the amount remaining after allowed monthly expenses—to your creditors for three to five years.

How many points does a Chapter 7 drop credit score?

Bankruptcy will have a devastating impact on your credit health. The exact effects will vary. But according to top scoring model FICO, filing for bankruptcy can send a good credit score of 700 or above plummeting by at least 200 points. If your score is a bit lower—around 680—you can lose between 130 and 150 points.

Will trustee take my tax refund?

No, the trustee can only take the portion of your refund that can be traced back to before your case was filed. So, if someone files on March 30, the trustee can only take 1/4 of the refund. That's because as of March 30, there are three quarters left in the year, so the pre-filing portion of the refund is only 1/4.

What is IRS Fresh Start Program?

The Fresh Start Initiative Program provides tax relief to select taxpayers who owe money to the IRS. It is a response by the Federal Government to the predatory practices of the IRS, who use compound interest and financial penalties to punish taxpayers with outstanding tax debt.

What happens at the end of Chapter 7 bankruptcy?

At the conclusion of your Chapter 7 bankruptcy you will receive a discharge of debt. A discharge releases you (the debtor) from personal liability for certain dischargeable debts. Some taxes may be dischargeable. Whether a federal tax debt may be discharged depends on the unique facts and circumstances of each case.

What is Chapter 7?

Chapter 7 provides relief to debtors regardless of the amount of debts owed or whether a debtor is solvent or insolvent. A Chapter 7 Trustee is appointed to convert ...

How to contact IRS about bankruptcy?

Please note: We cannot provide legal or other advice about your bankruptcy case. If you have questions about filing and paying your federal taxes you can find answers here on our website and in the list of resources on the right side of this page. If you want to speak to someone at the IRS please call: 1 Individuals – 1-800-829-1040 2 Businesses – 1-800-829-4933

Can you get your tax refunds while in bankruptcy?

However, refunds may be subject to delay, to turnover requests by the Chapter 7 Trustee, or used to pay down your tax debts. If you believe your refund has been delayed, turned over, or offset against your tax debts you can check on its status by going to our Where’s My Refund tool or by contacting the IRS’ Centralized Insolvency Operations Unit at 1-800-973-0424. The unit is available Monday through Friday from 7:00 a.m. to 10:00 p.m. eastern time.

Do you have to increase your withholdings if you file for bankruptcy?

To take full advantage of the bankruptcy laws and get a fresh start, it is important that you do not continue to incur additional debt. If all or part of the reason you are filing bankruptcy is overdue federal tax debts, you may need to increase your withholding and/or your estimated tax payments. For help determining the proper withholding, visit our online Tax Withholding Estimator. For help with your estimated taxes, visit our Estimated Taxes page.

What happens when you file Chapter 7 bankruptcy?

In general, when you file for chapter 7 bankruptcy, all of your assets become part of what is called a bankruptcy estate. This is controlled by an administrative party known as the trustee. The job of this person is to gather information about your case, hold hearings regarding your case and debts, and help the creditors you are indebted to in collecting on those debts. This may involve the selling of property or other non-exempt assets you own, as well as the seizure of any money you possess.

What happens to your tax refund after bankruptcy?

Any money you receive after filing for bankruptcy is yours to keep. Unfortunately, tax returns fall into a strange category of their own when it comes to qualifying as preexisting funds or newly-earned money; although you may receive your refund after filing for bankruptcy, the process which rendered the refund may have taken place before the filing, thus making this money eligible for seizure by the trustee of your bankruptcy.

How to minimize tax return?

To do this, you must first know that you will likely be filing for bankruptcy in the coming year. Adjust your withholdings on your tax forms for that upcoming year to minimize the amount withheld from each paycheck. You will receive more pay each period, and your tax return will be much smaller. Often, these adjusted returns can be so small that they are deemed useless as repayment to creditors, forcing your trustee to abandon them and allowing you to keep the total amount.

What expenses are not accepted in a bankruptcy?

Generally, any expense that can be shown to be part of your necessities or those of a dependent family member are accepted. Expenditures for luxury goods, leisure-related travel, repayment to non-creditor entities or repayment of part of your total debt without consent of your trustee are not accepted.

Can bankruptcy trustees seize money?

Your bankruptcy trustee cannot seize money that has already been spent. If you have recently received a tax refund and are concerned that is might be seized in your imminent chapter seven case, consider spending it on necessary items and services for yourself and your family. While this isn’t technically keeping the money in your pocket, it is transferring the amount into something you can keep, something that is unlikely to be eligible for seizure during your bankruptcy.

When to spend your refund?

Spend your refund before you are asked to remit it, using it to cover necessary expenses .

Can you keep your money in bankruptcy?

This is typically your worst-case scenario. In any bankruptcy, the debtor can keep a court-determined amount of money or assets, known as exemptions. If your refund is sizeable and you receive it shortly before filing or it is based on money that was earned prior to your filing, you may be able to include it in this exempt amount. The total amount you’ll be allowed to exempt from your eligible assets will generally depend on which state you file your bankruptcy in.

What percentage of tax refunds are considered assets in bankruptcy?

Typically, if a married individual files bankruptcy without their spouse and the tax returns resulting in refunds were filed jointly, only 50% of the refunds are considered assets of the bankruptcy estate.

What happens to assets when you file bankruptcy?

Upon filing a bankruptcy, all of the debtor's assets become property of the bankruptcy estate. The bankruptcy estate is administered by a person called a trustee. It is the trustee's job to liquidate assets for the benefit of the debtor's creditors. The Bankruptcy Code defines assets very broadly.

What is the purpose of the bankruptcy code?

The Bankruptcy Code was designed so that individuals could get a "fresh start." Part of that fresh start is making sure that an individual doesn't lose everything to trustee liquidation. As such, the Bankruptcy Code allows for certain exemptions.

How to calculate 2015 tax refund?

As such, the prorated portion of the 2015 tax refund can be calculated by dividing 90 days by 365 days. Obviously, at the time the bankruptcy petition is filed a debtor can't file their tax returns for a calendar year that has not yet completed.

When is bankruptcy filing for 2015?

Debtor files a Chapter 7 petition on April 1, 2015. The following are assets of the bankruptcy estate: **If the bankruptcy is filed April 1st, 90 days of calendar year 2015 have passed.

Can you lose your tax refund if you file Chapter 7?

Understandably, people filing or considering filing Chapter 7 are concerned about losing their tax refunds. The good news is that if done properly, the bankruptcy filing will most likely not cause the loss of a tax refund. Most debtors lose their tax refunds because they fail to properly disclose and exempt the tax refunds, ...

Is the 2014 tax refund an asset?

What most debtors do not realize is that a portion of the tax refunds associated with the calendar year the bankruptcy petition is filed are also an asset. In other words, if you file bankruptcy in 2014, a portion of the 2014 tax refunds which will be received in calendar year 2015 are part of the bankruptcy estate.

File Irs Form 982 After Bankruptcy Discharge

How filing bankruptcy could affect your tax return and refund. Attorney Robert Geller.

Can My Creditors Still Repossess My Assets

Secured creditors retain their rights under their contract, even after Bankruptcy or Proposal completion. If you fail to meet the contractual obligations, the creditor can repossess the collateral . In some provinces, the secured creditors can still collect from you for the deficiency, even after repossession.

File Bankruptcy Tax Free

For the average individual consumer, filing bankruptcy and discharging debts has no tax consequences.

Warren & Migliaccio Can Help With Bankruptcy Law Matters

If you are concerned about when and how to file for bankruptcy, consult an attorney with expertise in bankruptcy law. The laws and regulations governing bankruptcy are complicated and diverse. Warren & Migliaccio will review your case and can help you through the process.

What Are Some Other Solutions For Tax Debt

If unpaid tax debt has you considering bankruptcy, you may want to explore other solutions first especially in light of the complex rules for bankruptcy and taxes.

Chapter 7 Bankruptcys Effect On Tax Refunds Is All About Timing

If you are considering filing a Chapter 7 bankruptcy around tax time, it is a good idea to talk to both a bankruptcy attorney and an accountant before heading to the courthouse.

I Intend To File For Bankruptcy Sometime Later This Year

As in the first example, any refund amount would be deemed as part of your estate under this scenario. However, you can avoid losing the money by, instead, adjusting the amount of money deducted from your paycheck for income taxes so that youll only be covering the actual tax youll eventually owe.

File Bankruptcy Tax Free

How filing bankruptcy could affect your tax return and refund. Attorney Robert Geller.

Turnover Of Tax Refund

Finally, if youâve already filed for bankruptcy and your tax refund is not exempt, make sure not to spend the refund check. That will get you into trouble. Instead, you must contact your trustee asking how to turn over the funds from your non-exempt refund.

Year That Bankruptcy Is Filed

Any refunds for the year in which bankruptcy is filed are sent to your trustee from CRA.

Chapter 13 Bankruptcy Will Allow You To Retain Your Tax Return

Much like a chapter 7 bankruptcy a chapter 13 may also allow most filers to keep tax returns. If the tax return is due to be paid, the filing of a chapter 13 will protect those funds from being garnished. The protection is provided by 11 U.S.C. § 362.

Possible Ways To Keep A Tax Refund In Chapter 13

Determining what to do with your tax refund is mainly discretionary, so your trustee might allow you to keep the tax refund. An unforeseen event or need that has affected your ability to pay living expenses might sway the trustee. For instance, it’s common for a debtor to need car repairs or a new vehicle at some point during the plan.

Can I Keep My Tax Refund

It depends on your circumstances. You must inform your trustee when you receive your tax refund. You also need to provide a copy of your ATO Notice of Assessment. Its important to not spend your tax refund until your trustee makes an assessment and informs you if they have a claim in the refund.

You Can Wipe Out Or Discharge Tax Debt By Filing Chapter 7 Bankruptcy Only If All Of The Following Conditions Are Met

The debt is federal or state income tax debt. Other taxes, such as fraud penalties or payroll taxes, cannot be eliminated through bankruptcy. In other words, the debt needs to be a regular tax payment that you owed either the State of Wisconsin or the federal government.