How does the IRS know if you have rental income?

Rental income includes:

- Normal rent payments

- Advance rent payments

- Payments for canceling a lease

- Expenses paid by the tenant

How do you claim rental income on taxes?

- Tax and COVID-19. Your rental property income and deductions may have been affected by COVID-19. ...

- Co-ownership of rental property. ...

- Renting out part or all of your home. ...

- Renting out your holiday home. ...

- Do not show at this section

- Video tutorials. ...

How do you calculate rental income?

- Determine Gross Income of Rental Property With a residential investment property, gross income is typically the rent you collect from tenants each month. …

- Calculate All Expenses Related to the Property In this step, itemize all the expenses made related to the rental property. …

- Obtain Cash Flow for Rental Property

How do I claim renters income on taxes?

You will need details of:

- all rental income earned

- interest charged on money you borrowed for the rental property

- other expenses relating to your rental property

- if applicable, the period your property was genuinely available for rent

- any expenditure on capital works to your rental property.

Can IRS find out about rental income?

The IRS can find out about unreported rental income through tax audits. The goal of an IRS tax audit is to review and examine the financial information and accounts of an individual to confirm that income was reported correctly.

How does the IRS define rental income?

Rental income is any payment you receive for the use or occupation of property. Expenses of renting property can be deducted from your gross rental income.

How can I avoid paying taxes on rental property?

Use a 1031 Exchange Section 1031 of the Internal Revenue Code allows you to defer paying capital gains tax on rental properties if you use the proceeds from the sale to purchase another investment.

What is the IRS self rental rule?

Under the self-rental rule, if a taxpayer rents a property to a business in which he or she materially participates, any net rental income from the property is deemed to be nonpassive. Net rental losses on such property, however, generally remain passive.

What happens if I don't declare rental income?

What happens if I don't declare rental income? If HMRC suspects a landlord has been deliberately avoiding tax, it can reclaim 20 years' worth of tax payments. They can also impose fines up to the total value of any unpaid tax, as well as the underpaid tax.

How does the IRS find out about unreported income?

The IRS can find income from cryptocurrency payments or profits in the same manner it finds other unreported income – through 1099s from an employer, a T-analysis, or a bank account analysis.

How much rent income is tax free?

How Much Rent is Tax Free? A person will not pay tax on rental income if Gross Annual Value (GAV) of a property is below Rs 2.5 lakh. However, if rent income is a prime source of income then a person might have to pay the taxes.

How much rent is tax free?

Under the Section 80 GG, the self-employed or the salaried person can claim a HRA tax exemption or the rent paid by him or her, in excess of 10% of his/her income or salary respectively.

Is rental income considered earned income?

Is Rental Income Considered Earned Income? Rental income is not earned income because of the source of the money. Instead, rental income is considered passive income with few exceptions.

How do you avoid self rental rules?

Taxpayers can avoid or reduce the detrimental tax effect of the self-rental rule. One way is to reduce their participation level in the operating activity so it fails the material participation tests.

Do I have to report rental income from a family member?

Typically, home owners will charge family members below fair market value rent for allowing them to stay in their home. If this is the case, you do not need to claim the income. However, you cannot claim any rental expenses or rental loss on your taxes.

Is self rental considered passive?

Self-rental Rule in a Nutshell It defines “passive activity” as any trade or business in which the taxpayer does not materially participate. Rental real estate activities generally are considered passive activities regardless of whether the taxpayer materially participates.

What is rental income?

Rental Income. Most individuals operate on a cash basis, which means they count their rental income as income when they actually or constructively receive it, and deduct their expenses when they pay them. Rental income includes:

What expenses can you deduct from rental income?

Rental Expenses. Examples of expenses that you may deduct from your total rental income include: Depreciation – Allowances for exhaustion, wear and tear (including obsolescence) of property. You begin to depreciate your rental property when you place it in service.

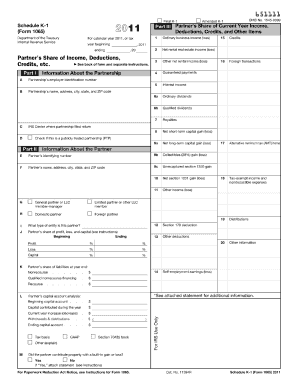

What is Schedule E 1040?

You can generally use Schedule E (Form 1040), Supplemental Income and Loss to report income and expenses related to real estate rentals. If you provide substantial services that are primarily for your tenant's convenience, report your income and expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship).

Can you deduct advance rent?

Advance rent – Generally, you include any advance rent paid in income in the year you receive it regardless of the period covered or the method of accounting you use. Expenses paid by a tenant – If your tenant pays any of your expenses, those payments are rental income. You may also deduct the expenses if they're considered deductible expenses.

Is cash rental income taxable?

Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income. In general, you can deduct expenses of renting property from your rental income.

When is security deposit used as rent?

If a security deposit amount is to be used as the tenant's final month's rent, it is advance rent that you include as income when you receive it, rather than when you apply it to the last month's rent.

Is a repair cost deductible?

Repair costs, such as materials, are usually deductible. For information about repairs and improvements, and depreciation of most rental property, refer to Publication 527, Residential Rental Property (Including Rental of Vacation Homes).

What is rental income?

Rental income includes: Normal rent payments. Advance rent payments. Payments for canceling a lease. Expenses paid by the tenant. Rental income generally doesn’t include a security deposit if the taxpayer plans to return it to their tenant at the end of the lease.

What form do you use to report rental income?

In most cases, a taxpayer must report all rental income on their tax return. In general, they use Schedule E (Form 1040) to report income and expenses from rental real estate.

What are the expenses of a business?

Ordinary expenses are common and generally accepted in the business, such as depreciation and operating expenses. Necessary expenses are appropriate, such as interest, taxes, advertising, maintenance, utilities and insurance.

How many days can you use a rental property as a residence?

A dwelling is considered a residence if it’s used for personal purposes during the tax year for more than the greater of 14 days or 10 percent of the total days rented to others at a fair rental value. In general, personal use includes use of the property by:

What is residential rental property?

Residential rental property. Residential rental property can include a single house, apartment, condominium, mobile home, vacation home or similar property. These properties are often referred to as dwellings. Taxpayers renting property can use more than one dwelling as a residence during the year. A dwelling is considered a residence ...

When does special rules apply to rental income?

Special rules. Special rules apply if the taxpayer rents out a dwelling that’s considered a residence fewer than 15 days during the year. In this situation, the taxpayer doesn’t report the rental income and doesn’t deduct rental expenses. Publication 527 has more information about these rules.

How long does it take to recover from a rental property?

The Tax Cuts and Jobs Act changed the alternative depreciation system recovery period for residential rental property from 40 years to 30 years. Under the new law, a real property trade or business electing out of the interest deduction limit must use the alternative depreciation system to depreciate any of its residential rental property.