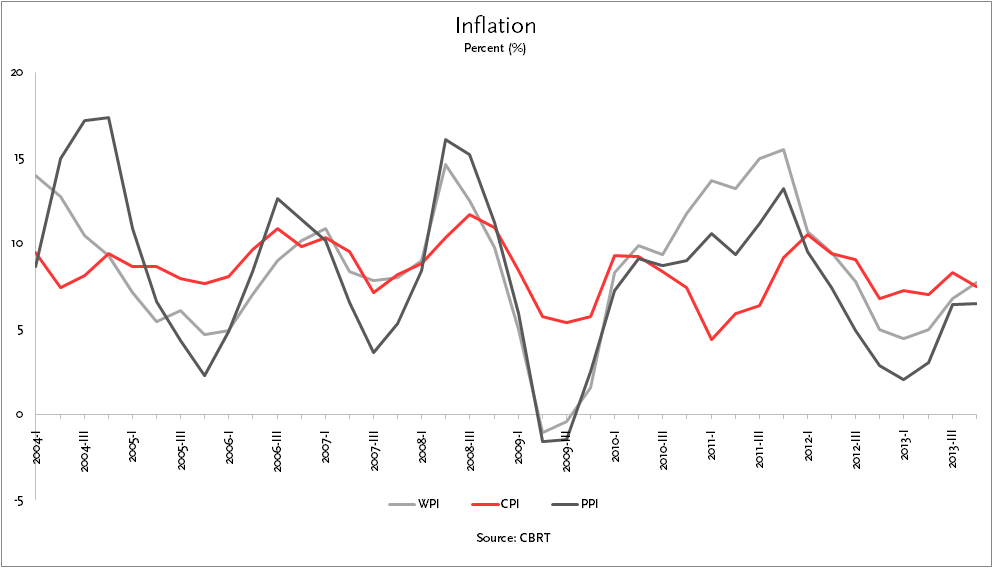

With inflation, the rule works in reverse: Consumers can approximate how quickly higher prices would halve the value of their savings. To do this, divide 72 by the annual inflation rate. Using this formula, consumers’ money would halve in value in roughly 8 to 8½ years.

Will inflation halve the value of your money?

The ‘rule of 72’ may help The ‘rule of 72’ can help consumers loosely approximate would quickly inflation will halve the value of their money. The Consumer Price Index jumped 8.6% in May relative to a year earlier, the fastest pace since 1981.

What is the rule of 72?

The rule of 72 is this–if you take a constant rate of growth of anything (savings accounts, price levels, or even the size of trees) and ignore the percent sign, then you divide 72 by that number, that will tell you how long it will be before the thing in question doubles in size. Let’s consider the growth of prices.

How long does it take for inflation to double?

The fact that, if inflation persisted at this same rate, it would take prices less than 10 years to double is reason for concern. We’re not under “hyperinflation,” but prices are certainly rising at a rate that troubles most Americans. And the rule of 72 helps us understand why their concern is warranted.

Will 7% inflation persist every year for ten years?

So a 7.5% rate of inflation is a milestone of a sort, but the next question is, will this actually happen? Will 7.5% inflation persist every year for ten years? The answer is, at this point, it doesn’t seem likely.

Does the Rule of 72 account for inflation?

The Rule of 72 is also used to determine how long it takes for money to halve in value for a given rate of inflation. For example, if the rate of inflation is 4%, a command "years = 72/inflation" where the variable inflation is defined as "inflation = 4" gives 18 years.

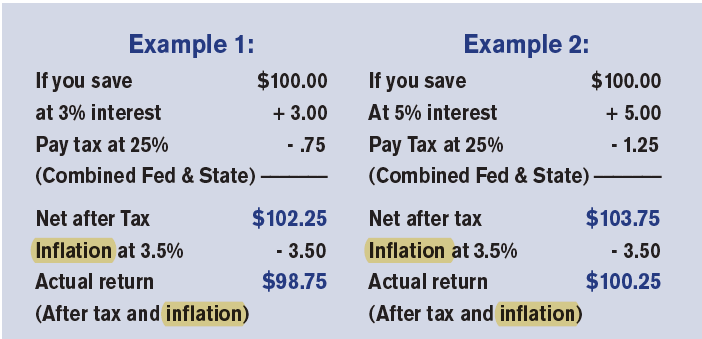

Why does inflation affect your savings account?

How Inflation Shrinks Savings. Let's say you have $100 in a savings account that pays a 1% interest rate. After a year, you will have $101 in your account. But if the rate of inflation is running at 2%, you would need $102 to have the same buying power that you started with.

How does inflation affect cash in bank?

When you keep your money in the bank, you may earn interest, which balances out some of the effects of inflation. When inflation is high, banks typically pay higher interest rates. But once again, your savings may not grow fast enough to completely offset the inflation loss.

How can the Rule of 72 be applied to increasing debt?

You can also use the Rule of 72 to plug in interest rates from credit card debt, a car loan, home mortgage, or student loan to figure out how many years it'll take your money to double for someone else. For example, the average interest rate for credit cards is 17.3%. If you divide 72 by that rate, you get 4.16 years.

Who wins when inflation is high?

Inflation allows borrowers to pay lenders back with money worth less than when it was originally borrowed, which benefits borrowers. When inflation causes higher prices, the demand for credit increases, raising interest rates, which benefits lenders.

Where should I put my money during inflation?

Real estate traditionally does well during periods of higher inflation, as the value of a property can increase. This means your landlord can charge you more for rent, which in turn increases their income so it is on pace with the rising inflation.

Will interest rates go up if inflation rises?

The relationship between inflation and interest rates is interchanging, meaning when one rises, the other will usually fall.

What do you do with savings with high inflation?

Investing your money over the medium to long term may give you a better chance of beating inflation. That's because investments, such as funds, shares, bonds and other assets could give your money greater potential to increase in value over time.

How do I protect my savings from inflation?

How to protect your savings from inflationShop around for the best interest rate. It is generally considered wise to have at least six months' worth of essential expenditure saved as an emergency fund. ... Shift longer-term savings into equities. ... Choose your investments wisely. ... Maximise tax efficiency. ... Seek expert advice.

How much interest does $10000 earn in a year?

Currently, money market funds pay between 0.85% and 1.05% in interest. With that, you can earn between $85 to $105 in interest on $10,000 each year.

How long will it take to double your money at 10% per year?

7 yearsGiven a 10% annual rate of return, how long will it take for your money to double? Take 72 and divide it by 10 and you get 7.2. This means, at a 10% fixed annual rate of return, your money doubles every 7 years.

Where is the Rule of 72 most accurate?

The most accurate results from the Rule of 72 are based at the 8 percent interest rate, and the farther from 8 percent you go in either direction, the less precise the results will be. Still, this handy formula can help you get a better grasp on how much your money may grow, assuming a specific rate of return.

Can savings accounts beat inflation?

While a savings account may not be a growth asset, a high-yield savings account can keep up with inflation in nominal terms as long as inflation is complemented with short-term interest rate changes.

How can you save money when inflation is high?

Budget for savings first. Often it can be easy to spend your income and then run out of money for savings before you've even realized it. ... Set spending priorities, focus on paying down debt. ... Cut back on energy bills. ... Shop for cheaper alternatives. ... Consider a side gig. ... Negotiate for a raise.

Do savings account interest rates rise with inflation?

The interest rate on your savings account is influenced by what the Federal Reserve does. The Federal Reserve is raising the federal funds rate to combat inflation. When the Federal Reserve raises rates, the interest rate on your savings account tends to go up, too.

How inflation eats your money?

At an individual level, higher inflation leaves lower money for savings and discretionary spending after household expenses. Further, it also impacts the returns on your investments negatively. And hence the phrase 'inflation eats into your returns'.

What is the rule of 72?

You need to ensure that your investment return is at or above the expected level of inflation to enable you to enjoy the lifestyle you deserve in retirement. If you are struggling with how much income and purchasing power you will have in retirement, the rule of 72 and the magic of compound interest can be a guide to help you plan for your future.

How long does it take for a 2% investment to double?

Coming back to our two hypothetical investments and applying the rule of 72, we find that it will take 36 years for the investment returning 2% to double in value. You arrive at that by taking 72 and dividing by 2 to get 36. For the investment returning 6% per year, we find that it will take 12 years for your money to double, as 72 divided by 6 gives 12. Doubling one’s investment is a good thing, but the time element is key. The 2% investment will take 36 years to double, whereas the 6% investment will only take 12 years to double.

What is inflation and longevity?

Inflation and longevity (i.e. how long I will live and hence, how long my savings need to provide for my income in retirement) are key aspects of any retirement planning approach.

Do people get rich overnight?

We’ve all heard of or know people who have gotten rich overnight. Alas, for most people, saving for retirement and being able to maintain the lifestyle of one’s choice depends a lot more on the magic of compound interest than “winning the lottery.”

Is 6% per year better than 2%?

One opportunity is paying you 2% a year and the other is returning 6% per year. All else equal, most of us can surmise that the investment paying 6% per year is better than the one paying 2% per year. But you also must factor in inflation to better understand how much better the 6% return is for your future self. Enter the “rule of 72.”.

Answer

The rule of 72 is a formula used to measure the approximate time it will take for an investment to double. The word "approximate" should be highlighted, as it is not a 100% exact formula.

Answer

The Rule of 72 is also used to determine how long it takes for money to halve in value for a given rate of inflation. For example, if the rate of inflation is 4%, a command "years = 72/inflation" where the variable inflation is defined as "inflation = 4" gives 18 years.

New questions in Social Studies

which phrase tells how the hawaiian culture was characterized for centuries before europeans and americans came to the hawaiian islands?

What is Rule 72?

Rule 72 is a quick, useful formula that helps you calculate the number of years it will take for your investment to double in value at a given rate of interest.

How to measure the impact of inflation?

To measure the impact of inflation, you have to divide the rate of inflation into 72.

What is the interest rate for double money?

According to the rule of 72, if you want to double your money in 5 years, the required interest rate is 15%.